Live from Music Row Thursday morning on The Tennessee Star Report with Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 a.m. to 8:00 a.m. – host Leahy welcomed Fox Business contributor and Wall Street expert Liz Peek on the newsmaker line to give her take on today’s financial outlook and provide positive news on oil and gas prices as she predicts Saudi Arabia may step in.

Leahy: We are joined on our newsmaker line now by our very good friend, Fox News contributor and former partner in a major Wall Street firm, Liz Peek. Liz, thanks for joining us today!

Peek: Thank you very much for having me on.

Leahy: Every time you’re on, Liz, it seems everything has gotten worse and worse.

Peek: Do you think there’s a connection? (Chuckles)

Leahy: No, I mean, you’re documenting the just utter dismay that everybody is seeing in the economic system in the world now. The Russians have invaded Ukraine, gas prices up, wheat in short supply. My goodness. Please help! Tell us what’s happened, what’s going to happen?

Simon: Is there anything left that’s cheap?

Leahy: That’s Roger Simon, by the way, our all-star panelist and senior editor at large for The Epoch Times in-studio with us. So, Liz, please, we implore you, help us make sense of this.

Peek: I think we’ve got problems. You’ve just said it. Everything seems to be getting worse. And let’s start with inflation. Yesterday we had the JOLTS number come out. That’s the number of jobs that are available out there, over 11 million jobs available. Only about 6 million people looking for work. Guess what? That means wages are going to continue to go up, which would be kind of good in one sense, except we are deeply embedded now in a wage-price spiral, meaning wages go up because workers go to their boss and say, hey, the cost of everything’s going up. I need a raise. He gets a raise because labor is tight and then the company has to raise their prices because he’s got to pay for the rate. So we’re seeing that everywhere.

I mean, there really isn’t any corner of the economy that I’m aware of where prices are going down. I read a day or so ago an interesting sort of analytical article about the pieces of the CPI, the various elements that are stoking inflation. By the way, we’ll get a CPI number this morning, consumer price index, and it’s likely to be, I think, above eight percent. A pretty big number. And so they went bit by bit and they said, well, you know, used car prices will probably top out.

They’re not going to go down, but they won’t be going up as fast, which is probably true. The problem is I think you get into a period of time, and we’ve seen this before, where people are just raising prices because everyone’s raising prices. If you go to your local gas station, forget about it. But let’s say you go to your local hair salon. Well, you find out they’ve raised the price, $5 or whatever, and they don’t really have a reason for it. It’s not like they have sat down with a pencil and paper and figured it out. It’s just they know everybody’s raising prices. So I think we’re in that phase.

I think we well are past the place where it’s only supply chain problems or only the ports in L.A. that are blocked, or this or that. And by the way, when it’s oil – and it is oil right now that is obviously the focus of everybody – that gets into everything. It gets into plastics and fertilizer. So it gets into food prices. So, yes, Ukraine is a big problem. You’ve got wheat going through the roof, corn. That’s also a major export from Ukraine.

Obviously, exports there are being driven down because of all the war-related issues. But the reality is pretty much across the spectrum of commodities. The commodity index that Bloomberg puts together hit an all-time high this week. So there is nothing going south right now. And I think we’re in this. I’ve seen people I really respect on the street, economists saying, oh, by the end of the year it will be down to three percent. I don’t think so.

Simon: That sounds like fiction to me.

Peek: If you take the individual pieces out, you can kind of make that case. I just don’t think that’s correct.

Simon: A case like what? What would you base a case like that on?

Peek: Used car prices had this gigantic kind of astounding increase last year and also this year, but that won’t go on forever. And I agree with that. You’re not going to get a 40 percent increase in used car prices every year. Let’s talk about rents. Rents in my view, the rent component is one of the many things that the Fed missed last year. When house prices, home prices are going through the roof, rents are going to follow. I mean, that’s just sort of logic. Right? And they did.

And about 30 percent of the consumer price index are rents. Rents are steadily moving higher. You can make a case that if the Fed begins to ratchet up interest rates, mortgage rates go up, then house price increases will level out and rents will level out. I just think we’re behind the curve on that. And it’s going to take a year or two to catch up. So let’s stop talking about inflation, which is everywhere and everyone’s aware of it now. What does the Fed do?

The Fed is under enormous pressure to limit these price increases. This is a huge political liability for the Democrats. And let’s face it, there is a political element to Jay Powell’s tenure at the Fed. I think he didn’t move early on inflation because he wanted to get reappointed. He got reappointed. Now he has to do something. He’s catching fire from all sides. What does he do? He starts to raise interest rates. Okay. So I think the odds of inflation are still less than 50 percent next year, but they’re certainly increasing.

Simon: What about the danger of crashing the market?

Peek: Well, and by the way, thank you. Glad you went there, because that was the other thing that the Fed completely whiffed on. In 2020, even in 2021, people were making huge amounts of money in their IRA, their stock portfolios and their home prices. The consumer net worth number went up about $10 trillion over two years. An unprecedented increase in consumer net worth.

What does that do? It makes you feel good, right? You sort of look at something that maybe you wouldn’t have bought six months ago, and you think, I could afford that? I’m worth 20 percent more than I was this time last year. Markets going up. Everybody feels terrific. And so you go and spend money. And now I think we have the other obviously, the other side of that, people are beginning to pull in their horns are saying maybe that extra vacation, we don’t want to spend the money on.

Portfolio is down 15 percent. And there’s huge uncertainty. At the end of the day, the number I really fasten on is the consumer sentiment index. And that has been appallingly bad. Amazingly! (Chuckles) It really is amazing.

Simon: My consumer sentiment is bad. I’ll tell you that.

Leahy: Everybody here in Tennessee has sort of bad sentiment about the economy. Let me ask you this. The price of oil, gas prices are now at $4.17 and getting higher, with the Russian invasion of Ukraine, what’s going to happen to gas and oil prices?

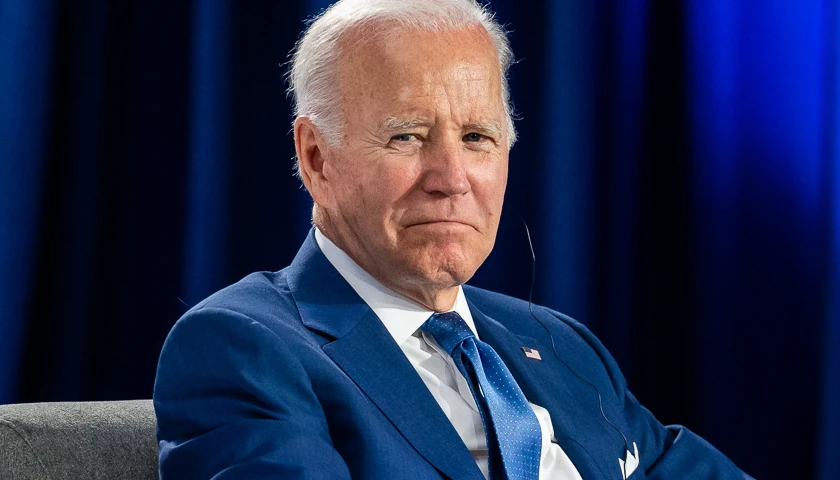

Peek: I’m hoping to put out a piece today that basically says the Saudis will step in. And I think that’s what will happen. I think Saudi Arabia is incredibly ticked off at Joe Biden. Joe Biden, stupidly early in his presidency, insulted MBS, the Crown Prince of Saudi Arabia, Mohammed bin Salman, gratuitously went after him because he had allied with Trump. So, oh, my God, if something is good that Trump did, let us immediately smash and destroy it. And so we don’t have good relations now with the Saudis. But the Saudis are pretty smart. They’re smarter about energy than Joe Biden is, frankly.

Simon: That’s not hard. (Laughter)

Peek: They see $100, $110 oil and they’re worried. They’re not pleased. They’re worried because they know it destroys demand. It means that all kinds of other producers will start to ramp up production. Even under Biden, American producers are – in fact, the rate count’s up 60 percent over last year. Eventually that will show up in production. And the Saudis really don’t want that. They want to control oil markets. So my guess is they’ll step in. We saw a little of that yesterday, right? The UAE in Iraq announced that they were going to increase production and …

Simon: … the market went up in minutes.

Peek: The stock market went up and oil prices went crashing down.

Leahy: I saw that as well. That is so fascinating. And I think that is good news. You have made my day greater.

Peek: (Chuckles) Good. I’m glad.

Leahy: And I so appreciate that last question for you. When are you and your family moving to state-income-tax-free Tennessee?

Peek: Believe me, it’s just appalling. You should just disregard everything I already said because I’m so stupid because I still live in new York. (Laughter) Toss everything out the window.

Leahy: We will welcome from you to Tennessee. We’ll have a welcoming party for you. We’ll get a bunch of real estate agents and we’ll show you houses here. Come on down to Tennessee, Liz.

Simon: The real estate agents are the people getting richer out there.

Listen to the full interview:

– – –

Tune in weekdays from 5:00 – 8:00 a.m. to The Tennessee Star Report with Michael Patrick Leahy on Talk Radio 98.3 FM WLAC 1510. Listen online at iHeart Radio.