The politically-divided Virginia General Assembly agreed on a “stopgap” budget bill before lawmakers adjourned the legislative session Saturday, with lawmakers indicating work remains to reach a final deal on amendments to the state’s two-year state spending plan.

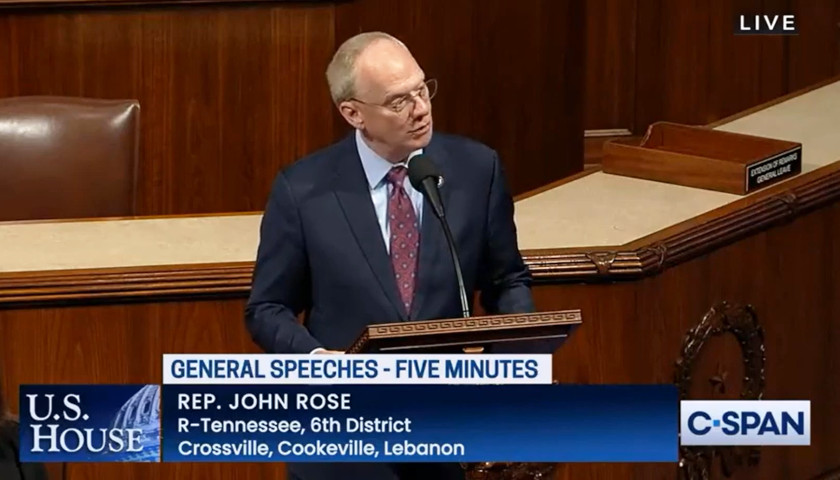

Without an agreement reached on key aspects of proposed amendments to the state’s budget – including $1 billion in tax cuts proposed by Gov. Glenn Youngkin – the legislature agreed to pass what House Appropriations Committee Chair Del. Barry Knight described as a “stopgap” budget with just a few items.

Read the full story