The unemployment rate in the U.S. ticked upwards to 4.2 percent in November, with 161,000 additional Americans saying they are unemployed in the latest household survey by the Bureau of Labor Statistics.

Read the full storyTag: tax cuts

Trump Pledges to Eliminate Taxes on Overtime

Former President Donald Trump on Thursday pledged to eliminate taxes on overtime wages if he is elected back to the White House in November.

Trump has previously promised to eliminate taxes on tips, and social security benefits. All three proposals appear to be part of an effort to woo working-class and senior voters, groups that could be crucial in November’s election.

Read the full storyState Rep. Jake McCalmon: Tennessee is Fighting an ‘Uphill Battle’ Against the Biden Administration

Tennessee State Representative Jake McCalmon (R-Franklin) said the Volunteer State is “fighting an uphill battle” against the Biden administration on “multiple” fronts due to the administration’s “failed policies.”

Read the full storyTennessee Celebrates Small Business Appreciation Week

Gov. Bill Lee (R) has officially proclaimed April 28 to May 4 as Small Business Appreciation Week in Tennessee.

Noting that small businesses are “the backbone of Tennessee’s economy, comprising a significant portion of the State’s employment including nearly half of private-sector workforce,” and that “supporting small business owners in Tennessee strengthens the State’s resilience against economic downturns and promotes sustainable economic development,” Lee released the official proclamation on the state’s website.

Read the full storyHaley Lays Out Economic ‘Freedom Plan,’ Packed with Promises of Tax Cuts, Entitlement Reform and Regulatory Relief

Declaring that it’s time for Washington to start working for Americans and not the other way around, GOP presidential candidate Nikki Haley laid out her economic “Freedom Plan in a speech Friday in New Hampshire.

The former South Carolina governor and United Nations ambassador is proposing a litany of middle-class tax cuts, regulatory relief and “third rail” entitlement reforms in a proposal she asserts will check communist China aggression through American prosperity.

Read the full storyGOP Presidential Hopeful Tim Scott Unveils Economic Plan Ahead of Campaign Trip to Hawkeye State

U.S. Senator and Republican presidential hopeful Tim Scott is unveiling his “Build, Don’t Borrow” economic plan as he prepares for another campaign trip to Iowa.

Scott says his proposal targets runaway government spending, while cutting taxes, expanding jobs and “unleashing American manufacturing and energy production” with his Made in America agenda.

Read the full storyBudget Revisions at Impasse over Tax Cuts and Underfunded Virginia Schools

Virginia entered the fiscal year on July 1 without a revised budget for the first time in over 20 years due to a lack of consensus in the General Assembly – to the tune of roughly $1 billion.

Virginia operates on a two-year budget that is passed in even years, but revisions are made in odd years to keep up with state programs, priorities and changes in legislation.

Read the full storyGeorgia Again Reports Decreased Tax Collections in June

Georgia reported decreased monthly tax collections for the fourth consecutive month.

Georgia’s net tax collections of more than $2.8 billion in June decreased 0.4 percent, or $10.9 million, compared to a year ago. The Peach State reported decreased tax collections in March, April and May.

Read the full storyRepublican Tax Cuts Headed for Budget Showdown

The $4.4 billion tax cut plan approved by Republicans at the Wisconsin Capitol is the latest piece of the new state budget that Gov. Tony Evers is promising not to sign.

Republicans on Thursday okayed a tax cut package that will lower income taxes for everyone, but will give top earners in the state a larger tax cut.

Read the full storyBudget Reformers Push Tax Cuts Despite Dip in Wisconsin Tax Revenue

The threat Wisconsin may see less money over the next two years is not deterring one budget reform group from pushing for “historic” tax reform.

The Institute for Reforming Government this week released its Playbook for Income Tax Relief in Divided Government.

Read the full storyYears of Tax Revenue Surpluses Bring Grocery Tax Break to Tennesseans

Governor Bill Lee signed the largest tax cut in Tennessee history on Thursday, his office announced. The Tennessee Works Tax Act (TWTA) aims to provide $400 million in savings for families and small businesses.

The sweeping new legislation includes a three-month grocery tax holiday, a tax credit for companies who offer paid family leave to employees, and $150 million in small business tax relief.

Read the full story$400 Million Tax Cut Bill Includes Grocery Tax Holiday, Tax Cuts for Small Businesses

According to the Tennessee Department of Revenue (TDOR), the state will soon begin implementing a $400 million tax cut law recently passed by the Tennessee General Assembly.

“Decades of smart fiscal stewardship have enabled Tennessee to maintain a balanced budget while cutting taxes for Tennessee families and businesses,” said Governor Bill Lee in a TDOR release. “We are proud to continue that legacy this year by putting dollars back in the pockets of Tennesseans and supporting future economic growth across Tennessee, and I thank the General Assembly for its partnership to promote future growth and opportunity for our state.”

Read the full storyNew Report Highlights Benefits of a Wisconsin Flat Tax

As the Wisconsin Legislature considers sweeping tax cuts, a new report finds a flat tax would yield substantial benefits for all.

The report, published by the Badger Institute, notes single-rate reform to Wisconsin’s costly progressive tax system would spur faster economic growth, creating more jobs and more investment — all while lowering the burden on Badger State taxpayers.

Read the full storyKatie Hobbs Breaks Arizona Veto Record for a Single Session

The Arizona Senate Majority Caucus released a statement Tuesday, announcing that Governor Katie Hobbs had vetoed another 11 bills, bringing her total to 63 and surpassing the previous record for most legislation vetoed in a single session.

“Vetoing is a tool that weak leaders will use in an effort to control legislative priorities, and we’re witnessing this tactic front and center from Katie Hobbs,” said Senate President Pro Tempore T.J. Shope (R-Coolidge). “Instead of demonstrating diplomacy and bipartisanship, the Governor is showcasing her failure to work across the aisle. Instead of accomplishing the priorities of our citizens and strengthening our communities, she’s done little outside of hosting press gaggles and photo ops with activist groups and Democrats alike.”

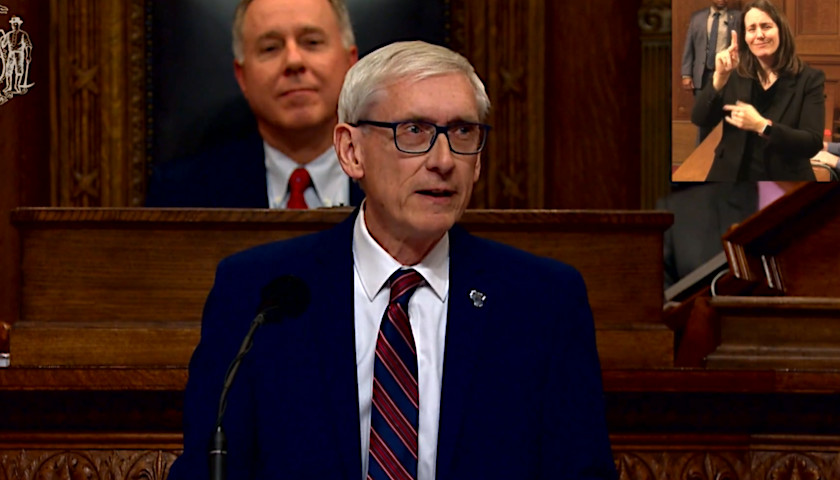

Read the full storyEvers Unveils Record $104 Billion Budget Plan, Republicans Get Ready to Rewrite

Billing it a “breakthrough budget,” Governor Tony Evers rolled out a massive two-year spending plan on Wednesday that would dump billions more taxpayer dollars into a host of new programs, raise taxes by $1 billion-plus on businesses, deliver a sweetheart deal to the Milwaukee Brewers, and gobble up much of the state’s historic $7.1 billion surplus.

At approximately $104 billion, Evers’ budget proposal is the first to break the $100 billion mark and comes in at about $13 billion more than his 2021-23 plan and more than $16 billion higher than the current budget he signed into law in June 2021.

Read the full storyGov. Tony Evers Signals Big Spending Plans for Wisconsin in State of the State Address

In his fifth State of the State address Tuesday evening, Gov. Tony Evers began laying out how he plans to use Wisconsin’s $6.6 billion surplus, pitching a spending bender of big government initiatives already with a price tag to date of around $1.3 billion. But there’s more to come. Evers is still constructing his biennial budget plan, set for release in a few weeks.

Read the full storyArizona Senate Republicans Introduce Tax Cut Bills for Groceries and Rent Payments

State Senate Republicans have introduced two bills that target Arizona’s grocery and rental taxes to give local families a financial break. Kim Quintero, the spokeswoman for the Senate Republican Caucus, told The Arizona Sun Times that it would be unwise for Governor Katie Hobbs (D) to veto bills like these should they pass the legislature.

“It would not be wise of the Governor to veto the food tax bill, as this will provide immediate inflation relief to those living paycheck to paycheck, and it’s something that resonates with a large portion of her voter base,” Quintero said via email.

Read the full storyYoungkin Says Tax Cuts Can Give Virginia a Win Against Other States

Heading into the second year of his term, Virginia Gov. Glenn Youngkin says he wants to “compete to win” with other states when it comes to attracting business and people to the Commonwealth.

That was the main takeaway from a speech given by the governor Thursday, when he touted proposed budget amendments to cut $1 billion in taxes and outlined his strategy to “win” in the Commonwealth.

Read the full storyRobin Vos Looks to Compromise with Governor on Abortion, School Choice, Tax Cuts

The top Republican in the Wisconsin Assembly says he’s willing to work on “solutions” with Gov. Tony Evers.

Speaker Robin Vos on Thursday said he sees Republicans offering the governor compromises on abortion, school choice and taxes.

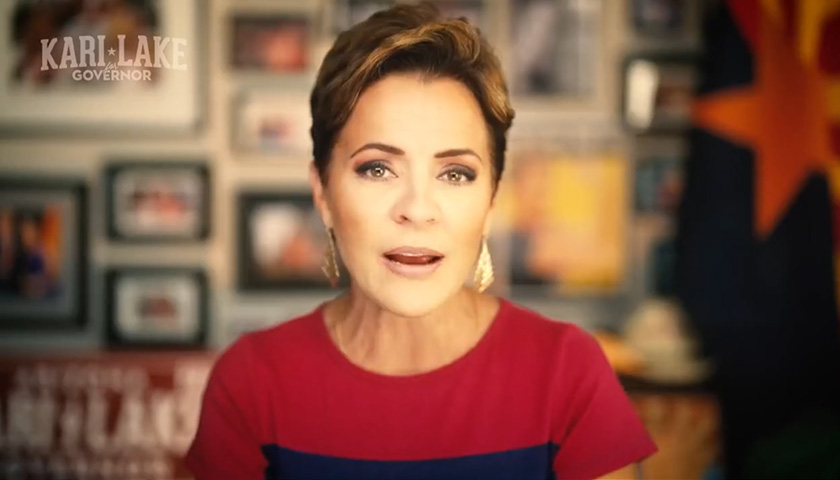

Read the full storyKari Lake Slams Katie Hobbs for Not Supporting More Tax Cuts as Inflation Continues to Soar

New data shows that inflation continues to rise for consumers across the country, and in response, Arizona’s gubernatorial Republican nominee Kari Lake slammed her Democrat opponent Katie Hobbs for not supporting more tax cuts in the state.

“Today’s skyrocketing inflation data is another tragic reminder of the damage Democrats like Katie Hobbs and Joe Biden have done to Arizona’s economy. Arizona families can’t keep up with the soaring costs. I have a plan to provide some immediate relief by eliminating taxes on groceries and rent, which Katie Hobbs obviously opposes because she’d rather tax you than help you. It’s unfathomable that Katie Hobbs wants Arizonans to pay tax on top of these already crushing prices, but not surprising coming from the party of Joe Biden,” Lake said in a statement emailed to the Arizona Sun Times.

Read the full storyNew Kari Lake Ad Promises to Cut Taxes for Arizonans

Arizona’s Republican gubernatorial nominee Kari Lake told Arizonans that economic relief might be on the horizon in a new ad released Sunday detailing her plan to fight high costs if elected as the state’s next governor.

“Thanks to Joe Biden’s and Katie Hobbs’ liberal tax-and-spend agenda, Arizona has one of the highest rates of inflation in the country. Katie Hobbs and the Democrat Party won’t do anything to provide relief for Arizonans, but Kari Lake will,” said the Kari Lake Campaign in a statement.

Read the full storyDemocratic Wisconsin Governor Pitches Tax Reduction Plan Ahead of November Election

Wisconsin’s governor says he wants to cut taxes in the state.

After proposing more than $1 billion in new taxes and new spending in each of his two proposed state budgets, Gov. Tony Evers on Tuesday proposed a $600 million tax cut and price cut plan.

Read the full storyCommentary: President Trump’s Policy Victories, from A to Z

Whatever one thinks about President Donald J. Trump’s personality, his policies were the most conservative reforms that America has seen since President Ronald Wilson Reagan left office — and perhaps even before he arrived.

Read the full storyReport: Tax Cuts Dropped as Whitmer, GOP Disagree

Tax cuts are no longer on the negotiating table as Gov. Gretchen Whitmer and the GOP-dominated Michigan Legislature square off before a deadline to submit a budget.

Crain’s first reported the story, citing two anonymous sources familiar with negotiations, and said lawmakers hope to pass a budget on Thursday.

Read the full storyVirginia Budget Deal Includes Middle-Class Tax Cuts, Grocery Tax Cut

After months of debate about Virginia’s biennium budget, lawmakers reached a deal to provide an income tax cut for the middle class, a reduction in the grocery tax and a pay raise for teachers.

The deal earned approval from Republicans and Democrats in a joint conference committee, but still needs to pass the House of Delegates and the Senate and be signed by Gov. Glenn Youngkin. Republicans narrowly control the House and Democrats narrowly control the Senate.

Read the full storyMinnesotans Demand Permanent Tax Cuts: ‘They’re Stealing from Us’

Minnesotans are calling on Gov. Tim Walz and the Legislature to return the record-breaking $9.3 billion budget surplus to the people by permanently cutting taxes.

A crowd gathered inside the Minnesota Capitol rotunda Saturday for the “Give it Back Tax Rally.” The rally was hosted by the Center of the American Experiment and involved several speakers including multiple radio hosts and a former U.S. congressman.

Read the full storyKemp Signs Bill Cutting Taxes on Military Pensions

A new law signed by Gov. Brian Kemp (R) says that a certain amount of income from Georgia veterans’ military pensions will be exempt from income tax.

Article 2 of Chapter 7 of Title 48 of the Official Code of Georgia Annotated dictates tax exemptions.

Read the full storyThe John Fredericks Show: Virginia State Senate Candidate John McGuire Talks Youngkin’s Tax Cut

Thursday morning on The John Fredericks Show, host Fredericks welcomed House Delegates member John McGuire who is now running for the Virginia State Senate to talk about why his running and getting Governor Younkin’s tax cut passed through the Senate.

Read the full storyLawmakers Call for Challenge to ARPA Rules Limiting Connecticut Tax Reduction

Connecticut Republican legislators said on Saturday they want the state to challenge a part of the American Rescue Plan Act which limits states’ ability to cut taxes.

GOP senators and representatives are calling for tax reduction beyond the targeted relief backed by Gov. Ned Lamont (D). A major roadblock to greater decreases will be the COVID-relief bill President Joe Biden signed into law last year. The act included $195.3 billion in recovery funds for states and barred states accepting allocations from using them to “directly or indirectly offset a reduction in net tax revenue… or delay the imposition of any tax or tax increase.”

Read the full storyGovernor Walz Releases Proposed Budget, Includes $500 Payments to Residents

Minnesota Governor Tim Walz and Lieutenant Governor Peggy Flanagan released a new budget that considers a budget forecast projecting an increased surplus.

An analysis from the Minnesota Management and Budget office detailed that the state’s budget surplus has increased to roughly $9.3 billion.

Read the full storyMinnesota Ranks Among States with Highest Income Tax, New Report Shows

Minnesota ranks among states with the highest income tax, a new report from the Tax Foundation shows.

The organization, a nonpartisan nonprofit that analyzes tax policies from each state, ranked the governments based on the impact of their individual income taxes, as Minnesota was placed at number 43 in the country.

Read the full storyKnox County Mayor Glenn Jacobs Talks State Budget Bump and Fighting Mask Mandates

Tuesday morning on The Tennessee Star Report, host Leahy welcomed Mayor Glenn Jacobs of Knox County to the newsmakers line to talk about this continued fight against mandatory mask mandates in schools and the new state budget.

Read the full storyConnecticut Gov. Lamont Proposes $336 Million in Tax Cuts

Gov. Ned Lamont said he is proposing a package of legislative proposals that would provide for $336 million in tax relief for state residents.

The governor announced the first package of tax aid comes as the state has a projected $1.48 billion surplus in its operating budget. The surplus, Lamont said, enables the tax cuts to be built into the budget and will ensure the state’s Rainy Day Fund remains strong.

Read the full storyState Represenative Jerry Sexton Talks State of the State, Budget, and Tax Cuts

Wednesday morning on The Tennessee Star Report, host Leahy welcomed State Representative Jerry Sexton from Bean Station in studio to talk about his district changes and State of the State Address.

Read the full storyTrump Ended His First Year with Big Tax Cut Win, Biden Finishes His with Crushing Manchin Loss

Buffeted by a Russia scandal that proved false, Donald Trump ended the first year of his presidency on a high note with passage of historic tax cuts. In contrast four years later, Joe Biden’s first year in office is ending with a stunning rebuke from a senator in his own party.

On Sunday, Sen. Joe Manchin (D-W.Va.) gave a resounding “No” to Biden’s signature Build Back Better legislation, leaving an uncertain path for the Democrats’ ambitious agenda despite the fact they control the Senate, House and White House.

Read the full storyReport Shows Arizona Has Recovered All Jobs Lost During COVID-19 Pandemic

Arizona has recovered all jobs that were lost during the coronavirus pandemic, according to a report from the Arizona Office of Economic Opportunity (OEO).

The data shows that the state’s economy has gained 101 percent of jobs lost during the initial months of the economic shutdowns associated with the pandemic.

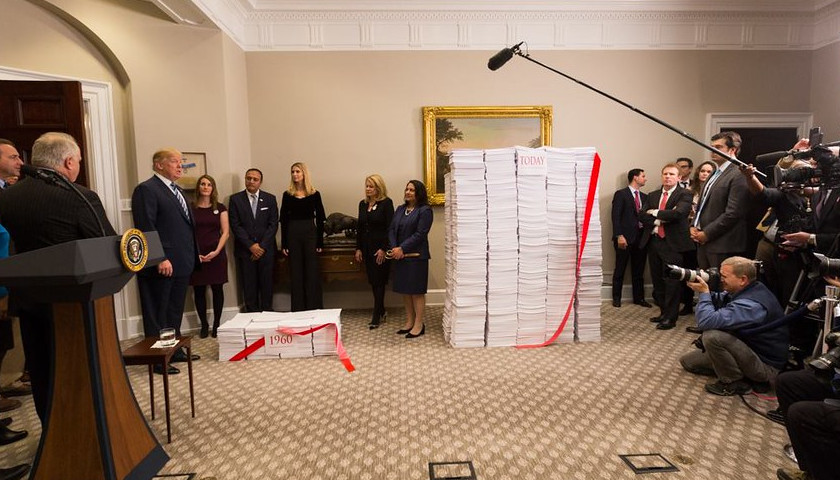

Read the full storyStudies: Trump Tax Cuts Helped Lower Income Families, Build Back Better Helps Wealthier Americans

Democrats have argued that the tax reforms implemented through the 2017 Tax Cuts and Jobs Act (TCJA) only benefited the rich, and that the Build Back Better Act (BBBA) will help middle-and working-class Americans the most.

But several nonpartisan groups found that the TCJA reduced the tax burden for the middle- and working-class by up to 87% and, they argue, the $2.4 trillion BBBA – before the U.S. Senate this week – would increase taxes on the middle- and working-class by up to 40%.

A new analysis published by the Heartland Institute found that the TCJA reduced the average effective income tax rates for taxpayers in every income tax bracket – but the lower- and middle-class saw the greatest benefits – with the lowest-income filers receiving the largest tax cuts.

Read the full storyMichigan State Senator Aric Nesbitt Introduces Bill to Cut State Taxes

Michigan State Senator Aric Nesbitt (R-Lawton) on Thursday introduced legislation to cut the state’s income tax rates.

The measure, Senate Bill 768, would reduce the personal and corporate income tax rates to 3.9% from 4.25% and 6%, respectively.

Read the full storyLawsuit Filed Against Referendums That Attempt to Reverse Arizona’s Historic Tax Cuts

The Arizona Free Enterprise Club filed a lawsuit recently against Invest in Arizona over the organization’s attempt to get three referendums on the Arizona ballot that would reverse Arizona’s recently passed tax cuts. The lawsuit contends that since the tax cuts “provide for, and directly relate to, the generation of revenues that are remitted to the general fund and appropriated to various agencies, departments and instrumentalities of the state government,” they cannot be the subject of a referendum and are unconstitutional.

AFEC President Scot Mussi, who is one of the plaintiffs, said, “All three bills directly provide for the support and maintenance of the state, were key aspects of the state’s budget, and therefore are not referable by Invest in Arizona.”

Read the full storyProgressive Groups Seek to Reverse Historic Arizona Tax Cuts

A coalition of progressive groups filed a request with the Secretary of State’s office on Friday for a voter referendum that would block historic tax cuts that were passed by the state legislature and enacted by Governor Doug Ducey.

The groups will now have 90 days to collect a minimum of approximately 120,000 valid signatures from residents of the state — a move that would prevent the tax cuts from taking effect until all voters could decide on the measure in November 2022.

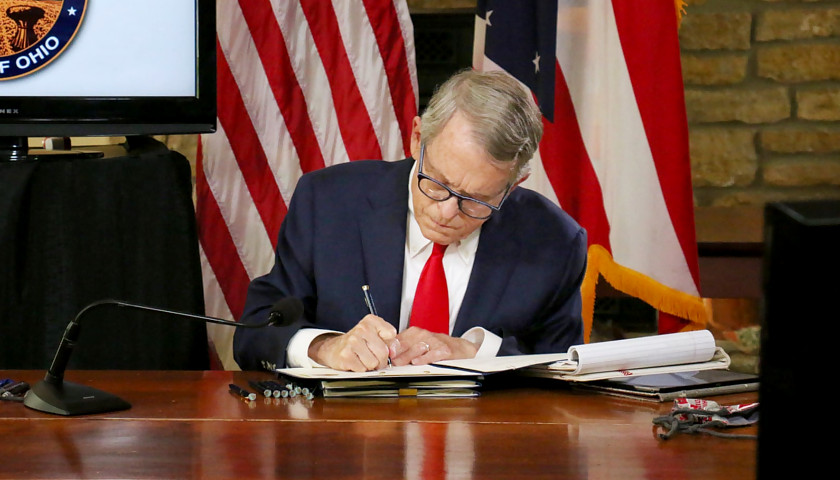

Read the full storyGovernor Mike DeWine Signs Ohio Budget into Law

Ohio Governor Mike DeWine (R) signed the state’s budget into law in the early hours of Thursday morning — but not without vetoing several components of the bill.

The budget, which will find the state’s operations for two years, including key provisions such as tax cuts and the funding of public K—12 schools.

Read the full storyArizona Legislature Wraps up Session for the Year

The Arizona Legislature wrapped up this year on Wednesday with a nearly record-long session, reaching 171 days. Lawmakers came to an agreement on most of the budget last Friday that contained historic tax cuts. Governor Doug Ducey signed that bill, HB 2900, also on Wednesday.

During the last few hours, the legislature approved the education budget bill, HB 2898, which included an expansion of the school voucher program. It reduces the length of time children must attend a public school before they are eligible for vouchers to use at a private school. Low-income children who live near poorly-rated schools will be eligible immediately, and others will only have to spend 45 days in the school, down from 100 days.

Read the full storyHistoric Income Tax Overhaul Reduces Burden by 13 Percent for Most Arizonans

Arizona Governor Doug Ducey is expected to sign a budget bill the Arizona Legislature sent to him on Friday that includes a historic tax reform package. HB 2900 implements the lowest flat tax in the country, 2.5%. The average Arizona family will see a 13% income tax reduction, about $350 per year. According to the nonpartisan Tax Foundation, Arizona previously had one of the highest marginal income tax rates in the country.

The budget bill also eliminates taxes on veterans’ retirement pay and prevents a 77% increase on small business taxes. It reduces property taxes by 10% on small businesses and job creators by 10%, capping the maximum tax rate on businesses at 4.5% and reducing commercial property taxes. According to a report by Ducey, 43% of Arizonans in the private sector work for small businesses. HB 2900 increases the homeowner’s rebate so the state covers half of homeowners’ primary property taxes.

Read the full storyAnalysis: Federal Tax Overhaul Increased Taxes on Wealthy in Many Blue States

The 2017 Tax Cuts and Jobs Act, harpooned by progressive Democrats as a handout to wealthy corporations, turned out to be more progressive in practice, new data from the federal government revealed.

The federal tax reform measure supported by President Donald Trump increased taxes on some wealthy property owners in high-tax jurisdictions such as Illinois and New Jersey and decreased tax burdens on the middle class.

Read the full storySecond Wave of Middle Class Tax Cuts Slated for September

Keeping with his promise in 2018 that he would be issuing a second round of tax cuts, President Donald Trump’s administration signaled that details of the new cuts would be announced in September.

Read the full storyCommentary: Embrace Fiscal Responsibility, Not Tax Cuts, in 2020

As Democratic presidential candidates stumble over one another in a headlong rush towards socialism and fiscal insanity—promising trillions in new spending on everything from child care, health care, and higher education for all, to “the Green New Deal” and slavery reparations—President Trump faces a critical choice.

Read the full storyCameron Sexton Radio Spots Promote Republican Legislative Accomplishments

State Representative Cameron Sexton (R-Crossville) is promoting the legislative accomplishments of the Republican Administration and legislative supermajorities with a new pair of radio ads. Many of the successful legislative items, from tax cuts to school safety to job creation were lost in the shuffle when scandals involving House Speaker Glen Casada and his top staffers captivated the media as the Session ended. Sexton ran similar spots intended to advance the agenda of the Republican supermajority in the House earlier in the year. As Caucus Chair he has said that part of his role is policy, not just politics, and the ads during Session and in advance of a Special Session in August are an important way to fulfill that role. Sexton is seeking the nomination for House Speaker in a Republican Caucus meeting scheduled for later this week. The winner of that election, which requires at least 37 votes in the 73 Member Caucus, is expected to succeed House Speaker Glen Casada following his resignation on August 2. The full House will vote on a new Speaker on August 23 during the Special Session called by Governor Bill Lee. Tennessee Star Political Editor Steve Gill says the ads are…

Read the full storyCommentary: The Truth About How Much Americans Are Paying in Taxes

by Adam Michel As Americans file their taxes this April, they might be in for a surprise: Most Americans got a tax cut last year. It shouldn’t be a surprise given the Tax Cuts and Jobs Act of 2017, but unfortunately, the media have produced a never–ending deluge of misleading or inaccurate reporting on the issue. Last year, The Heritage Foundation studied how the tax cuts would affect Americans in every congressional district across the country. We found that each of the 435 districts got a tax cut and that the average American household paid about $1,400 less in taxes as a result in 2018. Americans with children also benefit from the tax cuts. A married couple filing jointly with two children saw their tax bills fall by an average of $2,917. Depending on how much you make, where you live, and how many kids you have, the numbers can look different. You can check out the average tax cut in every congressional district here. Americans don’t just benefit from the lower taxes. They benefit a second time from higher wages generated by a faster-growing economy. Lower taxes for businesses and individuals help fuel more investment and innovation, which…

Read the full storyTrump Tax Cuts Spur Unexpectedly High State Revenues

by Evie Fordham The Tax Cuts and Jobs Act touted by President Donald Trump is one of three reasons that at least 19 states are reporting unexpectedly high general fund revenue halfway through fiscal year 2019, tax policy expert Adam Michel told The Daily Caller News Foundation Thursday. “Trump can also take credit for the larger economy to the extent that that’s now fueling additional spending,” Michel, a Heritage Foundation policy analyst, told TheDCNF via telephone. “It’s not only the Tax Cuts and Jobs Act that’s growing the economy but his deregulatory agenda is fueling economic growth. All of those things wouldn’t have happened if he didn’t push for them.” Increased spending in the larger economy gave state sales tax revenue a boost. “I think we will see most states end up with more revenue at the end of the year,” Michel told TheDCNF. Heritage is a conservative think tank located in Washington, D.C. The current fiscal year will hit its halfway point on Dec. 30. The National Association of State Budget Officers (Nasbo) released a report Thursday that said 19 states have received general fund revenue that exceeded expectations for fiscal year 2019. Those states include Georgia, Pennsylvania,…

Read the full storyBlackburn Campaign Releases Final Two Ads Prior to Election Day Highlighting Trump and Border Security

The Marsha Blackburn campaign for the U.S. Senate on Saturday released its final two television ads which will air in media markets across the state. In an ad titled, “Closing,” U.S. Rep. Blackburn (R-TN-07) says, “As a World War II veteran’s daughter, I know America is always one generation from slipping away. I’m Marsha Blackburn. I’ll fight to build the wall, reclaim the Supreme Court, protect Trump’s tax cuts, and repeal Obamacare. Phil Bredesen, he won’t do any of that. I’m Marsha Blackburn and I approve this message because we won’t right America if we don’t fix what’s wrong.” “I’m Marsha Blackburn, and I approve this message because we won’t right America if we don’t fix what’s wrong.” “Closing” is available to watch here. A second new ad is “We Need Marsha.” In the video, President Donald Trump says, “We need Marsha Blackburn to win. We need Marsha in the Senate to continue the amazing progress and work that we’ve done over the last year and a half. This November this is the state where America’s comeback will continue full speed ahead. We need Marsha. We will make America great again.” “We Need Marsha” is available to watch here. Speaking about…

Read the full story