Across the state and country, activists are calling for curbs on immigration enforcement because it’s making illegal immigrants fearful. But that’s the way it should be, says Michael Cutler, a nationally-recognized expert and retired senior special agent with the former Immigration and Naturalization Service (INS). “You should be fearful if you break the law,” said Cutler in an interview Monday with The Tennessee Star. In Nashville, activists angered by President Trump’s enforcement plans have gone so far as to demand that Immigration and Customs Enforcement (ICE) leave the city. Students at Vanderbilt have insisted that the university be a sanctuary campus and Metro Nashville Public Schools say they intend to make illegal immigrant students and their families feel safe. Cutler, who writes commentary on immigration issues, appears in TV interviews and hosts a show on Blog Talk Radio, said efforts to provide sanctuaries for illegal immigrants will make it harder for law enforcement to root out gangs, drug traffickers, terrorists and other criminals. Problems with crime and drug trafficking will worsen if immigration enforcers aren’t able to do their jobs, said Cutler, who blames loose borders for the reason “why heroin has never been cheaper and more plentiful.” Cutler said it…

Read the full storyDay: March 8, 2017

Gov. Haslam Has a History of Supporting Tax Increases

Gov. Bill Haslam has a history of supporting tax increases. His current proposal to increase the gas tax by 7 cents per gallon and diesel fuel by 12 cents per gallon in 2017 is no aberration, it is part of a consistent pattern. In 2004, newly elected Knoxville Mayor Bill Haslam raised the city’s property taxes approximately 13%, but claimed the property tax rate was the lowest in several years. Former Lt. Governor Ron Ramsey challenged the claim saying that a reappraisal which lowered the overall rate, did not lower the overall percentage increase. Years earlier, Haslam was being schooled by his father on the need to raise taxes in Tennessee. Jim Haslam II, was a board member of Citizens for Fair Taxes, a group planning a public education blitz about Tennessee’s “state budget crisis” as a prelude to supporting Don Sundquists’ proposal for a state income tax. Fast forward to 2010 when Haslam, during his first gubernatorial campaign materials stated affirmatively that, “…taxes are job killers. The last thing we should do is raise taxes on a population that is already struggling and a small business community that has been forced to cut back,” and, that: “Tennessee already has the highest…

Read the full storyHouse Transportation Committee Fails To Advance IMPROVE Act, Despite Multiple Tactics By Chairman Doss

The House Transportation Committee failed to advance Gov. Haslam’s IMPROVE Act (HB 0534) on Tuesday, despite multiple tactics employed by Chairman State Rep. Barry Doss (R-Leoma), a vigorous proponent of the governor’s gas tax increase proposal, to accomplish that outcome. The committee voted instead to roll the vote over for another session in one week. Voting in favor of a one-week delay were Representatives David Alexander (R-Winchester), Dale Carr (R-Sevierville), Timothy Hill (R-Blountville), Bo Mitchell (D-Nashville), Courtney Rogers (R-Goodlettsville), Bill Sanderson (R-Kenton), Jerry Sexton (R-Bean Station), Terri Lynn Weaver (R-Lancaster) and Jason Zachary (R-Knoxville). Voting against the delay were Chairman Doss, and Representatives Barbara Cooper (D-Memphis), Bill Dunn (R-Knoxville), Kelly Keisling (R-Byrdstown), Eddie Smith (R-Knoxville), Ron Travis (R-Dayton), Sam Whitson (R-Franklin), John Mark Windle (D-Livingston). Chairman Doss initially declared that the motion to delay the vote for one week had failed, even though the roll call vote was 9 to 8 in favor the delay. When several members vocally objected, Chairman Doss declared the motion passed and the meeting was quickly adjourned. The day began in subterfuge, when Chairman Doss held a bill review session one hour prior to the scheduled full committee meeting. That bill review session was…

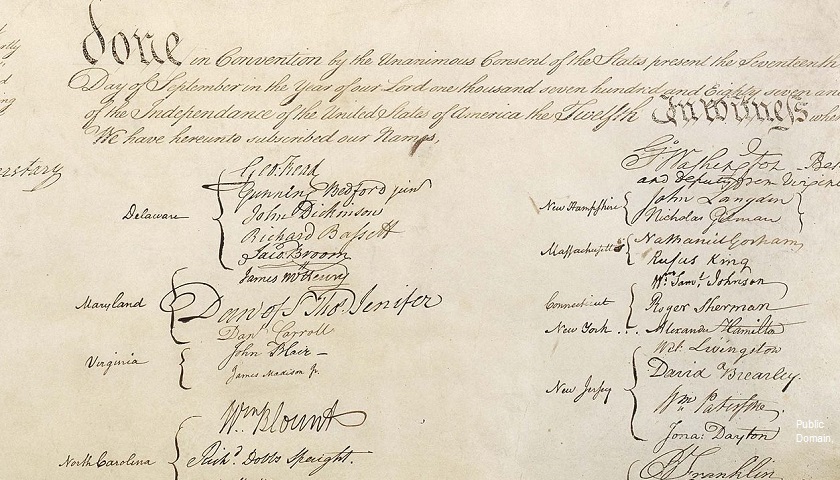

Read the full storyCommentary: Our Constitution Is Essential for Our Identity

Understanding our government and founding documents, such as the Constitution, creates a more reflective, clear-thinking, and invested citizen.

Read the full storyAUDIT: Dickson County Workers Duped by Phishing Scheme for $60,000 in Taxpayer Cash

A thief duplicated an email address belonging to Dickson County’s director of schools and then duped the school system’s staff into wiring $20,000 in taxpayer money, an audit says. Someone pulled the same stunt with the Dickson County Mayor’s Office a few days later, in April of last year, according to Tennessee Comptroller Justin Wilson’s audit, which was released this week. Auditors called it a phishing scheme. No one at the county mayor’s office immediately returned a request for comment Tuesday. Director of Schools Danny Weeks told Tennessee Watchdog that law enforcement agencies, including members of the Tennessee Bureau of Investigation, have yet to catch the culprit. “Last I heard, Dickson County law enforcement thought it was someone from outside the country,” Weeks said, adding what happened was “a perfect storm of events coming together from someone with crafty and evil intentions.” “I was out of town the day it happened, and it was the last thing that happened on a Friday afternoon. My business manager assumed she got an email from her boss, and you do what your boss asks you to do. If it were something that happened on a normal day in the office, she would have…

Read the full storyCommentary: Governor’s Gas Tax Plan Hurts the ‘Little Guy’

The Tennessee Department of Transportation (TDOT) boasts on its website that: “Tennessee’s conservative process of funding its highway program is often referred to as a ‘pay as you go’ program. The agency only spends the funds that are available through its dedicated revenues, the highway user taxes and fees, and federal funding.” For consumers, the Governor’s proposal adds a 7-cent increase per gallon for gas and a 12-cent increase per gallon for diesel with future increases tied to the Consumer Price Index. The plan also includes a $5.00 increase to vehicle registration prices. Americans for Tax Reform and the Brookings Institute agree, that higher gas prices negatively impact economic growth and low to moderate income households: “…higher gas prices drain purchasing power from the economy. That means that these families get hit twice: once by the direct impact on their household budgets but a second time when higher prices retard the economic recovery.” Add to that, higher fuel taxes are likely to add to the cost of consumer goods when the increased cost paid by businesses is passed onto consumers. even with the tax cut in taxes paid by businesses included in the Governor’s plan. There is also a modest half…

Read the full story