by Robert Romano

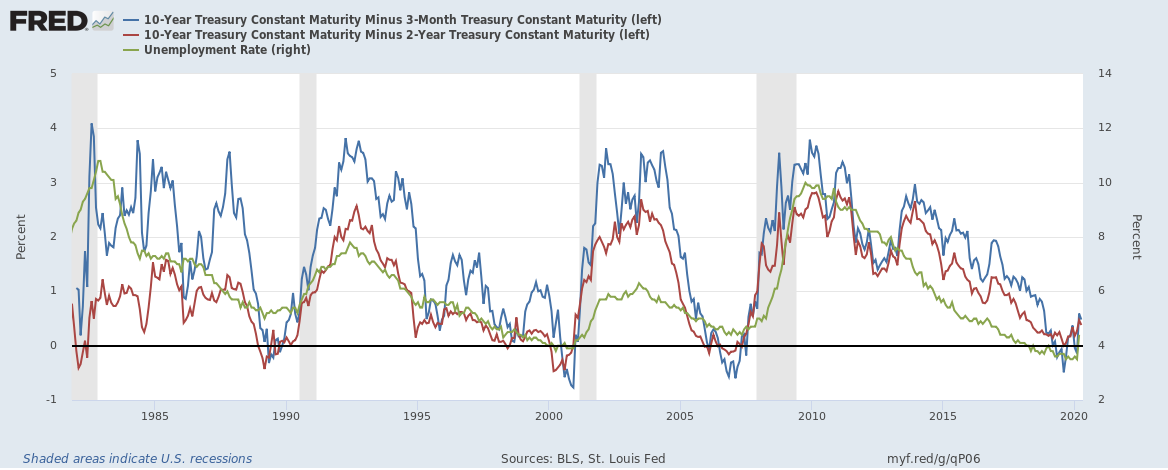

The unemployment rate will likely continue rising as the spread between the 10-year treasury on one side, and the 2-year and 3-month treasuries on the other, continue rising over the next weeks and months, an analysis of interest rates over the past four recession shows, according to data compiled by the Federal Reserve, U.S. Treasury and the Bureau of Labor Statistics.

The relationship shows that peak unemployment comes after the inversions and tends to continue until the peak the 10-year-2-year, and the 10-year-3-month spreads, with the average period lasting 26 months from when the inversions ended, and the range being from about 13 months as in the 1982 recession 30 to 31 months in the cases of the 1991, 2001 and 2007-2009 recessions.

The question here is how quickly will the U.S. get to peak unemployment?

Both the 10-year-2-year and 10-year-3-month spreads uninverted in Oct. 2019, and then another brief inversion happened in the 10-year-3-month last month, but not for the 10-year-2-year. So where to start counting from? October or last month?

It’s impossible to know but you can produce a very wide range, and say that unemployment will probably continue rising until at least Nov. 2020, but could continue rising until Dec. 2021 or even May 2022 depending on the severity of the downturn. The past is prologue but much appears to depend on the environment to foster a recovery that is put into place.

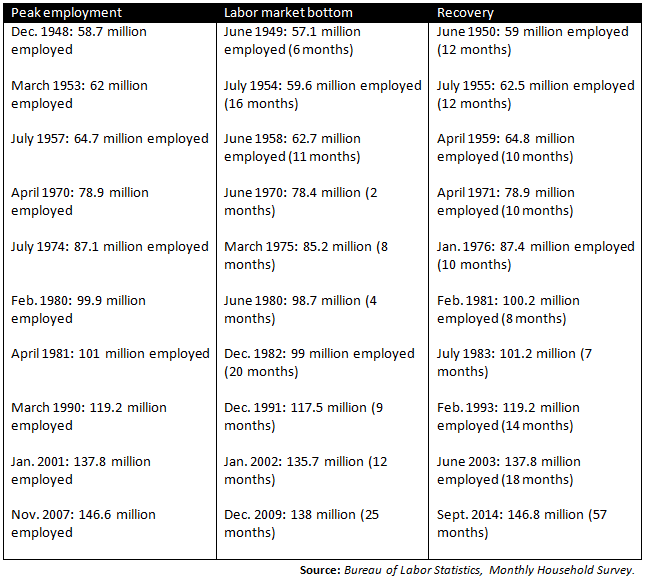

Already, with more than 26 million jobs lost and counting amid state-government-directed closures, the recession is already three times as bad as the last one, making this the worst economic crisis since the Great Depression.

So many uncertainties abound. For example, owing to the unprecedented nature of the current pandemic and economic shutdown, does the sheer magnitude of the job losses mean that the downturn could be even longer?

Will deflation take root with the U.S. dollar stronger than ever relative to foreign currencies, further exacerbating the problems we are already witnessing?

Finally, how effective will the $2.7 trillion in relief including $730 billion for small businesses be preserving at American jobs? Will further stimulus help businesses to recover much more rapidly? And what will phase four look like?

All these are critical to any analysis going forward, with the imminent U.S. presidential election just to make things that much more interesting.

Since Franklin Roosevelt, Democrats have tended to win the trifecta of the White House, Senate and House whenever they win the presidency. How would that affect the outlook in 2021? The last time Joe Biden was Vice President it took 57 months to recover the jobs lost in the last recession after peak unemployment was reached.

Would reelection by President Donald Trump improve that outlook? A strong case could be made that the American people have already seen what a Democratic program for recovery looks like, and that Biden has so far failed to produce any concrete plan. Whereas, President Trump and his team had the foresight to already put in place a massive relief program without which society itself might be at risk of collapsing right now.

What is clear is that the economic emergency will most probably continue until the election and thereafter, important context for the President to consider right now as he, his team and Republican leaders in Congress consider what phase four legislation ought to look like. President Trump has said he wants Congress to go big, and so far they have delivered what he has requested.

As states begin reopening, Trump’s political fate will be tied to how things with the pandemic play out plus what the economy looks like in the fall, meaning what happens next is very much up to him to help America get back to work. Go big, Mr. President. What have you got to lose?

– – –

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.

I thought we might have learner from the housing crisis under Obama’s watch that throwing money at a problem is not a solution. Remember all of those “shovel ready” projects that did not exist and did little to nothing to help? How about the GM bailout? In fact, it often makes recovery much slower and difficult.

No more stimulus – please!