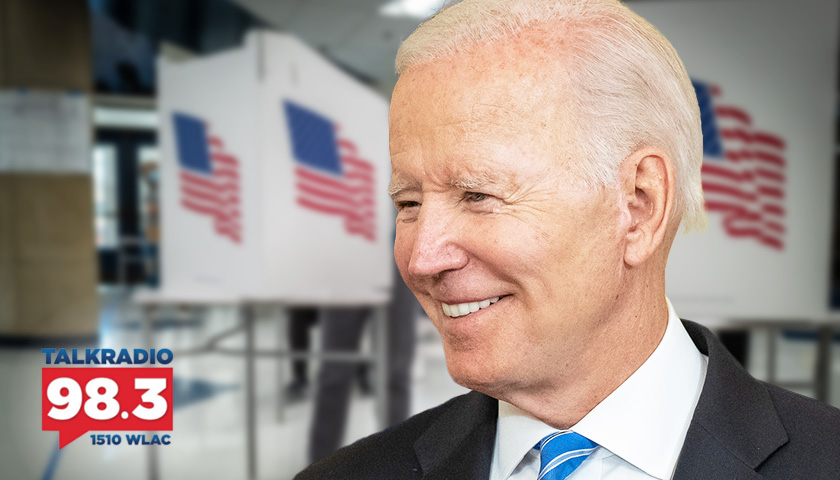

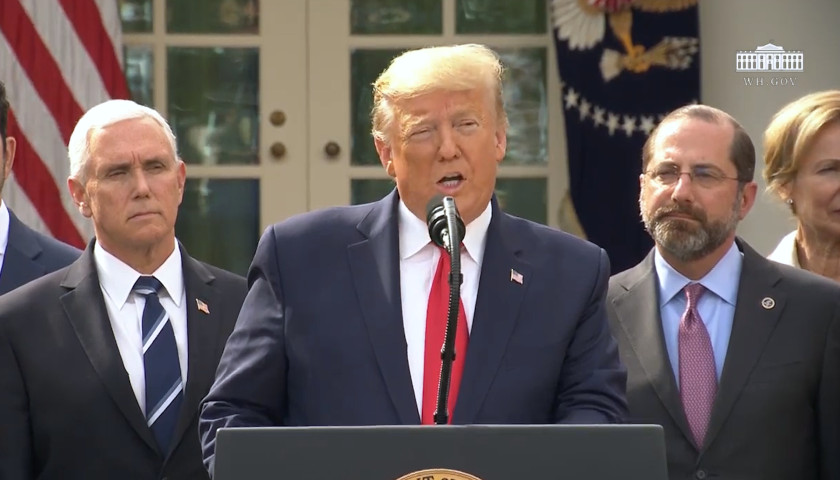

Scott Bessent, billionaire investor and founder of Key Square Capital Management Fund, joined Wednesday’s edition of The Tennessee Star Report with Michael Patrick Leahy to discuss how the stock market’s rally coincides with former President Donald Trump being ahead in the 2024 presidential election polls.

In a letter to investors, which was recently leaked to Bloomberg, Bessent’s Key Square Capital Management Fund said it believes that equity markets are “in the midst of a ‘Trump Rally’ that will last as long as he remains ahead of Biden in the polls.”

Read the full story