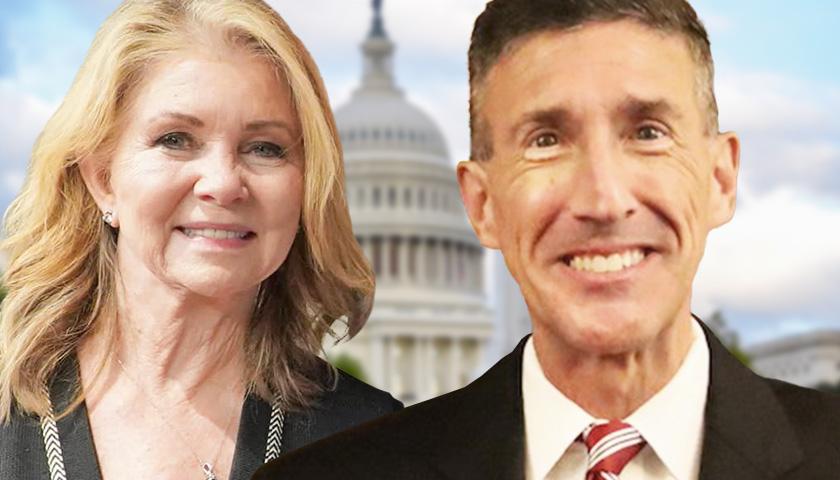

Majority Whip Johnny Garrett joined the newsmaker line on Monday’s episode of The Tennessee Star Report with Michael Patrick Leahy to share his insights on the new legislative session as it begins its second week at home as snow continues to blanket the region.

Garrett expressed optimism about Governor Bill Lee’s proposed education freedom scholarships, though he said he does anticipate some opposition to the proposal.

The conversation then turned to the potential constitutional issue regarding the franchise excise tax law that could leave taxpayers on the hook for as much as $1.2 billion. Garrett noted Attorney General Jonathan Skrmetti is evaluating the claims to see if tax relief for the companies in question would address constitutional concerns.

Read the full story