A bill that is pending in the State Senate Ways and Means Committee would make it more difficult for the Ohio General Assembly to raise taxpayers’ income taxes.

Senate Joint Resolution 3, titled the “Approve income tax increases by supermajority,” would amend the state’s constitution. Sen. David Burke (R-OH-26) is the primary sponsor of the bill that would change the constitution to require a two-thirds vote of the General Assembly to approve an income-tax increase. It could go to ballots in the fall.

The text of the legislation is available here.

Putting a roadblock in the government’s path does not sit well with a liberal policy lobbying nonprofit, Policy Matters Ohio, which said it wants income taxes to increase the next time a recession hits.

The organization’s research director, Zach Schiller, said in a statement:

“Ohio’s income tax is the only major tax based on the ability to pay. This principle was embraced by founders of our democracy, as well as the intellectual father of capitalism, Adam Smith. As your income goes up, you pay a higher rate. The tax supports public education and a myriad of local services, from public safety to libraries.

“In every recession during the past 40 years, under both Democratic and Republican governors, Ohio has raised taxes at least temporarily to make up for lost revenue. Authors of this proposal are telling Ohioans that the next time, the income tax will be off limits—and so only more regressive taxes and fee increases, falling harder on low- and middle-income Ohioans—will be possible.”

The full statement by Policy Matters Ohio is available here.

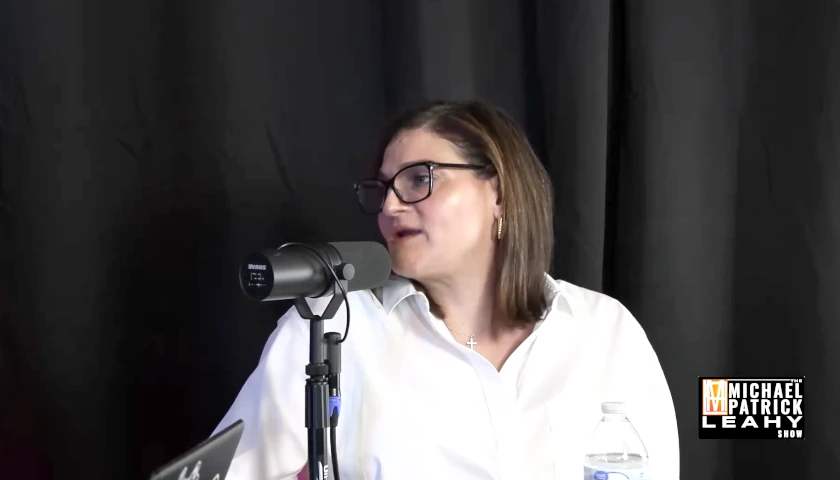

State. Sen. Theresa Gavarone (R-OH-02) doesn’t take that view, and has signed on as a co-sponsor.

She told the Sandusky Register that legislators should cut the size of government before hitting up taxpayers.

When it comes to the state deciding to take more money from people’s paychecks, “I think we should have overwhelming support,” Gavarone said. “It should be a higher bar.”

– – –

Jason M. Reynolds has more than 20 years’ experience as a journalist at outlets of all sizes.