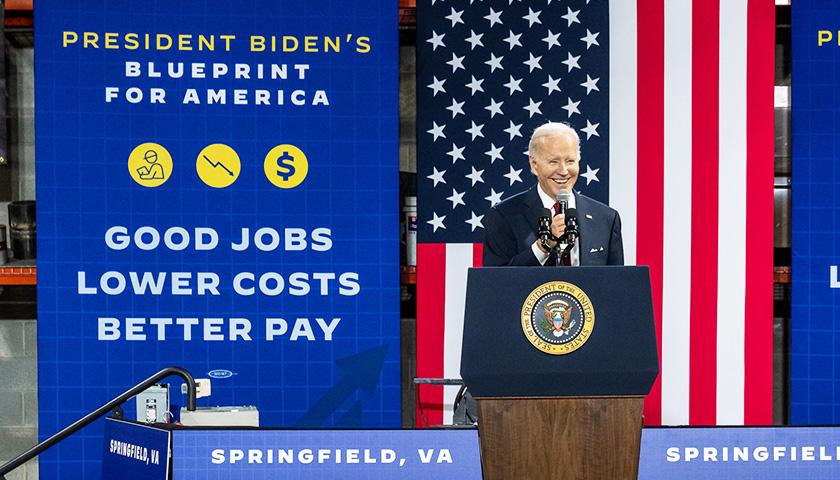

Inflation is running rampant, federal spending is out of control, gas prices are at an all-time high and Americans are pessimistic on the future outlook of the economy. So what is President Joe Biden’s solution?

He has released a budget proposal that includes 36 tax increases on families and businesses totaling $2.5 trillion over the next decade. Alarmingly, this includes 11 tax increases on the oil and gas industry, taxes that will put a burden on households.

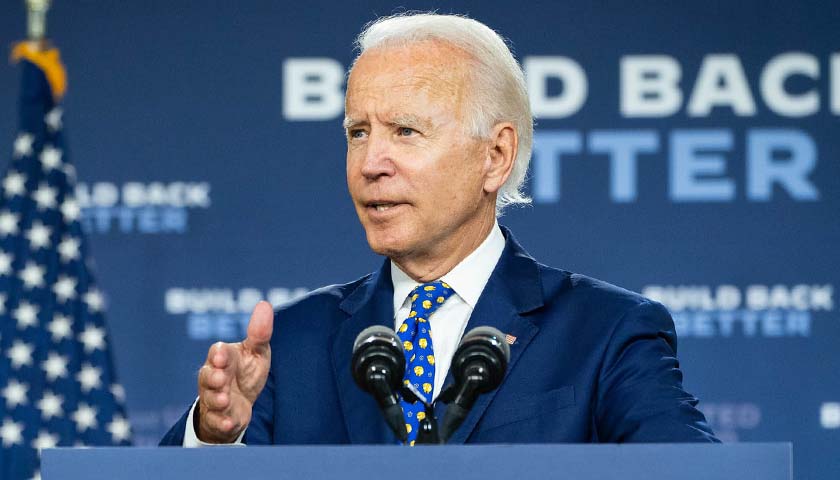

The budget doesn’t even include all the tax increases being pushed by Democrats because the budget omits the cost of tax increases within their stalled multi-trillion dollar Build Back Better Act. Instead of detailing these tax increases, the Biden budget includes a placeholder asserting that any new spending will be fully offset.

Read the full story