by J.D. Davidson Three of four bills targeting rising property taxes in Ohio have been sitting in committees for more than a year without a vote or public opposition. And Ohio lawmakers have no plans to return to work until mid-November. That has Democratic leaders at the Statehouse pushing for immediate action. “House Democrats and local leaders have been fighting to lower property taxes and create a fairer system that doesn’t constantly rely on property owners to pick up the tab,” said House Minority Leader Allison Russo (pictured above), D-Upper Arlington. “We can lower our property taxes, reduce costs, and still support essential services by ensuring the state pays its fair share and returns more of our tax dollars to our community. It’s time for the state legislature to take action; Ohioans need help now.” Three of the four bills have bipartisan sponsorship, including the most recent – House Bill 645 that would give a $1,000 property tax rebate and $1 billion in tax relief to more than 1.3 million homeowners and renters after their tax payments exceed 5% of their income. That bill was recently introduced and has not been assigned to a committee. Three others, however, have…

Read the full storyTag: Property Taxes

Details of New $1.3 Billion 76ers Arena Proposal Announced

The Philadelphia 76ers will pay the entire $1.3 billion to build the new 76 Place at Market East Arena, but will benefit from not having to pay property taxes.

Instead, the team will use a payment in lieu of taxes model.

Read the full storyGeorgia Lt. Gov. Burt Jones Celebrates Passage of ‘Save Our Homes Act’ to Cap Property Tax Increases

Georgia Lt. Governor Burt Jones on Tuesday celebrated the passage of legislation he championed to restrict property tax increases and offer property owners a chance to appeal decisions about how much they pay.

Jones said in a statement that HB 581, the Save Our Homes Act, “limits increases in property taxes years to year, reforms the appeals process, and allows for more transparency in our taxation procedures.”

Read the full storyAmericans for Prosperity – Tennessee Reveals Top Areas of Reform in Its 2024 Legislative Agenda

Americans for Prosperity – Tennessee (AFP-TN) published its 2024 Legislative Agenda on Tuesday, suggesting four major policy changes in the state as the General Assembly convened for this year’s legislative session.

Read the full storyBeacon Poll: Tennesseans Looking Forward to School Choice, Property Tax Discussions this Upcoming Legislative Session

The Nashville-based Beacon Center of Tennessee published results Thursday of its poll revealing which topics registered Tennessee voters are looking forward to being discussed this upcoming legislative session.

Read the full storyDavidson County Property Owners Whose Homes Were Damaged by Tornadoes May Seek Relief on Assessment Value

Metro Nashville and Davidson County Property Assessor Vivian M. Wilhoite announced residents whose properties were impacted by the December 9 severe storms may be eligible to seek property appraisal adjustments.

Read the full storyState Representative: Georgia Lawmakers Might Act on Property Tax Increases

Earlier this year, Georgia Gov. Brian Kemp signed House Bill 118 and House Bill 622 to triple Bartow County’s homestead tax exemptions for school and county ad valorem taxes.

But property owners across the Peach State have seen their property tax bills balloon. State Rep. Matthew Gambill, R-Cartersville, spoke with The Center Square recently about property taxes and what action state lawmakers might take.

Read the full storyWisconsin Assembly Speaker Robin Vos Calls Governor Tony Evers a ‘Liar’, Expects Evers’ Partial Vetoes to be Challenged in Court

Democrat Governor Tony Evers’ “creative” partial veto that boosts public education spending for the next four centuries “proves he’s a liar,” Assembly Speaker Robin Vos said during a Sunday morning interview.

The Rochester Republican said the governor’s “unprecedented” veto trick leaves Republicans — and taxpayers who would be on the hook for 400-plus years of spending increases — with “little option” but to take the governor to court.

Read the full storyWisconsin Governor Tony Evers Signs Budget, Guts $3.5 Billion Tax Cut with ‘Frankenstein’ Veto Pen

In signing Wisconsin’s new two-year spending plan Wednesday, Democrat Governor Tony Evers liberally applied his veto pen to the Republican-crafted biennial budget, gutting a $3.5 billion tax cut proposal that had reduced the state’s tax brackets and delivered relief for all taxpayers.

Republicans blasted the governor for his 51 partial vetoes, including a particularly sneaky one that changed the meaning of funding for schools to a four-century commitment.

Read the full storyNashville Mayoral Candidate Alice Rolli: I Offer Voters the Best Chance to ‘Reset the Priorities for Our City’

Nashville Mayoral Candidate Alice Rolli appeared on The Tennessee Star Report Wednesday morning, June 21, on TalkRadio 98.3 and 1510 WLAC.

Read the full storyRutherford County Holds Public Comment Hearing on Proposed Property Tax Rate Hike

The Rutherford County Budget and Finance Committee held a public comment hearing on Tuesday night for residents to weigh in before the county commission votes on the mayor’s 16.17 percent property tax rate increase.

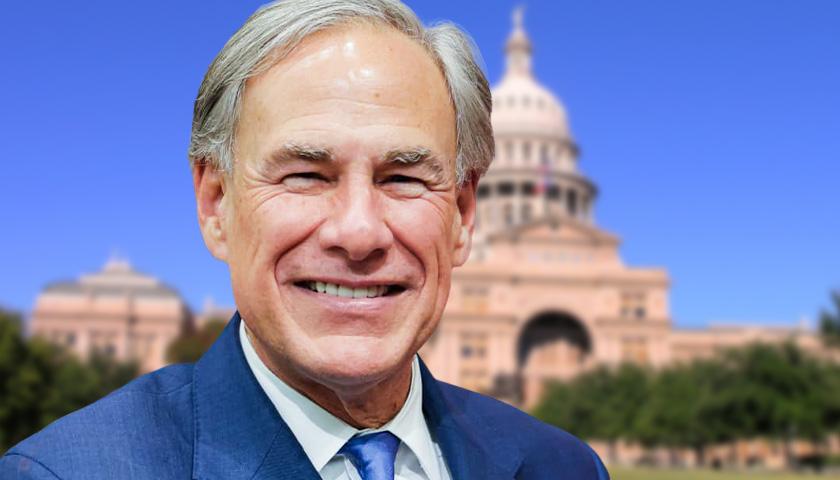

Read the full storyTexas Governor Aims to Eliminate Property Taxes

Gov. Greg Abbott says his goal is to eliminate homeowners’ property taxes in the state of Texas. He says it’s possible to achieve over time because of the significant economic growth of the state.

All three Republican leaders, Abbott, Lt. Governor Dan Patrick and Speaker Dade Phelan, have pledged to reduce property taxes and made it a legislative priority.

Read the full storyCity of Houghton Fights Walmart over ‘Dark Stores’, Lost Michigan Tax Revenue

A Michigan city in the Upper Peninsula is fighting Walmart over tax assessments.

The Center Square reported about the “dark stores” strategy in June 2021, when vacant big box retail stores often seek the property assessed at tax rates sometimes 50 percent lower than previous rates, which often leaves local taxpayers to foot the tab.

Read the full storyExclusive: Wisconsin Institute for Law & Liberty Report Urges Ending ‘Taxation Without Representation’ in Funding Badger State Tech Colleges

A new report finds Badger State homeowners pay nearly a half-billion dollars annually in property taxes to fund Wisconsin’s technical colleges, a figure expected to grow in the next biennial budget.

But in Wisconsin there are no directly elected members to authorize these taxes, creating a system of “taxation without representation,” according to the study from the Wisconsin Institute for Law & Liberty (WILL).

Read the full storyProperty Taxes Climb 3.6 Percent Across U.S. to $339.8 Billion

Property taxes levied on single-family homes in the United States increased 3.6 percent to $339.8 billion in 2022, according to a new report from a real estate data firm.

That’s up from $328 billion in 2021. The 2022 increase was more than double the 1.6 percent growth in 2021, but smaller than the 5.4 percent increase in 2020, according to the report from ATTOM, a property data provider.

Read the full storyOhio Congressional Candidate Landsman Runs as a Tax Cutter But Hiked Taxes

Greg Landsman, the five-year Democratic Cincinnati City councilman vying for Congress against Steve Chabot (R-OH-1), is running a television advertisement contending that he cut taxes while Chabot raised them.

The facts suggest otherwise.

Read the full storyLegislation Would Exempt Ohio’s Fully Disabled Veterans from Property Taxes

State Representative Tom Patton (R-OH-Strongsville) is spearheading an effort to end property taxation for fully disabled military veterans and their surviving spouses in the Buckeye State.

According to the legislature’s official analysis of Patton’s bill, Ohio presently exempts $50,000 of the assessed value of homes owned by honorably discharged veterans who the federal Department of Veterans Affairs has given a 100-percent disability rating. Individuals so designated are considered severely impaired and unable to function professionally. A deceased veteran’s surviving wife or husband can access the exemption if the veteran received the benefit the year he or she died, lived at the residence during the veteran’s passing and continues to own that home.

Read the full storyState Representative Pushes to Constitutionally Eliminate Pennsylvania School Property Taxes

State Representative Frank Ryan (R-PA-Palmyra) this week proposed amending the Pennsylvania Constitution to eliminate the portion of property taxes collected by localities to fund public schools.

In February, Ryan sponsored another bill to abolish school property taxes by statute; that measure has yet to receive a vote in the House of Representatives Finance Committee. While enacting a statute requires majority assent of the House and Senate and the signature of the governor, amending the state Constitution requires House and Senate approval in two consecutive sessions. The policy would then go before Pennsylvania voters as a ballot question for approval or rejection and the governor would play no role in that process.

Read the full storyPhiladelphia Voters Want Lower Property Taxes, but Higher Taxes on the Rich

Philadelphia has one of the worst city tax burdens in America, and voters aren’t pleased. It will also be a struggle for city leaders to find a politically popular solution.

A poll from the Pew Charitable Trusts found that Philadelphians have become more opposed to taxes, but an anti-tax revolt isn’t brewing in the city either.

Read the full storyKnoxville Mayor Proposes 2022-2023 Budget Totaling Approximately $434 Million

Knoxville Mayor Indya Kincannon proposed her 2022-23 budget on Friday at the State of the City Address, according to a press release by the city.

Read the full storyConnecticut No Longer First in Personal Income Per Capita

New data from the federal Bureau of Economic Analysis (BEA) reveals that Connecticut is no longer first place among states in terms of per-capita personal income.

The Constitution State’s per-capita individual income exceeded every other states’ since 1987. Last year, however, Massachusetts outranked Connecticut regarding individuals’ mean income. The latter state’s residents averaged a yearly income of $82,475 each, whereas the former’s average earner got $82,082 annually. (The national average was $63,444.)

Read the full storyBill Strips Ohio School Districts’ Ability to Challenge Property Valuations

Property owners could be spared challenges to property valuations from local school districts and the potential of higher property taxes if a bill recently passed by the Ohio Senate clears the House and is signed by Gov. Mike DeWine.

Amended House Bill 126 stops local school districts from initiating challenges to property tax valuations and appealing a decision from the board of revision to the board of tax appeals if a property owner filed a challenge.

The Ohio School Boards Association (OSBA) called the legislation an overreach, while the Ohio Chamber of Commerce and the Ohio Realtors Association supported the bill and recently penned an opinion piece on it.

Read the full storyArizona Supreme Court to Hear Brnovich’s Lawsuit Against Arizona State University over Its Sweet Deal to Hotel Developers

The Arizona Supreme Court has agreed to accept an appeal from Arizona Attorney Mark Brnovich in his lawsuit against Arizona State University and the Arizona Board of Regents (ABOR) challenging a deal they made with hotel developers letting them use school property, which allows them to avoid property taxes.

Brnovich said shortly after filing the lawsuit, “ABOR shouldn’t be subsidizing out-of-state billionaires. Worst of all, ABOR is depriving K-12 schools and community colleges millions of dollars in property tax revenue that must be made up by other taxpayers by placing the hotel on property tax exempt land.”

Read the full storyDetroit, Michigan Voters to Decide on Left-Wing ‘Proposal P’ on Tuesday

When Detroit, Michigan voters head to the polls for next Tuesday’s primary, they will decide on a referendum concerning a major proposed revision of the city charter which would institute numerous left-wing programs and reforms.

The ballot item, known as “Proposal P,” provides for the creation of a new “Task Force on Reparations and African American Justice,” an “Office of Economic Justice and Consumer Empowerment,” a “Department of Environmental Justice and Sustainability” and an “Office of Immigrant Affairs,” among other new government offices.

Read the full storyCarol Swain Helps NoTax4Nash.com and 4GoodGovernment.com in Nashville to Stop the 32 Percent Property Tax Increase

Live from Music Row Thursday morning on The Tennessee Star Report with Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 a.m. to 8:00 a.m. – host Leahy welcomed Dr. Carol Swain to the studio.

At the top of the second hour, Swain described two local grassroots groups she is working with that hope to offer budgetary alternatives in order to avoid Mayor John Cooper’s proposed 32% property tax increase. She urged people to get involved and make their voices heard by going to NoTax4Nash.com and 4GoodGovernment.com and by contacting their local city council members.

Read the full storyCarol Swain: ‘We Are Getting a Taste of What It’s Like to Live Under Democratic Party Rules’

Live from Music Row Thursday morning on The Tennessee Star Report with Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 a.m. to 8:00 a.m. – Leahy was joined on the newsmakers line by all-star panelist Dr. Carol Swain.

During the second hour, Swain weighed in on Mayor Cooper’s handling of the shutdown and how he is not making good on his promises that he ran on. She believes that it is a poor time to increase property taxes and that this is a perfect example of what it would be like to live under a Democratic Party rule.

Read the full storyThe Beacon Center’s Mark Cunningham: People Need to Look at City Leadership Over These Past 10 Years

Towards the end of the third hour of Monday’s Tennessee Star Report with Michael Patrick Leahy, The Beacon Center’s Marks Cunningham weighed in on Mayor Cooper’s proposed 32% property tax increase stating that it was the wrong time to be doing this to the citizens of Nashville in lieu of the government-mandated shutdown and recent tornado destruction. He suggested that government cuts and freezes need to be put on the table if they are going to hinder small businesses while corporate businesses receive tax breaks and incentives.

Read the full storyMetro Council Member at-Large Steve Glover Weighs in on Mayor Cooper’s Plan to Raise Davidson County Property Taxes By 32 Percent

Live from Music Row Wednesday morning on The Tennessee Star Report with Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 a.m. to 8:00 a.m. – host Leahy welcomed guest Metro Councilman-at-Large Steve Glover to the newsmakers line.

Read the full storyNashville Mayor Reveals Plan to Raise Property Taxes Amid Tornado Devastation and Coronavirus Pandemic

Nashville Mayor John Cooper announced during his virtual State of the Metro address Tuesday that he plans to “sharply increase” the city’s property tax rate.

Cooper said the Nashville Finance Department predicts that revenue from sales taxes and other activities will be down between $200 and $300 million because of the coronavirus pandemic.

Because of the unusual circumstances, Cooper didn’t have a budget proposal to discuss but said the budget ordinance he plans to present to the Metro Council in April will “sharply” increase the city’s property tax rate. Cooper said the final rate will still be lower than other cities throughout Tennessee.

Read the full storyMetro Council Member Steve Glover Talks Nashville’s Fiscal Fact Versus Fiction and the Need to Curb Unnecessary Spending

Live from music row Monday morning on The Tennessee Star Report with Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 am to 8:00 am – host Leahy and all-star panelist Crom Carmichael welcomed in-studio guest Metro Councilman Steve Glover to the show. At the top of the third hour, Glover expressed urgency to curb costs and expenditures in Nashville. He explained how the cycle of business has been that of increased revenues that are mishandled instead of being used on necessary infrastructure repair. Glover was concerned that the money continues to be spent in irrelevant areas creating a budget issue in a booming city. Leahy: In the studio with us the original all-star panelist, Crom Carmichael. Good morning, Crom. Carmichael: Michael. Leahy: And, Metro council member Steve Glover. Carmichael: Thank you, sir. Leahy: Well, a big week ahead for Nashville Metro council. Budget battles. Glover: I think it starts. I think we’re going to have a good conversation. Prior to that though, let me say, Frank and Barbara very good friends of mine. Leahy: Frank and Barbara? Glover: Today is their anniversary. Leahy: Frank and Barbara 57th anniversary. Carmichael: Wuthier? Frank and Barbara Wuthier? Leahy:…

Read the full storyFree Market Expert Explains House Bill 2638 That Would Cap Local Property Tax Hikes

On Wednesday’s Tennessee Star Report with Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 a.m. to 8:00 a.m. – guest host Ben Cunningham welcomed Beacon Center of Tennessee’s Ron Shultis to the newsmakers line.

Read the full storyDesperate David Briley Punches Down, Criticizes Nashville Tea Party’s Opposition to Property Tax Increase

On Friday’s Tennessee Star Report with Michael Patrick Leahy and special guest Ben Cunnigham – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 am to 8:00 am – Leahy and Cunningham talked about Cunningham’s recent Tweets stating that he would hold John Cooper accountable to his implied commitments to the reallocation of Davidson County funds and not raising property taxes.

Read the full story