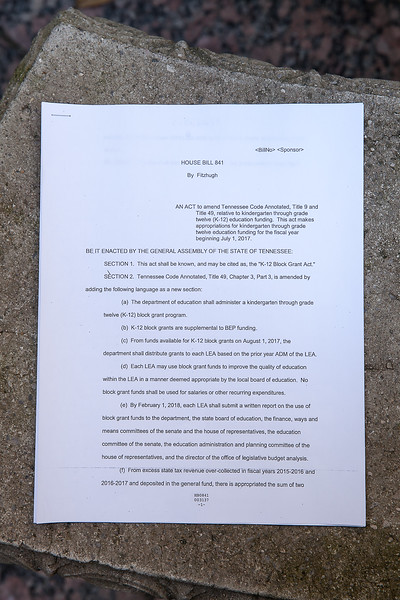

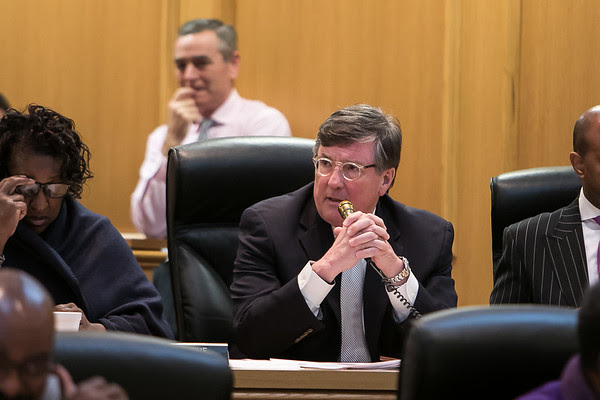

Twenty-three of the 25 Democrats in the House voted for Gov. Haslam’s gas tax increasing IMPROVE Act last Wednesday, amid rumors of a $250 million deal made between Governor Haslam and House Minority Leader Craig Fitzhugh (D-Ripley) in a quid pro quo tradeoff: Democrats vote for the governor’s bill, the governor backs House Bill 841, sponsored by Fitzhugh, which appropriates $250 million from excess state tax revenue over-collected in fiscal years 2015-16 and 2016-17 to spend on education in the K-12 Block Grant Act.

Democrats would have been expected to oppose the gas tax increase, given the many arguments that the IMPROVE Act’s tax cuts went largely to a handful of businesses, not middle class and working class voters who comprise the traditional Democratic constituency. The higher cost of living for middle class and working class voters resulting from the increased prices for food and other staples of life resulting from higher diesel taxes paid by trucking companies will likely not be offset by the small reductions in the sales tax on food.

HB 841 was on the agenda for the House Finance Ways & Means Subcommittee meeting scheduled for Wednesday, April 26, but Leader Fitzhugh said the plan is still “coming together,” and asked for the matter to be taken up after the budget, which is expected to be on Tuesday, May 2.

The Tennessee Star will be there to report on the final outcome of this $250 million in funding the Democrats want, and Governor Haslam does not at present appear to be opposing.

On WPLN radio the morning of the House floor vote on the IMPROVE Act April 19, Leader Fitzhugh reportedly said the Democrats told Governor Haslam if he supports a $250 million education expenditure, they will support the gas tax increase.

In an interview with WWTN’s Ralph Bristol that same morning, Governor Haslam responded, “No,” when asked by Bristol, “Did you make any agreements with Democrats?”

But the progress of the $250 education bill through the Tennessee General Assembly, though delayed now until next week, suggests that some kind of deal was made by the Democrats with someone, and Governor Haslam is the man in charge.

During his presentation of the bill to Education Administration & Planning Subcommittee on April 4, Fitzhugh said, “I’ve had some really, really good talks with the administration on this, believe it or not.”

Fitzhugh requested that, because this was the last meeting, the subcommittee move the bill out to the full committee, referring to talks with the administration, “we’ve made some changes and we’re in the process of trying to put something together.”

When Rep. Harry Brooks (R-Knoxville) asked if the subcommittee moved the bill out, would Fitzhugh have an answer by the next week, Fitzhugh replied, “Yes, sir.”

Looking around the room that day, Fitzhugh added these words which now look a lot like deal signaling:

“We’re all friends here. I’ll just … we have a little bit of leverage, because frankly, this doesn’t have anything to do with the gas tax, but there’s some of us that are interested in doing something other than just leaving that money without working for us. So, it’s sort of a combination deal. So, as the gas tax moves forward and votes are needed we think we can get closer to it.”

In terms of funding the Block Grant Act, Fitzhugh proposed, “We do have a lot of resources available that we haven’t had in years past. If you recall, in last year’s budget, there was a lot of money that was not even recognized. And this year as well, we’re going to have some unrecognized money. So that means a good portion of this probably $50 million isn’t even being considered in this year’s budget.”

The bill requires the Department of Education (DOE) to administer a block grant program for K-12 schools based on the average daily membership (ADM) of each local education agency (LEA). Use of block grant funds for salaries or other recurring expenditures is prohibited by the Act.

A one-time transfer of $250 million would be made from the General Fund to the Education Fund, and the DOE will distribute grants from funds available on August 1, 2017. The “fiscal memo” assumes that grants will be awarded evenly over a ten-year period beginning in fiscal year 2017-18 and ending in fiscal year 2026-27.

The fiscal note also states that beginning in fiscal 2017-18, which begins July 1, 2017, the DOE will require two additional positions to administer the K-12 Block Grant Act. One of the positions will receive a salary of $73,140 plus benefits of $19,061 and the other will receive a salary of $36,948 plus benefits of $13,056, for a recurring cost of at least $142,205. The fiscal note does not indicate the estimated increased costs of pay raises or increased benefit costs.

Additionally, there is an estimated $5,500 one-time expense to provide the new staff members for computers, telecommunications and other miscellaneous items.

[…] rumors of the quid pro quo deal were confirmed when the video of Leader Fitzhugh explaining the plan during an April 4 Education Administration […]

So it wasn’t appropriate to use OUR surplus dollars to keep the TN taxpayers from a gas tax increase, but it was fine to promise democrats $250 of OUR surplus for increased education spending to get their votes. Something is definitely rotten in the state of TN government The Governor won’t be voting to allow it, but legislators will. Are those republicans who voted for the gas tax increase ready for another mark of shame by voting in support of this agreement? Education funding is important, but fairness and real consideration for TN taxpayers are paramount.

So, how much of these Million of dollars will actually make it to the classrooms? Tennessee does not have an under funded education system. Tennessee has an over funded school administration, director of schools, and over spending problem.