by Ross Pomeroy

One of the main planks of President Biden and congressional Democrats’ agenda is making corporations and high-earning Americans “pay their fair share” through higher taxes. But a recently published analysis in the journal SAGE Open delving into sixty years of U.S. economic data from 1960 to 2020 suggests that their proposal, if implemented, could backfire.

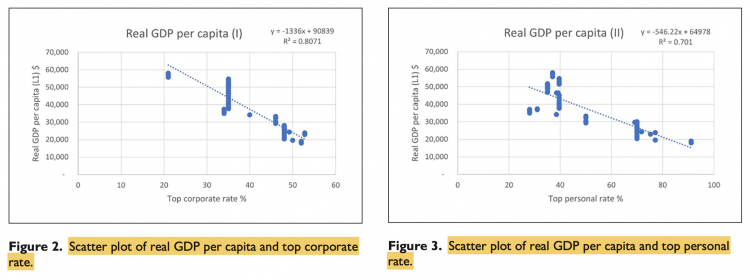

“In short, as the top corporate rate or top personal rate goes higher, real GDP per capita decreases,” the authors, Ted Peterson, an Adjunct Professor in the Department of Political Science, and Zachary Blair, a recent graduate focusing on advanced financial analysis, reported.

Peterson and Blair sought to explore how the top corporate and personal tax rates correlated with real gross domestic product (GDP) per capita, which shows a country’s economic output per person adjusted for inflation. Though imperfect, the measure is considered a proxy for the economic wellbeing of a country’s citizens.

In the United States, the corporate tax rate currently stands at 21%, lowered from 35% in 2017 when President Trump and congressional Republicans passed the Tax Cuts and Jobs Act of 2017. The top personal tax rate for 2022 is 37% for individual incomes over $539,900 or $647,850 for married couples filing jointly. President Biden’s 2023 budget proposal included raising the corporate tax rate from 21% to 28% and hiking the top personal tax bracket to 39.6%.

The authors’ analysis, which used data from the St. Louis Federal Reserve, took into account other variables as well, such as money supply, gross federal debt, personal saving rate, and net exports of goods and services. It found that for each 1% increase in the corporate tax rate, real GDP per capita drops by a range of $187 to $1,336. For each 1% increase in the top personal rate, real GDP per capita drops by $49 to $546.

“In short, based on our research we would recommend the following: if Congress and the President wish to increase taxes, they should emphasize an increase in the personal top tax rate before raising the top corporate tax rate. The models show that the negative impact of increases on the corporate tax rate can be as high as nine times the size of the personal tax rate on GDP per capita. This impact may stem from the argument that corporations do not pay taxes. Rather, corporations merely act as pass-through institutions insofar as they are able,” Peterson and Blair wrote.

The authors caution, however, that real GDP per capita can be a misleading metric as it doesn’t capture wealth inequality. A country with a few rich people and many poor can have a shiny GDP per capita, but you couldn’t say that most people in that country are doing well.

Peterson and Blair also warn that the benefits of lowering taxes on GDP aren’t endless.

“At some point, a decrease in taxes will not spur growth and could have a significantly detrimental effect on a nation’s ability to service its debts in addition to potentially devastating economic and national effects.”

Source: Peterson T, Bair Z. United States Tax Rates and Economic Growth. SAGE Open. July 2022. doi:10.1177/21582440221114324

– – –

Ross Pomeroy is a writer for RealClearScience.

Photo “U.S. Capitol” by Raul654. CC BY-SA 3.0.