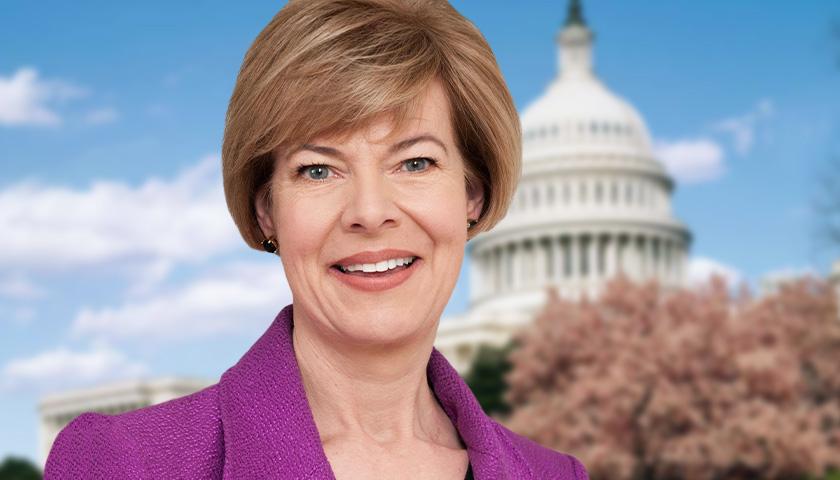

U.S. Senator Tammy Baldwin (D-WI) is urging fellow members of Congress to pass a measure to raise taxes on corporations with operations in low-tax foreign countries.

The legislation, called the No Tax Breaks for Outsourcing Act, would effect American participation in a global minimum tax, a major Biden-administration policy priority. In 2021, U.S. Treasury Secretary Janet Yellen joined 130 nations to negotiate a framework to equalize corporate taxation so companies could not escape high taxes in their home countries. Two months ago, all 27 member states of the European Union agreed on a plan for their involvement in such a system.

Yellen hailed the EU’s decision as a move that would help to “level the playing field for U.S. business while protecting U.S. workers” who fear outsourcing threatens their jobs. Other nations including the United Kingdom and South Korea have also taken steps toward implementation.

Alongside Senator Sheldon Whitehouse (D-RI) and Congressman Lloyd Doggett (D-TX-37), Baldwin is sponsoring the new U.S. legislation to guarantee more companies pay as much of the full 21-percent U.S. corporate tax rate as possible. The bill would end deductions for “global intangible low-tax income,” treat international corporations as domestic entities if they are managed on U.S. soil and nix provisions of U.S. tax law that the sponsors say encourage offshoring.

“To me, this is simple: We should not be rewarding big companies that ship jobs abroad,” Baldwin said in a statement. “I’m proud to support the No Tax Breaks for Outsourcing Act and work to close loopholes that big businesses get for outsourcing jobs, helping level the playing field for Wisconsin’s small businesses and support American workers.”

The senator cited an analysis by Kimberly Clausing of the UCLA School of Law suggesting that the federal government could realize $77 billion in additional revenue through legislation of the kind she proposes. And labor unions including the American Federation of Government Employees, the AFL-CIO, the Service Employees International Union and United Steelworkers have endorsed her measure as helpful to keeping American jobs from moving abroad. But free-market voices like the American Institute for Economic Research (AIER) warn higher corporate taxes will wreak largely negative consequences.

“The main catch is that the more that a tax binds, by which I mean the more that it can be enforced on the intended target (in this case corporations with offshore operations), the more incentive that the target has to avoid the tax,” AIER Senior Faculty Fellow Robert E. Wright told The Wisconsin Daily Star via email. “In this instance, if multinational corporations (MNCs) find that workarounds to the new law are too expensive, they might be induced to exit the United States entirely.”

Wright posited that the only way policymakers can be certain to get the same amount of taxes from multinationals as they do from corporations solely operating in the U.S. is to stop taxing corporate income. He pointed out that the Treasury already collects revenue from corporations through capital-gains and personal-income taxes and reasoned that the additional burden of a corporate income tax stifles growth.

– – –

Bradley Vasoli is managing editor of The Wisconsin Daily Star. Follow Brad on Twitter at @BVasoli. Email tips to [email protected].

Photo “Tammy Baldwin” by Senator Tammy Baldwin. Background Photo “U.S. Capitol” by Carol M. Highsmith.