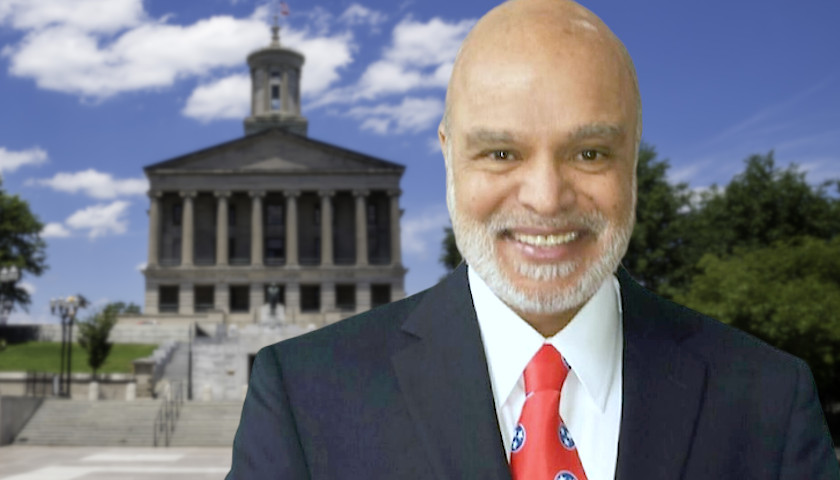

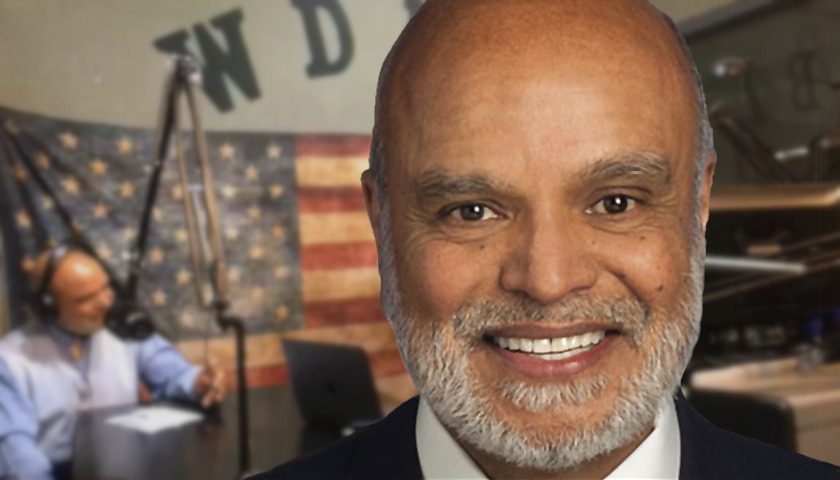

Creating the kind of forced savings payroll deductions that State Rep. Sabi ‘Doc’ Kumar, R-Springfield, wants to impose upon Tennessee presents a variety of challenges, according to a detailed study.

As The Tennessee Star reported this week, Kumar wants to introduce a bill in the Tennessee General Assembly that would require payroll deductions for savings. This, he said, because too many Americans don’t seem to want to do it on their own initiative.

A four-year-old study on Pewtrusts.org said Illinois, Massachusetts, Oregon, New Jersey, and Washington have enacted their own state programs.

“States must determine whether they have the administrative and financial capacity to manage large savings programs. Many already have experience running retirement plans for public employees, health exchanges under the Affordable Care Act, and 529 college savings plans. But creating viable state-run retirement programs for private sector workers can present different challenges in achieving both scale and efficiencies if they must manage many small account balances funded by the payroll systems of many small employers. States can learn from the experiences of one another as they consider the best paths forward,” according to the study.

“States would be well served to make policy choices that balance competing objectives and take into consideration the specific economic and demographic characteristics of the workers who could participate in these plans.”

State governments, the Pew Study went on to say, must tread carefully, and they also must minimize the costs to taxpayers.

“States face challenges in generating and protecting workers’ savings over the long run. Low-risk investments make losses less likely but also increase the chances that accounts won’t grow enough to meet retirees’ needs,” according to the report.

“Some states have looked at ways to guarantee certain rates of return, but that approach also brings possible risks and costs to the state.”

As The Star reported, Kumar wants members of the Tennessee General Assembly to make such a plan mandatory for state residents using a Roth IRA.

People, however, may opt out of the proposed plan in writing if they wish, Kumar said.

– – –

Chris Butler is an investigative journalist at The Tennessee Star. Follow Chris on Facebook. Email tips to [email protected].

Photo “Sabi Kumar” by Sabi Kumar.