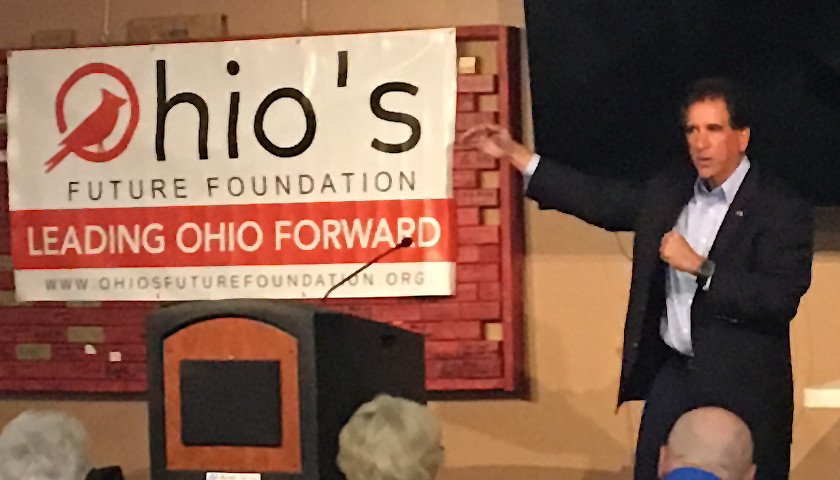

YOUNGSTOWN, Ohio – Former Congressman Jim Renacci and Ohio’s Future Foundation (OHFF) were hosted by the Mahoning County Republican Party Tuesday evening. The GOP group held a social for OHFF in their meeting room in Youngstown. Rick Barron, the Mahoning County Leader, announced that, ‘Tom (Weyand – OHFF’s Outreach Director) asked me to head up OHFF in Mahoning County, and we turned two blue seats red!’ Republicans gained a State Representative and a State Senator in an area which, prior to President Trump, was overwhelmingly Democratic. Next spoke Executive Director Jeff Anthony. Republicans, he shared, were the party most likely to support their plans of making Ohio prosperous again by changing laws that inhibit business growth. ‘For thirty years politicians have been telling us what they will do. We want to tell them what they need to do,’ he exclaimed. The program turned to John Fadol, their researcher, who took a ‘deep dive into policy’. He discussed House Bill 6, an energy bill to bailout the nuclear power plants, and House Bill 166, the state biennium budget. “House Bill 6 began as a placeholder bill, an empty 63 pages,” stated Fadol. “However the bill has now been updated.” It…

Read the full storyTag: Budget

Anti-Smoking Groups Actually Testified Against Ohio Gov. DeWine’s Proposal to Raise Minimum Age to 21

Ohio Gov. Mike DeWine has called for raising the minimum age to purchase tobacco from 18 to 21, a proposal that’s included in Ohio’s biennial budget bill. But anti-smoking groups in the state have actually testified against the proposal. These groups believe that the proposal would mostly punish youth for underage sales but would do little to punish retailers for illegal sales. “Those of us who work on this issue every day in venues around the country recognize this bill as unacceptable by today’s standards,” said Wendy Hyde of the Preventing Tobacco Addiction Foundation. “Simply changing ‘18’ to ‘21’ without changing the structure of licensure and enforcement would be meaningless.” During a May 5 testimony on House Bill 166, Hyde said that “penalties for illegal sales to persons under age 21 should be placed on the retail owner who makes a profit from illegally selling harmful and deadly products rather than on the clerk or the youth.” “Penalties for repeated violations must result in meaningful fines and be followed up with license suspension for those few retailers who refuse to comply. Penalizing youth is not an an effective strategy for reducing youth smoking,” she said. She went on to…

Read the full storyNashville’s Public Bus Service WeGo Needs $8.7M Cash Infusion or It May Have to Raise Rates or Make Cuts to Routes

Nashville’s bus service WeGo Public Transit is looking at a need to raise rates while cutting hours or frequency of routes thanks to a budget shortfall of $8.7 million, Nashville Public Radio says. WeGo presented its budget to Metro Council on Wednesday. The financial gap is due largely to a reduction in state funding, a dip in fare revenue and higher employee insurance costs, Nashville Public Radio said. WeGo asked Mayor David Briley for $57.3 million to maintain its service, but Briley proposed a budget of $48.6 million. The last fare increase was in 2012. According to WeGo’s fare card, rates start at $1.70. WeGo Public Transit officials told WKRN that this would be the third straight year for a flat funding level from the city. While the budget is not a cut, they are not receiving the amount they requested to cover their expenses. Activist group Music City Riders Unlimited held a rally Wednesday afternoon at 1 Public Square, according to its Facebook page. One post on Tuesday previewing the rally read: Don’t let Mayor Briley pit public services — and the public — against each other. Join us tomorrow, May 15 @ 4:30 at 1 Public Square to put…

Read the full storyMinnesota Budget Talks Break Down as Shutdown Looms

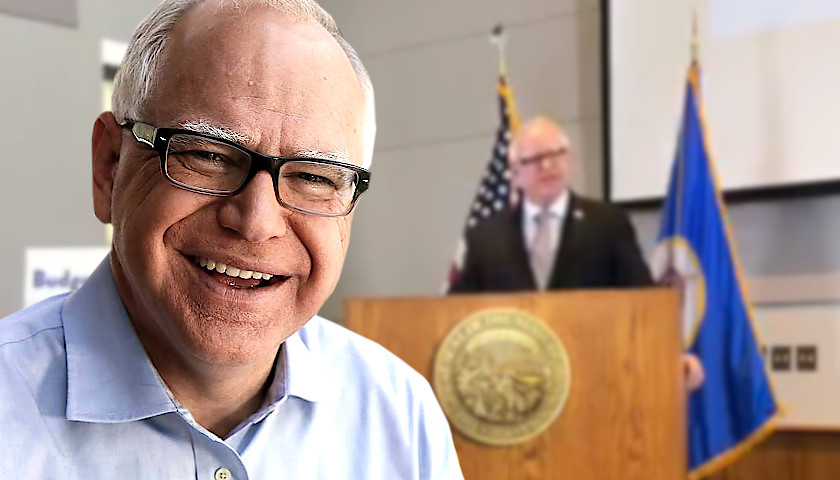

Budget negotiations broke down Monday night as a visibly frustrated Gov. Tim Walz emerged from a third round of meetings and blasted Republicans in the Senate. “I don’t have fair partners to work with right now,” Walz said during a 15-minute conversation with reporters. “They cannot stand in front of you with a straight face, no matter how many emojis are behind them.” Walz was referring to Senate Majority Leader Paul Gazelka’s (R-Nisswa) use of a chart containing emojis to explain the Republicans’ latest budget offer. “Minnesota is in good shape with enough money in our budget, reserves, and surplus. No need for a $12 billion increase in taxes over the next four years,” the Senate GOP wrote on Twitter. Minnesota is in good shape with enough money in our budget, reserves, and surplus! No need for a $12 billion increase in taxes over the next 4 years. 👍🏻 #mnleg pic.twitter.com/km3h8oUI2a — Minnesota Senate Republicans (@mnsrc) May 14, 2019 The Republican-controlled Senate has been unwilling to budge on the 20-cent gas tax increase or the continuation of the medical provider tax. Instead, Republicans would like to pull $75 million for K-12 education, and $25 million for public safety from…

Read the full storyOhio House Passes Tax Increases on Small Businesses During Small Business Week

The Ohio House passed House Bill 166 Thursday, its version of the state’s biennial budget. While the bill includes substantial income tax reductions, some groups aren’t pleased with the impact it will have on small businesses. Under the bill, Ohio’s Business Investment Income Deduction would be lowered to $100,000. As of now, small businesses don’t pay taxes on the first $250,000 of income, but that would be lowered to $100,000 under House Bill 166, which passed Thursday in a 85-9 vote. Eight Republicans and one Democrat voted against the budget proposal. “We had some really good debates and good ideas, and I think this budget will make a difference for Ohioans,” House Speaker Larry Householder (R-Glenford) said in a press release. “Some of the ideas we talked about are going to become separate bills in order to build them out a bit more. We’re just getting started.” The Ohio Chamber of Commerce was disappointed the bill passed, saying it “includes a $1.1 billion tax hike on small business owners, reducing their ability to reinvest in their businesses.” The bill “means less money for worker training, increased wages, new technology or equipment, or expanded operations,” the Ohio Chamber said. “Tax…

Read the full storyDeWine Proposed Budget Includes New Taxes for Ohio’s Tattoo Artists and Body Piercers

Governor Mike DeWine’s proposed budget for Ohio includes a provision that will raise taxes and regulations on all tattoo artists and body piercers throughout the state. The new provision would require that all current and future tattoo artists and body piercers register with the state for as long as they are operating in that capacity. In addition, they would also have to pay a “registration fee” of $250. Furthermore, the provision would also call for a comprehensive overhaul of the current tattoo and body piercing training standards. This would cover anyone whose profession is defined as a “body artists” There is currently a medley of rules, regulations, and fees associated with being a tattoo artist in the Buckeye State. Some of the most extensive concern the cleanliness of needles and the heating devices that sterilize them, including that they: Ensure that weekly tests of the business’s heat sterilization devices are performed to determine whether the devices are functioning properly. In having the devices tested, the operator of the business shall use a biological monitoring system that indicates whether the devices are killing microorganisms….The operator shall maintain documentation that the weekly tests are being performed. To comply with the documentation requirement, the…

Read the full storyOhio Future Foundation’s Chairman Jim Renacci Hosts Facebook Live Budget Forum with State Rep. Powell and Buckeye State Fellow Greg Lawson

The Ohio Future Foundation hosted a wide-ranging Facebook live interview that reviewed the March 15 budget biennial 2020-2021 proposed by Governor DeWine. Ohio Future Foundation Chairman Jim Renacci was joined by Republican State Representative Jena Powell of Ohio’s 80th district and Senior Fellow Greg Lawson of the Buckeye Institute, a free-market think tank based in Ohio. Lawson is the author of the just-released Piglet Book, which analyzes state budgets for waste and abuse. They hoped to discuss the “good, the bad, and the pork” of the recently released budget. Renacci began the discussion by assessing the overall state of the Ohio economy and how this new budget was factoring in for it. He noted that there were “big indications that Ohio’s economy was slowing down, but the budget outlined projected record revenues” for the state over the next two years. Lawson concurred, stating: revenues are coming in well at the moment, the state is assuming that this is going to continue through the next year and some slowdown in the second fiscal year….However, there’s a lot of reason for trepidation. The main issue, he noted was a significant divide between the economic numbers produced by the Governor’s office and the…

Read the full storyLawmakers Eye a Huge Backdoor Spending Increase

by David Ditch Members of Congress are promoting the concept of changing three programs from the discretionary category (requiring annual appropriations) into mandatory (auto-pilot) spending. Such changes would become a huge backdoor spending increase. Spending limits have come under relentless attack from both parties. In 2013, 2015, and 2018, Congress passed massive spending increases with little to no effort to find pay-fors. With just two years remaining for the Budget Control Act’s modest restraints, there is tacit agreement that Congress will likely make yet another deal to add to the nation’s $22 trillion debt. If that was not bad enough, there is a long, bipartisan tradition of finding shortcuts around already-inflated spending limits. Appropriators have repeatedly used fake savings to squeeze more spending inside the caps. Disaster and war funding exceptions have been abused to the tune of hundreds of billions of dollars. Congress has accepted flagrant violations of budget rules with minimal resistance. Another tactic for avoiding budget discipline is to re-categorize existing programs. While discretionary spending is subject to limits and annual deliberation, so-called mandatory spending is typically left to grow unchecked. The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more >> Mandatory spending—which…

Read the full storySmoking Age Will Jump to 21 Under DeWine Budget

In a move to improve health quality in the state, Ohio Republican Gov. Mike DeWine has included a provision in his proposed 2020-2021 Executive Budget that would increase the age for purchasing cigarettes from 18 to 21. The intent is to further discourage the use of cigarettes overall throughout the Buckeye State. Governor DeWine’s proposed budget was officially released on March 15. Outlined in the Executive Budget: The fiscal years 2020-2021 Executive Budget proposes an important change to the cigarette and OTP taxes. The Budget would change Ohio law by increasing the minimum legal age – from age 18 to age 21 – for purchasing cigarettes, other tobacco products, alternative nicotine products, and cigarette papers. Although the proposed age increase does not constitute a change in how these products are taxed, it would reduce the quantity of purchased items because of the age change and therefore result in a modest decline in cigarette and OTP tax revenue. By the governor’s own assessment, the move would cut cigarette revenues by more than $20 million over the two year budget period. Despite this, a 2017 poll found that 58 percent of Ohioans favor this change. The measure has significant precedent throughout the country.…

Read the full storyWalz’s Revised Budget Proposal Still Includes 20-Cent Gas-Tax Increase

Gov. Tim Walz (D-MN) was forced to reexamine his budget proposal “line by line” after the state’s budget forecast came up $492 million short of November’s estimated $1.5 billion surplus. But his recently released revised budget recommendations still include a 20-cent gas-tax hike. “The governor recommends the state commit to a major transportation investment plan to fund the estimated $6 billion gap that exists between funding needs and available revenues over the next 10 years. The governor proposes filling the $6 billion gap in road and bridge funding by initiating a 20 cent gas tax increase, including fuel in distributor storage at the start time of each increase,” the budget recommendations state. Walz is also calling for increasing the registration tax from 1.25 percent to 1.5 percent and increasing the motor vehicle sales tax from 6.5 percent to 6.875 percent. “This is not a choice between whether we want the gas tax or not. It’s a choice between living in a state with the best transportation system in the country or one with crumbling roads and bridges,” Walz said in February when unveiling his initial budget proposal. Overall, Walz’s budget proposal would raise spending by more than $3 billion, increasing…

Read the full storyOhio Senate Breaks Even Further from Governor DeWine, Lowering Gas Tax to Six Cents

The Republican-held Ohio Senate joined Republicans in the House of Representatives in opposing Gov. Mike DeWine on his proposed gas-tax hike. House Bill 62 (HB 62), the 2020-21 Ohio transportation budget, first proposed by DeWine on Feb. 12, originally called for an 18 cent increase to the current gas tax. This was the first major bill proposal of his term. He called the measure “a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy.” In his State of the State address, as well as in other forums, he maintained that this was the absolute lowest the tax could be and would have to go into effect immediately. After being referred to the House, the Republican-held legislature broke significantly from the governor, lowering the rate to 10.7 cents and ordered it to be phased in over three years. “If they pass the House bill, we’re going to end up with the worst of all worlds,” DeWine said in response. He was insistent that the 18 cent number was the only acceptable rate. While DeWine seemed hopeful he could convince the legislature to return to his 18 cent number, the Ohio Senate seems to be making it clear that 18…

Read the full storyNashville Promises, Once Again, to Give Rank and File Workers Cost of Living Adjustment Increase

Metro Nashville’s rank and file workers may receive a cost-of-living raise that the city has long promised but failed to deliver after a contentious budget process last year. Nashville Mayor David Briley on Monday announced a cost-of-living adjustment (COLA) of 3 percent for all Metro employees in FY 2020, starting with the new budget on July 1. “After a year when we had to put out a tight budget – which was a disappointment to me – I am proud to say that we can now give Metro employees the cost-of-living adjustment they deserve,” Briley said. “I would like all the men and women who work for our city to know that I deeply appreciate everything they do for residents throughout Nashville and Davidson County.” Briley said he will recommend funding step and open-range increases in the budget he will submit to Metro Council by May 1. If the rank and file employees do receive the COLA, they will be playing catch-up with Briley’s inner circle. The Tennessee Star reported last September that Briley gave merit raises to 20 members of his own staff. Two of the mayor’s staff received 6 percent increases. Briley said in his press release that…

Read the full storyOhio Governor Mike DeWine Cites Bible in Budget Proposal That Increases Spending by Seven Percent

Gov. Mike DeWine (R-OH) released his first two-year budget proposal Friday morning in what he is describing as a $69 billion investment in “Ohio’s future.” “As I shared in my State of the State address, the Bible tells us that there is a time and a place for everything. Now is the time for us to invest in Ohio,” DeWine said in a letter addressed to his “fellow Ohioans.” “We must invest in our children to help our youngest Ohioans get the best start in life. We must invest in efforts to fight mental health and substance use disorders so our fellow Ohioans can lead fulfilling, healthy lives. We must invest in Ohio’s workers and in innovation and technology that spurs job creation so our families can prosper. And, we must invest in preserving and protecting Lake Erie and all of Ohio’s waterways, so that all Ohioans have access to clean water and our outdoor spaces are preserved for generations to come,” he continued, touching on the main priorities of his budget. While the proposal places a significant emphasis on mental health and child support services, DeWine identified five core areas for his budget, including: Children and Families Local Communities…

Read the full storyOhio Governor DeWine Blasts Republican Controlled House for Lowering Gas Tax Proposal

Governor Mike DeWine aggressively condemned his fellow Republicans Monday for not supporting his gas tax increase in a candid interview with the Cleveland Plain Dealer Editorial Board. During the interview, he accused them of outright endangering the safety of Ohioans statewide by not supporting his plan. DeWine, in one of his first major bills proposed to Ohio legislature, chose to introduce House Bill 62 (HB 62), to the 2020-2021 transportation budget. Starting off his tenure as a Republican Governor with a tax increase was inevitably going to give many Republicans pause. However, this initial hesitation was greatly compounded by the fact that there are no tax offsets to the hike. In addition, the tax increase will not be gradually phased in over several years, as similar tax increases often are, but will into effect immediately. Lastly, the tax will be indefinitely pegged to the Consumer Price Index which could potentially see the tax increase every year. This is a tough pill to swallow for many Ohio Republican legislators. Conversely, DeWine is accurate when he notes the dire state of roads and bridges in Ohio. As previously reported: A 2018 study gave the state’s infrastructure an “A-” while the national state average came in at a “D+.”…

Read the full storyOhio Governor Mike DeWine Announces Plan for 30 New Drug Courts to Combat Opioid Epidemic

Ohio Governor Mike DeWine unveiled the latest aspect of his plan Tuesday to fight opioid addiction by creating more specialty courts statewide. The plan is the latest announced component of his upcoming budget proposal for the 2020-2021 fiscal year. If approved, it would allocate $2.5 million in 2020 for the creation of “15 specialty dockets” as well as an additional $5 million in 2020 to “support the newly created specialty dockets and fund an additional 15.” Governor DeWine said of the courts: Specialty dockets give judges the flexibility necessary when they encounter someone in the court system who is may benefit more from treatment for substance use disorder rather than serving jail time,…These specialty courts are a proven way to hold those with substance use disorder accountable and ensure participation in mental health and addiction treatment. According to the Ohio Office of Criminal Justice Services, Specialty Courts, often referred to as “Drug Courts,” “specialize in the adjudication and treatment of offenders who use drugs.” Judges across the state found that they were seeing the same individuals again and again for drug-related offenses. These courts were designed to more effectively address the issues relating to these individuals. The only offenders eligible for these courts are those who have been…

Read the full storyTim Walz Buried Gun Control Measures in His Budget Proposal

Gov. Tim Walz’s (D-MN) budget proposal calls for a one-time payment of $350,000 and $200,000 each year thereafter to implement gun control measures that are currently being considered by the Minnesota Legislature. As The Minnesota Sun reported Friday, both a “red flag” bill and a universal background checks bill cleared the House Public Safety Committee this week. By including these proposals in his budget, however, Walz can sidestep the legislative process and secure gun control in the state through the passage of his budget. Buried in his proposal for the Department of Public Safety is a request for funds “totaling $350,000 in the FY20 and $200,000 each year ongoing for measures to prevent gun violence.” “The funding included in the budget provides resources to implement two proposals currently introduced in the legislature. First, the governor recommends a proposal to create a new requirement for background checks when private parties transfer any firearm. With the exception of immediate family members, private parties must obtain a transferee permit and all transfers will be subject to a background check,” Walz’s proposal states. It notes that an initial amount of $188,000 and an annual amount of $38,000 would be used “to modify and maintain…

Read the full storyWalz’s Budget Calls for $700,000 in Additional Funding for His Own Office

Gov. Tim Walz’s (D-MN) proposed budget for the 2020-2021 biennium calls for a $700,000 increase in funding for his own office to help with “outreach and engagement efforts.” “The Office of Governor Tim Walz and Lt. Governor Peggy Flanagan recommends a $700,000 FY 2020-2021 biennial General Fund increase to fund a new office of Public Engagement in the Governor’s Office,” the budget proposal states, noting that the funding would amount to a 9.7 percent increase. According to the proposal, the increased funding would help respond to the “large volume of mail, email, telephone calls, and constituent visits.” On average, the budget estimates that the Governor’s Office receives “over 125,000 constituent contacts per year.” “The Office does not have the current capacity to provide additional reactive and proactive outreach and engagement efforts, which are critical to Governor Walz and Lt. Governor Flanagan’s vision for One Minnesota,” the budget claims. As such, Walz’s first budget proposes creating a new “Office of Public Engagement,” whose “primary responsibility is to connect with Minnesotans across the state to make government inclusive, transparent, accountable, and responsible.” “The Office of Public Engagement helps open the two-way dialogue, ensuring that the issues impacting our state’s proud and diverse…

Read the full storyOhio Governor DeWine to Announce Gas Tax Hike

At an annual forum sponsored by the Associated Press, Ohio Republican Gov. Mike DeWine announced Wednesday he intends to formally recommend raising the current gas tax. The recommendation will come as he introduces his first two-year transportation budget Friday. Despite appointing an Advisory Committee on Transportation Infrastructure Issues specifically to explore alternative solutions to simply raising the gas tax, the governor made it clear he felt there was no real alternative. He did make a point to say the hike is “just to keep us where we are today and with the ability to do some safety projects that absolutely need to be done.” It can be inferred from this statement that his intention is to raise the gas tax enough to not let the state’s road and bridge repair funding deficit get worse than it currently is. This suggests that the tax hike would be more modest relative to addressing the full scope of road and bridge repair needed in Ohio. Currently, there is a $1 billion gap in funding. The current state tax on gas in Ohio is 28 cents per gallon. However, when combined with federal and local taxes, the total amount climbs to just about 46.5 cents per gallon.…

Read the full storyGovernor Walz’s $49 Billion Budget Proposal Will Make Minnesota a ‘Cold California’

Gov. Tim Walz (D-MN) unveiled his highly anticipated budget proposal for the 2020-2021 biennium at a press conference Tuesday afternoon. When all is said and done, the two-year budget registers at $49.5 billion with no cuts to any existing spending. “I’ve often said that a budget is far more than a fiscal document; it’s a moral document. This budget reflects the morals and values of the people of Minnesota. This is the budget that Minnesotans voted for in historic numbers in November,” Walz said during his lengthy address. Walz said his proposal prioritizes three core areas: education, health care, and “community prosperity.” For the first, Walz proposed a three percent followed by a two percent increase in education spending, which is roughly $523 million more. “While some schools have turf fields and a stadium, another school is trying to pass a referendum to fix a leaky roof,” he said. “As a former teacher, I’ve seen firsthand the power of investment in a child.” He went on to lay out a number of health care proposals, including a “OneCare Minnesota” public buy-in option, and the continuation of the two percent provider tax, which Republicans would like to let expire at…

Read the full storyBill Lee Delivers First of Many Planned Video Addresses From Family’s Franklin Ranch to Summarize His Work as Governor

Last week, Gov. Bill Lee gave what he called a “Friday Afternoon on the Farm” video address on Twitter to celebrate his first week in office and provide a brief update on his work. The video, just over a minute in length, is available here on his official governor’s Twitter page. We’ve had a great first week in office. I issued my first executive order focused on rural Tennessee and we began work on the budget. We’ll be posting regular Fridays from the Farm videos, and I’m excited to post my first one here on my new, official Twitter page: pic.twitter.com/VFuaF1qx3X — Gov. Bill Lee (@GovBillLee) January 26, 2019 In the video’s post, Lee says, “We’ve had a great first week in office. I issued my first executive order focused on rural Tennessee and we began work on the budget. We’ll be posting regular Fridays from the Farm videos, and I’m excited to post my first one here on my new, official Twitter page.” While he and wife Maria are living in the Governor’s Mansion in Nashville, they were spending a three-day weekend on “the farm,” he said. The farm to which Lee refers is his family’s Triple L Ranch…

Read the full storyPresident Trump’s Executive Order Freezing Federal Pay Saves Taxpayers from Double-Digit Pay Increases

by Rachel Greszler President Donald Trump issued an executive order effectively freezing federal pay for 2019 at current 2018 levels. Had the president not issued this executive order (and lacking congressional action on federal pay), federal workers would have received a 2.1 percent across-the-board pay increase, as well as a 25 percent increase in locality-based pay. A 2.1 percent across-the-board increase would have cost roughly $5 billion in 2019 while the locality-based increase would have cost a reported $26 billion. That exceptional pay spike would have kicked in had the president not acted and had the default changes specified in the 1990 Federal Employees Pay Comparability Act kicked in instead. That act provides for annual federal pay increases based on the Bureau of Labor Statistics’ Employment Cost Index, which tracks civilian employment costs. [ The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more ] Despite the specified formulaic federal pay increases, federal pay has more recently been set by presidents through their authority to propose an alternative pay schedule. As has become the norm in recent decades, presidents typically set their own pay proposal by Aug. 31 and barring alternative congressional action…

Read the full storyCommentary: Only Two Weeks Left for Republicans to Get It

by Rachel Bovard There’s only one area where bipartisanship still reigns in Washington: avoidance. Republican and Democrat leaders this week held hands and used the funeral events for President George H. W. Bush as an excuse to move their funding deadline—which previously expired on December 7—two weeks forward, to December 21, four days before Christmas. In doing this, Congress isn’t getting festive. Rather, backing up a government funding deadline dangerously close to the Christmas holiday is an old political tactic, designed to assure passage of bloated and controversial spending bills. In the old days, the carrots in this equation were earmarks—funding pet projects of lawmakers was the way to grease the skids on controversial bills. But now that earmarks have been banned (in theory, anyway), the only option left is a stick: threatening lawmakers with chaos, missed Christmas holidays and a government shutdown, unless they instantly (and many times, without reading) pass whatever bill their leaders cook up. This is a vexing development for conservatives, particularly when it comes to the big will-they-won’t-they question circulating around Washington: the fate of Trump’s border wall. If GOP leaders are already willing to waste critical weeks in the waning days of their majority, what…

Read the full storyREPORT: EPA Paid $14.5 Million For Foreign Nationals, Not Americans, To Work In Government Labs

by Michael Bastach The Environmental Protection Agency (EPA) paid $14.5 million to foreign nationals to work at agency laboratories over the past 11 years that could have been awarded to U.S. citizens and permanent residents, according to federal investigators. EPA’s Office of Inspector General (OIG) found the agency’s cooperative agreement with the National Academy of Sciences (NAS) funded 107 fellowships to “foreign nationals or persons who were not citizens or permanent residents of the United States.” “Allowing foreign nationals to participate in the fellowships is inconsistent with the EPA practice of awarding fellowships to U.S. citizens, which is required for the EPA’s directly awarded fellowships,” OIG reported Wednesday. EPA’s cooperative agreement with NAS began in 2007 and lasted until 2017, so it spanned multiple administrations. In that time, EPA has come under criticism for wasting taxpayers dollars. Federal auditors found in 2014 that eight EPA employees racked up 20,926 hours on paid leave “and cost the government an estimated $1,096,868.” Each “was on extended administrative leave for four or more months,” auditors found. The Government Accountability Office noted in a 2014 report the “salary cost for EPA employees on administrative leave for fiscal years (FYs) 2011 through 2013 was $17,550,100.” Most notably, former…

Read the full storyNo Raise Is Too Little For Nashville Mayor Briley’s Staff While Remainder of City Employees Left Out of Pay Increases

In a year where Metro Nashville’s rank and file workers learned they would not get promised cost of living increases, Nashville Mayor David Briley gave merit raises to 20 members of his own staff, WSMV reported. Two of the mayor’s staff received 6 percent increases. One Briley staffer, Chief Strategy Officer Brian Kelsey, got a $7,178 raise, increasing his salary to $126,824. Briley also gave merit-based raises to department heads. Briley’s decision to reverse the cost of living adjustments – COLAs – for Metro employees created a lot of controversy. Nashville Fire Chief Will Swann refused his 2.5 percent pay increase, choosing to pass the Open Range money to 19 administrators under him. Briley said that although city workers would not get cost of living adjustments this year, 71 percent of the city’s work force could expect their paychecks to increase during the coming year. Workers can get what are called step increases. Metro Nashville’s being strapped for cash did not stop Briley from compiling a wish list of expensive projects like a $125 million floodwall for downtown, The Tennessee Star reported. Police officers and firefighters wanted the raises they were promised to help with the cost of living, WSMV…

Read the full storyWith the End of the Fiscal Year September 30, Congress Is Running Out of Time to Fund ‘The Wall’

By Robert Romano The 2018 fiscal year will end on Sept. 30 but Congress is no closer to achieving key Trump administration priorities including fully funding the southern border wall, something President Donald Trump has been demanding since 2017 and campaigned on extensively in 2016. So far, both the House and the Senate have passed appropriations bills for Defense, Energy & Water, Interior, Agriculture, Financial Services, Transportation and Housing and Urban Development, Legislative Branch and Military/Veterans. But so far, no wall. Of those, Energy & Water, Legislative Branch and Military/Veterans have been consolidated into a single bill, H.R. 5895, which is now in conference between the House and Senate. And Interior, Agriculture, Financial Services and Transportation and Housing and Urban Development have been consolidated into H.R. 6147. Everything else, including Commerce/Justice/Science, Homeland Security (which includes the wall), Labor/HHS/Education and State/Foreign Operations that have not already passed both chambers are likely to be wrapped up in a continuing resolution at the end of this month. On one hand, that can be a good thing — or at least a not bad thing —insofar as it gives Congress a little bit more of an opportunity to get those things right. For example, the Labor-HHS…

Read the full storyThree Budget ‘Reforms’ That Would Make Matters Worse, Not Better

by Dody Eid and Romina Boccia A congressional select committee on reforming the budget process recently held another public hearing, supposedly with the ultimate aim of designing a more transparent, accountable, and responsible budgetary process. Any such changes should also re-establish and enhance Congress’ power of the purse. But if those are the goals of the Joint Select Committee on Budget and Appropriations Process Reform, it is badly missing the mark by repeatedly discussing only three proposals. They are unlikely to be much of an improvement—and could make matters even worse, if that’s possible: biennial budgeting, earmarks, and moving from a fiscal year to a calendar year. Biennial budgeting: Among the proposals considered by the committee, one that is gaining traction is biennial budgeting. That would relieve Congress of the obligation to submit a budget resolution each year. Instead, it would only prepare a budget every two years. Proponents contend that such a change gives the legislative branch more time to dive deeper on the issues presented by the growing budgeting challenge, to provide more oversight of the executive, and to reduce budget dysfunction as fiscal year deadlines approach. At the July 12 hearing, former Defense Secretary Leon Panetta, who served early in…

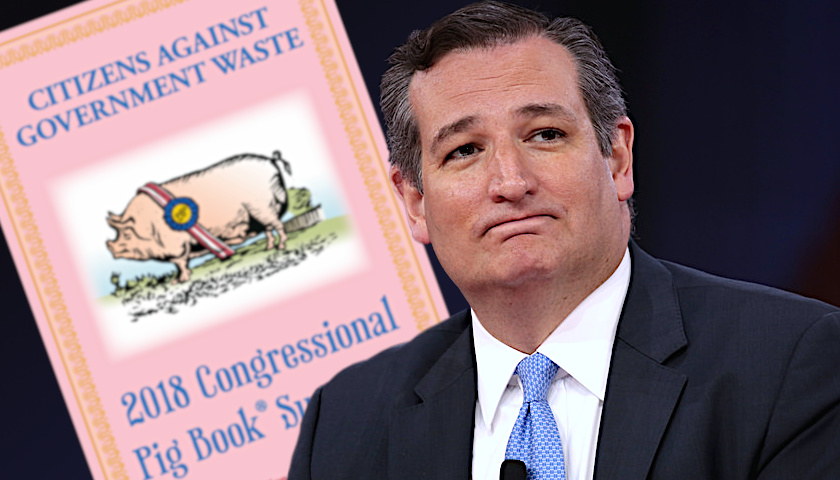

Read the full story‘Pig Book’ Spotlights 232 Earmarks Amid Pork That Wastes Taxpayers’ Money

by Katherine Rohloff All but a relative few farmers and other rural residents have had electricity and telephone service for a generation, but the U.S. government devoted $10 million in the current budget to a duplicative Rural Utilities Service program designed to help pay for energy costs. Taxpayers continue to finance the program even though then-President Barack Obama tried to eliminate the High Energy Costs Program in 2013 because it duplicated the U.S. Electric Loan Program. The program buried in the Agriculture Department budget is brought to the surface in the “2018 Congressional Pig Book” compiled by Citizens Against Government Waste, a watchdog that has put together the catalog of pork, earmarks, and other questionable federal spending since 1991. “Earmark spending, deficits, and debt all grow when the lights are turned off—all grow when attention is focused somewhere else,” Sen. Ted Cruz, R-Texas, said Wednesday at the organization’s press conference announcing the new edition. “What earmark spending, deficits, and debt loathe more than anything is sunshine, is being revealed,” Cruz said. “Because that sunshine has a disinfectant effect.” The 2018 #PigBook has been released! Find out why this little pink book makes Washington squirm… https://t.co/Fiwzzvv0w6 — Citizens Against Government Waste (@GovWaste) July 18, 2018 The 2018…

Read the full storyThe Social Security and Medicare Trust Funds Are Nearly Depleted

By Robert Romano 2026. That is when the Medicare Hospital Insurance trust fund will be depleted, according to the Board of Trustees for the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. That is down from 2029. After that, the share of benefits paid for by revenues will drop until 2039, when payroll taxes will only be enough to pay 78 percent of benefits. Then, benefits would rise to 85 percent by 2092. The most obvious culprit is the Medicare Access and CHIP Reauthorization Act of 2015, which overwhelmingly passed Congress and which former President Barack Obama signed into law. That was the bill that ended the sustainable growth rate that had been the centerpiece reform of the GOP Congress and President Bill Clinton in the late 1990s to balance the budget. The sustainable growth rate was a 1997 reform intended to put the failing program on a sustainable footing before its trust fund was exhausted. Before passage of the 2015 repeal, which sent costs spiraling out of control, the draining of the Medicare trust fund was said to have been in 2030. Then it dropped to 2029 and then to 2026. To be fair, even if the bill had not passed, the trust…

Read the full storyNashville Metro Council Asks Citizens to Critique Future Budgets

Nashville residents soon will have a voice in Metro Council’s spending habits. Metro Council voted 34-4 to create a “Blue Ribbon Commission” like a popular one in Atlanta in which private citizens may critique the budget, Nashville Public Radio WPLN reports. The commission will form by October. Councilman Fabian Bedne said he doesn’t want to see the effort turn partisan as people do not always agree on spending. Councilman John Cooper suggested the commission. The commission’s recommendations will be just that — recommendations. “This is a statement from us as a council that we recognize … our budget process is somewhat broken. That we do need fresh eyes,” said Councilwoman Angie Henderson. WPLN also reports that Metro Council members, who were dissatisfied with the surprise budget shortfall, also voted to cut funding by $103,000 for the city’s Finance Department. Those funds will provide a finance expert to work directly for the council to help them handle the budget. Betsy Phillips of The Nashville Scene reports that move will help the council hold the Finance Department accountable — since the department answers to the mayor. Phillips compares the mayor’s office’s control of the complicated budget to The Labyrinth of Greek myth:…

Read the full storySenate Fails to Pass the Rescission Package

By Printus LeBlanc When President Donald Trump signed the omnibus spending bill back in March, he did so reluctantly. The swamp knew the President’s feelings for the military and hid behind them to fill the omnibus with wasteful spending. The President signed it, hoping some of the spending would be later rescinded. After all, who on Capitol Hill wants to fund programs that do nothing and waste money. The President and the American people got their answer when the Senate continued to do what it does best, disappoint the taxpayers. It is bad enough the House barely passed its modest $15 billion rescission package, but the Senate failing to pass the measure is downright embarrassing. The bill failed 48-50 with two Republicans voting to continue wasting money on government programs that don’t do anything. One has to wonder why Senators Richard Burr (R-N.C.) and Susan Collins (R-Maine) crossed the aisle to vote with hardline progressives to fund programs that do nothing? What about Sen. Joe Manchin (D-W.Va.)? Doesn’t he claim to be a fiscal conservative? One of the most aggravating examples of government waste is the Advanced Technology Vehicles Manufacturing Loan Program. The program provides taxpayer-funded loans to automobile and automobile part…

Read the full storyCongress Can Cut Billions in Wasteful Spending by Following This Blueprint

by Romina Boccia The Senate Budget Committee met May 23 to consider the Government Accountability Office’s annual report on Government Efficiency and Effectiveness, which identifies areas of unnecessary overlap, fragmentation, and duplication among federal programs. The Government Accountability Office supplements that identification of waste with recommendations of what to do about it, presenting specific proposals upon which Congress and executive agencies should act. This year, the report identified 68 new and 297 renewed cost-saving recommendations for members of Congress and leaders of federal agencies. Examples include a modification to low-activity radioactive-waste treatment by the Department of Energy that would save tens of billions of dollars; site neutrality in payments to hospitals under Medicare that would save $1 billion to $2 billion annually; and prevention of overpayments by the Social Security Administration that would save billions. The benefits are sitting right in front of policymakers and agency leaders, but Washington fails to act. Since 2011—the inception of the Government Accountability Office’s annual report—48 percent of recommendations remain only partially addressed or entirely unaddressed. [ The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more ] Fully addressing these actions could save additional tens of…

Read the full storyTrump’s ‘Rescission’ Package Would Save Unspent Tax Dollars

by Justin Bogie President Donald Trump on Tuesday submitted a special message to Congress requesting that $15 billion in unspent funding be rescinded. That’s a good first step toward re-establishing fiscal responsibility. Congress should embrace it and quickly adopt the president’s rescission package. Still, the package does nothing to claw back the tens of billions of additional dollars in wasteful spending authorized by the 2018 Omnibus Appropriations Act. Nor is it the answer to the nation’s long-term debt problem. Congress and the president should work together on additional rescission packages that target 2018 spending and pass a fiscal year 2019 budget that rolls back the latest budget deal and addresses the programs driving the national debt. [ The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more ] The president’s rescission package would take back $15 billion in previously provided spending authority. Of that, $7 billion would come from funds provided in 2017 to the Children’s Health Insurance Program, also known as CHIP. No authority was ever actually granted to CHIP to spend that money. The obvious question: If the money was never going to be spent anyway, then how is it “saving” taxpayers money…

Read the full story‘Penny Plan’ Puts the Spotlight on Out-of-Control Federal Spending

by Romina Boccia Sen. Rand Paul, R-Ky., and Rep. Mark Sanford, R-S.C., recently revived the “penny plan,” which calls on Congress to reduce spending by at least one penny on the dollar from one year to the next. The proposal was introduced in 2011 by then-Rep. Connie Mack, R-Fla., and Sen. Mike Enzi, R-Wyo., and has been introduced several times since then. Sounds easy, no? The Paul and Sanford proposals highlight an issue that is becoming more severe every year. Yet, there’s more to the story. [ The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more ] The penny plan is appealing for a few reasons. It’s simple. While budget discussions in Washington can be very complex and hard to follow for most people, the penny plan is easy to understand. It would simply reduce spending by 1 percent. Just about any American can support the idea that the federal budget can probably make do with 1 percent less in spending. The plan’s simplicity hides the actual spending reductions required to make it work. It appears to work. The plan would reduce federal spending sufficiently to balance the budget in…

Read the full storyExclusive: Conservative Lawmakers’ Blueprint Would Trim Nondefense Spending, Balance Budget in 8 Years

by Rachel del Guidice House conservatives propose to cut nondefense spending and balance the federal budget within eight years in a blueprint released Wednesday. The document produced by the Republican Study Committee, the largest caucus of GOP lawmakers in the House, includes a long list of policy goals such as repealing Obamacare, restoring power to states, making tax cuts “permanent,” reforming welfare programs, and “saving” Social Security and Medicare. The 169-page blueprint, called “A Framework for Unified Conservatism,” proposes to cut government spending by more than $12.4 trillion over the next 10 years, compared with current law. “I am very hopeful, when it comes to the legitimacy of this, if we are ever going to talk about the expectation of the federal government to live within its means, here’s the framework, this is the blueprint,” Rep. Mark Walker, R-N.C., chairman of the 150-member caucus, said Tuesday during a press briefing. [ The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more ] “I don’t believe for one second that everything can be immediately instituted,” Walker told reporters, but “our job … is to put together some kind of blueprint, the framework…

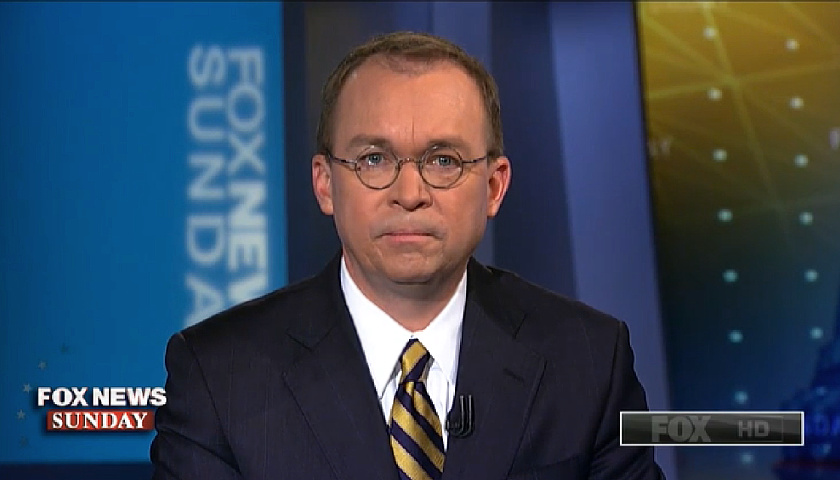

Read the full storyBudget Director Mick Mulvaney Says He Will Ask Congress to Cut Spending in ‘Coming Weeks’

by Rachel del Guidice Office of Management and Budget Director Mick Mulvaney says his staff will soon be sending a package to Congress to rescind some of the planned spending in the $1.3 trillion omnibus bill signed last month by President Donald Trump. “[We] hope to have something here in the next couple weeks,” Mulvaney saidWednesday during a House appropriations subcommittee meeting, reports The Washington Times. Conservative lawmakers, such as Rep. Dave Brat, R-Va., want Trump to send a rescission request to Congress to cancel nondefense spending that the legislators previously approved in the 2,000-plus-page omnibus bill. “We need a plan right now, where the White House and then the House leadership both say, ‘Look Mitch, there’s plenty of money just sitting around in pots, where we can buy significant savings for the American people after that omni[bus], and we want to show them we are serious about fiscal responsibility,’ and so that’s what it is going to take,” Brat told The Daily Signal in a phone interview Thursday. [The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more ] Senate Majority Leader Mitch McConnell, R-Ky., said Tuesday that he does not…

Read the full storyTennessee House Votes to De-Fund Memphis ‘Bicentennial Celebration’ After the Midnight Statue Removal Debacle

Using ‘the power of the purse,’ the Tennessee House of Representatives passed an amendment by a vote of 56-31 Tuesday to de-fund Memphis’ bicentennial celebration by $250,000 as a consequence to the overnight removal of two Confederate monuments in late 2017. “If you recall, back in December, Memphis did something that removed historical markers in the city,” Tennessee Republican Rep. Steve McDaniel said from the House floor. “It was the city of Memphis that did this, and it was full knowing it was not the will of the legislature.” Memphis Mayor and City Council schemed to sell the land containing the parks and statues of Confederate President Jefferson Davis and Gen. Nathan Bedford Forrest on very favorable terms to a nonprofit which then took them down. As The Tennessee Star reported: Confederate monuments on what was until recently city property were taken down in Memphis after the sun set on Wednesday with little advance public discussion of the propriety of the actions taken secretively to circumvent state law. Whether the actions of the Memphis City Council and Mayor Jim Strickland that caused these stealth take downs of Confederate monuments Wednesday legally circumvent state law, or are in fact a brazen violation of state law, is a matter…

Read the full storyThe Little-Used, Budget-Trimming Technique Called ‘Rescissions’ Can Reduce Spending with Simple Majority Votes

By Printus LeBlanc When the President signed the budget a few weeks ago, it was obvious he was disgusted about having the sign the horrible bill. The only reason the President signed the bill was because the military was in dire straits. Those pushing the bill knew how the President felt about the military and used that against him to get the bloated bill passed. Fear not, however, there is a way the President can reduce some of the spending, while at the same time putting Congressional Democrats up for reelection on the record. The President can and should submit multiple rescissions immediately. Title X of the Congressional Budget Act of 1974 is known as the Impoundment Control Act. The act divides impoundments into two categories and establishes distinct procedures for each. A deferral delays the use of funds; a rescission is a presidential request that Congress rescind (cancel) an appropriation or another form of budget authority. To propose a rescission, the President must submit a message to Congress specifying the amount, the accounts and programs involved, the estimated fiscal and program effects, and the reasons for the rescission. Multiple rescissions may be grouped into a single message. After the…

Read the full storyOfficial Budget Forecasters Raise Debt Projections

Red ink will spill even faster over the next decade than projected as recently as last summer, the Congressional Budget Office (CBO) reported Monday. The numbers crunchers forecast that this year’s deficit will be $242 billion larger than the budget office forecast in June. The CBO attributes $194 billion of that to the tax cut Congress passed and President Donald Trump signed in December.

Read the full storyHere Are The Nearly 100 Republicans Who Voted Against The Spending Bill

Almost 100 Republican representatives voted against the 2,000 page omnibus spending bill Wednesday night. The House of Representatives voted to pass a $1.3 trillion spending bill in a 256 to 167 vote with seven people abstaining from voting. The spending bill offers funding to defense matter, the opioid crisis and more school safety measures.

Read the full storyTrump Signs Spending Bill, Averting Government Shutdown

US President Donald Trump on Friday signed a $1.3 trillion compromise federal spending bill despite being “unhappy” with many of its provisions — thereby averting what would have been the third government shutdown of 2018. Trump said he signed the measure that had passed the Senate just hours earlier “as a matter of national security,” because it dramatically expands military funding and provides for “the largest pay increase” for US troops in over a decade.

Read the full storyCommentary: OmniBUST: Congress Fails to Secure Border

By Robert Romano A year late, Congress has finally approved the President’s supplemental request to begin construction of the southern border wall at $1.6 billion. The supplemental was requested in March 2017. It was supposed to be included in the May 2017 omnibus spending bill affecting spending levels for Oct. 1, 2016 through Sept. 30, 2017. This would have paved the way for the full funding for the wall being included this year. Unfortunately, it didn’t happen. Because Congress did not get started with the supplemental last year, the odds they were going to get to full funding for the wall for fiscal year 2018, that is, spending levels for Oct. 1, 2017 through Sept. 30, 2018, dropped markedly. Now those who were warning of precisely this outcome have been vindicated. This was a broken promise from the get-go. After the election, House Speaker Paul Ryan and Senate Majority Leader Mitch McConnell were promising $12 billion to $15 billion for the wall. On Jan. 27, 2017, Ryan told the American people that, “This is something, [the wall], we want to get on right away. And so we do believe this is urgent. We believe this is one of the most…

Read the full storyRepublicans’ $1.3 Trillion ‘Pass It to Read It’ Boondoggle

Republicans, following months of negotiations with Democrats, finally came up with an omnibus spending bill, and in a word, it “sucks.” It’s 2,232 pages of $1.3 trillion taxpayer expenditures. And lawmakers only have until Friday to pass it, or face yet another shutdown.

Read the full storyRepresentative Diane Black Calls Out the U.S. Senate for It’s Continued Funding of Planned Parenthood

Representative Diane Black appeared on FoxNews’ ‘Tucker Carlson Tonight’ to discuss the how it is that the Republican Congress continues to fund the nation’s largest abortion provider, Planned Parenthood. In his set-up to the interview with Black, Carlson said, “Congressional Republicans have repeatedly promised to defund Planned Parenthood. It’s hasn’t happened or even come close to happening. Even now, the country’s biggest abortion provider gets more than 500 million taxpayer dollars every year.” “Would Democrats be okay if the NRA [National Rifle Association] got half-a-billion a year? Would they let that stand?” After introducing Representative Black, Carlson said, “You’ve said many times on the record – and you seem like one of the more sincere Republican members on this question – that you’re opposed to giving half-a-billion dollars to Planned Parenthood, which is just an adjunct to the Democratic Party. Why hasn’t the Republican Congress defended it? Specifically, why?” Black replied, “That goes over to the Senate. Twice now with my leadership we have passed, in 2015 and 2017, a measure in the House, sent it over to the Senate, and they have not done their work. “I want to challenge anyone watching this show who is pro-life to call your senator and ask them where…

Read the full storySome on Right Worry Trump’s Infrastructure Plan Is a Boondoggle in the Making

President Donald Trump unveiled his plan Monday to fix what the White House describes as the “unacceptable state of disrepair” of the nation’s roads and bridges, but some experts warn it could turn into a costly and unneeded boondoggle to fix a problem that doesn’t really exist.

Read the full storyMetro Nashville Finance Director: It Is Challenging To Spend More Money Than City Takes In

“Cash is king.” That economic saying is something Metro Nashville may be learning as the finance director warns the city cannot keep spending money as if it is minting it. Metro Finance Director Talia Lomax-O’dneal has warned department heads that they cannot request new spending measures in the 2018-2019 budget, The Tennessean reports. The city’s current $2.2 billion operating budget was a $122 million, a 5.9 percent increase over the previous year. The 2016-17 operating budget was a $121 million, a 6.1 percent increase over the previous year. Mayor Megan Barry’s current budget took Metro Nashville over the $2 billion mark for the first time. “Prudent financial management requires a periodic look for efficiencies and savings opportunities, and there are several fiscal challenges for the 2018 fiscal year,” Lomax-O’dneal said in her letter to department heads. Those “challenges” include tax collections that have returned to normal levels, dwindling reserve balances and increased debt payment obligations. Lomax-O’dneal’s letter failed to mention two issues, one a current budget “challenge,” and the other a potential “challenge.” The former is the $17.1 million lifeline the Metro Council voted last month to give Nashville General Hospital. The latter is the proposed $9 billion light rail…

Read the full storyCommentary: How the Filibuster and ‘Bipartisan Consensus’ Is Spending Us Into Oblivion

By Robert Romano Say, you’re a fiscal conservative. You think the federal government is spending too much of your hard-earned tax dollars and that the $20.7 trillion national debt is pushing it. You took a gander at the campaign brochures of each of the major parties in 2016, Democrats and Republicans, and discovered Republicans were actively campaigning on balancing the budget. So, you rolled the dice and as fortune would have it, the Republicans were elected to majorities in the House and Senate plus claiming the White House for only the fourth time since the Great Depression — the other times were 1953-54 and 2003-07 when they had all three. And, at least initially in 2017, it looked like this might finally be the time spending could actually be cut. President Donald Trump offered his first budget, which proposed increasing defense spending but cutting non-defense and other mandatory spending, with a full $4.5 trillion of overall spending cuts over ten years. Fast forward a year later, and although Congress did agree to increase defense spending, it was unwilling to cut spending elsewhere. The result is $165 billion of defense spending increases and $131 billion of non-defense over the next two years. The…

Read the full storyRepresentative Jim Jordan Says the ‘Swamp Won’ on Spending Bill

Rep. Jim Jordan says the swamp struck back with the passage of a massive budget deal that increases government spending by $300 billion. “I’m saying the swamp won and the American taxpayer lost,” Mr. Jordan, co-founder of the House Freedom Caucus, said on “Fox News Sunday.”

Read the full storyBette Midler Calls for Attacks on Senator Rand Paul

With her latest tasteless stunt, actress and comedienne Bette Midler may be entertaining a knock at the door from the Secret Service. In response to the attempt by Sen. Rand Paul (R-Ky.) to derail passage of the federal budget yesterday — which could have led to another government shutdown — Midler crassly suggested the solution to Paul’s hour-long delay was a physical attack on him from behind.

Read the full storyCommentary: Swamp Creatures Stir to Life as Big Spending Sparks Bipartisanship

Any time you hear Washington talk about bipartisan agreement, America, grab your wallet and run! Once again, lawmakers in Washington have finally cut through all the thorny brambles of partisanship and discovered (yet again! yippie!) something they can all agree upon: spending scads and scads more of other people’s money that we don’t even have!

Read the full storyBudget Hawks During Tax Debate, Democrats Now Silent on Deficits

Democrats who howled about the debt during last year’s debate over tax cuts have stood silent over a comparably large increase in red ink projected from a budget-busting spending plan that cleared Congress and was signed by President Donald Trump early Friday.

Read the full story