Arizona Gov. Katie Hobbs (D) announced several legislative actions on Tuesday, including the veto of Senate Bill (SB) 1063, sponsored by State Senator Sonny Borrelli (R-Lake Havasu), which would have prevented Arizona municipalities from enforcing a tax on groceries.

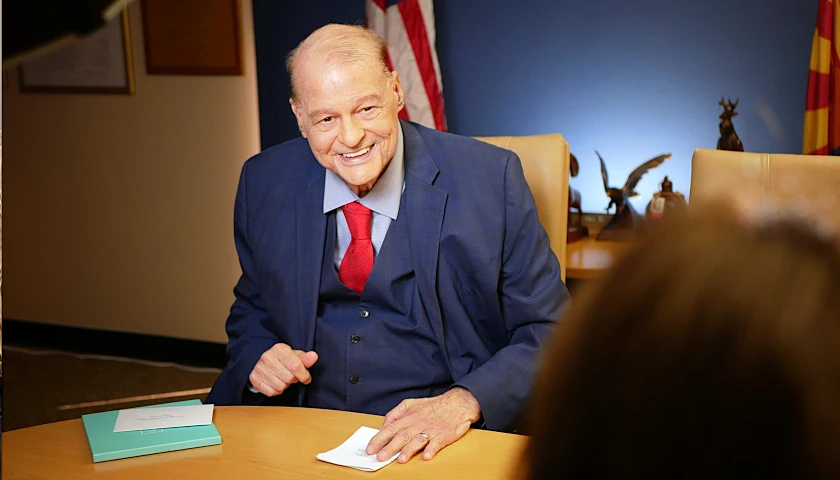

“This veto is a disgraceful windfall for cities and an absolute gouge for families,” said Majority Leader Borrelli. “We’re not only paying inflated prices to feed our families, but we’re also paying more in taxes as the cost of food rises. Food is not a luxury; it is a necessity. A tax on our groceries is regressive and hurts everyone.”

FOR IMMEDIATE RELEASE: Governor Continues Unwillingness to Help Arizonans Amid Crippling Inflation ⬇️ pic.twitter.com/qwOJSxorOH

— AZSenateRepublicans (@AZSenateGOP) March 28, 2023

As reported by The Arizona Sun Times, the State House passed Borrelli’s bill on March 22nd after a heated debate between Democrat and Republican legislators. While Republicans argued it was a way to put money back into the pockets of Arizonans, Democrats said the bill could harm cities and hurt constituents in the end. SB 1063 would have gone into effect in July 2025 had it passed.

In her veto letter, Hobbs’s reasoning mirrored the other Democrats, stating that the tax cut would not help anyone.

“I’ve heard from dozens of local leaders about the impact this legislation would have on municipalities. From potential cuts to service – including public safety – to increased property taxes, it’s clear that this bill doesn’t actually eliminate costs for our residents. It simply moves those costs around,” Hobbs shared.

She also said the bill would not help Arizonans struggling with inflation because it would not take effect for over two years.

However, Borrelli said he does not buy the argument that cities will struggle because of this bill, as he said they are expected to increase their revenue in the coming years.

“Over the next four fiscal years, cities and towns are estimated to receive an average of $2.3 billion per year in state-shared revenues, which is an increase of $844 million more than the average for the last four fiscal years. And yet the governor vetoed this bill, only padding cities’ bloated budgets instead of leaving more money in the wallets of hardworking taxpayers,” Borelli said.

Despite the setback, the senate majority caucus said its goal of reducing costs for Arizonans would not stop.

“Senate Republicans have been working toward introducing legislation necessary to provide financial relief to all Arizonans, especially low-income families who are feeling the tremendous burden of inflation,” said Senate President Warren Petersen (R-Gilbert). “It’s very clear the governor has no interest in helping with that financial burden.”

Chierstin Susel, a spokesperson for the caucus, told The Sun Times there are still some bills in the legislature aiming to give Arizonans money. For example, SB 1281, sponsored by Sen. Janae Shamp (R-Surprise), would direct the Arizona Department of Revenue (ADOR) to issue a one-time individual income tax rebate. The taxpayer must have been a resident as of December 31st, 2022, and filed an individual tax return for the 2022 tax year. The refund would be $200 for a single filer and $400 for a married couple who filed together. This bill is currently in the House.

“Providing some version of significant meaningful tax relief is one of Senate Republican’s top priorities, but whether any of these bills will be signed into law will depend on what the Governor decides to do,” Susal said via email.

According to the Common Sense Institute’s monthly inflation update, inflation was up 8.5 percent in March. Since 2020, the institute found that Arizonans have paid $1,460 more on food and beverages than they would have without the effects of inflation.

– – –

Neil Jones is a reporter for The Arizona Sun Times and The Star News Network. Follow Neil on Twitter. Email tips to [email protected].

Photo “Katie Hobbs” by Gage Skidmore. CC BY-SA 2.0. Photo “Sonny Borrelli” by Sonny Borrelli. Photo “Warren Petersen” by Gage Skidmore. CC BY-SA 2.0. Background Photo “Grocery Store” by Kenny Eliason.