Georgia Governor Brian Kemp signed an executive order Tuesday declaring a state of emergency in the Peach State due to high inflation, which included temporarily suspending the state’s excise tax on motor and locomotive fuel.

Read the full storyTag: Gas tax

Tennessee Senate Committee Hears Testimony on Mileage-Based Vehicle Tax Options

A Tennessee Senate committee heard testimony on Wednesday on a potential mileage-based user fee to replace the state’s gas tax.

Several states have begun pilot programs on what is called an MBUF while Virginia has gone to a permanent model.

Read the full storyOhio Looking at Options to Replace Gas Tax

Calling the gas tax an unsustainable way to fund transportation infrastructure, the Ohio Department of Transportation is studying its options.

Using a $4 million federal grant, Ohio developed a website to seek public opinion on potential funding options. Those results will eventually be forwarded to the General Assembly later this year, according to a promotional video produced by ODOT.

Read the full storyPennsylvania Lawmakers Aim to Stop Gas Tax Hike, but Price at the Pump Expected to Fall

Pennsylvania’s gas tax is a major funding source for the upkeep and repair of roads and bridges across the state.

It’s also one of the highest gas taxes across the nation.

Read the full storyGovernor Lee Announces $26 Billion Transportation Proposal

Tennessee Governor Bill Lee recently announced a $26 billion proposal to address transportation needs across the state. Lee’s infrastructure proposal, “Build With Us,” comes as the state’s growth is outpacing roadway capacity investments.

Read the full storyGeorgia’s Kemp Extends Gas Tax Moratorium Again

Georgia Gov. Brian Kemp has signed an extension of the state’s gas tax moratorium, saying such a move is needed because of a potential diesel fuel shortage.

The extension runs through Dec. 11.

Kemp also extended the locomotive fuel tax moratorium and a supply chain state of emergency. The governor, who is in the middle of a reelection campaign against Democrat Stacey Abrams, squarely placed the blame for high gas prices on President Joe Biden’s policies.

Read the full storyGeorgia Gov. Kemp Signs Another Extension of the State’s Gas Tax Moratorium

Georgia Gov. Brian Kemp has extended the suspension of the state’s collection of taxes on motor and locomotive fuel.

The governor also extended the supply chain state of emergency. Both orders will be effective through Nov. 11, shortly after the election.

Read the full storyYoungkin Approval at 49 Percent, Majority Support Failed Gas Tax Suspension in VCU Poll

Governor Glenn Youngkin hit 49 percent job approval and 38 percent disapproval in a new poll from the Virginia Commonwealth University (VCU). The poll included questions focused on key budget policy debates, and reports 58 percent support a three-month gas tax suspension.

“The responses in the poll suggest what I have always stated: The people are always ahead of the leaders,” former Governor Doug Wilder said in a press release. “The grocery tax proposal is very receptive; gas tax suspension and/or stipend is greeted positively, which can be viewed as a direct response to rising inflation.”

Read the full storyGovernor Brian Kemp Extends Gas Tax Suspension as Costs Remain High

Georgia Governor Brian Kemp announced an additional extension of the suspension of the state’s gas tax—an effort to curb high prices.

Kemp first enacted the suspension on March 18, signing legislation passed by the General Assembly.

Read the full storyOhio Governor DeWine Opposes Biden’s Call to Suspend Gas Taxes

While President Joe Biden this week began urging Congress to suspend the national gas tax for three months and asking states to do the same with their gas levies, Ohio Gov. Mike DeWine (R) came out against the idea.

The federal government charges gasoline buyers $0.18 per gallon and diesel motorists $0.24 per gallon. The Buckeye State meanwhile imposes a $0.385-per-gallon tax on gasoline as well as a $0.47-per-gallon tax on diesel and other fuel types. Both levels of government use the revenues from these sources to fund transportation projects. Biden maintains that dollars flowing to the U.S. Treasury are sufficient to prevent compromising federal highway repairs in the event of a three-month tax holiday.

Read the full storyMichigan Senators Take Steps Toward Gas-Tax Vacation

As residents of the Great Lakes State and out-of-state tourists prepare to inaugurate the 2022 outdoor vacation season, they’re being stymied by gasoline prices rising steadily toward the $5 per gallon range.

The Michigan Senate has passed a slate of bills designed to alleviate drivers’ pain at the pump. If signed into law by Gov. Gretchen Whitmer, the bills would save Michigan drivers between 40 cents to 50 cents a gallon by temporarily eliminating the state’s 6% sales tax and 27-cent-per-gallon excise tax.

Read the full storyConnecticut Gas Prices Rising Despite Tax Pause

Both Democrats and Republicans in Hartford worked for and celebrated the Connecticut gasoline-tax suspension that Gov. Ned Lamont (D) signed in late March, but new data indicate its effect could be lessening.

The center-right Yankee Institute (YI) published an analysis on Saturday showing that the difference between gasoline costs in Connecticut and those in Massachusetts, which did not enact a similar gas-tax holiday, are narrowing.

Read the full storyOhio Senator Proposes Eliminating State Income Tax

Ohioans would no longer pay state income tax and the state would become the 10th without it if a bill recently filed in the Senate becomes law.

Sen. Steve Huffman, R-Tipp City, introduced a plan to lower the tax rate in each bracket by 10% a year over the next 10 years, eventually eliminating the state income tax completely.

Read the full storyGovernor Lee Announces Passage of His Full Agenda and $52.8 Billion Budget

Tennessee Governor Bill Lee marked the close of the 2022 legislative session Friday, which included the passage of his $52.8 billion budget and full agenda as outlined during his State of the State address in February.

“Tennessee is America at Its Best, and we’ve made strategic investments to cut taxes, strengthen infrastructure and invest in education at every level to prepare our state for future growth,” Governor Lee said in a statement. “I thank Leader Johnson and Leader Lamberth for carrying key legislation, and commend the General Assembly for passing measures that will benefit Tennesseans and continue our state’s reputation for conservative fiscal management.”

Read the full storyLamont and Legislators Moving on Connecticut Budget Deal

Connecticut Gov. Ned Lamont (D) and leaders of the Democrat-controlled General Assembly are touting a $24-billion budget deal for the next fiscal year that contains almost $600 million in tax reduction.

Most of the tax relief, however, will only remain in effect through the end of the year.

Read the full story‘Gasoline Misery Index’ Details Direct Impact of Record-High Gas Prices

The “Gasoline Misery Index” from the Metro Business Daily Network details the direct impact record-high gas prices have had on consumers across the United States.

Since President Joe Biden took office, prices of gas and other goods and services have continued to increase, as many peaked after Russia’s invasion of Ukraine.

Read the full storyLawmakers Call for Challenge to ARPA Rules Limiting Connecticut Tax Reduction

Connecticut Republican legislators said on Saturday they want the state to challenge a part of the American Rescue Plan Act which limits states’ ability to cut taxes.

GOP senators and representatives are calling for tax reduction beyond the targeted relief backed by Gov. Ned Lamont (D). A major roadblock to greater decreases will be the COVID-relief bill President Joe Biden signed into law last year. The act included $195.3 billion in recovery funds for states and barred states accepting allocations from using them to “directly or indirectly offset a reduction in net tax revenue… or delay the imposition of any tax or tax increase.”

Read the full storyConnecticut Gas Tax Holiday Takes Effect

Connecticut’s plan to reduce the pain at the gas pump for its residents took effect Friday.

HB 5501 passed the state legislature last week. It, like laws in many other states, provides for a gas tax holiday as prices at the pump continue to hover at near record levels.

Read the full storyYoungkin Says Virginia Will ‘Work Hard’ to Suspend Gas Tax

Virginia’s governor is once again proposing a suspension of the state’s gas tax as prices at the pump remain near record highs.

“It’s time for us to give Virginians a break, and we’re going to work hard to suspend the gas tax,” Gov. Glenn Youngkin (R) said in a Tuesday interview with Fox News Radio. “I’ve got to send a bill down to our legislature, which I’ll call back into special session, and we’re going to get them working on this.”

Read the full storyConnecticut Gas Prices Dip Down, Remain Above National Average

Connecticut’s gas prices have slowly dipped down after reaching historic highs following the decision from President Joe Biden to ban the import of Russian oil.

According to the American Automobile Association (AAA), drivers are paying $4.337 per gallon at the pump, compared to $4.465 one week ago.

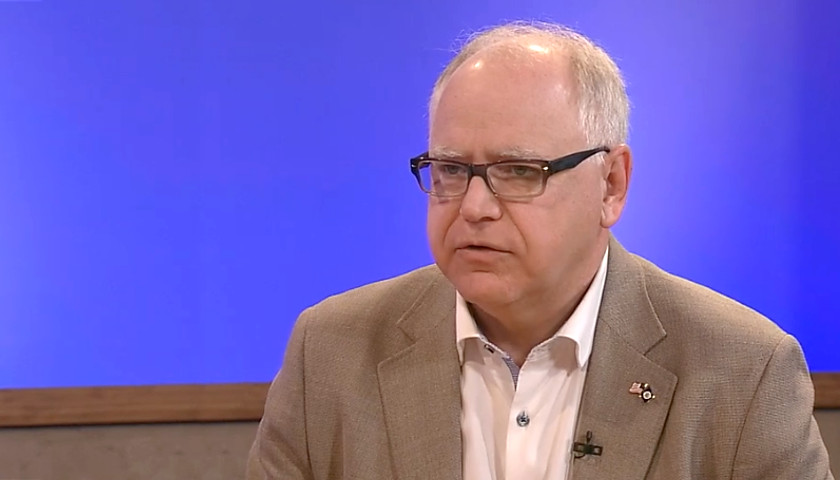

Read the full storyMinnesota GOP Calls Out Governor Walz, Democrats for ‘Playing Gimmicks’ with Minnesotans’ Taxes as the State Has a Historic Budget Surplus

On Wednesday, Republican Party of Minnesota Chairman David Hann called out Governor Walz and the Democrats for their “continued political gimmicks regarding taxes on Minnesotans amidst rising energy prices and a historic state budget surplus.”

Read the full storyState Senator Jake Corman Introduces Legislation to Lower Pennsylvania Gas Tax

Pennsylvania Senate President Pro Tempore Jake Corman (R-Bellefonte) proposed lowering the state’s gas tax levels in order to ease the burden on consumers.

Corman’s legislation, known as the Consumer Gas Prices Relief Act, would reduce the state’s liquid fuels tax by one-third through the end of 2022, cutting roughly 20 cents per gallon off the price.

Read the full storyDemocrats Call on Youngkin to Activate Anti-Price Gouging Law over High Gas Prices

Amid high gas prices, Virginia Democrats are calling on Governor Glenn Youngkin to enact a state of emergency, which would cause an anti-price gouging law to take effect.

“Governor Youngkin has the power to act and help protect Virginians at the pump, but so far, has failed to do so. Instead, he continues to point fingers and waste precious time,” Minority Leader Eileen Filler-Corn (D-Fairfax) said in a Thursday press release. “Virginians do not need talking points and failed campaign promises—we need leadership and action.”

Read the full storyPennsylvania Budget Secretary Defends Governor’s Budget That Lawmakers Say Overspends

Pennsylvania’s House Appropriations Committee ended hearings on next fiscal year’s budget on Thursday, with the governor’s budget chief defending a plan that many lawmakers fear significantly overspends.

Governor Tom Wolf (D) has asked the Republican-controlled General Assembly to consider a Fiscal Year 2022-23 budget that spends $43.7 billion, an increase of 16.6 percent over current expenditures. His proposal assumes the state will enjoy a revenue intake that surpasses that predicted by the nonpartisan Independent Fiscal Office (IFO) by $762 million.

Read the full storyAs Budget Negotiations Continue, Gov. Youngkin and Virginia Legislators Make Last-Minute Pitch for Pet Proposals

As legislators work towards a budget compromise balancing increased spending with revenue losses from tax cuts, Governor Glenn Youngkin and legislators are continuing to argue for their positions.

“The idea that we have to choose between tax relief and our shared priorities is a false choice. It is critical that we do our part to reduce the tax burden on our citizens, particularly at a time when present receipts continue to be as robust as they are,” Youngkin wrote in a Wednesday Richmond Times-Dispatch column.

Read the full storyOhio Rep. Tim Ryan Blames Putin for Rising Gas Prices

An Ohio U.S. congressman and U.S. Senate candidate has joined many of his Democrat counterparts in blaming Russia and its President Vladimir Putin for skyrocketing gas prices.

“Today I’ll vote to ban U.S. dollars from funding Putin’s war machine. Now we must do everything in our power to shield working people from Putin’s price hike at the pump by fully restoring America’s energy independence and passing a working-class tax cut,” Rep. Tim Ryan (D-OH-13) said Wednesday on Twitter.

Read the full storyGeorgia Governor Kemp, General Assembly Set to Suspend State Gas Tax

Georgia Governor Brian Kemp announced that he plans to work with the Georgia General Assembly to temporarily suspend the state’s excise tax on motor fuel sales, according to a Wednesday statement by Kemp’s office.

Read the full storyWisconsin Governor Tony Evers Calls for Federal Suspension of Gas Tax amid Soaring Prices

Wisconsin Governor Tony Evers joined other Democratic governors and sent a letter to Congressional leadership, urging the federal lawmakers to pass legislation to suspend the federal gas tax.

The legislation, introduced by Senator Mark Kelly (D-AZ) and known as the Gas Prices Relief Act, would terminate the 18 cents per gallon gas tax that individuals pay, temporarily lowering the prices for consumers.

Read the full storyGovernor Youngkin Renews Calls for a Gas Tax Exemption to Combat Rising Fuel Prices in Virginia

Virginia Governor Glenn Youngkin announced his plan to combat rising gas prices in his state Monday while delivering a speech to ChamberRVA.

During his speech, the Governor blamed the current energy price hikes as results of bad energy policies at the federal level. Youngkin also admitted that inflation could not be fixed through the actions of one state’s governor alone, however, continued his push to suspend Virginia’s gas tax increase for one year.

Read the full storyDemocrat Senators in Georgia, Michigan, Arizona Introduce Bill to Suspend Gas Tax

In an effort led by Senator and Rev. Raphael Warnock (D-GA), several Democrat Senators in battleground states have signed on to a bill that would suspend the gas tax until 2023.

The Gas Prices Relief Act would lower prices at the pump as gas prices rise to nearly a decade high in a crucial election season.

Read the full storyArizona Senator Mark Kelly Introduces Bill to Suspend Federal Gas Tax amid Surging Prices

Senator Mark Kelly (D-AZ) on Thursday introduced a bill to suspend the federal gas tax through the end of the year, amid surging prices due to inflation.

The legislation, known as the Gas Prices Relief Act, would terminate the 18 cents per gallon gas tax that individuals pay, temporarily lowering the prices for consumers.

Read the full storyOhio Sen. Stephen Huffman Wants to Reduce State’s Gas Tax

An Ohio state senator wants to lower the state’s gasoline tax to pre-2019 levels for the next five years, but a panel of state economists believe the plan is a bad idea.

Sen. Stephen Huffman, R-Tipp City, believes Ohioans could use the break, especially when the federal government has committed to giving the state 10 times more revenue over the same time span than the gas tax traditionally generates.

Read the full storyTennessee State Rep. Griffey Files Bill to Repeal Gas Tax

A member of the Tennessee State House of Representatives filed a bill Wednesday to repeal the state’s gas tax.

“The working people of Tennessee are getting hammered by inflation and horrendous energy policy that has caused gas prices to sky rocket! All thanks to the I’m competence of Joe Biden and the Democrats in DC,” Rep. Bruce Griffey (R-Paris) told The Tennessee Star. “Tennessee is currently running monthly budget surpluses is in the hundreds of millions of dollars over projected budgeted revenues. This gas tax repeal is a way to try to help working Tennesseans and all those Tennesseans paying bother prices at the pump.

Read the full storyReport Shows Virginia’s Road Condition Improving but Bridges Need Work

Virginia’s state-owned transportation infrastructure is improving, ranking the state 13th among the rest of the U.S. for pavement condition. Bridge condition lags somewhat, ranking 17th, but more than 25 percent of the Commonwealth’s bridges are close to being ranked structurally deficient, the Joint Legislative Audit and Review Commission (JLARC) reported to legislators on Monday.

“You may recall that there was interest in taking a look at the state’s revenue streams, planning process, and infrastructure condition after a series of major legislative actions over the last five years or so,” JLARC Director Hal Greer said. “As you’ll hear, the state’s revenue picture has improved, and recent changes have made the state’s planning process more rigorous, and based on objective data. We have, though, identified some important, but relatively minor changes to be considered to better address some of the state’s transportation needs.”

Read the full storyGeorgia Suspends Gas Tax Amid Shortage

Gov. Brian Kemp (R) Tuesday signed an executive order temporarily eliminating the Peach State’s gas tax, among other measures, after a cyber attack on the Colonial Pipeline has halted gas flow to much of the southeast.

“Today I signed an executive order suspending the gas tax in Georgia to help with higher prices as a result of the Colonial cyber attack. We are working closely with Colonial and expect for them to recover by the end of the week,” Kemp said on Twitter, attaching an official statement from his office.

Read the full storyMichigan Diverts a Third of All Gas Tax Revenues Away from Road Repairs

Every U.S. state taxes fuel sales to fund road repairs.

Fully half of them, however, divert a portion of those taxes for other purposes. And Michigan, with a gas-tax diversion rate (GTDR) of 33.9 percent, is ranked with New Jersey as the third highest GTDR in the nation. Only New York (37.5 percent) and Rhode Island (37.1 percent) have higher GTDRs.

Read the full storyMichigan House GOP Pushes Own Infrastructure Plan, Rejecting Whitmer’s 45 Cent Gas Tax Hike

by Tyler Arnold Michigan House Republicans unveiled an infrastructure funding plan that would divert all revenue generated from sales taxes paid on gasoline purchases to fund road improvements, rejecting Gov. Gretchen Whitmer’s plan to increase road funding through a 45-cent gas tax hike. The Republican plan would provide about $800 million annually in additional funds for roads once fully phased in, which is far less than Whitmer’s plan crafted to generate about $2.5 billion. “It’s our duty to do the best job we can to provide an effective, efficient and accountable state government with the money taxpayers already provide,” Rep. Shane Hernandez, R-Port Huron (pictured above), said in a news release. “We have gone through the budget line-by-line to find savings and set priorities that reflect what matters most to Michigan taxpayers and families,” Hernandez said. “That’s the approach we should take – rather than asking taxpayers for more money.” Currently, the sales tax paid at the pump is used mostly to fund schools and local governments, rather than roads. Hernandez’s plan would divert all of this money to infrastructure, but would do so without sacrificing money for schools and local governments. Money will be diverted back into schools and…

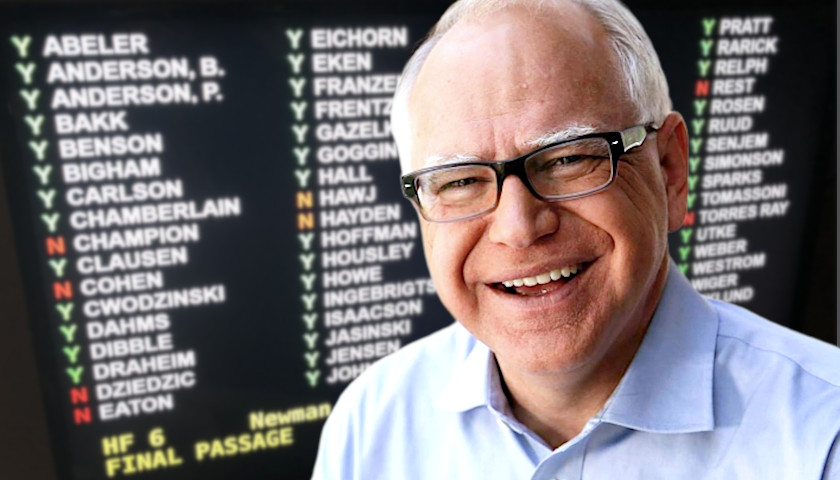

Read the full storyMinnesota Gov. Walz Says Republicans and Business Leaders Will Beg Him for a Gas Tax Next Year

Minnesota Gov. Tim Walz said he expects businesses and Republican legislators to suggest a gas tax to him next year. The governor, a member of the Democratic Farmer-Labor Party, made the remarks Friday during an interview with Mary Lahammer on Twin Cities Public TV. The Minnesota Senate Republican Caucus provided a video clip here. Hard pass. Again. ✋ pic.twitter.com/SU0QHuNGR2 — Minnesota Senate Republicans (@mnsrc) June 1, 2019 Walz said, ”I fully expect that the business community and Republicans legislators will suggest it to me.” The full interview is available here. (The gas tax discussion starts around 12 minutes and 6 seconds.) He said his proposal is not ideological but about needs. “That’s what the engineers tell us we need,” he said. It was obvious to him during negotiations that “Republicans weren’t going to do a single penny,” he said. When asked if he would revisit the tax next year, Walz made the remark about opponents coming to him. The reaction was overwhelmingly skeptical on the Minnesota Senate Republican Caucus’ Facebook video post here. In February, Center of the American Experiment criticized Walz’ planned tax hike of 20 cents per gallon of gas. So, even with a projected budget surplus…

Read the full storyNo Gas Tax Increase for Minnesota

An omnibus transportation budget bill is on its way to Gov. Tim Walz’s desk without any gas tax increase. After clearing the DFL-controlled House Friday evening, the bill passed out of the Senate later Friday night in a 54-13 vote. It’s official…no gas tax increase in Minnesota. Senate just passed transportation bill after House passed earlier. On its way to the governor. pic.twitter.com/Yk81S8lq3j — Tom Hauser (@thauserkstp) May 25, 2019 The transportation bill was one of 13 bills state lawmakers passed during their marathon 21-hour special session that wrapped up Saturday morning just before 7 a.m. “This year we drove down the cost of health care, gave tax relief to the middle class, made historic investments in education, and funded roads and bridges. This is a budget that all Minnesotans can be proud of,” Senate Majority Leader Paul Gazelka (R-Nisswa) said Saturday morning. “This year we drove down the cost of healthcare, gave tax relief to the middle class, made historic investments in education, and funded roads and bridges. This is a budget that all Minnesotans can be proud of.” #mnleg pic.twitter.com/IiBzkg1Og0 — Paul Gazelka (@paulgazelka) May 25, 2019 Sen. Scott Newman (R-Hutchinson), chair of the Senate Transportation Finance…

Read the full storyMichigan Senate’s Budget Excludes Gas Tax Proposed by Gov. Whitmer, Potential Veto

by Tyler Arnold The Michigan Senate passed a budget package that secured some additional funding for roads, but falls far short of Democratic Gov. Gretchen Whitmer’s proposed road funding and excludes her proposed 45-cent gas tax hike, which would nearly triple the tax. “We are … investing an additional $132 million entirely to local roads – fully implementing $1.2 billion from the 2015 roads plan a year ahead of schedule,” Sen. Stamas, R-Midland, said in a news release. Stamas is the chairman of the Senate appropriations committee. “Discussions can and will continue on additional funding for our roads, but we need to press forward and fulfill our other responsibilities with the resources that we currently have,” Stamas said. “It’s one of our top jobs to pass a balanced budget on time – and we owe that to all Michigan families.” Whitmer’s plan would have increased the state’s gas tax from 26 cents to 71 cents to generate $2.5 billion in revenue that would be spent fully on road funding. But her plan would have eliminated $600 million of road funding from the general revenue and diverted that money to other issues, including education and ensuring the quality of drinking…

Read the full storyPolling Continues to Show Strong Opposition to 20-Cent Gas Tax Increase

Veteran political reporter Tom Hauser was chastised in December by at least one state representative when he correctly pointed out that all but one recent poll showed opposition to a gas tax increase. Hauser said at the time that “nearly ever poll,” with the exception of one Star Tribune poll, showed that a majority or plurality of Minnesotans opposed an increase in the state’s gas tax, as The Minnesota Sun reported. He noted that “every KSTP/SurveyUSA poll in the last 15 years” found opposition to an increase. Polling has continued to confirm Hauser’s analysis. A late April poll from the Minnesota Chamber of Commerce and the Minnesota Business Partnership found that 65 percent of Minnesotans oppose Gov. Tim Walz’s proposed 20-cent gas tax hike. Now, a new poll conducted for the Center of the American Experiment by Meeting Street Research has found similar results. The poll, published in the latest issue of Thinking Minnesota, found that 60 percent of Minnesotans oppose the 20-cent increase, and 45 percent are strongly opposed. Just 35 percent of respondents said they support the increase, and an even smaller 17 percent “strongly” support it. The 20-cent increase, which was approved Monday by the Minnesota…

Read the full storyCommentary: To Avoid a Future Gas Tax, Infrastructure Must Be Rebuilt Now

by Jeffrey A. Rendall Think about it. How many times have you driven down the road and thought, ‘Gee, someone had to pay a lot of money to build this?’ Or used the restroom in a public place and pondered, ‘When I flush the toilet, where does it all go?’ Here’s thinking hardly anyone — maybe outside of a civil engineer — even gives such scenarios a second thought. Here in western civilization, everyone takes it for granted when they switch on the faucet that clean and potable water will emerge and driving over a bridge or passing through a tunnel that it won’t collapse on them. Over the years lots of smart people ensured that everything works properly for us…or they would’ve lost their jobs (and been sued!). But even the most well-conceived systems require maintenance, and they’ll eventually wear out and need replacement or expansion. The timeless creations of Ancient Rome didn’t last forever. Here in America the decay is noticeable in many places. President Donald Trump campaigned on upgrading the country’s infrastructure and made it a central pillar of his “Make America Great Again” platform. As a lifelong builder of big beautiful things, Trump appreciates the…

Read the full storyMinnesota House Approves 20 Cent Gas Tax Hike, Likely DOA in Senate

The Minnesota House approved a 20-cent gas tax increase Monday in a vote along party lines, but the proposal is likely dead-on-arrival in the Republican-controlled Senate. “We’re not going to do a gas tax. I’ve made it very clear that is not a direction we’re going to go,” Senate Majority Leader Paul Gazelka (R-Nisswa) said Monday, according to The Star Tribune. The transportation bill passed the House in a 74 to 58 vote. Under the bill, the state’s gas tax would jump from 28.5 cents per gallon to 48.5 cents, which is a 70 percent increase. The bill also included a metro-wide sales tax to help fund Light Rail, a vehicle registration tax increase, and a new vehicle tax increase. “The House DFL’s plan to raise excessive tax and fees, including a 70 percent gas tax increase, a metro area sales tax, and more expensive tab fees is reckless and will cause serious financial harm to Minnesota families,” Rep. Jon Koznick (R-Lakeville) said. “Their plan puts Minnesota drivers in reverse.” DFL legislators staunchly defended the tax increases during a Monday press conference held before the vote. “This morning we are joining Gov. [Tim] Walz in offering Minnesotans a choice.…

Read the full storyPoll Finds Minnesotans Overwhelmingly Oppose 20-Cent Gas Tax Increase

A new poll released last week by the Minnesota Chamber of Commerce found overwhelming opposition to an increase in the state’s gas tax. The poll, conducted in conjunction with the Minnesota Business Partnership, discovered that nearly two-thirds of voters statewide oppose Gov. Tim Walz’s proposed 20-cent gas tax hike. The results of the poll show that 65 percent of respondents oppose the increase, while 54 percent are “strongly” opposed. Those numbers are even higher for Greater Minnesota respondents. Seventy-five percent of those surveyed in Greater Minnesota oppose a 20-cent increase, and 63 percent said they were strongly opposed. That’s compared to 57 percent of Twin Cities respondents who said they were opposed, while 40 percent in the metro area support the increase. As an alternative, 64 percent of Minnesotans said they are in favor of dedicating the auto parts sales tax to the transportation budget. Minnesota’s gas tax is currently the 24th highest in the country, and was last raised in 2008. A poll from The Star Tribune in October found that 56 percent of Minnesotans actually support a gas tax increase. That poll, however, asked about a 10-cent increase, as opposed to the 20-cent increase mentioned by the Minnesota…

Read the full storyCommunities Brace for Diesel Tax Increases After Ohio Gov. DeWine Signs Gas Tax Into Law

In one of his first major acts in office, Gov. Mike DeWine (R-OH) signed into law the state’s first gas tax increase since 2005. The issue has been the focal point of his first few months in office, and negotiations with House and Senate Republicans have not been easy. But on Tuesday, all parties finally agreed to a compromise: 10.5 cents on regular fuel, and 19 cents on diesel. That will bring the total gas tax to 38.5 cents, and the total diesel tax to 47 cents, both of which are currently taxed at an equal rate of 28 cents. The increase, set to go into effect July 1, doesn’t seem to have the support of most Ohioans, especially those who rely on diesel fuel. “Diesel fuel powers our economy, because it’s what the trucks that deliver Ohio-made products to market run on. A 19 cent increase on diesel will move Ohio well past the state average of 30.2 cents of tax per gallon and leave us with the sixth highest tax rate on diesel fuel in the country. This does not make Ohio more competitive and will be damaging to Ohio’s economy and to our businesses,” the Ohio Chamber…

Read the full storyGas Prices Spike as Ohio Legislature Approves Gas Tax Hike

The American Automobile Association (AAA) announced Monday that only three months into 2019, the nation’s average gas price has spiked by almost 45 cents. Ohio prices increased as well, but by slightly less than the national average. While Ohioans may be relieved, experts are predicting that these price increases are expected to continue indefinitely. According to AAA, the current average gas price is $2.69 for regular unleaded gas. Though this is far from the historical high of $4.16 in May of 2011, it’s still more expensive than gas has been in the previous three years. At the state level: The nation’s top 10 largest weekly increases are: Florida (+13 cents), California (+12 cents), Indiana (+11 cents), Georgia (+11 cents), Idaho (+9 cents), Kentucky (+9 cents), Washington (+9 cents), Oregon (+8 cents), Nevada (+8 cents) and Ohio (+8 cents). “Three months ago motorists could find gas for less than $2.50 at 78 percent of gas stations. Today, you can only find gas for that price at one-third of stations, which is likely giving sticker shock to motorists across the country,” AAA spokesperson Jeanette Casselano said. “Gasoline stocks have been steadily decreasing since early February causing spikes at the pump that are likely…

Read the full storyOhio Conference Committee Fails to Reach Deal on Gas Tax, Cancels Monday Meeting

The Ohio Legislature failed to agree on a transportation budget before its midnight deadline Sunday. While several items were agreed to, a comprise hasn’t yet been reached on the gas tax. As The Ohio Star reported, the Ohio House and Gov. Mike DeWine settled on an 11-cent gas-tax increase, seven cents down from what DeWine initially proposed. “I’m pleased that we have reached an agreement with the Speaker of the House on the transportation budget that will enable the Ohio Department of Transportation to improve and maintain safer roads, bridges, highways, and intersections across Ohio. I am hopeful that the Senate agrees to this plan as well,” DeWine said in a statement after the agreement was announced. But the Ohio Senate is opposed to the 11-cent figure, and previously passed a bill that would institute a six-cent hike. A joint conference committee composed of six members has been meeting since Wednesday, but failed to reach an agreement. Senate President Larry Obhof (R-Medina) has been relatively quiet on the matter, but spoke with reporters Friday about the negotiations. “We will continue conversations and will all be back on Monday or Tuesday of next week. So I think it’s just a matter…

Read the full storyWalz’s Revised Budget Proposal Still Includes 20-Cent Gas-Tax Increase

Gov. Tim Walz (D-MN) was forced to reexamine his budget proposal “line by line” after the state’s budget forecast came up $492 million short of November’s estimated $1.5 billion surplus. But his recently released revised budget recommendations still include a 20-cent gas-tax hike. “The governor recommends the state commit to a major transportation investment plan to fund the estimated $6 billion gap that exists between funding needs and available revenues over the next 10 years. The governor proposes filling the $6 billion gap in road and bridge funding by initiating a 20 cent gas tax increase, including fuel in distributor storage at the start time of each increase,” the budget recommendations state. Walz is also calling for increasing the registration tax from 1.25 percent to 1.5 percent and increasing the motor vehicle sales tax from 6.5 percent to 6.875 percent. “This is not a choice between whether we want the gas tax or not. It’s a choice between living in a state with the best transportation system in the country or one with crumbling roads and bridges,” Walz said in February when unveiling his initial budget proposal. Overall, Walz’s budget proposal would raise spending by more than $3 billion, increasing…

Read the full storyBuckeye Institute Blasts Tax Hike, Warns Legislators: ‘Don’t Increase the Tax Burden on Ohioans!’

A joint committee of the Ohio House of Representatives and Senate was convened Wednesday in the hopes of reconciling the major divides in their respective transportation budgets. As they work towards a solution, one state think tank is reminding them not to forget the consequences Ohio citizens will face as a result of their decisions. House Bill 62 (HB 62), the 2020-21 Ohio Transportation Budget, the first major bill proposed of newly-elected Ohio Republican Governor Mike DeWine’s tenure, called for an 18 cent gas tax increase. It would go into effect immediately and carry no tax offsets. The Ohio House of Representatives revised the proposal to 10.7 cents and ordered it to be phased in over three years. Most recently, the Ohio Senate dropped the tax rate even lower to six cents. None of the proposals carry a complete tax offset. In this joint session, the legislators hope to reconcile differences, yet DeWine has maintained from day one that his 18 cent proposal is “a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy.” The Buckeye Institute, an independent think tank whose focus is “to advance free-market public policy” has acknowledged that a gas tax increase is…

Read the full storyOhio Senate Breaks Even Further from Governor DeWine, Lowering Gas Tax to Six Cents

The Republican-held Ohio Senate joined Republicans in the House of Representatives in opposing Gov. Mike DeWine on his proposed gas-tax hike. House Bill 62 (HB 62), the 2020-21 Ohio transportation budget, first proposed by DeWine on Feb. 12, originally called for an 18 cent increase to the current gas tax. This was the first major bill proposal of his term. He called the measure “a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy.” In his State of the State address, as well as in other forums, he maintained that this was the absolute lowest the tax could be and would have to go into effect immediately. After being referred to the House, the Republican-held legislature broke significantly from the governor, lowering the rate to 10.7 cents and ordered it to be phased in over three years. “If they pass the House bill, we’re going to end up with the worst of all worlds,” DeWine said in response. He was insistent that the 18 cent number was the only acceptable rate. While DeWine seemed hopeful he could convince the legislature to return to his 18 cent number, the Ohio Senate seems to be making it clear that 18…

Read the full story