GALLATIN, Tennessee – By a vote of 17 to 7, the Sumner County Board of Commissioners passed a 17 percent hike in the property tax rate at the regularly scheduled meeting on August 19.

The new tax rate adopted by the County Commission will be $2.262 per $100 of assessed value and go into effect for the 2019-2020 budget year, which began July 1.

The increase comes in the year of a five-year reappraisal cycle, from which the certified revenue-neutral tax rate calculated by the Sumner County Assessor of Property was $1.9284.

The certified tax rate was lowered from the property tax rate of $2.50 in place since 2014, due to the increase in property values since the last five-year reappraisal process in 2014.

There had been indication since May that there could be as much as a 14-cent adder to the then-unknown certified tax rate, ostensibly to cover inflation.

However, Sumner County expenditures were budgeted to grow by more than three percent every year since the last property tax increase of 20 percent in the 2014-2015 fiscal year. In addition, Sumner County realized surpluses of one to three percent over the budgeted increases.

In other words, Sumner County’s planned budget increases over the five-year period amounted to nearly $20 million, while the surpluses yielded in excess of $12 million.

The Beacon Center of Tennessee, as The Tennessee Star reported, said Sumner County has a spending problem, not a revenue problem and is balancing fiscal irresponsibility on the backs of taxpayers.

The next biggest adder to the tax increase came from the last-minute announcement by the Sumner County Schools Director Del Phillips of a $4,000 pay increase for certified staff to go into effect in the 2020-2021 school year.

Certified staff in a school system generally refers to anyone who needs a certificate or license in order to be qualified to do a particular job, with teachers making up the bulk of that population.

The Sumner County Schools budget for the 2019-2020 fiscal year, which began on July 1, was approved unanimously by the School Board on May 21 and did not include the pay raises. It was then forwarded on to a joint meeting of the County Commission’s Education and Budget Committees on May 29, where the school budget received unanimous approval by both committees.

The budgets were set to be voted on at the June meeting of the Sumner County Board of Commissioners, but due to the discussion on the use of eminent domain to install a greenway and sewer line for a new school campus, the budget vote was delayed.

After two more months, the teacher pay raise came up less than two weeks before the Sumner County Board of Commissioners was to vote on the budgets, when Director Phillips introduced it to the School Board at a non-voting study session on August 6. The issue was not brought up at the County Commission Education Committee meeting held just the evening before.

A Facebook post by Director Phillips about the pay raises came shortly after the start of the School Board study session.

Director Phillips reported to the Budget Committee on August 12 that the pay increase would impact approximately 2,200 employees in the Sumner County School system. An additional $8.8 million in revenue would be required to fund the raises.

The Aug. 12 Budget Committee meeting started with a proposed tax rate of $2.3170, up 20 percent from the certified tax rate of $1.9284, reported by The Star.

By the end of the meeting, a reduction of $0.0250 for additional county capital needs was removed. In addition, reductions of $0.015 from the jail module, parking garage and justice center projects, as well as $0.01 from additional Highway Department needs and $0.0050 from School Resources Officers in each existing school were made.

The result was a new proposed property tax rate of $2.262, which represented a 17 percent increase over the certified tax rate.

Teachers and others were mobilized through the Nation Builder website, where a pre-written email asked County Commissioners to fund the teacher pay raises of $4,000.

A few days later, the pre-written email message was modified and promoted on Facebook by Scott Langford, who holds the dual roles of Assistant Director of Schools and County Commission Chairman, now asking Commissioners to support the $2.262 tax rate.

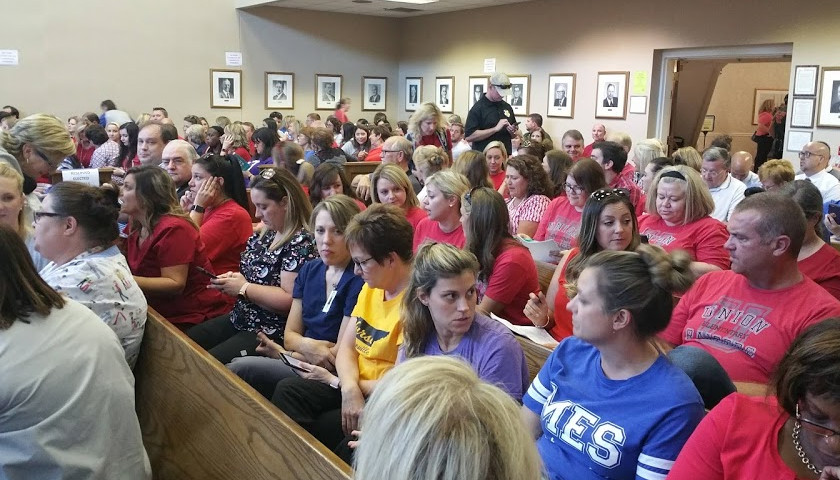

Supporters of the tax increase that would fund the teacher raises were encouraged to wear red to the County Commission meeting on August 19.

Before 5 p.m., the parking lot, filled to capacity, was closed by law enforcement leaving would-be attendees to find other parking arrangements mostly at the nearby Walmart. School Director Phillips and Assistant Director Langford were already on-site.

The County Commission chambers was essentially filled to capacity, most of the attendees wearing red.

Emergency services was on-site and charged with limiting the building to the capacity of 650, per the local fire marshall.

At 7 p.m., the meeting was called to order by Chairman Scott Langford, wearing a red shirt from his post at the front of the chambers, and shortly thereafter public comments began.

Seventeen citizens spoke against a property tax increase with most, if not all, expressing support for increasing teacher pay. Many wore stickers and voiced concerns that, with the way the teacher pay increase came about, teachers were not priorities, but were instead being used as pawns.

Twenty-six spoke in favor of the proposals before the County Commission, including several Sumner County school principals, teachers and nurses as well as elected officials.

Judge Louis Oliver spoke on behalf of the six elected judge in Sumner County, saying they are all in accord with the statement that the judges support the budget, the proposed $100 million courthouse and the tax rate of $2.26.

Gallatin City Council member at-large Shawn Fennell, who sat on the County’s Courthouse Ad Hoc Committee, also spoke in support of the proposed courthouse project and teachers.

Gallatin City Council member Jimmy Overton wanted to reiterate Shawn Fennell’s support for the parking garage, included in the tax increase. Overton also said he fully supports the judicial center and the City of Gallatin partnering with the County on the parking garage, funding for which is included in the tax increase.

Overton said he has a son with a master’s degree who is a teacher in Sumner County Schools and pleaded for the pay increase for teachers.

Once public comments concluded about four hours later at 11 p.m., a 15-minute presentation was made by the County Finance Director and the Budget Committee Chairman, Chris Taylor. At the presentation’s conclusion, Chris Taylor made a motion to adopt the $2.262 tax rate which was seconded by Commissioner Billy Geminden.

Commissioner Steve Graves had a failed attempt to separate the approval of the certified tax rate from the proposed tax increase rate of $2.262, as Budget Committee Chairman Chris Taylor said would happen during the previous week’s meeting.

Commissioners Jeremy Mansfield and Moe Taylor offered funding alternatives to eliminate or reduce the property tax increase and burden on taxpayers, to no avail.

More than an hour and a half later, the tax rate was voted on with 7 opposing and 17 approving of the $2.262 property tax rate and corresponding 17 percent rate increase. Voting in favor were Commissioners Deann Dewitt, Alan Driver, Loren Echols, Jerry Foster, Billy Geminden, Paul Goode, Michael Guthrie, Larry Hinton, Caroline Krueger, Scott Langford, Justin Nipper, Gene Rhodes, Baker Ring, Leslie Schell, Danny Sullivan, Chris Taylor and Shellie Tucker.

Voting against the $2.262 property tax rate were Commissioners Jerry Becker, Steve Graves, Merrol Hyde, Jeremy Mansfield, Moe Taylor, Luke Tinsley and Terry Wright.

A few minutes later, an amendment to separate the County and Sumner County Schools budget failed.

The budgets for the 2019-2020 fiscal year, which began July 1, 2019, were out of balance without the property tax increase.

However, the budgets passed by an even greater margin with a vote of 21 to 3, with four who voted against the tax increase voting in favor of the budgets.

The three voting against the budgets were Jeremy Mansfield, Moe Taylor and Terry Wright.

Through an amendment, the pay raises for teachers will go into effect in January 2020, rather than the originally proposed 2020-2021 school year.

The video of the six-hour August 19 Sumner County Board of Commissioners meeting can be watched online, Part 1 here and Part 2 here.

– – –

Laura Baigert is a senior reporter at The Tennessee Star.

[…] The Tennessee Star reported, the fiscal year 2020 budget included a $0.33 property tax increase approved by a 17-7 vote of the […]

Please considering encouraging good conservatives to run against the below “tax and spend” Commissioners!

Commissioners Deann Dewitt, Alan Driver, Loren Echols, Jerry Foster, Billy Geminden, Paul Goode, Michael Guthrie, Larry Hinton, Caroline Krueger, Scott Langford, Justin Nipper, Gene Rhodes, Baker Ring, Leslie Schell, Danny Sullivan, Chris Taylor and Shellie Tucker.