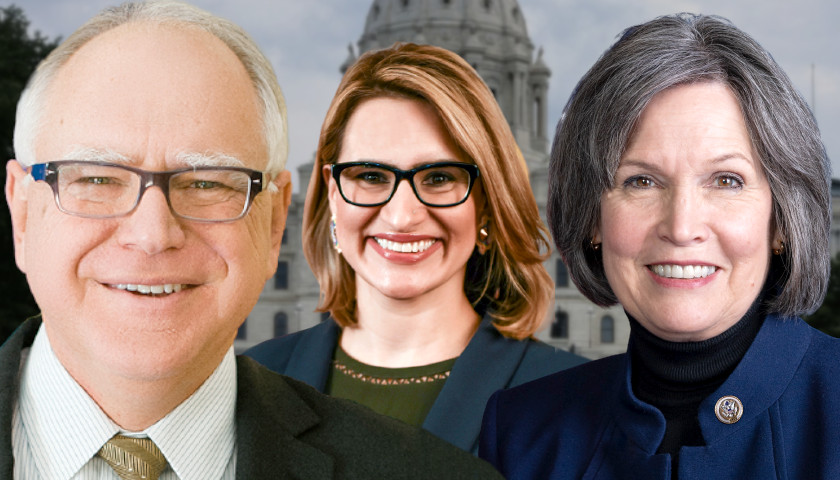

The House and Senate voted this week to pass a conference report amending HF2, the Paid Family and Medical Leave Act, that will tax employers and employees to help fund a new, state-run paid leave insurance program.

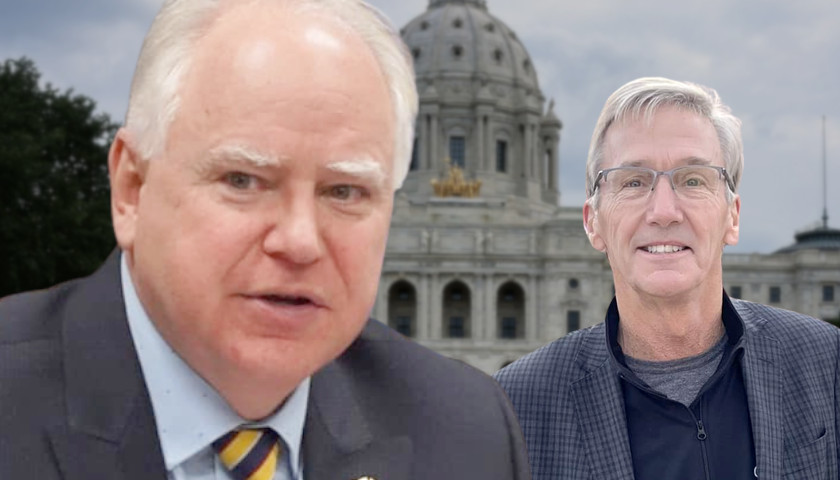

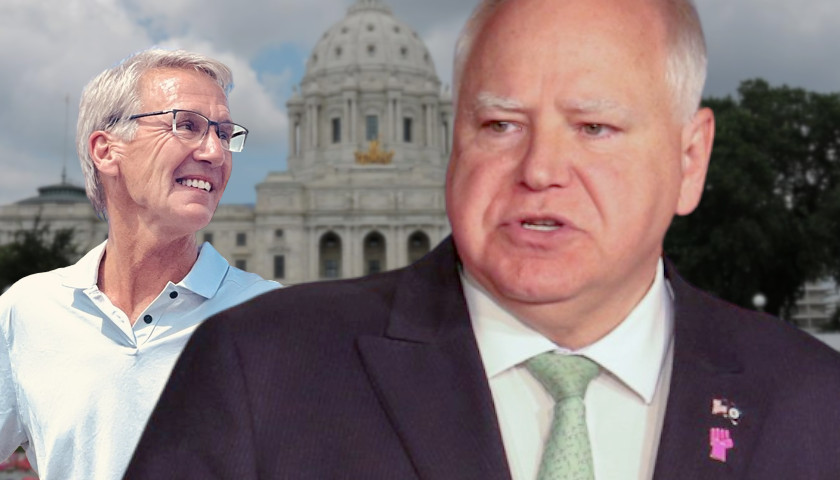

As amended by a DFL-only conference committee, the version of the bill that will head to Gov. Tim Walz for signature now includes a provision agreed upon by conferees to implement payroll taxes for the program on Jan. 1, 2026. Conferees also agreed to dedicate nearly $650 million in existing state revenue in 2024 as “seed money” for the program so that the state can begin providing those benefits in 2026.

Read the full story