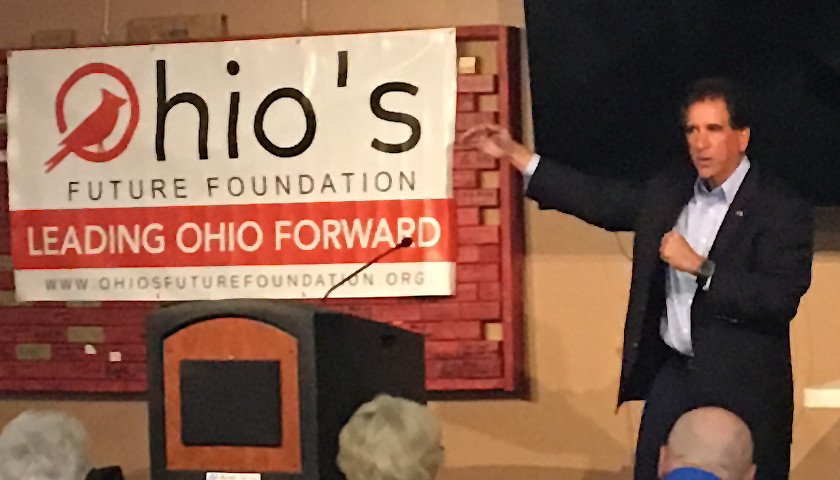

YOUNGSTOWN, Ohio – Former Congressman Jim Renacci and Ohio’s Future Foundation (OHFF) were hosted by the Mahoning County Republican Party Tuesday evening. The GOP group held a social for OHFF in their meeting room in Youngstown. Rick Barron, the Mahoning County Leader, announced that, ‘Tom (Weyand – OHFF’s Outreach Director) asked me to head up OHFF in Mahoning County, and we turned two blue seats red!’ Republicans gained a State Representative and a State Senator in an area which, prior to President Trump, was overwhelmingly Democratic. Next spoke Executive Director Jeff Anthony. Republicans, he shared, were the party most likely to support their plans of making Ohio prosperous again by changing laws that inhibit business growth. ‘For thirty years politicians have been telling us what they will do. We want to tell them what they need to do,’ he exclaimed. The program turned to John Fadol, their researcher, who took a ‘deep dive into policy’. He discussed House Bill 6, an energy bill to bailout the nuclear power plants, and House Bill 166, the state biennium budget. “House Bill 6 began as a placeholder bill, an empty 63 pages,” stated Fadol. “However the bill has now been updated.” It…

Read the full story