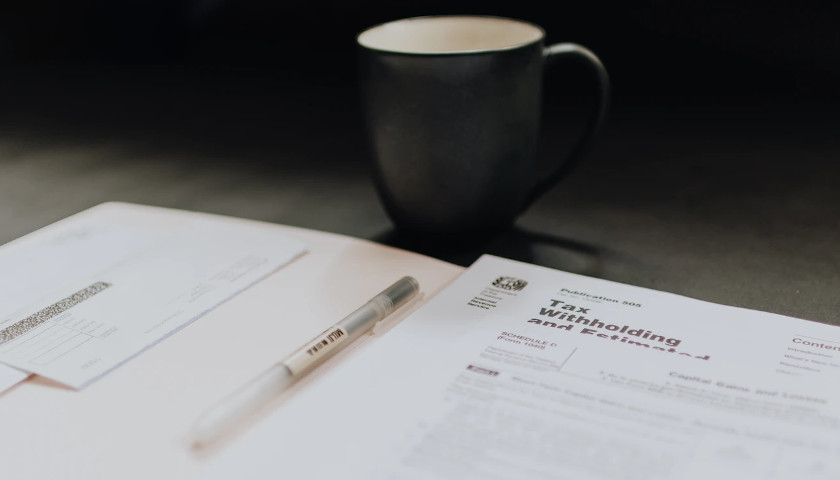

The Wall Street Journal Editorial Board said that a Democratic effort to crack down on tax cheating would give the Treasury Department access to almost every American’s bank account.

The Thursday op-ed focused on a proposal that would require financial institutions to report individual accounts containing at least $10,000 to the IRS. That effort, the board wrote, would affect the vast majority of Americans who did not exclusively use cash to make purchases and pay bills.

“The details are murky, but most Americans could still get ensnared in this dragnet unless they pay bills and buy goods in cash,” the editorial board wrote. “Democrats say banks will only have to report total annual inflows and outflows, not discrete transactions. But nearly all Americans spend more than $10,000 a year.”

Read the full story