by Art Benavidez

A national poll has concluded that most Americans oppose the Democrats’ Inflation Reduction Act.

Don’t count Gov. Gretchen Whitmer (D-MI) as part of the opposition. Whitmer celebrated the bill after the U.S. Congress passed the Inflation Reduction Act.

“I am thrilled that the Inflation Reduction Act has been sent to the president’s desk,” Whitmer, who is up for reelection in November, said in a statement. “This commonsense legislation will lower the cost of prescription drugs, health care, and energy, and create and protect millions of good-paying manufacturing jobs. My administration is working every day to lower costs, and this legislation will provide even more relief to families.”

A recent Senate Opportunity Fund poll surveyed Americans’ opinion on the Inflation Reduction Act that, according to nonpartisan analysis, will raise taxes on nearly all working Americans. Knowing that the average household will pay over $2,120 more in taxes, 66% of Americans oppose the bill.

“NEW @SenOppFund poll: 66% of Americans are AGAINST the average American household’s $2,120 tax hike provided by the Democrats’ Inflation Reduction Act,” Vice President of Tag Strategies Erin Perrine wrote on Twitter.

The SOF poll also showed 68% of Americans do not think President Joe Biden and Congressional Democrats are doing enough to stop inflation. This includes 43% of liberal voters and 67% of moderate voters.

The poll was conducted from Aug. 11 to 14 and surveyed 800 general election likely voters.

According to a Joint Committee on Taxation analysis, taxes under the legislation will increase by $16.7 billion in 2023 on taxpayers earning less than $200,000 —a nearly $17 billion tax targeted solidly at low- and middle-income earners, amidst stagflation. The 10-year window will increase the average tax rate for nearly every income category, and by 2031, Americans earning less than $400,000 are projected to bear as much as two-thirds of the additional tax revenue collected that year.

The JCT analysis also shows that any supposed tax credit benefits only outweigh the tax hits for a small portion of the population. Even for the small minority who do receive a small benefit, significantly larger portions of American taxpayers would still face the burden of a tax increase.

Nonpartisan research shows that in 2023, tax increases would happen for 24.6% of taxpayers earning between $10,000 and $20,000; 61.7% of those earning between $40,000 and $50,000; 91.3% of those earning between $75,000 and $100,000; and 97.2% of those earning between $100,000 and $200,000.

– – –

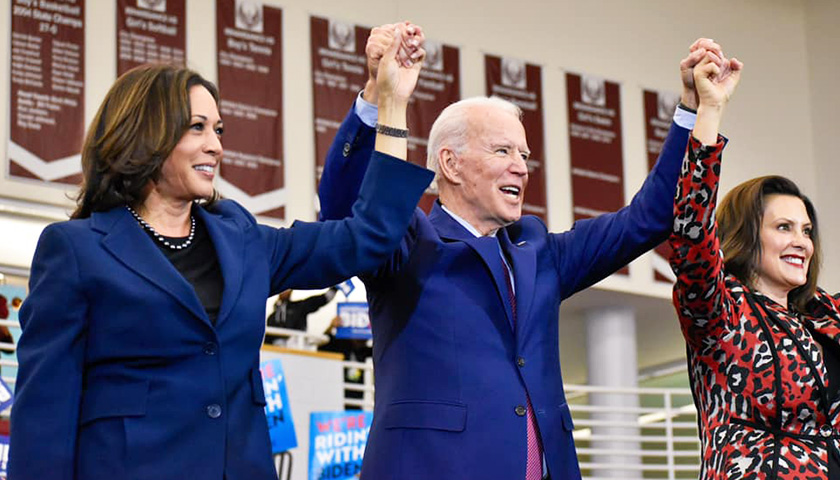

Photo “Whitmer with Biden and Harris” by Gretchen Whitmer.