by Scott McClallen

The Michigan Senate approved a bill that aims to lower the personal and corporate tax rate to 3.9%.

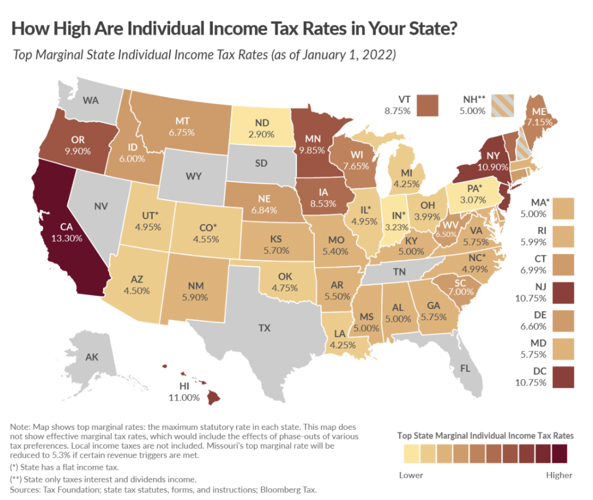

Michigan currently taxes corporations at 6% and Michiganders at a flat 4.25% income tax.

A Tax Foundation map compared tax rates nationwide.

A Tax Foundation map compared tax rates nationwide.

Senate Bill 768 aims to help Michiganders and businesses recover from COVID and attract inflow migration as Michigan’s death outpaced its birth rate in 2020 – a warning sign for a state’s economic health since taxpayers fund public services.

Sen. Aric Nesbitt, R-Lawton, said the four square-block radius of the Michigan Capitol is “out-of-touch” when it celebrates a $7 billion surplus while the rest of the state is battling inflation.

“State government may be flush with cash. But it’s not our money,” Nesbitt said on the floor. “It’s not the governor’s money. It’s the people’s money. And right now, they need to be sending less of it to Lansing so they can have more of it to fill up their cars, heat their homes, and feed their families.”

The bill would create a non-refundable $500 tax credit for each child under age 19 and increase the tax exemption for retirement income to $30,000 for individuals and $60,000 for couples.

If enacted into law, a Senate Fiscal Agency report estimates the bill would reduce General Fund revenue by $1.75 billion to $1.79 billion in fiscal year 2021-22, $2.33 billion to $2.38 billion in fiscal years 2022-23, and $2.40 billion to $2.45 billion in fiscal years 2023-24.

The bill’s enactment would reduce School Aid Fund revenue by $23.4 million in fiscal year 2021-22; between $147.0 million and $156.0 million in fiscal years 2022-23; and between $150.3 million and $160.9 million in fiscal years 2023-24.

The revenue loss would continue to grow with the economy and Michiganders’ growing families. Both tax changes would be retroactive.

Sen. Curtis Hertel, D-East Lansing, voted “no.” He said the bill favored companies over Michiganders.

“This bill is nothing but a show; an attempt to pay off large corporate donors and does nothing for the people of Michigan,” Hertel said in a floor speech.

Michael LaFaive, senior director of fiscal policy for the free-market Mackinac Center for Public Policy, applauded the bill’s passage.

“Senate Bill 768 finally rolls back the 2007 [Gov. Jennifer] Granholm personal income tax hike that was promised to expire, but that promise has yet to be fulfilled,” LaFaive said in a statement. “Our research has shown that returning the personal income tax rate to 3.9% would create 15,000 new jobs for Michiganders in its first year alone. We thank the senators who approved this broad-based tax relief for Michigan families and businesses.”

The Michigan Freedom Fund welcomed the bill passage, citing 40-year high inflation as a reason to give back surplus tax money.

“We applaud the Republican members of the Senate who voted to cut the state income tax and return a billion dollars to the people of Michigan,” Executive Director Tori Sachs said in a statement. “The state has a $20 billion budget surplus and recently handed out a billion dollars to just one company. Instead of spending the taxpayers’ money on more projects for Whitmer’s special interests, the Senate voted to give it back to the people. The State House should do the same and quickly vote to return this money to taxpayers who are struggling with record inflation in the Whitmer-Biden economy.”

The bill moves to the House.

– – –

Scott McClallen is a staff writer covering Michigan and Minnesota for The Center Square. A graduate of Hillsdale College, his work has appeared on Forbes.com and FEE.org. Previously, he worked as a financial analyst at Pepsi.