Governor Haslam will hold ceremonial signings of the controversial and gas-tax increasing IMPROVE Act Monday in each of Tennessee’s three grand divisions, as reported last week by The Tennessee Star.

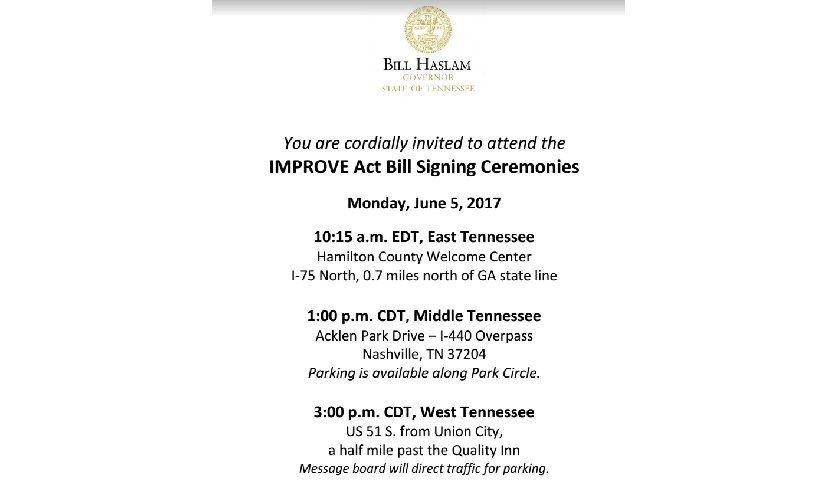

According to the invitation on Governor Bill Haslam’s letterhead, the IMPROVE Act signing ceremonies will be held as follows:

10:15 a.m. EDT, East Tennessee

Hamilton County Welcome Center

I-75 North, 0.7 miles north of GA state line

1:00 p.m. CDT, Middle Tennessee

Acklen Park Drive – I-44 Overpass

Nashville, TN 37204

3:00 p.m. CDT, West Tennessee

US 51 S. from Union City

A half mile past the Quality Inn

The signings are spaced so closely together in time, Gov. Haslam is almost certainly flying from site to site at taxpayers’s expense to celebrate this tax increase.

The IMPROVE Act, initially named for “Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy,” was renamed to the Tax Cut Act of 2017, by its House sponsor of HB 534 Rep. Barry “Boss” Doss (R-Leoma), will raise the gas tax by 6 cents per gallon and the diesel tax by 10 cents per gallon phased in over three years.

Effective July 1, the gas tax will increase from 20 cents to 24 cents per gallon and the diesel tax will increase from 17 cents to 21 cents per gallon. The gas tax will go up another one cent per gallon and diesel tax another 3 cents per gallon on July 1 of both 2018 and 2019.

Also effective July 1, vehicle registration fees will increase by $5.00 for passenger vehicles and $100 for electric vehicles. Higher increases will be incurred by commercial and freight motor vehicles.

The additional revenues will ostensibly be used to complete 962 backlogged projects in all 95 Tennessee counties, at a cost of $10.5 billion. The Tennessee Department of Transportation (TDOT) list of backlogged projects attached to the IMPROVE Act ballooned from $6 billion on the previous November 2015 backlog list to the $10.5 of the Act’s January 2017 launch, after statewide tours by Governor Haslam and TDOT Commissioner John Schroer.

Decreases in taxes, disingenuously claiming to offset the gas and diesel tax increases, include a one percent reduction in the state portion of the sales tax on grocery foods, a reduction in the business franchise and excise tax and a one percent reduction in the Hall Income Tax passed into law during the last legislative session.

Over the course of the debate, primarily within the state House of Representatives and initiated by the conservative wing of the super-majority Republicans, the IMPROVE Act underwent several changes that reduced the impact of the tax raises and increased the tax reductions to Tennessee taxpayers.

A June 1 post to the City of Memphis Facebook page showing Memphis City Mayor Jim Strickland speaking to reporters that still has 2,657 Memphis Light, Gas and Water customers without power, said there was no indication that Governor Haslam would be visiting to witness the damage from a May 25 storm, stating he heard, “If they do it, it’s not going to be soon.”

Information on the comments made by Governor Haslam at the ceremony held in Chattanooga can be found on the state’s website.

[…] Haslam also held ceremonial signings on Monday in Hamilton County in East Tennessee and Union City in West Tennessee. […]

Tell me again when we are going to be rid of this embarrassment of a governor. Of course, the “Tax Inequality Act” would not have gotten to his desk without a group of turncoats in the Legislature stabbing their constituents in the back – including my senator. Politics as usual.