by Chris White French President Emmanuel Macron made his way back to France Sunday as protesters turn the streets of Paris upside down over sky-high gas taxes designed to fight global warming. Officials are considering declaring a state of emergency to deal with the unrest. Macron returned from his trip in Argentina to chaos in the streets as so-called “yellow jacket” demonstrators continued protesting against taxes and Macron’s perceived indifference toward everyday citizens. Prime Minister Edouard Philippe canceled plans to attend a climate change summit in Poland. One person died outside Paris during the weekend’s protests, bringing the number of casualties to three. More than 260 people were arrested, including 133 in Paris, according to police reports. More than 412 people were arrested nationwide. Christophe Castaner, France’s interior minister, told reporters Sunday he would not rule out the president’s declaring a state of emergency. Macron has emergency powers that were expanded after terrorist attacks roiled the country in 2015 — it is not yet clear if he will exercised those powers. Saturday and Sunday’s protests drew roughly 136,000 people, slightly down from the 166,000 who gathered in late November, the Interior Ministry said in a press statement. Politicians and police officials believe the situation was…

Read the full storyTag: taxes

FEC Records Indicate Taylor Swift’s Political Contributions to Federal Candidates Total $15 To-Date

Taylor Swift is making the headlines again but this time, on the political stage. After her statement on Sunday that she is endorsing Democrat Phil Bredesen over Rep. Marsha Blackburn (R-TN-07) in this November’s contest to replace retiring Sen. Bob Corker (R-TN), The Tennessee Star tried to find some information about her financial contributions to federal political candidates. A brief review of Federal Election Commission records indicates that Swift appears to have made just one contribution to a political candidate for federal office in her career. That contribution came in 2014, when she generously gave fifteen dollars to a far left candidate campaigning in a congressional district of New Jersey. Tuesday morning on The Tennessee Star Report, broadcast Monday through Friday from 5 am to 8 am on Talkradio 98.3 FM and 1510 WLAC, Tennessee Star Report: Early Edition (5 am to 6 am hour) co-hosts Michael Patrick Leahy and Doug Kellett talked about the discovery and it’s implications. Kellett: We were talking about the Presidents comments yesterday about Taylor Swift and he was making these comments while he was swearing in the new justice on the US Supreme Court, Judge Kavanaugh. And he said he likes Taylor Swifts music…

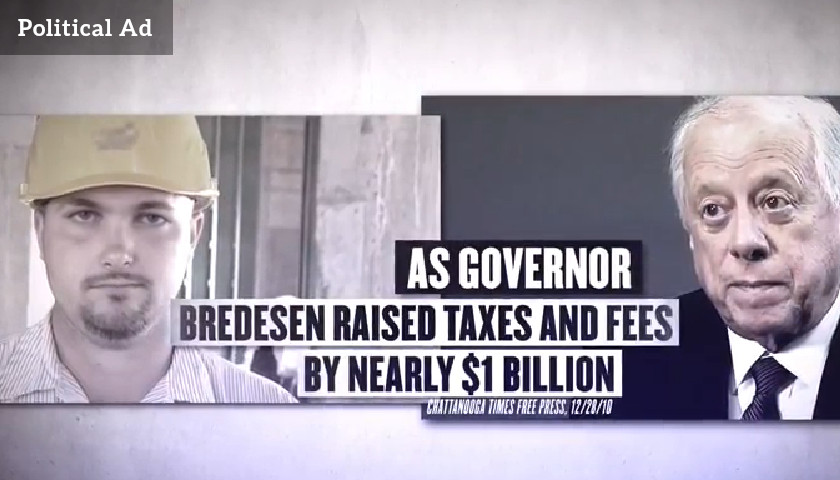

Read the full storyFact Checking Shows Bredesen Raised Taxes, Fees By Nearly $1 Billion as Governor

Republicans are checking the facts about Phil Bredesen’s “phony” claims to have balanced the state budget when he was governor, pointing out Tennessee’s constitution requires a balanced budget. “Phil Bredesen is touting his budgetary accomplishments in a recent ad, but he’s not giving Tennesseans the full story,” the Tennessee Republican Party said in a statement. Bredesen, a former Democratic governor, is running for the seat being vacated by U.S. Senator Bob Corker (R-TN), who is retiring. His opponent is U.S. Representative Marsha Blackburn (R-TN-07). The Tennessee Republican Party says their latest video shows “Bredesen doesn’t have a leg to stand on.” The video is available to watch here. Tennessee has balanced its budget every year since voters approved a balanced budget amendment to the state Constitution in 1978. The GOP points out how Bredesen fails to say that as governor he raised taxes and fees by nearly $1 billion, citing a 2010 story by the Times Free Press, and “raided hundreds of millions of dollars from the state’s highway fund so that he could pay for his own budgetary priorities.” “Our state constitution has strictly prohibited anything other than a balanced budget since 1978, so it’s pretty rich for Phil…

Read the full storyNew Ad Touts ‘Out of Touch’ Bredesen’s History of Supporting Tax Increases

Senate Leadership Fund on Tuesday launched a new advertising blitz targeting Phil Bredesen’s fixation with raising taxes on Tennessee families. The $1.1 million buy will run statewide on a combination of broadcast and cable television, radio and digital. The ad is available to watch here. Bredesen, a former Democratic governor, is running for the seat being vacated by U.S. Senator Bob Corker (R-TN), who is retiring. His opponent is U.S. Representative Marsha Blackburn (R-TN-07). The ad, titled “Out of Touch,” highlights Bredesen’s 30-year record of supporting higher taxes and fees, and his opposition to the recently passed tax reform legislation. “Phil Bredesen is an out-of-touch multimillionaire who raised taxes and fees on Tennessee taxpayers by over $1 billion,” said Senate Leadership Fund Spokesman Chris Pack. “Bredesen never saw a tax hike that he didn’t like, which explains why he was so resolutely opposed to the Trump tax cuts that are helping Tennessee’s families and jobs.” Senate Leadership Fund’s website says this about the organization: “As an independent Super PAC, the Senate Leadership Fund has one goal: to protect and expand the Republican Senate Majority when Elizabeth Warren, Bernie Sanders and Chuck Schumer, together with their army of left-wing activists, try to take it back in 2018.” The $1…

Read the full storyReligious Organizations: Take the Hillsdale Option

by Jenna Suchyta I am tired of hearing Masterpiece Cakeshop v. Colorado Civil Rights Commission hailed as a “victory” for religious liberty; it was no such thing—unless we’re also going to start counting forfeits and rain delays as wins. Masterpiece was a bunt, and not a very promising one at that. Although the outcome of the decision was in favor of Jack Phillips, the Christian baker in Colorado who refused to bake a cake for a same-sex wedding, the reasoning of the decision was mostly based on the hostility that Phillips faced from the Colorado Civil Rights Commission. If proponents of religious liberty unwittingly allow this false sense of security to pervade their thinking, they run the risk of being caught by surprise in later cases, like this one in Michigan to be discussed later. In the Masterpiece case, the Supreme Court very clearly refused to make a ruling on religious exemptions to discrimination law and public accommodations law. “The delicate question,” Justice Kennedy writes in the majority opinion, “of when the free exercise of his religion must yield to an otherwise valid exercise of state power needed to be determined in an adjudication in which religious hostility on the part of the State itself would not be a…

Read the full storyHouse Votes Overwhelmingly To Kill Obamacare’s Tax On Medical Devices

by Julia Cohen A bipartisan majority in the House voted to repeal President Barack Obama’s 2.3 percent medical device tax Tuesday. The repeal passed 283-132, with 57 Democrats and all but one Republican voting in favor. North Carolina Republican Rep. Walter Jones was the sole Republican against the bill. “Minnesota’s innovators can breathe easier since we’re one step closer to ending the medical device tax for good,” Minnesota Republican Rep. Erik Paulsen, the bill’s sponsor, said in a Tuesday press release. “Today’s vote shows strong bipartisan support for lifting this burden on innovators in an industry so important to Minnesota. I’m more optimistic than ever we’ll be successful in giving these job creators the certainty and predictability they need to thrive.” The repeal will reduce federal tax revenue by about $22 million over the next 10 years, according to a Wall Street Journal article. The tax was temporarily rolled back in 2016, and Congress extended the rollback to 2020. Paulsen’s bill makes the repeal permanent. “This bipartisan legislation will make healthcare more affordable and ensure Americans have access to the most innovative life-saving and life-improving medical technology,” Speaker Paul Ryan tweeted Tuesday. Good news→ The House just voted to repeal Obamacare’s Medical Device Tax. This bipartisan legislation will make…

Read the full storyRepublicans Unveil Tax Cuts Round Two On The Same Day Progressives Release Plan For Tax Increases

by Julia Cohen House Republicans announced they are working on a second iteration of tax cuts on Tuesday, the same day the Congressional Progressive Caucus announced a proposal for raising taxes. “The tax cuts have been working incredibly well to get this economy moving, to create more jobs, to put more money in the pockets of hardworking families … we’re gonna continue building on that growth,” House Majority Whip Steve Scalise said during a Tuesday press conference. GOP Texas Rep. Kevin Brady, the House Committee on Ways and Means chairman, went to the White House Monday to discuss a second round of tax cuts, Scalise said during the press conference. WATCH: The #TaxCutsandJobsAct has jump-started our economy, created more jobs, and put more money in the pockets of hard-working families. Americans are #BetterOffNow. And there's still more to come—#TaxCuts 2.0 ✂️ pic.twitter.com/9bigUUCtxi — Steve Scalise (@SteveScalise) July 24, 2018 Brady released a listening session framework for the proposed round of tax cuts, which includes making the original individual and small business tax cuts permanent and new tax write-offs for startups, on Tuesday as well. “With this framework, we are taking the first step to change the culture in Washington D.C. where tax reform only happens…

Read the full storyJust Facts Think Tank President: The True Effects of Regulations on the Economy

by James D. Agresti In a New York Times article about President Trump scaling back regulations, reporters Binyamin Appelbaum and Jim Tankersley report “there is little historical evidence tying regulation levels to” economic growth. They support this sweeping claim only with a quote from Jared Bernstein, a former chief economic adviser to Vice President Joe Biden, who says: “The notion that deregulation unleashes growth is virtually impossible to find in the data.” In reality, there is a wealth of data indicating that regulations harm economic growth, and economists have identified numerous mechanisms by which this can occur. This includes but is not limited to: preventing workers from using the most efficient means of production. In the words of an economics book published by Johns Hopkins University Press, “The sectors that provide services related to human capital investments [like education and healthcare] may produce inefficiently because regulations preclude efficient production,” which “may result in much greater costs of achieving specific investments than would be possible with fewer regulations.” diverting people from productive work. For example, federal tax laws and regulationsrequire taxpayers to spend 6.1 billion hours per year filling out forms and performing other tax compliance tasks. This is more than the combined work time of…

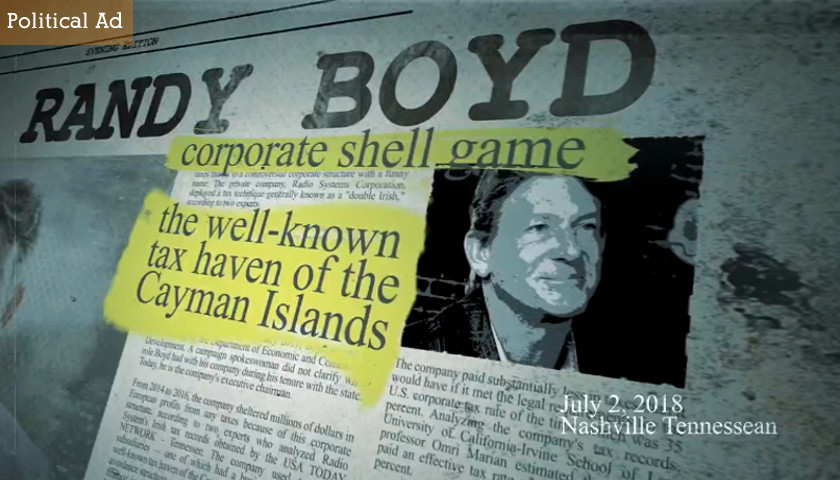

Read the full storyBlack Blasts Boyd on Taxes in New Ad

The gloves are definitely off in the Tennessee Republican Primary for Governor. Diane Black has unleashed a vicious television hit on Randy Boyd based upon a Tennessean story claiming that Boyd has used the location of his company’s foreign operations in order to avoid U.S. taxes. “From 2014 to 2016, the company sheltered millions of dollars in European profits from any taxes because of this corporate structure, according to two experts who analyzed Radio System’s Irish tax records obtained by the USA TODAY NETWORK – Tennessee,” The Tennessean reported on Monday. One of two “experts” quoted by the Tennessean was a California-Irvine School of Law Professor. “Analyzing the company’s tax records, University of California-Irvine School of Law professor Omri Marian estimated the company paid an effective tax rate of a little more than 1 percent,” The Tennessean said. However, as The Tennessee Star has reported, whatever documents were provided by the Tennessean for review by the professor could not have been obtained from public records, raising questions about the legality of the means by which The Tennessean procured them. The Tennessean has refused to make the “tax records” they obtained available for review by the public or other news media outlets, nor…

Read the full storyAs a Tax Accountant, I Can Tell You Tax Reform Is Helping Small Businesses

by Kalena Bruce As we enter the summer, Republicans and Democrats continue to debate the merits of the tax cuts. Lost in this partisan bickering is the genuine and long-overdue relief the tax cuts offer small businesses. Sadly, the media reporting on small business tax cuts has been heavily politicized, complicating rather than clarifying the issue. Even The New York Times couldn’t get it straight in an article earlier this year, leading to an embarrassing correction. As a certified professional accountant, I’ve already started dealing with the new tax code for small business clients who file returns on a quarterly basis. Here’s what they need to know. The new tax structure lowers tax rates and expands the income thresholds for anyone who pays individual income tax, including small businesses that are structured as pass-throughs. These include sole proprietorships, partnerships, LLCs, and S-Corps. The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more >> Under the new tax structure, rates fall to 10, 12, 22, 24, 32, 35, and 37 percent from 10, 15, 25, 28, 33, 35, and 40 percent. Income thresholds under these new rates are also expanded. For instance,…

Read the full storyCommentary: The ‘Internet Tax’ Fight Isn’t Really About Internet Taxation

By Dan Mitchell One of the key principles of a free society is that governmental power should be limited by national borders. Here’s an easy-to-understand example. Gambling is basically illegal (other than government-run lottery scams, of course) in my home state of Virginia. So they can arrest me (or maybe even shoot me) if I gamble in the Old Dominion. I think that’s bad policy, but it would be far worse if Virginia politicians also asserted extraterritorial powers and said they could arrest me because I put a dollar in a slot machine during my last trip to Las Vegas. And if Virginia politicians tried to impose such an absurd policy, I certainly would hope and expect that Nevada authorities wouldn’t provide any assistance. This same principle applies (or should apply) to taxation policy, both globally and nationally. On a global level, I’m a big supporter of so-called tax havens. I’m glad when places with pro-growth tax policy attract jobs and capital from high-tax nations. This process of tax competition rewards good policy and punishes bad policy. Moreover, I don’t think those low-tax jurisdictions should be under any obligation to enforce the bad tax laws of uncompetitive countries. There’s a very similar debate inside America. Some…

Read the full storyTaxes To Be Filed on a Postcard?

The dream of tax reformers for decades has been to transform the maddeningly complex federal tax code into a system simple enough for Americans to file their tax returns on a postcard. Republican leaders who the Tax Cuts and Jobs Act on Thursday said that dream would become reality for 90 percent of taxpayers. Meeting with…

Read the full story