Governor Haslam will hold ceremonial signings of the controversial and gas-tax increasing IMPROVE Act Monday in each of Tennessee’s three grand divisions, as reported last week by The Tennessee Star. According to the invitation on Governor Bill Haslam’s letterhead, the IMPROVE Act signing ceremonies will be held as follows: 10:15 a.m. EDT, East Tennessee Hamilton County Welcome Center I-75 North, 0.7 miles north of GA state line 1:00 p.m. CDT, Middle Tennessee Acklen Park Drive – I-44 Overpass Nashville, TN 37204 3:00 p.m. CDT, West Tennessee US 51 S. from Union City A half mile past the Quality Inn The signings are spaced so closely together in time, Gov. Haslam is almost certainly flying from site to site at taxpayers’s expense to celebrate this tax increase. The IMPROVE Act, initially named for “Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy,” was renamed to the Tax Cut Act of 2017, by its House sponsor of HB 534 Rep. Barry “Boss” Doss (R-Leoma), will raise the gas tax by 6 cents per gallon and the diesel tax by 10 cents per gallon phased in over three years. Effective July 1, the gas tax will increase from 20 cents to 24…

Read the full storyAuthor: Laura Baigert

Gov. Haslam Attends Ceremonial Signings, Ignores Severe Weather Damage in Memphis

As Governor Bill Haslam sets out next Monday on cross-state IMPROVE Act Bill Signing Ceremonies, he has not yet seen the damage himself from the severe weather that hit Memphis and surrounding Shelby County last Saturday night. And, he has no plans to travel there this week, according to a report from Fox 13 Memphis. Meanwhile, Governor Haslam has announced IMPROVE Act Bill Signing Ceremonies to be held Monday, June 5 in each of Tennessee’s three grand divisions. As of Thursday morning, the fifth day after the storm, Memphis Light Gas and Water Division (MLGW) power outage map indicates that over 32,000 customers are still impacted by power outages, down from a peak of 188,000. While power has been restored to the majority of customers, full restoration could take more than a week for the remaining customers as progress slows dealing with smaller outages. The storm has been described by MLGW as the “third worst storm in the area’s history.” An email dated May 31 from the Tennessee County Services Association (TCSA) Executive Director, David Connor, attached an invitation on Governor Haslam’s letterhead that included the details of the ceremonies: 10:15 a.m. in Hamilton County, 1 p.m. in Nashville/Davidson…

Read the full storySoon-to-Announce Gubernatorial Candidate Mae Beavers Tells WWTN Audience ‘We’re In It To Win’

In an interview with WTN 99.7’s Pamela Furr, who was standing in for Ralph Bristol on Memorial Day, State Senator Mae Beavers (R-Mt. Juliet), demonstrating resolve to her pending gubernatorial campaign said on two occasions, “We’re in it to win.” Saturday evening, after hosting the monthly Wilson County Conservative Republicans meeting and attending a Memorial Day service at The Stone Church in Alexandria, Sen. Beavers issued a press release stating she plans to announce her campaign for governor on June 3. Due to a scheduling conflict in her district, Sen. Beavers was not able to attend the Rutherford County Republican Party Reagan Day Dinner last Thursday, where four other stated or expected candidates for governor participated in a forum, U.S. Rep. Diane Black (District 6), Governor Haslam’s former state Economic and Community Development Commissioner Randy Boyd, state Senator Mark Green R-Clarksville) and businessman Bill Lee. The full transcript of the interview can be found below. Pamela Furr: You prayerfully decided to do it. Sen. Mae Beavers: Well, Pamela, you know I think that when we pray about something, I think we’ve got to commit it to the Lord and just put our faith in Him, and I think he’ll…

Read the full storyState Rep. Judd Matheny: ‘If Everybody Does Stand Together, Government Has to Come Down to Our Level’

MOUNT JULIET, Tennessee — At the Wilson County Conservative Republicans meeting Saturday, guest speaker Rep. Judd Matheny (R-Tullahoma) said of the battle over the 2018 state budget, “If everybody does stand together, government has to come down to our level.” Matheny was referring to the stand-off that occurred in the House of Representatives when he added a constitution-breaking amendment to the budget, which prompted House Speaker Beth Harwell (R-Nashville) to come down on the House floor and sit next to Matheny in Rep. Mark Pody’s (R-Lebanon) adjacent empty seat. Alluding to Pody’s absence that day preaching the eulogy at a funeral, “The seat was empty next to me, and believe me, I felt it,” said Matheny. The monthly meeting, according to host Sen. Mae Beavers (R-Mt. Juliet), started seven to eight years ago and was attended this month by a crowd of about 40 overflowing the room at the Providence location of Logan’s Roadhouse in Mt. Juliet. Pody introduced Matheny at the Saturday meeting, saying that sitting next to Judd Matheny was the only request he has ever made of Speaker Harwell when he came to the House and she asked what Pody wanted for a wide range of…

Read the full story70 Grassroots Activists Honor Gas Tax Opponents at Knoxville Event

KNOXVILLE, Tennessee — Seventy grassroots activists came out to hear a debriefing Tuesday evening on the recently concluded legislative session by Knoxville Republican gas tax opponents Representatives Roger Kane and Jason Zachary at an Americans For Prosperity (AFP) West Knoxville Town Hall. Kane and Zachary were recognized by AFP’s Deputy State Director, James Amundsen, as the only two Knoxville representatives who voted against the gas tax increase. Representatives Zachary and Kane gave opening comments to the standing room only crowd at O’Charley’s on Parkside Drive in the Turkey Creek section of Knoxville followed by a question and answer session for an event that ran more than an hour. Zachary started his comments by passing out and reviewing two handouts printed on his official letterhead, “Under Conservative Leadership, Tennessee is a Better Place To Live, Work, And Raise A Family” and “Bills Passed On Behalf Of District 14, 2017 Session.” As he went through the six bills, HB 0055, 0056, 0057, 0362, 0368 and 0469, Zachary explained how they came about through requests by individuals, making the point that “especially at the state level, one person can make a tremendous difference.” Kane made a similar point when he said, “We actually…

Read the full storyGovernor Haslam’s IMPROVE Act Allows Local Non-User-Fee Funding of Mass Transit

The foundation of the case by Governor Haslam and other proponents of the IMPROVE Act gas tax increase was that it is a “user fee,” paid by those who use the roads. In contrast, for the purpose of funding public transit system projects, the IMPROVE Act authorizes 16 local governments, through public referendum, to levy a surcharge on six existing taxes that aren’t remotely linked to a mass transportation user fee, otherwise known as passenger fares. The IMPROVE Act, passed by the legislature as HB 534, specifies a local government, for purposes of the surcharge, as any county in this state including a county with a metropolitan or consolidated form of government with a population in excess of 112,000, which is currently Blount, Davidson, Hamilton, Knox, Montgomery, Rutherford, Shelby, Sullivan, Sumner, Washington, Williamson and Wilson, and any city in this state with a population in excess of 165,000, which is currently Chattanooga, Knoxville, Memphis and Nashville. The six taxes eligible for surcharge are the local option sales tax, business tax, motor vehicle tax, local rental car tax, tourist accommodation/hotel occupancy tax, and residential development tax. Looking at other transit systems around the country, it’s obvious that these additional revenues will…

Read the full storyWilson County Commissioner Announces Primary Run For Rep. Susan Lynn’s House District 57

“It’s time to go against the status quo, and I hope to be the next Representative for the 57th District,” says Wilson County Commissioner, Dan Walker, as he announced his intention to run in the Republican primary for the 2018 election. Walker is the second to announce a run in the 2018 Republican primary for the 57th House District, a seat currently held by Rep. Susan Lynn (R-Mt. Juliet), joining Jeremy Hayes, who announced his intention to run on February 28 in an exclusive interview with The Tennessee Star. At the time of his announcement, Hayes cited Lynn’s support for Governor Haslam’s gas tax. Lynn later denied support for the gas tax when Hayes challenged her to a debate, saying “I am not for the gas tax so there is nothing to debate.” On April 19, Rep. Lynn was one of 37 Republicans and 23 Democrats who voted for the gas-tax increase containing IMPROVE Act. Walker’s announcement states, “Dan is running on a small government approach, bringing with him a strong business acumen and military leadership to work for the great people of the 57th State District of Tennessee.” A quote from Walker in the announcement states, I am…

Read the full storySC Gov. McMaster Vetoes Gas Tax, In Stark Contrast to TN Gov. Haslam, Who Championed It

South Carolina Governor Henry McMaster posted a video “Gas Tax Veto” to his Facebook page, saying “Today I vetoed the General Assembly’s gas tax bill, and I would like to tell you why.” He continued, “Unfortunately, raising taxes was the only solution seriously considered by the legislature.” Quite a contrast to recent events in Tennessee, where Governor Haslam was the one who would only accept a gas tax increase to fund roads through his IMPROVE Act. The Governor persisted in his “my way or the highway” solution to road funding, despite other alternatives being offered by some members of the House of Representatives, and nearly half of his own party at 35 of 37 Republican Representatives, voting against it. Tennessee suffers from much the same problem as South Carolina, as stated by Governor McMaster, “Right now over one-fourth of your gas tax dollars are not used for road repairs. They’re siphoned off for government agency overhead and programs that have nothing to do with roads.” As previously reported by The Tennessee Star, some of the current road “user fees” are diverted from the Highway Fund, and the Tennessee Department of Transportation (TDOT) “overhead” has grown 63 percent under Governor…

Read the full storyEffort to Correct Some of The Gas Tax ‘User Fee’ Diversion From The Highway Fund Amended Away

A bill introduced to remove a portion of the diversion of fuel tax “user fees” from the Highway Fund to the General Fund was amended so drastically that the bill was rewritten so that it rewrote the bill, and instead increased the amount distributed to the Wildlife Resources Fund. As reported by The Tennessee Star, and confirmed by Rep. Susan Lynn (R-Mt. Juliet), Tennessee Code Annotated requires that portions of the “user fee” fuel taxes be allocated to the General Fund to cover the costs incurred by the state Department of Revenue for the collection of those taxes. HB 910 / SB 230 by Rep. Tim Wirgau (R-Buchanan) and Sen. Mark Green (R-Clarksville), respectively, would have “eliminated the administrative allocation of the gasoline tax, motor fuel tax, and gasoline inspection tax to the General Fund.” It would have no impact on the total collections from the various fuel taxes, but would simply allocate them to the Highway Fund rather than the General Fund. The fiscal memo for the original bill reported increases to the Highway Fund of $12 million and to local governments of $2.6 million. The bill was then completely re-written by the amendment so that the diversions to the General Fund…

Read the full storyEducation Bill Passed By House, But Rolled to 2018 In Senate

While House Minority Leader Craig Fitzhugh (D-Ripley) relentlessly pursued his education funding bill, HB 841, through passage in the House, the Senate sponsor, Jeff Yarbro (D-Nashville) wasn’t as successful with SB 831, and requested of the Senate Finance Ways & Means Committee that the bill be rolled to 2018. The bill, originating in the House and rumored to be in exchange for Democratic votes in favor of the IMPROVE Act, used excess state revenues over-collected in fiscal years 2015-16 and 2016-17 in the amount of $250 million to be used for K-12 block grants that would be distributed by the Department of Education. After passing through the House Finance, Ways & Means Subcommittee and Committee, Fitzhugh started by introducing Amendment 1 on the House floor May 9, which rewrote the bill to enact the Education Investment Act. The Act creates the K-12 block grant program via a revocable trust to be administered by the state treasurer, with a board of trustees that would also include the comptroller of the treasurer, the secretary of state, the commissioner of education and the commissioner of finance and administration. Amendment 1 passed by voice vote. Rep. Sabi “Doc” Kumar (R-Springfield) sponsor of Amendment 2,…

Read the full storyAn Unusual End to An Unusual Session of the Tennessee House of Representatives

The final action of the Tennessee House of Representatives 2017 session of the Tennessee General Assembly was for Rep. Tilman Goins (R-Morristown) to roll a bill he sponsored this year, HB16/SB38, to 2018, after a conference committee could not reconcile the differences between the House and the Senate. The bill authorizes members of the General Assembly and political campaigns to fund raise during prescribed legislative recesses in even numbered, or election, years. The move was unusual, even in a session of unusual legislative events, most notably an increase in the gas tax which has remained unchanged for nearly three decades and maneuvers that nearly “blew up” the budget. The Senate added an amendment that was not accepted by the House, and the Senate refused to recede from its amendment, thereby creating a kind of stalemate. In such situations, a conference committee is appointed, usually consisting of at least three members of each house. In this instance, the conference committee consisted of Senators, the Senate bill’s sponsor, Steve Southerland (R-Morristown), Bo Watson (R-Hixson) and Brian Kelsey (R-Germantown) and four Representatives, Tilman Goins, Glen Casada (R-Franklin), Andy Holt (R-Dresden), and Mike Stewart (D-Nashville) The conference committee’s mission is “to meet and attempt to…

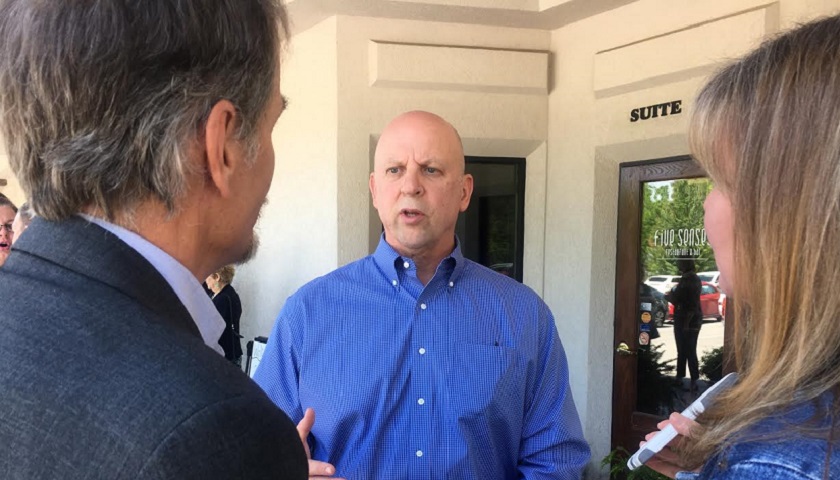

Read the full storyEXCLUSIVE Interview with U.S. Rep. Scott DesJarlais About American Health Care Act

“We need transparency in health care where people know exactly what something’s going to cost and whether they’re willing to pay for that or not,” U.S. Representative Scott DesJarlais (R-TN) told The Tennessee Star in an exclusive interview on Monday about the American Health Care Act, recently passed by the House of Representatives and now under consideration in the U.S. Senate. “If they are, they can take that health savings card, like a debit card, and pay for that procedure. I’ll guarantee they can negotiate a better price,” DesJarlais said. “I know as a doctor, if someone came in and I said I charge $200 to excise that skin cancer, but they said I’ll pay you $150 today, are you willing to accept that, I probably would knowing I didn’t have to go through insurance,” DesJarlais added. “People are able to negotiate better prices that way,” the Tennessee Republican noted. DesJarlais was in his home district, Tennessee’s Fourth Congressional District, on Monday, the guest of honor at an invitation-only luncheon held in Murfreeesboro with about 40 local activists and office holders who wished to express their appreciation to the Congressman, particularly for his work on the American Health Care…

Read the full storyMulti-Million Dollar Education Bill Still in Play, Critics Claim in Return for Democrat Support of IMPROVE Act

While last week’s two-day House floor showdown over Governor Haslam’s 2017-18 budget never did take up an amendment for a $55 million education appropriation, HB 841, known as the K-12 Block Grant Act, was approved in a new form in the House Finance, Ways & Means Subcommittee and Committee on Monday. That approval advances the bill to the Calendar & Rules Committee meeting, which was later scheduled to Tuesday. In full Committee, House Minority Leader Craig Fitzhugh (D-Ripley) before moving for adoption spoke very briefly on his new and only amendment to the bill, which, he stated, “takes out the funding for the bill in the way it was originally funded.” The bill in its original form called for a one-time transfer of $250 million from a variety of revenue sources within the General Fund to the Education Fund, as The Tennessee Star reported previously. Fitzhugh referred to the arrangement as an Education Investment Endowment Act for which a Fund (EIEF) would be created, and said “It’s much on the same premise as the Tennessee Promise,” where the reserves from the lottery have been set up as an endowment for the Tennessee Promise. Fitzhugh continued, We are attempting to do the same thing…

Read the full storyHouse Finance Chair Charles Sargent Strips Amendment For Vets, Reverting to Pork Project

House Finance Chairman Charles Sargent (R-Franklin) on Friday stripped an amendment to the budget bill, HB 511, that would have given $3.12 million to veterans, opting instead for a pork project in Williamson County. On Thursday during House debate on the budget, Rep. Jimmy Matlock (R-Lenoir City) introduced an amendment that redirected $3.12 million from the Historical Commission for the demolition and construction of a new Carter House Visitors Center in Franklin to four Tennessee chapters of Honor Flight and Honor Air programs across the state. These non-profit organizations fly aging veterans to Washington, D.C. in order for them to pay their final respects the memorials dedicated to their sacrifice and to their fellow soldiers who died in battle. Top priority is given to the senior veterans, World War II veterans, survivors, people who have given their all. Many of these veterans could be disabled, handicapped, or even terminally ill. Sargent initially tried to kill the amendment by making the motion to “lay on the table,” but the motion failed by a vote of 35 ayes, 52 nays. Despite the disagreement throughout much of the day, this amendment passed with bipartisan support on Thursday with a vote of 49 ayes and 36…

Read the full storyCommentary: Finance Chair State Rep. Charles Sargent Misrepresented Copeland Cap on House Floor in Budget Debate

During his presentation of the budget bills during the House floor session Friday State Representative and Chairman of the House Finance, Ways & Means Committee, Charles Sargent (R-Franklin) misrepresented the Copeland Cap constitutional amendment several times. Charles Sargent has served in the Tennessee House since 1997, became a member of the House Finance, Ways & Means Committee in 2003, Vice-Chairman in 2009, and Chairman in 2011, a role in which he continues to serve. The 1978 amendment to Article II, Section 24 of the Tennessee constitution, named for its sponsor former Representative David Copeland, states, “In no year shall the rate of growth of appropriations from state tax revenues exceed the estimated rate of growth of the state’s economy as determined by law.” In the specific case of Sargent presenting HB 514 to the House membership for passage as part of the budget, the operative word is “appropriations,” when referring to growth by the state, not revenues as Sargent maintains throughout the discussion on the bill. According to Merriam-Webster, the definition of appropriation is “money set aside by formal action for a specific use,“ whereas the definition of revenue is “the yield of source of income (such as taxes)…

Read the full storyHouse Passes Governor Haslam’s $37 Billion State Budget in Anticlimactic Ending

After much drama, heated exchanges on the floor, a tense caucus meeting on Thursday, it seemed that Friday’s floor session to address the fiscal year 2017-18 budget was not starting off much better when there were not enough members present for a quorum at 9:07 a.m. But, by 11:23 a.m. the four bills that made the state $37 billion 2017-18 budget had been passed by the House. When a quorum was not detected by 9:07 a.m., Republican Caucus Leader Ryan Williams (R-Cookeville) requested a recess until 10 a.m. for the purpose of a caucus meeting, which took place in the library. The caucus meeting was quickly turned over by Williams to House Majority Leader Glen Casada (R-Franklin), who reviewed the process for the day. Casada explained that there would be two amendments to the budget appropriations bill, the first being a “stripper” amendment, which would take off all of the additional appropriations to HB 511 approved Thursday. The second was the addition of a $55 million non-recurring appropriation to counties taken from the Highway Fund for the purpose of “kick starting” road work. Casada also mentioned the possibility of a third amendment, but was reluctant to share details until he was…

Read the full storyHouse of Representatives In Turmoil Going Into Day Two of Budget Review

NASHVILLE, Tennessee — After nearly a six and a half hour day, the Tennessee House of Representatives appears to be no closer to having a finalized budget for fiscal year 2017-18 when it goes back into session Friday at 9 a.m., as the first bill to approve the budget appropriations did not make it to a vote on Thursday. As the first legislative year of the 110th General Assembly draws to a close, the last of the bills are being heard and the budget for fiscal year 2017-18 needs to be approved. The budget passed the House Finance Ways & Means Subcommittee and full Committee on Wednesday and was placed on the calendar for the House floor session to convene at 9 a.m. Thursday. After dozens of resolutions and bills were passed, but prior to the discussion of the four bills that make Governor Haslam’s budget for the upcoming fiscal year, at 10:34 a.m., Republican Caucus Chairman Ryan Williams (R-Cookeville) requested a recess until 11:30 for a caucus meeting. While a handful of members responded with their own comments, the real purpose of the Republican caucus meeting was to allow “leadership” to “encourage” support of the budget. Leadership was…

Read the full storyDemocrats Unlikely to Get The $250 Million Education Bill For Their Yes Vote On The IMPROVE Act

House Minority Leader Craig Fitzhugh (D-Ripley) said Wednesday in both the Finance, Ways & Means Subcommittee and full Committee that he didn’t have the votes for the $250 million K-12 Block Grant Act, which was reportedly part of the deal Governor Haslam made to get needed support from the Democrats to pass his IMPROVE Act. On the morning of the House floor vote which eventually approved the IMPROVE Act, there were rumors that the Governor would appropriate $250 million for an education plan and that the Democrats, despite their expected opposition to the gas tax increase, were going to vote for it. The deal appeared successful when 23 of 25 Democrats voted in favor of the IMPROVE Act. The rumors of the quid pro quo deal were confirmed when the video of Leader Fitzhugh explaining the plan during an April 4 Education Administration & Planning Subcommittee meeting came to light. The plan, called the K-12 Block Grant Act, would take $250 million from various sources, as Fitzhugh explained, and put it in an endowment type fund from which the interest would be drawn and allocated to school systems throughout the state for non-recurring expenses. During the Finance, Ways & Means…

Read the full storyHouse Finance Ways and Means Committee Votes to Break The Copeland Cap

At the final stop before the full House makes its first of three votes on Governor Haslam’s 2017-18 $37 billion state budget, the Finance, Ways & Means Committee finalized the bills required to move the budget on, including HB 514, which Chairman Charles Sargent (R-Franklin) referred to as the “indexing bill” or Copeland Cap. The Copeland Cap is the 1978 amendment to Article II, Section 24 of the Tennessee constitution that states, “In no year shall the rate of growth of appropriations from state tax revenues exceed the estimated rate of growth of the state’s economy as determined by law.” The amendment was named for its author, former state Representative David Copeland of Ooltewah. As reported by The Tennessee Star, with the growth of state revenues, lawmakers were expected to have to break the Copeland Cap. That was confirmed Wednesday, when Chairman Sargent presented the bill to the committee, saying, “Revenues have grown and collections in the 16 budget that was not recognized in 16. That money has been placed over into the 17-18 budget. So we have to recognized that we went over. We went over by 2.85 over and above the Copeland Cap.” No further details were provided as…

Read the full storyFollow The Money: Campaign Receipts May Shed Light on Why Some Republicans Voted For The Gas Tax

“Follow the money” is a catchphrase made popular in the 1976 movie, “All The President’s Men,” based on the actual events of the Watergate Break-in and suggests a money trail or corruption scheme within the political arena. While campaign receipts are no guarantee of how an elected official will vote on a particular issue, when a politician’s vote comes as a surprise to their constituents and political pundits, the behind-the-scenes world of money and power may shed light on the matter. The situation of campaign financing in the state of Tennessee is a complex web of individual and Political Action Committee (PAC) contributions and receipts to and from each other. The Tennessee Bureau of Ethics and Campaign Finance defines a PAC as a “multi-candidate politician campaign committee that participates in any state or local election. ‘Multi-candidate committee’ is defined as a committee that makes expenditures to support or oppose two or more candidates for public office or two or more measures in a referenda election. T.C.A. 2-10-102(9).” The State of Tennessee’s Online Campaign Finance webpage includes a searchable database for contributions and expenditures to candidates and PACs and from candidates, PACs, private individuals or businesses/organizations. The complexity, special interests…

Read the full storyHaslam’s Gas Tax Increase May Force Tennessee Lawmakers to Violate the Copeland Cap Amendment to State Constitution

Governor Haslam’s 2017-18 budget that incorporated IMPROVE Act and other spending promises now exceeds the constitutional budget growth limit established by the 1978 amendment to Article II, Section 24 of the Tennessee Constitution that states, “In no year shall the rate of growth of appropriations from state tax revenues exceed the estimated rate of growth of the state’s economy as determined by law.” The amendment is known as the Copeland Cap, named for its author former state Representative David Copeland of Ooltewah. The General Assembly will now be forced into a position of voting to break a constitutional commitment to the taxpayers, or appear as the “villains” by taking away the “gifts” the Governor has promised. The 2017-2018 budget estimates appropriations from state tax revenues will be $17.9 billion, which represents an 8.3 percent growth over appropriations from tax revenues in the 2016-2017 state budget at $16.5 billion. The estimated rate of growth of the state’s economy for the 2017-18 budget year, as defined by state law, is 4.6 percent over the 2016-17 budget year. The governor’s budget, as currently structured with the IMPROVE Act, will therefore violate the Copeland Cop by 3.7 percent. The relevant law, Tennessee Code Annotated (TCA) 9-4-5201 states that the basis…

Read the full storyThe $250 Million Education Bill the Democrats Reportedly Want in Return for IMPROVE Act Support is Still Alive

Twenty-three of the 25 Democrats in the House voted for Gov. Haslam’s gas tax increasing IMPROVE Act last Wednesday, amid rumors of a $250 million deal made between Governor Haslam and House Minority Leader Craig Fitzhugh (D-Ripley) in a quid pro quo tradeoff: Democrats vote for the governor’s bill, the governor backs House Bill 841, sponsored by Fitzhugh, which appropriates $250 million from excess state tax revenue over-collected in fiscal years 2015-16 and 2016-17 to spend on education in the K-12 Block Grant Act. Democrats would have been expected to oppose the gas tax increase, given the many arguments that the IMPROVE Act’s tax cuts went largely to a handful of businesses, not middle class and working class voters who comprise the traditional Democratic constituency. The higher cost of living for middle class and working class voters resulting from the increased prices for food and other staples of life resulting from higher diesel taxes paid by trucking companies will likely not be offset by the small reductions in the sales tax on food. HB 841 was on the agenda for the House Finance Ways & Means Subcommittee meeting scheduled for Wednesday, April 26, but Leader Fitzhugh said the plan is…

Read the full storyBoss Doss Admits To TDOT Contract After Being Elected

For the first time, State Rep. Barry “Boss” Doss (R-Leoma), who is the House sponsor of Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017” and is serving as Chairman of the House Transportation Committee, admitted to having a contract with the Tennessee Department of Transportation (TDOT) since he was elected in 2012. The admission came during an interview with WSMV Monday, as he was attempting to refute conflict of interest charges related to his sponsorship of the IMPROVE Act “Tax Cut Act of 2017.” The potential conflict of interest, as reported by The Tennessee Star, was raised on March 27 via a letter from the Tennessee Republican Assembly (TRA) to Speaker Beth Harwell (R-Nashville) that called for an ethics investigation. Rep. Doss, serving as Chairman of the Transportation Committee and House sponsor of Governor Haslam’s IMPROVE Act with his “capability to sway the committee” or “manipulation of the rules” with the outcome of the legislative process having the potential for “direct financial impact on his business” did not meet the “Guiding Principle” of avoiding even the appearance of conflicts, TRA said. Thus far, Speaker Harwell has not responded to the request for an investigation and Doss had not commented. That was until Monday, when Rep.…

Read the full storyHouse Majority Leader Glen Casada Defends His Vote to Increase The Gas Tax

House Majority Leader Glen Casada (R-Franklin), issued a press release Monday defending his vote to increase the gas tax through Governor Haslam’s IMPROVE Act, after initially announcing on February 8 his support for the alternative Hawk Plan. The press release was forwarded via email, addressed to “Friends,” stating “I wanted to forward a statement I released to the press regarding my vote on the IMPROVE Act.” If the comments on Rep. Casada’s Facebook page responding to posts on the gas tax, the overwhelming majority of which are against the gas tax, is representative of other feedback he’s been getting, it likely prompted Casada’s need to explain his vote. The cover email continued, Though I still believe there was a better way to fund road construction for Tennessee that did not raise taxes, I did vote for the amendment that was the IMPROVE Act. My support for the alternative plan that would have shifted funds to the Department of Transportation without raising the gasoline tax died twice in committee and again on the House floor. Thus, my only option was to do nothing on road funding, or vote for the IMPROVE Act – the next best vehicle available to attain our goal of…

Read the full story6 Things Boss Doss Got Wrong In His Sales Pitch For Governor Haslam’s Gas Tax Increasing IMPROVE Act

As the House sponsor of the IMPROVE Act Tax Cut Act of 2017 (HB 534), State Rep. Barry “Boss” Doss (R-Leoma) was well versed on all of the related subject matter and respectful throughout his long and challenging sales pitch for Governor Haslam’s IMPROVE Act to the various committees and on the House floor. There were, however, several things Rep. Doss got wrong. And, as former Majority Leader Gerald McCormick (R-Chattanooga) said several times through the process, “You can have your own opinions, but you can’t have your own facts.” Here are the top six things Boss Doss got wrong: 1. “I’ve been proud that we cut taxes by $300 million so far.” The state portion of the annual budget has grown from $13.7 billion in 2011-12 to a recommended $16.5 billion for 2017-18. Since state law requires that all of the revenues be allocated, that’s a $2.8 billion, or 20 percent, increase in state spending in just six years. 2. The average family of 4 will recognize a monthly increase of $5.54 from the gas tax hike versus a savings in their food tax of $7.72, for a net savings of $2.18 per month. In terms of the…

Read the full storyHouse Republican Conservatives Put Up a Valiant Fight Against Gov. Haslam’s Gas Tax Increase, Setting Stage for 2018 Election

When the Tennessee House of Representatives passed Governor Haslam’s gas tax increase bill by a 60 to 37 margin on Wednesday, a bare majority of Republicans–37 for and 35 against—voted yes in favor of the unpopular tax increase. The 35 conservative Republicans who stood for the foundational principle of limited government were not sufficient to withstand the huge financial and political pressures mounted by the special interests who wanted the bill to pass. Those forces arrayed against the conservative opposition were significant, beginning with Governor Haslam’s taxpayer funded statewide tour that promoted a 962 road project list in all 95 counties, the support of lobbying groups numbering in the thirties, tax reductions for a select group of businesses, and a reported $250 million taxpayer funded deal for the Democrats. These conservatives lost the battle in 2017, but the war for the Tennessee General Assembly election in 2018 has just begun. The arguments made by these 35 stalwarts on the floor of the House on Wednesday will resonate throughout the state over the next year and a half. The process through the House subcommittees and committees was not without controversy including the make up of the Transportation Committee, procedural issues, breaking…

Read the full storyHaslam Bargained with Democrats and Establishment Republicans to Pass Gas Tax Increase Bill

Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017” (HB 534), which includes a 6 cents per gallon gas tax increase and a 10 cents per gallon diesel tax increase phased in over three years, garnered 23 votes from Democrats and 37 establishment Republicans, which was more than sufficient to get it to pass in the Tennessee House of Representatives by a vote of 60 to 37 late Wednesday. It was a long day for State Rep. Barry “Boss” Doss, the leading co-sponsor of the bill, who spent several hours presenting the case for the bill on the floor of the House prior to the final vote. Only two Democrats, State Rep G. A. Hardaway (D-Memphis) and State Rep. John Mark Windle (D-Livingston), joined the conservative caucus of Republicans, who cast 35 votes against the IMPROVE Act “Tax Cut Act of 2017.” Rumors swirled throughout the capitol Wednesday that Governor Haslam had made a deal with the Democrats to secure their votes. Rep. Doss (R-Leoma) was seen conversing on the floor with several Democrats throughout the day, which was not, by itself, particularly unusual. More significantly, Democratic Minority Leader Craig Fitzhugh (D-Ripley) was seen accompanying administrative staffer Warren Wells to the…

Read the full storyHaslam Reduced Highway Fund Budget By 13 Percent, Grew State Budget By 20 Percent Before Proposing Gas Tax Increases

Governor Haslam reduced the Highway Fund budget by 13 percent, while he grew the State budget by 20 percent during his first six years in office. Only after he made these reductions in the Highway Fund budget did he propose the gas tax and diesel tax increases included in the IMPROVE Act when he introduced it in January 2017. From Governor Haslam’s first budget year of 2011-12 to the most recent 2016-17, Highway Fund allocations went from $867 million to $757 million, a reduction of 13 percent. HIGHWAY FUND ALLOCATIONS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated DOWN Budget $ $866,886,300 $823,104,600 $683,800,400 $792,219,800 $740,645,600 $756,856,000 -13% Sheet 54 of 656 54 of 545 54 of 542 54 of 550 54 of 558 54 of 558 Page A-22 A-22 A-22 A-22 A-22 A-22 During that same period, the state portion of the budget, excluding the unpredictable and heavily mandated federal funding, grew from $13.7 billion in 2011-12 to $16.5 billion in 2016-17, representing a 20 percent increase. STATE BUDGET IN BILLIONS OF DOLLARS Link 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17 Actual Actual Actual Actual Actual Estimated INCREASE Billion $ $13.7 $14 $14.6 $14.8 $15.3…

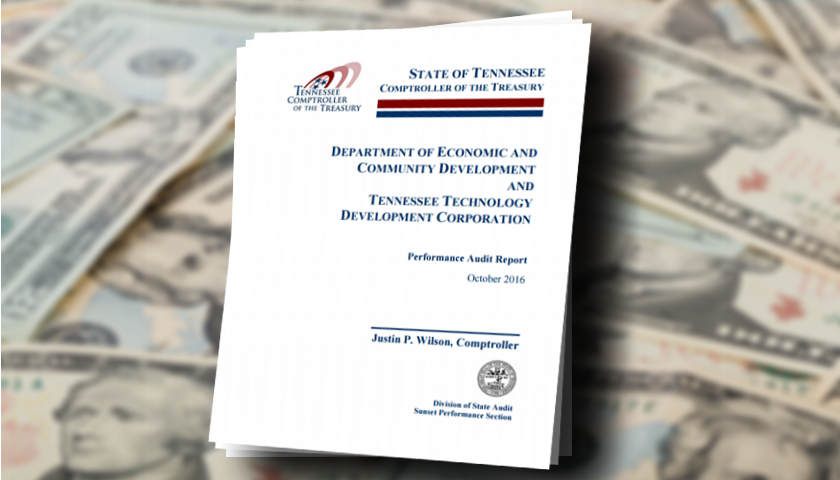

Read the full storyHaslam’s IMPROVE Act Includes Same ‘Economic Development’ That Lost Millions in TNInvestco

“A performance audit from the Tennessee Comptroller’s Office has revealed the State of Tennessee has only recovered $5.3 million of its initial $200 million investment in the TNInvestco program,” according to a statement dated November 10, 2016, under the name of Justin P. Wilson, Comptroller, referring to a performance audit report. The statement from the Comptroller focused primarily on the TNInvestco program from the 60-page October 2016 “Performance Audit Report” produced by the state’s Comptroller’s office on Governor Haslam’s Department of Economic Development and Tennessee Technology Development Corporation. The Report was conducted by the Comptroller’s Department of Audit, Division of State Audit, with the report dated October 25, 2016, signed by Director, Deborah V. Loveless, CPA and addressed to The Honorable Ron Ramsey, Speaker of the Senate; The Honorable Beth Harwell, Speaker of the House of Representatives; The Honorable Mike Bell, Chair, Senate Committee on Government Operations; The Honorable Jeremy Faison, Chair, House Committee on Government Operations; and, Members of the General Assembly; and The Honorable Randy Boyd, Commissioner, Department of Economic and Community Development. At the time of the audit, the program was in in its sixth year, having been approved by the Tennessee legislature in 2009. With…

Read the full storyTDOT Reduces Backlog From $6 Billion to $4.7 Billion, But Total ‘Project Needs’ Grow to $10.5 Billion

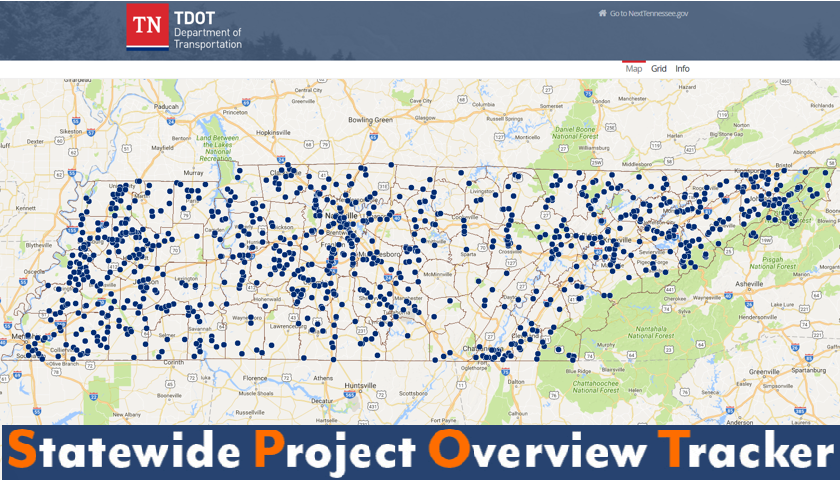

The Tennessee Department of Transportation (TDOT) list of projects issued at the end of 2015 totaled $6.1 billion. The updated project list included with the 2017 IMPROVE Act, on its surface, has a bottom line figure of $10.5 billion with the backlog potion being $4.7 billion. A spreadsheet document dated 11/9/15 was issued on TDOT letterhead titled “Current Backlog,” defined in the secondary heading as “Projects Approved by the TN General Assembly and Currently Under Development.” The last line of the 13-page document states “Total Estimated Cost of Remaining Phases of Work” with a reported total of $6,095,023,692. The 2015 backlog list included a total of 252 projects in 62 counties with Shelby and Blount counties having the highest number of projects at 25 and 10, respectively. Contrasted to the projects in the IMPROVE Act listed in a report generated by TDOT dated 1/12/17, there are now 962 projects in all 95 counties at a cost of $10.5 billion. TDOT’s slick and interactive SPOT – Statewide Project Overview Tracker – displays the IMPROVE Act projects in map and grid form. Utilizing the “grid” feature of the “project needs” page, as it is named, facilitates sorting by “yes” or “no”…

Read the full storyBoss Doss Claim That Tennessee is Lowest Taxed State in Nation Contradicted by Kiplinger Report

State Rep. Barry “Boss” Doss (R-Leoma), chairman of the House Transportation and champion of the IMPROVE Act “Tax Cut Act of 2017” claimed in the Finance, Ways and Means Committee last Tuesday that Tennessee is the lowest taxed state in the nation. The Kiplinger Report, a “leader in personal finance news and business forecasting” put together their list of “10 Best States to Live In For Taxes” in August 2016, and that list does not include Tennessee. In order, Kiplinger’s top 10 are: Wyoming, Alaska, Florida, Nevada, Arizona, Louisiana, Alabama, South Dakota, Mississippi and Delaware. Five states on the list, like Tennessee, do not have an income tax. Other robust criteria Kiplinger used for their ranking was property tax from U.S. Census’ American Community Survey, the Tax Foundation’s figure for average sales tax, fuel tax from The American Petroleum Institute, sin taxes from the state’s tax agency and the Tax Foundation, inheritance and gift taxes from each state’s tax agency, wireless taxes from the Tax Foundation, travel taxes from the state’s tax agency and a lodging tax study by HVS Convention Sports and Entertainment Consulting and the fiscal stability of the states by the Mercatus Center at George Mason University.…

Read the full storyGas Tax Increase Lobbyists Begin Advertising Campaign on Ralph Bristol’s WWTN Show

Regular listeners to Nashville’s Morning News With Ralph Bristol on 99.7 FM WWTN may have noticed a new advertiser on Thursday–the Transportation Coalition of Tennessee. The Coalition is a group of 39 lobbying groups that support Governor Haslam’s IMPROVE Act “Tax Cut Act of 2017,” the majority of which will directly benefit from the additional $10 billion in taxpayer-funded road projects. Several of the lobbying groups, such as the Tennessee County Highway Officials Association, Association of County Mayors and Tennessee County Commissioners Association, are funded by membership dues paid for by taxpayers through county budgets. Reports indicate that the ads are only being played on WWTN during Nashville’s Morning News with Ralph Bristol. Bristol has been a proponent of the IMPROVE Act “Tax Cut Act of 2017” since its introduction and continued his support in the second hour of Thursday’s show with an 8-minute “rant,” as Ralph often refers to them. The full transcript can be found here. In the third hour of the program, the one-minute advertising “spot” by the Coalition went like this: “Governor Bill Haslam’s IMPROVE Act responsibly funds important road and bridge work in all of Tennessee’s 95 counties. The IMPROVE Act funds transportation infrastructure and at…

Read the full storyThe 962 Road Construction Projects Costing $10.5 Billion in The Gas Tax Increase Bill Can Be ‘Modified’ by TDOT

Governor Haslam and other administration officials have stated since announcing the IMPROVE Act , now the “Tax Cut Act of 2017,” on January 18 that the purpose of the gas and diesel tax increases included in the bill is to fund 962 needed road construction projects in all 95 counties for a price tag of $10.5 billion.

These projects, however are the seventh in priority in a list of seven things for which the additional funds raised in the bill can be used.

Read the full storyGas Tax Increase Passes House Finance Committee on a Voice Vote

Rep. Charles Sargent (R-Franklin), chairman of the House Finance, Ways, and Means Committee, presided over a voice vote on Tuesday that advanced the controversial IMPROVE Act “Tax Cut Act of 2017” to the Calendar and Rules Committee, where it awaits scheduling for a vote on the floor of the full House. Rep. Barry Doss (R-Leoma), as sponsor of the bill, once again presented the features of the IMPROVE Act “Tax Cut Act of 2017.” Doss unexpectedly made a point of saying that the renaming of the bill last week to include The Tax Cut Act of 2017 was something that was not important to him, but it was to its sponsor, Rep. Gerald McCormick (R-Chattanooga). Chairman Sargent allowed a leisurely-paced question and answer period from Committee members to Rep. Doss, which came primarily from Democrat members of the Committee. Rep. Mike Carter (R-Ooltewah) pointed out that while he wished it wasn’t included in the IMPROVE Act “Tax Cut Act of 2017”, he wouldn’t vote for a bill that didn’t include the change from the franchise and excise tax to the single sales factor due to the loss of Polaris from his district to the state of Alabama. Rep. David Hawk (R- Greeneville)…

Read the full storyRep. Judd Matheny and Conservative Majority Caucus Denounce In-State Tuition for Illegal Immigrant Students

NASHVILLE, Tennessee–State Representative Judd Matheny (R-Tullahoma), joined by more than a dozen conservative state house members, held a press conference Monday to voice their strong opposition to the push by Governor Haslam and the Republican leadership to extent in-state tuition privileges to illegal immigrant students. “We are standing up because believe the hard-working families and small businesses that make up our great state need an advocate in Nashville who will put them first. We will stand up for the rights of Tennesseans when legislators fail to hear their constituents,” Matheny said. Tennessee Star cameras were rolling: The Star has covered the developments surrounding the in-state tuition push closely, from state Senators White and Gardenhire’s repeated bill proposals to the Tennessee Farm Bureau’s outspoken support. “Today, our goal is to shine the light of truth on a bill that will give in-state college tuition to illegal immigrants. We believe HB 863/SB 1014 is unconstitutional and it will cost Tennessee taxpayers dearly. It will make us a magnet for illegal immigrants – which will further strain our public education system,” Matheny said. “Our position regarding this bill is simple. Our state cannot afford to subsidize public college tuition for illegal aliens, nor should it.…

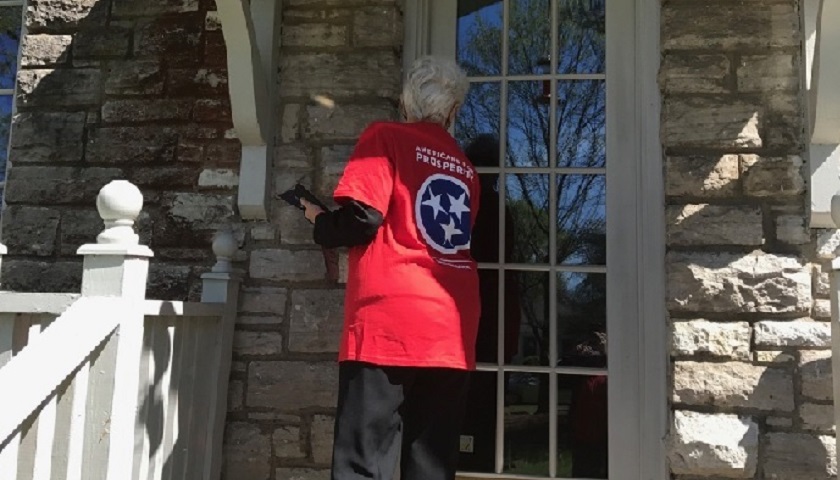

Read the full story80 Percent of Speaker Beth Harwell’s Constituents Contacted by AFP Door Knocking Oppose Gas Tax Increase

Americans for Prosperity (AFP) Tennessee organized a Day of Action Saturday during which volunteers knocked on doors in Speaker Beth Harwell’s (R-Nashville) district asking constituents whether they were in favor of a gas tax increase, or wanted revenues from the $2 billion surplus to be used for funding of road projects. Shawn Hatmaker, AFP Tennessee’s Field Director told The Tennessee Star that the overwhelming majority, 80 percent in fact, of respondents said they were opposed to a gas tax increase and wanted existing revenues to be used. As her constituents, respondents were encouraged by AFP volunteers to contact Speaker Harwell to urge her to push forward with the plan she announced last week. The plan, which Speaker Harwell addressed briefly Thursday, that does not raise any taxes, but simply transfers sales tax revenues already collected on new and used vehicles from the General Fund to the Highway Fund. Respondents as well as those not at home were left with a door hanger that provided an overview of Governor Haslam’s gas tax increase plan versus Speaker Harwell’s proposal that also included contact information for her office. Ed Smith is a Heritage Action Sentinel as well as an AFP volunteer who…

Read the full storyGrassroots Activists Petition Republican Majority to Oppose Gas Tax Increase

The Tennessee Alliance of Liberty Groups, a group of grassroots activists from around the state, were motivated by two events this week that prompted the issuance of an urgent action alert to sign a petition that will go to all state legislators about the gas tax. The first event this week prompting action by the group was the renaming of the IMPROVE Act to the “Tax Cut Act of 2017” is what the Alliance calls out as “an obvious attempt to deceive Tennesseans.” As reported by The Tennessee Star, the renaming took place in the House Finance, Ways and Means Subcommittee meeting through an amendment presented by Rep. Barry Doss (R-Leoma) and authored by Rep. and House Finance Subcommittee Chairman Gerald McCormick (R-Chattanooga). The Alliance very directly points out in their letter that “the purpose of the IMPROVE Act was never to reduce taxes but was to allocate funds for roads.” The letter continues, “So, this sleight of hand by Republican legislators in renaming a road repair & construction bill to a tax cut bill is not only offensive, it is the lowest form of deception by men and women to whom we have entrusted and lent the keys to…

Read the full storyDespite Ethics Cloud, ‘Proud’ Barry Doss Presented ‘New and IMPROVED’ Gas Tax Bill for ‘Rebranding’ as ‘Tax Cut Act of 2017’

Rep. Barry Doss (R-Leoma) told the House Finance, Ways and Means Committee on Wednesday he was “proud to bring the bill before you,” as he presented Governor Haslam’s IMPROVE Act, the gas tax increase proposal he co-sponsors, for consideration. Rep. Doss continues to sponsor and present the bill, despite the call for an ethics investigation by the Tennessee Republican Assembly over potential Tennessee Department of Transportation contracts for his company. Doss statement of pride in the gas tax increase proposal came both in his opening statement and again later in response to Rep. David Hawk (R-Greeneville). Hawk said he would continue to work to “present a plan our colleagues can vote for, as opposed to presenting a plan that our colleagues may have to hold their nose and vote for.” Doss took exception to Hawk’s comments, and said again that he was proud to sponsor the gas tax increase bill and that he is “not holding my nose today.” He conceded, however, that it’s “going to take some education of our constituents,” something he said he has “been doing for a solid year.” Although he has served two previous terms in the House of Representatives, Rep. Doss has not been a member…

Read the full storySpeaker Harwell Says She Will Have a Road Funding Plan That Does Not Raise The Gas Tax

Speaker Beth Harwell (R-Nashville) says that she and many other members of the Tennessee House of Representatives will introduce an alternative plan that will not increase gas taxes when the IMPROVE Act “Tax Cut Act of 2017” comes before the House Finance Ways and Means Committee on Monday for consideration. “When you buy a car in the state of Tennessee, whether used or new, you pay a sales tax on that. We want to take that sales tax and put it to our roads program. That brings in a tremendous amount of money and we think that’s an appropriate, new, dedicated source of funding for our roads, which then we would not have to raise the gas tax,” Harwell said in an interview with Ralph Bristol, host of 99.7 FM WWTN’s Nashville’s Morning News on Monday. Full details of the plan are being finalized, with input from other House members, Speaker Harwell said. But the plan will use existing revenues from the sales tax of new and used vehicle sales already collected by the state and dedicate those revenues to funding road projects, she added. Allocating the state portion of the vehicle sales tax revenues toward roads would result in…

Read the full storyAmericans For Prosperity To Hold ‘A Gas Tax Day Of Action’ In Speaker Harwell’s District

Americans For Prosperity-Tennessee (AFP) announced ‘A Day of Action’ in the fight against the gas tax hike in the home district of Speaker Beth Harwell (R-Nashville), in order to encourage her to oppose the unpopular measure. Volunteers will be door-knocking all day Saturday, April 8 from 9 a.m. to 5 p.m. in the Belle Meade, Forest Hills and Oak Hill areas of Nashville. Full details are available on AFP’s Facebook page. The gas tax increase is the more common term applied to Governor Haslam’s IMPROVE Act – recently renamed the “Tax Cut Act of 2017” – which, in its current form, includes a 6 cent per gallon gas tax increase and a 10 ten cent per gallon diesel tax increase. The tax hikes are slated to be phased in over a three-year period to fund the Tennessee Department of Transportation’s (TDOT) list of 962 projects that currently carry a $10.5 billion price tag. Speaker Harwell has played a key role this session in the advancement of the gas tax through the Tennessee House of Representaives. At the outset of the current 110th Tennessee General Assembly, she assigned the members and picked the chairmen of the House Committees and Subcommittees including the critical…

Read the full storyState Rep. Sexton Tells Speaker Harwell: ‘Hit The Restart Button’ On Gas Tax, Send It Back to Subcommittee ‘To Be Debated Fairly and Openly’

State Representative Jerry Sexton (R-Bean Station), joined by more than a dozen colleagues in the Tennessee House of Representatives, held a press conference Monday blasting the Republican leadership for their heavy-handed and ethically questionable tactics to ram through the Governor’s gas tax hike, the key element of the IMPROVE Act. “We are calling on Speaker Harwell, House Leadership, and those that support this bill to hit the restart button in regards to the IMPROVE Act and to send the bill back to Transportation Subcommittee to be debated fairly and openly,” Sexton announced. The Tennessee Star was there with cameras rolling: The Star has reported extensively on how State Rep. Barry Doss, Chairman of the House Transportation Committee, broke the rules of the House of Representatives to push Haslam’s gas tax through the committee. On March 22, for instance, The Star published a story titled “Boss Doss Breaks Rules to Ram Amended Gas Tax Increase Through House Transportation Committee,” which provided a blow-by-blow account of the subterfuge behind the bill’s passage that day. “The people have elected Republicans to govern at all levels of state government. The Republicans control the Governors Mansion, the state house, and the state senate. We,…

Read the full storyConcerned Veterans of America: ‘Veterans Being Used in Tennessee Tax Hike Ploy’

Concerned Veterans of America (CVA) blasted Tennessee’s Republican political establishment on Monday for using veterans in a “Tennessee [gas] tax hike ploy.” “The politicians pushing for this gas tax increase know that it’s unpopular, so they’ve resorted to using veterans as pawns to push their big government agenda. Pretending that this massive tax hike is good for the military community is an unconscionable move that disrespects those who fought and sacrificed for this country,” Mark Lucas, executive director of CVA said in a statement. “The truth is that this gas tax will hurt families and veterans alike who rely on affordable transportation in the state. Veterans deserve property tax relief, but not as part of a glaringly obvious ploy to increase taxes across the board. We urge the Tennessee legislature to look for ways to cut wasteful government spending instead of approving this disingenuous and costly tax hike,” Lucas said. The amended version of Gov. Haslam’s IMPROVE Act gas tax increase that passed the Senate Transporation Committee last week “includes a small tax relief for veterans which would exempt them from paying property taxes under certain circumstances, but would not protect them from the impact of the massive gas tax…

Read the full storyBoss Doss Breaks Rules to Ram Amended Gas Tax Increase Through House Transportation Committee

In a stunning abuse of power, State Rep. Barry Doss (R-Leoma) broke a long-standing rule of the Tennessee House of Representatives to ram an amended version of Gov. Haslam’s gas tax increase through the House Transportation Committee he chairs on Tuesday. A bill containing the new and improved IMPROVE Act amendment, which restores many of the elements of Gov. Haslam’s original gas tax increase proposal, passed the House Transportation Committee in an 11 to 7 vote, but that outcome could not have taken place on Tuesday had not Chairman Doss broken Rule 34 of the Tennessee House of Representatives. Rule 34 of the Tennessee House of Representatives allows any member the privilege of “separating the question” when an amendment is added to a bill that is up for consideration. A key element of Rule 34–which is known to every member of the House–is that it is a “privilege” that can be exercised without question whenever a member invokes it in a committee hearing. It is not a “motion,” which is subject to a vote of the committee. Every chairman of every committee in the Tennessee House of Representatives, including Rep. Doss, is well aware that Rule 34 is a privilege,…

Read the full storyUnder Governor Haslam, Tennessee Department of Transportation ‘Overhead’ Costs Have Grown 63 Percent, While ‘Highway Infrastructure’ Spending Has Shrunk By 33 Percent

The Tennessee Department of Transportation (TDOT) total costs for “Administration” plus “Headquarters Operation,” what would be considered “overhead” in the business world, have grown by 63 percent, from $78.9 to $117 million, in the seven years between Gov. Haslam’s first budget in FY 2011-12 and his proposed budget for FY 2017-18. While TDOTs overhead has skyrocketed, spending on one of the main Programs for road improvements, “Highway Infrastructure,” has gone down by more than 30 percent in that same time period. Table 1 provides the details of TDOT’s “Recommended Budget By Program and Funding Source” obtained from multiple years of budget documents and includes the links to the source documents and the page references. The table demonstrates that since fiscal year 2010-11, the last year of Governor Bredesen’s administration, there are multiple Programs, including Administration, Headquarters Operation, State Industrial Access, Planning and Research, Interstate System and Highway Infrastructure and TDOT as a whole, for which the funding was reduced by Gov. Haslam’s in his first year and have never recovered. Table 1 Department of Transportation Recommended Budget by Program Source Source Source Source Source Sheet 46 of 656 Sheet 46 of 550 Sheet 46 of 558 Sheet 47 of 558…

Read the full storyTennessee Department of Transportation Says it ‘Needs’ $46 Million For Distracted Driver Programs

The Tennessee Department of Transportation (TDOT) has identified 15 projects in a budget category best described as “distracted driver programs” that will cost $46.4 million, part of the 962 total statewide transportation projects it has scheduled over the next 12 years at a total cost of $10.5 billion. All these projects will be built, TDOT says, provided the governor’s IMPROVE Act, which contains four state tax increases, including a 7-cent gas tax, a 12-cent diesel tax, $5 on motor vehicle registrations and 3 percent on rental cars, becomes law. The department categorized the 962 IMPROVE Act projects into eight program types: Interstate Modernization, Primary Trade Corridors, Rural Access, Safety, Urban Economic Opportunity, Highway and Facility Maintenance, Technology/Intelligent Transportation System, Local Bridges. “Through this process we have made decisions to include only ‘needs’ vs. ‘wants,’ ” Commissioner John Schroer said at the conclusion of the TDOT budget presentation for FY 2017-18. Among these ‘needs’ are the $46.4 million of projects within the “Technology/Intelligent Transportation System” category that is probably better described as “distracted driver programs.” According to SPOT, a TDOT interactive page (short for Statewide Project Overview Tracker), the program type “Technology/Intelligent Transportation System . . . [includes] TDOT’s cameras, overhead…

Read the full storyThirty Tennessee General Assembly Members Signed The ‘Taxpayer Protection Pledge,’ But Some Are Breaking It With The IMPROVE Act

“Politicians often run for office saying they won’t raise taxes, but then quickly turn their backs on the taxpayer. The idea of the Pledge is simple enough: Make them put their no-new-taxes rhetoric in writing,” says Americans for Tax Reform. The “Taxpayer Protection Pledge” commits an elected official or candidate for public office “to oppose [and vote against/veto] any efforts to increase taxes.” According to the Americans for Tax Reform searchable data base, the Pledge has been signed by 30 active Tennessee State Representatives and State Senators, who are listed below. State Representatives State Senators District First Last District First Last 24 Kevin Brooks 17 Mae Beavers 19 Harry Brooks 16 Janice Bowling 71 David Byrd 22 Mark Green 63 Glen Casada 26 Dolores Gresham 16 Bill Dunn 27 Ed Jackson 11 Jeremy Faison 23 Jack Johnson 56 Beth Harwell 13 Bill Ketron 7 Matthew Hill 5 Randy McNally 22 Dan Howell 1 Steve Southerland 68 Curtis Johnson 24 John Stevens 89 Roger Kane 14 Jim Tracy 38 Kelly Keisling 57 Susan Lynn 72 Steve McDaniel 36 Dennis Powers 45 Courtney Rogers 61 Charles Sargent 49 Mike Sparks 40 Terri Lynn Weaver The IMPROVE Act includes five tax increases: a…

Read the full storyHuge Crowd at Trump Rally in Nashville ‘Optimistic About the Future’

The unseasonably cold temperature that topped out about 40 degrees with a substantial wind chill had no apparent impact on the enthusiasm of President Trump’s supporters who showed up by the thousands in Nashville on Monday. About 10,000 made it in to the Nashville Municipal Auditorium in time to hear the president’s speech, while as many as 5,000 who had stood in line did not make it in, due to the TSA security clearance process. Most of those waiting in the line that extended more than a half mile from the auditorium’s entrance had been there about six hours before being able to get inside. For many, the positive experience started while standing in that long line of rally ticket holders. Robin, who called in to Ralph Bristol’s Morning Show Ralph Bristol on WTN 99.7 the morning following the rally, said that there was “camaraderie” amongst those waiting in line and that everyone was “optimistic about the future.” Even though she arrived at 2:30 p.m., Robin was not able to get into the Auditorium before President Trump finished his speech, but said she would do it all again. Inside the Auditorium, the event started with comments and heads bowed for…

Read the full storyHouse Transportation Committee Delays Vote on The IMPROVE Act Another Week

State Rep. Courtney Rogers (R-Goodlettsville), Vice-Chair of the House Transportation Committee, acted as Chair when the committee convened on Tuesday in the absence of Chairman Barry Doss (R-Leoma), who was not present at the hearing. Acting Chair Rogers reported to the committee members present that Chairman Doss had asked that HB 534, the “caption bill” for the IMPROVE Act, be “rolled” for one week. The request, which constitutes the second delay in as many weeks of a vote on the bill, seemed an unexpected turn of events to the full-to-capacity meeting room that included media, camera crews, and several Tennessee Department of Transportation representatives. As The Tennessee Star reported last week, the committee voted 9 to 8 when it met one week earlier on March 7 to “roll” the bill forward to this Tuesday’s meeting in order to allow the committee members to review the numerous amendments proposed to the bill. A point of order raised at the March 7 meeting by State Rep. Timothy Hill (R-Blountville)–whether it was in order for Chairman Doss, as sponsor of the bill, to preside over the hearing–was raised indirectly at Tuesday’s meeting. Hill’s earlier point of order was resolved at the March…

Read the full storyCarr Amendment Funds Highways Through ‘User Fees’ Without A Gas Tax Increase

The House Transportation Committee convenes on Tuesday to vote on Gov. Haslam’s IMPROVE Act. The big question is whether Committee Chairman State Rep. Barry Doss (R-Leoma) will allow a vote on an amendment proposed by State Rep. Dale Carr (R-Sevierville), a member of the committee, that would change the funding source of from a gas and diesel tax increase, as proposed by the governor, to a re-allocation of 33.5 percent of taxes collected from the sale of new or used motor vehicles for highway funding. Proponents of Gov. Haslam’s gas tax increase proposal have argued that road construction must be funded by users through “user fees.” Carr’s amendment addresses those concerns, since taxes on the sale of new or used motor vehicles are clearly paid by users of the state’s highways. Rep. Carr tells The Tennessee Star that he hand delivered the amendment to Chairman Doss on Tuesday of last week, and intends to present it for consideration when the House Transportation Committee begins deliberations on Tuesday. He notes that the amendment was “written in consultation with leadership.” “A lot of people don’t want the [gas] tax and they are having a hard time moving it through committee,” he tells The Star in an exclusive…

Read the full storyState Rep. Susan Lynn: ‘I Am Not For The Gas Tax So There Is Nothing To Debate’

“No, I am not for the gas tax so there is nothing to debate,” State Rep. Susan Lynn (R- Mount Juliet) tells The Tennessee Star in response to challenger Jeremy Hayes’ March 8 press release calling on her to debate him over the issue. Hayes opposes Gov. Haslam’s proposed gas tax increase. In a February 28, 2017, exclusive interview with The Star, Hayes announced his run for the 57th House District in the 2018 Republican primary, citing Lynn’s support for Gov. Haslam’s gas tax increase proposal. “Thank you for giving me the opportunity to clear up this untruthful rhetoric,” Lynn responded to Hayes’ challenge in an email sent to The Star, adding: I have never voted for a tax increase and I have voted to lower our taxes many times. It is my responsibility as the representative for the 57th district to present facts, hear ideas and to create opportunities for constituents to discuss policy. While some lawmakers are shying away from holding Town Hall meetings – I have held seven since January and I will hold more on this topic and others. This individual worked for my democrat opponent – his integrity on this and other matters is entirely suspect. I’d…

Read the full story