The Arizona State House passed Senate Bill (SB) 1063 by State Senator Sonny Borrelli (R-Lake Havasu), which aims to eliminate the grocery tax across the state, sending it off to the governor’s desk for a final decision.

“At a time when thousands of Arizonans are already struggling to make ends meet, government shouldn’t be contributing to higher costs for basic necessities like food,” said State Representative Matt Gress (R-Phoenix) following his vote in the bill’s favor. “With Arizonans facing one of the highest inflation rates in the nation, I’ll never stop fighting to lower costs for families, seniors, and our most hard-hit fellow citizens.”

My statement on today’s Arizona House vote to eliminate Arizona’s tax on food.

I’ll never stop fighting to lower costs for families, seniors and our most hard-hit fellow citizens. pic.twitter.com/UGnlNLiMq5

— Matt Gress (@MatthewGress) March 22, 2023

Josselyn Berry, a spokesperson for Gov. Katie Hobbs (D), told The Arizona Sun Times via email Hobbs is currently reviewing the bill with stakeholders and will likely not make a final decision until “early next week.”

The plan to cut grocery taxes in the state has been in the works at the Arizona Senate since before the 2023 session began. As reported by The Sun Times, Senate President Warren Petersen (R-Gilbert) said in December that cutting the grocery and rental taxes would be a priority during the session, which eventually led to the introduction and passage of SB 1063 through the Senate.

Borrelli’s bill does exactly as advertised; it simply states that no municipality in Arizona may levy a tax on grocery items “for home consumption.” If it becomes law, it would go into effect on June 30, 2025.

However, the bill did not pass without some backlash. Democrat members of the floor voted unanimously against the bill, with some arguing it would not do as it claims. For example, State Representative Lupe Contreras (D-Avondale) said that cutting grocery taxes would not save people substantial money and would only amount to “pennies on the dollar.” Moreover, he argued that whatever money people save would likely be taken away, as cities would either need to raise taxes in other areas or cut funding to public programs to compensate.

However, State Representative Justin Heap (R-Mesa) refuted this point by saying city revenues are up this year, and there should be no reason a tax cut on groceries would cause cities to cut funding for important public services, like police or firefighters.

Additionally, the State House Republicans team tweeted that Arizona cities are expected to gain $700 million in shared income through next year and accused Democrats of “prioritizing city bureaucracy” over Arizona families.

House Dems voted against eliminating the tax on your groceries, saying it cuts $160 million to cities. The truth is cities will gain $700 million in shared income taxes alone from last year to next year. It’s not about the $ or public safety; they've prioritized city bureaucracy… pic.twitter.com/YgdBUzn49A

— Arizona House Republicans (@AZHouseGOP) March 22, 2023

Moreover, State Representative Leo Biasiucci (R-Lake Havasu) stated that the cuts could save families more than just pennies but upwards of $200 to $300 annually.

“Removing the grocery tax would save hundreds of dollars per family. All the Democrats voted NO because they stated saving a family pennies would mean nothing. Proud to stand with my Republicans to remove the tax on groceries,” tweeted Biasiucci.

Removing the grocery tax would save hundreds of dollars per family. All the Democrats voted NO because they stated saving a family pennies would mean nothing. Proud to stand with my Republicans to remove the tax on groceries. 🇺🇲 pic.twitter.com/tHPuvQAf7t

— Rep. Leo Biasiucci (@Leo4AzHouse) March 22, 2023

Furthermore, Republican legislators are not the only ones vying for a grocery tax cut. Chandler City Councilman Mark Stewart pushed for the same thing in his city. However, while Stewart said Chandler could handle the cut, he acknowledged that not every city is in the same situation. For example, Payson would potentially lose 16 percent of its current sales tax receipt if the bill went into law, a loss of $2.3 million. Stewart said Borrelli’s bill would ultimately “usurp local control.”

In total, 65 of Arizona’s 91 municipalities levy a grocery tax. It now lies on Hobbs (D) to decide the bill’s fate. Previously, Hobbs said, “I’m not going to say no to anything if there’s a way to provide relief for Arizonans.”

Seems like a no-brainer to sign this bill, especially since @KatieHobbs told @TedAtPBS of repealing the food tax 3 months ago: "I'm not going to say no to anything if there's a way to provide relief for Arizonans."@AZHouseGOP @AZSenateGOP #AZGov #AZLeghttps://t.co/RDhlsCndKB pic.twitter.com/bQDBM3Oa4K

— Brian Anderson (@AZBrianAnderson) March 23, 2023

– – –

Neil Jones is a reporter for The Arizona Sun Times and The Star News Network. Follow Neil on Twitter. Email tips to [email protected].

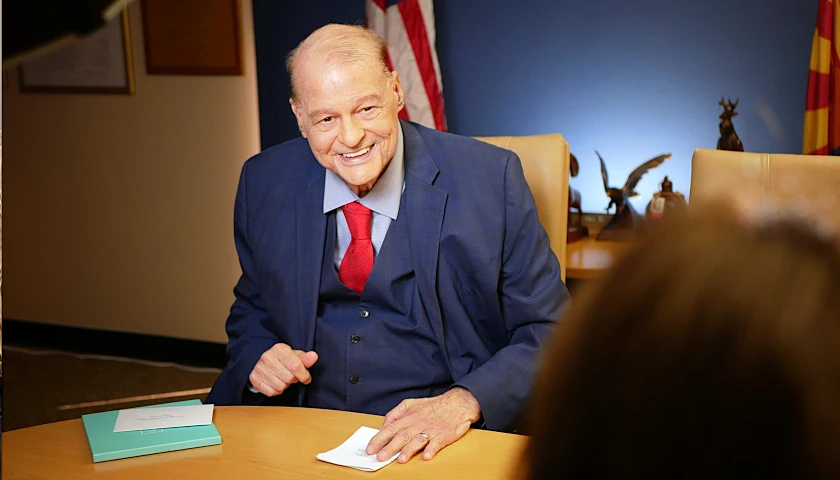

Photo “Katie Hobbs” by Katie Hobbs.