Judson Phillips, founder of Tea Party Nation, said Americans should expect to see a “new golden age” of the nation under former and president-elect Donald Trump during his incoming second term in the White House.

Read the full storyTag: taxation

Commentary: Americans Support Trump on the Election’s Two Most Important Issues

As the nation reels from a second cowardly attack on former President Donald Trump’s life, it is increasingly clear the radical left refuses to tone down their hateful rhetoric against Trump even if it threatens his life repeatedly. The American people, however, want to put Trump back in charge of the two most pivotal issues facing the country – the economy and immigration.

Just five days after the contentious debate between former President Trump and Vice President Kamala Harris blatantly exposed the mainstream media’s allegiance to the radical left, Trump fended off yet another attack on his life. On Sunday Trump was on what should have been a secure West Palm Beach golf course, only to be threatened once again by a radical extremist with a weapon.

Read the full storyCongress Reaches Deal to Increase Child Tax Credit, Negotiate Tax Treaty with Taiwan

Congressional negotiators from the Senate and House of Representatives announced a deal on Tuesday to increase the child tax credit and negotiate a new bilateral tax treaty with Taiwan, among other matters.

The child tax credit was first enacted in 1997 to provide parents with greater funds to care for children under the age of 17 and was expanded in 2021 under the American Rescue Plan Act, though that expansion expired in 2022 and has not been reauthorized. The new deal — known as the “The Tax Relief for American Families and Workers Act of 2024” — reached between Democrats and Republicans in Congress will change the way the tax credit is calculated, increase the credit every year until 2025 and index it to inflation, according to a technical summary of the plan published by the House Ways and Means Committee.

Read the full storyArizona House Celebrates Passage of $18 Billion State Budget

After months of debate and negotiations between Governor Katie Hobbs (D) and state Legislative leaders, the Arizona State House and Senate have passed a $17.8 billion state budget with bipartisan support, delivering some wins and losses for both sides of the political aisle.

“From day one, our Majority has been focused on getting the job done for our constituents: putting Arizona families first, protecting the vulnerable, and growing opportunity and freedom. We’re conservatives. We believe you should keep more of your money and the government should spend less. That’s why we believe this is Arizona’s Budget — a budget that reflects our needs, gives back, spends smart, and addresses real issues,” said House Speaker Ben Toma (R-Peoria). “We needed a budget that the Governor would sign that accomplishes our goal of putting Arizona families first. This budget accomplishes both.”

Read the full storyExclusive: Wisconsin Institute for Law & Liberty Report Urges Ending ‘Taxation Without Representation’ in Funding Badger State Tech Colleges

A new report finds Badger State homeowners pay nearly a half-billion dollars annually in property taxes to fund Wisconsin’s technical colleges, a figure expected to grow in the next biennial budget.

But in Wisconsin there are no directly elected members to authorize these taxes, creating a system of “taxation without representation,” according to the study from the Wisconsin Institute for Law & Liberty (WILL).

Read the full storyCrom’s Crommentary: ‘For the Left and Their Friends in the Media, the Truth is Irrelevant’

Friday morning on The Tennessee Star Report, host Leahy welcomed the original all-star panelist Crom Carmichael to the studio for another edition of Crom’s Crommentary.

Read the full storyAlways Right with Bob Frantz: Mike Gibbons Clears Up Viral Video’s Statement About Middle-Class Taxation

Monday morning on Always Right with Bob Frantz, weekday mornings on AM 1420 The Answer, host Frantz welcomed GOP Ohio Senate hopeful Mike Gibbons to the show to clear up what he meant in video audio that has resurfaced from a September podcast that has gone viral.

Read the full storyConnecticut No Longer First in Personal Income Per Capita

New data from the federal Bureau of Economic Analysis (BEA) reveals that Connecticut is no longer first place among states in terms of per-capita personal income.

The Constitution State’s per-capita individual income exceeded every other states’ since 1987. Last year, however, Massachusetts outranked Connecticut regarding individuals’ mean income. The latter state’s residents averaged a yearly income of $82,475 each, whereas the former’s average earner got $82,082 annually. (The national average was $63,444.)

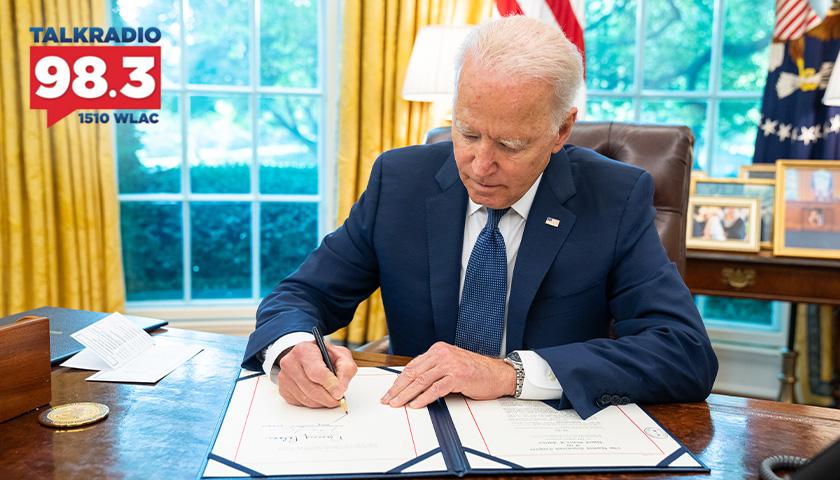

Read the full storyAnalysis: Biden’s Spending Could Become A Hidden Tax On Everything

As the U.S. climbs out of a once-in-a-century pandemic, rising prices have led to increasing worry that rapid inflation could be just over the horizon.

Americans have already witnessed higher prices in the past few months, with everything from gasoline to lumber to basic home items jumping in cost. The increases, partially fueled by non-existent interest rates and record government spending, could lead to inflation that the U.S. has not seen in decades, experts say.

“In the short term, consumers can expect to see rising prices across the board,” Henry Olsen, a senior fellow at the Ethics and Public Policy Center and a columnist at The Washington Post, told the Daily Caller News Foundation. “I expect in the next few months people will be getting sticker shocked in virtually all aspects of their life.”

Read the full story