“How do you increase your net worth by 69 million dollars while you’re working full-time as a Senator?” That’s the question Rolling Stone reporter Matt Taibbi asked about Senator Bob Corker (R-TN) on Friday.

Neither Taibbi nor Rolling Stone are fans of Corker (or of President Trump, Republicans, or conservatism in general). And Rolling Stone has had problems of its own, recently, as has Taibbi.

Nonetheless, Taibbi puts a fine point on what many political watchers across the Volunteer State have been asking for years.

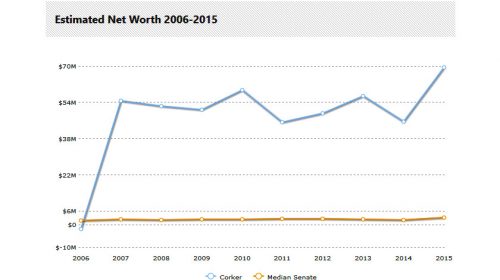

Federal campaign contributions and lobbying data tracker Open Secrets has perhaps the most jaw-dropping illustration of Corker’s rise to wealth.

Federal campaign contributions and lobbying data tracker Open Secrets has perhaps the most jaw-dropping illustration of Corker’s rise to wealth.

As Rolling Stone’s Taibbi writes, “Corker didn’t just enter the Senate without any money. He entered it carrying, according to his own disclosure forms, a mountain range of huge loans.”

Setting the stage for his ‘promotion’ from Chattanooga Mayor to U.S. Senator, Taibbi writes of Tennessee’s junior senator:

Corker took office in January, 2007, during the last gasp of the Bush/Rove political juggernaut. The Iraq war had gone south and the Republicans had just been routed in midterms. The financial crisis was just around the corner. And nobody paid attention to the smooth-talking freshman Senator from Tennessee, who turned out to have some financial issues. . .

It wasn’t until Corker took office and filled out disclosure forms that his finances became public – sort of. Few in the media seem ever to have read the “liabilities” section of Corker’s first disclosure, where the former mayor and construction magnate listed a series of massive outstanding loans. At the low end, Corker appeared to owe a hair-raising $24.2 million. At the high end, $120.5 million.

He took office in debt to some of the nation’s biggest lenders – including somewhere between $12 million and $60 million in debt to GE Capital alone.

Corker had been a construction magnate in Tennessee before taking office, a sort of mini-Trump. Before he ran for office, he sold off his business to a local developer named Henry Luken.

Corker insists that the debts associated with the business were included in the transaction, however his financial disclosures seem to conflict with that assertion.

Sixteen paragraphs in to the article, Taibbi reveals this startling information about the first steps Corker took to accumulate his millions:

Corker tested the limits of the profiteering possibilities in the legislative branch, essentially becoming a full-time day-trader who did a little Senator-ing in his spare time.

In the first nine months of 2007, Corker made an incredible 1,200 trades, over four per day, including 332 over a two-day period.

Followed a few paragraphs later by:

By 2014, when Corker sat on the Senate Banking Committee, a position that gave him regular access to prime information about the future direction of the markets, the Tennessee Senator still had his foot on the gas. He made 930 stock trades that year.

The brazen trades – and their frequency – went generally unnoticed, but for the occasional ethics watchdogs who would cry foul from time to time. Anne Weismann is one such individual that Taibbi found, who, as the director of the Campaign for Accountability, filed a complaint in 2015.

“Senator Corker’s trades followed a consistent pattern,” Weissman said in the Campaign for Accountability’s statement about their filing. “He bought low and sold high. It beggars belief to suggest these trades – netting the senator and his family millions – were mere coincidences.”

The statement highlights some specific, lucrative activities, noting:

Many of Sen. Corker’s profitable trades were made in advance of his broker, UBS, issuing reports impacting CBL’s trading price.

Sen. Corker recently amended his filings to reveal a 2009 purchase of between $1 and $5 million of CBL stock, sold just five months later in 2010 at a 42% profit. Similarly, Sen. Corker made purchases worth between $3 and $15 million in 2010 and, just after his last trade, UBS said it was upgrading its outlook. The stock went up 18%. Shortly thereafter, Sen. Corker began selling; a week later, UBS downgraded the stock and the share price soon declined about 10%.

Corker spokesperson Micah Johnson is quoted by the Rolling Stone’s Taibbi about the complaint(s) saying: “they were ‘yet another baseless accusation by this political special interest group. These claims are categorically false and nothing more than a smear campaign. When amending the senator’s financial disclosure report, our office worked directly with the Senate Ethics Committee to ensure items were reported accurately and in line with Senate guidelines.”

The Rolling Stone article is not the only press report involving questions about Corker’s investments.

“A real-estate firm that has been a favored investment of Tennessee Republican Sen. Bob Corker is under investigation by federal law-enforcement officials for alleged accounting fraud, according to people familiar with the matter,” The Wall Street Journal reported in March 2016:

The Federal Bureau of Investigation and the Securities and Exchange Commission are focusing their examination of CBL & Associates Properties Inc. on whether officials at the Chattanooga, Tenn., company falsified information on financial statements to banks when applying for financing arrangements, the people said. Law-enforcement officials have talked to former CBL employees who allege the company inflated its rental income and its properties’ occupancy rates when reporting those figures to banks, the people said.

The FBI and SEC officials have also separately asked questions about the relationship between the company and Mr. Corker, who is close with senior executives at the firm and has made millions of dollars in profits trading the company’s stock in recent years. Authorities don’t believe that Mr. Corker was involved in the company’s potential accounting issues, but they are interested in learning more about the senator’s trading in CBL’s stock, the people said.

They have found no evidence to suggest that Mr. Corker has committed wrongdoing.

In another matter, The Tennessee Star reported earlier this year that concerns about ongoing investigations looking into an extremely profitable real estate transaction in a Mobile, Alabama retail center may have contributed to Corker’s decision to not seek re-election. The Star’s own Editor-in-Chief Michael Patrick Leahy wrote a series of investigative reports for Breitbart News that detailed the senator’s Alabama sweetheart deal.

Read the full Rolling Stone article at: https://www.rollingstone.com/politics/features/taibbi-bob-corker-corrupt-what-a-surprise-w514493

The VAST Subprime Predatory Mortgage and Loan Operators LOVE Tennessee …… AND FAR FAR FAR FAR MORE ……. The PLAIN OLD TRUTH ….. America BAMBOOZLED https://americalooted.wordpress.com/notice-to-the-united-states-a-tale-of-frauds-deception-and-lootings-money-laundering-on-steroids/

Our elected elite made themselves exempt from the same “Insider Trading” laws that convicted Martha Stewart. I asked Corker about this and he vehemently denied it. This proves different. He had no intentions of “representing” the voters, only to get rich. Apparently he spent all his time trading, not working.

You are 100% correct! But that’s a fact that keeps getting swept under the rug. What Martha Stewart went to prison for, Congress members do on a daily basis!

No wonder Marsha Blackburn wants his seat. There’s only so much money that telecoms, ISPs, pharmaceutical companies, etc., shell out to House members.

The quickest way to become a millionaire in this country is to get elected to public office to do “the people’s work.” It’s not just Corker – it’s pretty much every single one of them. They are all bought and paid for.

I absolutely agree with you and it’s nothing short of criminal. Why do we citizens let our representatives continue to get away with this?

It is time for a special counsel to investigate getting rich while in office. The mission creep would be overwhelming.

I agree. Corker got out so he wouldn’t be investigated. And, Alexander also needs to be investigated. Yes, I voted for them regretably

And the GOP’ll field/fund another sell out RINO to replace him. Sad how stupid most Republicans are. Voted Lamer back in instead of Joe Carr.

Just did an analysis of Democrats on another project and Nancy Pelosi increased her net worth 225% between 2008 and 2010, Jared Polis increased his 170.62% between 2010 and 2014, and Alcee Hastings increased his 200% between 2014 and 2015. Lucille Robal-Allard increased hers 191% in just one year, between 2013 and 2014. All these big gains happened around “Stimulus” and “Stimulus 2” or when the Holder DOJ made the deal with banks that they could get $2 for $1 credit if they directed “donations” to the right places.

and during those time periods many, if not most Americans saw their investments going south. They are all crooked!

Nancy Pelosi’s husband is rich and buys and sells real estate. She isn’t day trading.

The Democrats actually hav more rich politicians than the Republicans. They’re all crooked.

The only way to do that is to be a crook! Take those gratuities, and dole out those favors.

corker aint nothing but a dam outright crook–he supports iranians not the usa!!

He must be owned by lobbyist.

Which lobbyist?

Thanks for the article.So disappointed with Corker! We now know he took the bait and was bought for his vote in passing tax reform. I’m sure he’ll sleep well as so many wealthy people do. Guys and gals enjoy what you have now. It’s getting late. Am beginning to think Trump will get away with anything. He’ll think of a way to stop Mueller. Don’t I sound sad? So disappointed in myself for writing this.

“The powers or financial capitalism had (a) far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country

and the economy of the world as a whole. This system was to be controlled in a feudalist

fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for

International Settlements in Basel, Switzerland, a private bank owned and controlled by the

world’s central banks which were themselves private corporations. Each central bank…sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the

country,

“and to influence cooperative politicians by subsequent economic rewards in the

business world.”

Prof. Carroll Quigley in his book Tragedy and Hope

Corker was Chairman of the “Foreign Relations Committee”. a “Globalist organization”.

Looks like his “Economic rewards” was huge..

Right on. I’ve been saying that this country’s wealthy have engaged in creating a modern day feudal system through financial taxation and buying as much property and Resources as possible to completely control our lives. Our states have been stripped of most of their constitutionally guaranteed powers and are homogenized into federal control.

Our founding fathers set up this republic to eliminate the old European feudalistic form of rule that the early settlers and immigrants were trying to free themselves from..

I think his trades were done before it became illegal for members of Congress to trade in insider information.

The harassment allegations were debunked by a journalist who actually asked the supposed victims what happened. Overlooked also was the disclaimer that the book was satire.

https://www.pastemagazine.com/articles/2017/12/the-destruction-of-matt-taibbi.html

He’s got the goods so I guess he’s going to get out while the gettin’s good, very timely exit for Corker. Maybe he should be called Porker.

Someone with a background in mathematics should show how astronomically unlikely it is for someone to make those kinds of gains in the stock market at such a rapid pace. This guy belongs in prison.

He’ll make even more money in prison.

Nearly every other American investing in 2007-2009 lost half or more of assets. How did Corker go from zero to $50 million in that time period? Very suspicious timing.

Magically lucky?

You aren’t supposed to ask questions like that.

Best answer