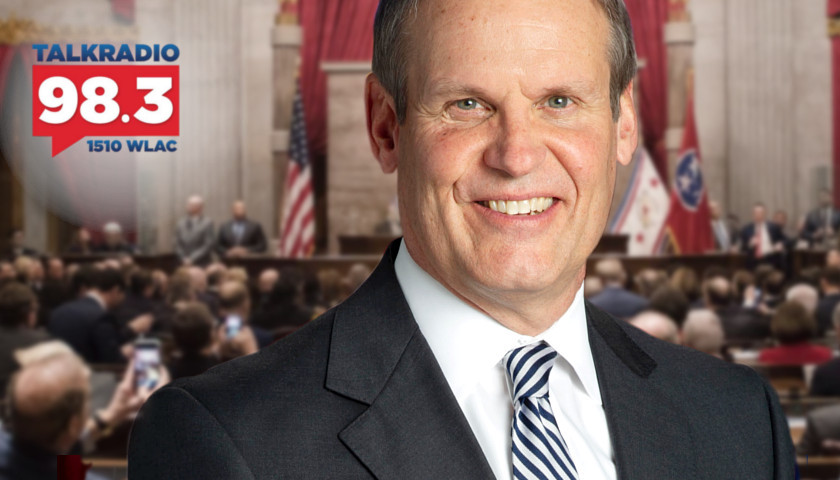

The Tennessee General Assembly this week passed major tax cut legislation, eliminating the $400 professional privilege tax levied on licensed individuals annually in 15 professions in Tennessee. This, according to a press release legislators sent out this week. Senate Bill 398, sponsored by Senator Brian Kelsey, R-Germantown, repeals the tax for accountants, architects, sports agents, audiologists, chiropractors, dentists, engineers, landscape architects, optometrists, pharmacists, podiatrists, psychologists, real estate brokers, speech pathologists, and veterinarians. “The idea that earning a living is a privilege is insulting to hardworking Tennesseans,” the press release quoted Kelsey as saying. “For many years, this tax has unfairly singled out individuals in 22 of the state’s 100 licensed professions by taxing them for the so-called ‘privilege’ of earning a living. I am very pleased that it will end for the majority of these taxpayers.” Action on the legislation comes after a 2016 Tennessee Advisory Commission on Intergovernmental Relations report said some professions in the state that are not taxed have higher average incomes. The report also noted that incomes of professionals vary significantly within the taxed professions and those in occupations earning lower salaries, pay the same amount as those earning more. Professionals in these areas must pay…

Read the full story