Gov. Bill Haslam has a history of supporting tax increases. His current proposal to increase the gas tax by 7 cents per gallon and diesel fuel by 12 cents per gallon in 2017 is no aberration, it is part of a consistent pattern. In 2004, newly elected Knoxville Mayor Bill Haslam raised the city’s property taxes approximately 13%, but claimed the property tax rate was the lowest in several years. Former Lt. Governor Ron Ramsey challenged the claim saying that a reappraisal which lowered the overall rate, did not lower the overall percentage increase. Years earlier, Haslam was being schooled by his father on the need to raise taxes in Tennessee. Jim Haslam II, was a board member of Citizens for Fair Taxes, a group planning a public education blitz about Tennessee’s “state budget crisis” as a prelude to supporting Don Sundquists’ proposal for a state income tax. Fast forward to 2010 when Haslam, during his first gubernatorial campaign materials stated affirmatively that, “…taxes are job killers. The last thing we should do is raise taxes on a population that is already struggling and a small business community that has been forced to cut back,” and, that: “Tennessee already has the highest…

Read the full storyTag: gas tax increase

House Transportation Committee Fails To Advance IMPROVE Act, Despite Multiple Tactics By Chairman Doss

The House Transportation Committee failed to advance Gov. Haslam’s IMPROVE Act (HB 0534) on Tuesday, despite multiple tactics employed by Chairman State Rep. Barry Doss (R-Leoma), a vigorous proponent of the governor’s gas tax increase proposal, to accomplish that outcome. The committee voted instead to roll the vote over for another session in one week. Voting in favor of a one-week delay were Representatives David Alexander (R-Winchester), Dale Carr (R-Sevierville), Timothy Hill (R-Blountville), Bo Mitchell (D-Nashville), Courtney Rogers (R-Goodlettsville), Bill Sanderson (R-Kenton), Jerry Sexton (R-Bean Station), Terri Lynn Weaver (R-Lancaster) and Jason Zachary (R-Knoxville). Voting against the delay were Chairman Doss, and Representatives Barbara Cooper (D-Memphis), Bill Dunn (R-Knoxville), Kelly Keisling (R-Byrdstown), Eddie Smith (R-Knoxville), Ron Travis (R-Dayton), Sam Whitson (R-Franklin), John Mark Windle (D-Livingston). Chairman Doss initially declared that the motion to delay the vote for one week had failed, even though the roll call vote was 9 to 8 in favor the delay. When several members vocally objected, Chairman Doss declared the motion passed and the meeting was quickly adjourned. The day began in subterfuge, when Chairman Doss held a bill review session one hour prior to the scheduled full committee meeting. That bill review session was…

Read the full storyCommentary: Governor’s Gas Tax Plan Hurts the ‘Little Guy’

The Tennessee Department of Transportation (TDOT) boasts on its website that: “Tennessee’s conservative process of funding its highway program is often referred to as a ‘pay as you go’ program. The agency only spends the funds that are available through its dedicated revenues, the highway user taxes and fees, and federal funding.” For consumers, the Governor’s proposal adds a 7-cent increase per gallon for gas and a 12-cent increase per gallon for diesel with future increases tied to the Consumer Price Index. The plan also includes a $5.00 increase to vehicle registration prices. Americans for Tax Reform and the Brookings Institute agree, that higher gas prices negatively impact economic growth and low to moderate income households: “…higher gas prices drain purchasing power from the economy. That means that these families get hit twice: once by the direct impact on their household budgets but a second time when higher prices retard the economic recovery.” Add to that, higher fuel taxes are likely to add to the cost of consumer goods when the increased cost paid by businesses is passed onto consumers. even with the tax cut in taxes paid by businesses included in the Governor’s plan. There is also a modest half…

Read the full storySenate Transportation Committee Approves 15 Percent Increase in TDOT Budget That Includes $278 Million From IMPROVE Act Funding

The State Senate Transportation Committee voted on Monday to approve the Tennessee Department of Transportation’s (TDOT) 2017-18 budget of $2.2 billion, an increase of 15 percent over the 2016-17 budget of $1.9 billion. Five members of the committee voted in favor of the increased funding, while three passed on the vote. Senators Richard Briggs (R-Knoxville), Becky Massey (R-Knoxville), Jim Tracy (R-Shelbyville), Jeff Yarbro (D-Nashville) and Chairman Paul Bailey voted for the budget, while Senators Mae Beavers (R-Mt. Juliet), Janice Bowling (R-Tullahoma) and Frank Nicely (R-Strawberry Plains) passed. Senator John Stevens (R-Huntingdon) did not respond for the roll call vote. The additional $300 million one year increase in the budget incorporates $278 million in additional funding that comes from the 7 cents per gallon tax increase (and 12 cents per diesel gallon tax increase) included in Gov. Haslam’s controversial IMPROVE Act proposal. The move sets up a conflict between the current version of Gov. Haslam’s plan, which passed through the House Transportation Subcommittee last week in an unusual legislative maneuver which required the governor’s allies to bring in House Speaker Pro-Tem Curtis Johnson (R-Clarksville) to break a 4-4 tie in committee. The bill that passed through the House Transportation Subcommittee temporarily…

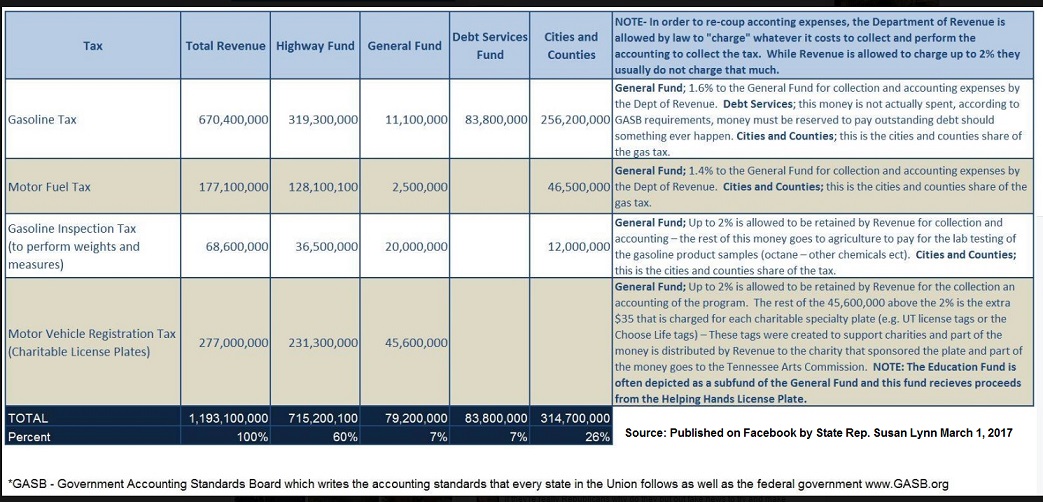

Read the full storyState Rep. Susan Lynn Confirms User Fees are ‘Diverted From the Highway Fund’ in Email Sent to Entire Tennessee General Assembly

“I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes,” State Rep. Susan Lynn (R-Mt. Juliet) told a constituent in an email, confirming The Tennessee Star’s report that Highway Fund user fees are being allocated to the General Fund, Education and Debt Service. The constituent had forwarded a link to The Star’s report on Wednesday that “The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service.” In the email reply to her constituent, Rep. Lynn copied every member of the Tennessee General Assembly in both the House and Senate, ensuring that they have knowledge of the “diversion” of user fees from the Highway Fund. You can read the first part of Lynn’s reply to her constituent here: I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes. Each amount makes perfect sense. Please see my slide below with…

Read the full storyState Rep. Barry Doss Dodges Key Questions on Haslam Gas Tax

After Gov. Haslam ally and gas tax advocate State Rep. Barry Doss (R-Leoma) voted “yes” in the House Transportation Subcommittee on Wednesday to send the governor’s IMPROVE Act to the full Transportation Committee which he chairs, The Tennessee Star contacted him and asked three simple, yet key questions pertinent to any further consideration of the gas tax: Can you confirm that 25% of Highway Fund user fees go to the general fund? Can you confirm that suppliers and retailers of both gas and diesel can hold the tax money anywhere from 20-51 days depending on the month before remitting to state per dept. of revenue fuel tax schedule?” Was there any particular reason these important and highly relevant issues were not raised prior to the subcommittee vote today? Rep. Doss did not respond to The Star prior to our deadline. As the House Transportation Committee which he chairs now takes the IMPROVE Act under consideration, Rep. Doss has an opportunity to bring the answers to these questions out in the open for public consideration. The answers to those questions are of great relevance to the public, since “[o]ne of the principles asserted by Governor Haslam in support of his IMPROVE…

Read the full storyState Rep Andy Holt Skewers pro-Gax Tax Hike Republicans in Blistering Facebook Rant

Wednesday afternoon, State Representative Andy Holt let loose with a blistering rant against the House Transportation Committee’s arcane maneuvers to pass Gov Bill Haslam’s IMPROVE Act, going so far as to include a photo of a bag of thirty pieces of silver. Via Facebook: Well everyone, The Governor’s gas tax just passed out of the House Transportation Sub-Committee. That’s what you expected from the “fiscally conservative” super-majority controlled republican House of Representatives here in Tennessee, right? So. Gross. If allowed to pass, your taxes are about to go up by HUNDREDS of MILLIONS of dollars in Tennessee — literally!! You all need to know something. You need to know the truth. You deserve the truth. The “media” will likely tell you that the tax was “stripped out of the bill”. That’s not true, and they know it isn’t… This episode of political theater was a well orchestrated display. The bill will soon be returned to its original form so they can add back all the taxes, and possibly more… Worst part of all? The “media” has been told by countless people what’s going on behind the scenes. They’ve literally been shown proof of corruption, lies, and quid pro quo, but…

Read the full storyGas Can Man Leads Opposition to Haslam Tax Increase

Gas Can Man cheered gas tax opponents at Wednesday’s legislative hearing. Making his grand entrance before the hearing, Gas Can Man strode in the room carrying a sign reading, “Haslam’s a Pain In My Gas.” Clearly the rock star of the event, he was photographed and videorecorded by admiring fans. Some even wore t-shirts bearing his likeness. He was surrounded by shouts of “Tank the Tax!” The packed hearing room was filled mostly with people there on behalf of the conservative group Americans For Prosperity, which opposes the tax. Having arrived early, they were able to grab a seat. People who couldn’t find a seat were sent to an overflow area outside the room where they could watch the proceedings on a TV screen. Among those who came from across the state was Chelsea Houk, who lives in Knoxville with her husband Zachary. The 26-year-old grew up in a family in which politics was rarely discussed to keep the peace. But now she finds that approach a misguided quest that doesn’t do anything to keep change at bay. “It provides a false sense of security,” she said. A farmhand who works with show horses, Houk these days finds…

Read the full story25 Percent of Highway Fund ‘User Fees’ Are Allocated to General Fund, Education, and Debt

One of the principles asserted by Governor Haslam in support of his IMPROVE Act and its proposed increase of 7 cents per gallon in the gas tax is that “users” of roads should pay for road construction. The gas tax is proper, he argues, because people who purchase gas to fuel their cars are the users of roads, and the gas tax is the best mechanism to charge them for that usage. For at least a decade, however, revenue sources originally designed to fund highway construction have been intermingled, and that “user” fee principle has not strictly been applied to the funding of road construction. The IMPROVE Act does not fully address the co-mingling of funds. The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service. Though the majority of these “user fee” revenues have been allocated to the Highway Fund, between 25 percent and 29 percent of those fees -ranging from $177 million to $196 million annually– have been diverted away from the…

Read the full storyNashville Talk Radio Led Opposition to Sundquist Income Tax But Is Split on Haslam Gas Tax

When former Gov. Don Sundquist proposed imposing a state income tax on residents of Tennessee in 1999, Nashville talk radio hosts Steve Gill and Phil Valentine led the horn-honking opposition that ultimately killed the unpopular proposal three years later in 2002. It is a different media landscape in 2017, as political controversy surrounds Gov. Haslam’s proposal to increase the gas tax to fund road construction. Like Sundquist, Haslam is a Republican. WLAC, 1510 am, is no longer in the local political talk business. 99.7 FM WWTN owns the local conservative talk market, with all local hosts, beginning at 5 a.m. with Ralph Bristol, 9 a.m. with Michael Del Giorno, noon with Dan Mandis, and 3 to 7 p.m. with Phil Valentine. The day’s talk agenda is set by Nashville’s Morning News host Ralph Bristol, and he testified before the State Senate Transportation Committee in favor of Gov. Haslam’s plan, provided it is truly revenue neutral, which he says it currently is not. Former Nashville talk radio host Steve Gill, in contrast, came out guns a-blazing in opposition to the gas tax increase in a commentary posted today at The Tennessee Star. “17 years ago, talk radio lead the fight to stop…

Read the full storyCommentary by Steve Gill: It’s Not About the Roads!

As Governor Bill Haslam continues to tout the need for a massive tax increase in order to fund road and bridge construction and maintenance in Tennessee it is increasingly clear that the well-funded and heavily lobbied campaign for higher taxes actually has nothing to do with roads. It is actually about spending billions in surplus and increased recurring revenue on everything EXCEPT roads! A good magician is a master of misdirection. While you are captivated by what they are doing with their right hand the real trick is happening in the left hand. Governor Haslam is using the same sort of misdirect move to hide the truth about his tax increase scheme. While Tennessee currently has a surplus of a billion dollars AND an extra billion dollars in recurring revenue the Governor is fighting against any an all efforts to spend ANY of that money on roads. He prefers to impose higher taxes on Tennessee drivers with a seven cent increase in the gasoline tax and a twelve cent increase in the diesel tax (plus additional fees and taxes) that will generate about $300 million a year more for state and local road projects. State Representative David Hawk has proposed…

Read the full storyRalph Bristol Testifies Before State Senate Transportation Committee on Gas Tax Increase Proposal

At the invitation of Chairman State Sen. Paul Bailey, 99.7 FM WWTN’s Ralph Bristol, host of Nashville’s Morning News, testified before the State Senate Transportation Committee on Monday afternoon about Gov. Haslam’s proposal to pay for additional road construction funding by increasing the state’s gas and diesel tax. Bristol provided The Tennessee Star with this summary of his prepared statement, which he authorized us to release after 1:30 p.m. today, when he was scheduled to deliver his testimony. Here is the complete final draft of his prepared statement, as provided to The Star late Monday morning: Testimony to Senate Transportation Committee (final draft) By Ralph Bristol, host, Nashville’s Morning News, 99.7 WTN (approx. 7:00) I’ll try to honor Chairman Bailey’s request to share a summation of my radio audience’s response, over the past few months, to the proposals before them, including, but not limited to the governor’s, to increase transportation funding, and to offer my own insight, however limited value that might have. First, understand that I understand my audience is not representative of all of Tennessee. Nor, might I add, are the fans of of the Tennessean or the Memphis Commercial Appeal, but I digress. People who listen to…

Read the full storySource: State Rep. Barry Doss Huddled With Gov. Haslam’s Top Staffer to Stop Hawk Plan at Subcommittee

Reporting by the Chattanooga Times Free Press that State Rep. Barry Doss (R-Leoma), a strong supporter of Gov. Haslam’s plan to increase gas taxes by 7 cents a gallon to fund more road construction, was the driving force behind the sudden adjournment of the Transportation Subcommittee on Wednesday prior to the expected vote on the Hawk Plan, the popular alternative to the governor’s plan, was re-enforced by photographs of the event taken by The Tennessee Star. In that photo, Doss is seen having an intense conversation with two unidentified individuals immediately before the sudden vote to adjourn was taken. According to a long-time legislative operative, the people in the photo appear to be State Rep. Barry Doss, Stephen Smith (the governor’s recently named legislative director) and an unnamed political operative with a beard. If indeed the person whose back is to the camera is Stephen Smith, it would underscore the governor’s near-panic that his gas tax was in major trouble last Wednesday. “I have seen sneaky legislative maneuvers before,” said the source. “And the presence of Stephen Smith huddled together with the governor’s lackey, Rep. Doss, would be understandable. The governor sending his #1 staffer to the legislature at this…

Read the full storyHaslam Gas Tax Hike Opponents Gather at ‘Tank the Tax’ Rally Set for Wednesday

As the Haslam IMPROVE Act plan to increase fuel taxes returns to the Transportation Subcommittee on Wednesday March 1, Americans for Prosperity and other activists plan to “turn up the heat” by gathering at Legislative Plaza to express opposition to the proposed tax increases. The Transportation Subcommittee, Chaired by Rep. Terri Lynn Weaver (R-Lancaster), is scheduled to meet at noon. Andy Ogles, Tennessee Director of Americans for Prosperity, said that activists will be coming from across the state to express opposition to the proposed tax increases. “Once taxpayers realize that the huge tax increases proposed by the Governor are coming when we have a TWO BILLION DOLLAR SURPLUS their reaction to the plan becomes almost a unanimous ‘NO’ and they can’t understand why their elected officials are even entertaining the idea,” Ogles noted. “The only way the Haslam Plan passes is if their supporters successfully hide the truth about what the plan actually means to the wallets of working men and women in Tennessee. To stop it, we simply need to get the truth out and encourage taxpayers to get engaged in this fight.” Ogles also expressed concern about the glaring absence of conservative leadership in the Legislature on this issue.…

Read the full storyGovernor’s ‘Transparent Tennessee’ Does Not Apply to Fuel Tax

Three years ago when the “Transparent Tennessee” website was launched, Governor Haslam said: “A state government that is accountable to Tennessee taxpayers is an important part of being customer-focused, efficient and effective. The advanced function of this website will allow citizens more access to information about how state dollars are spent.” Last year Haslam disclosed that the 2016 budget would repay the transportation fund $261 million dollars that was transferred to the general operating fund during the Sundquist and Bredesen administrations to close budget shortfalls. “We have a covenant with our citizens that the gas tax charged by the state at the pump is dedicated to transportation-related purposes and not something totally unrelated,” State Sen. Jim Tracy (R-Shelbyville) said several months before the 2016 legislative session began, urging that this repayment be made. This is called “dedicated funding” and according to TDOT, “[n]o money from the state’s general fund, which relies on the sales tax, is used in any of the programs of the Tennessee Department of Transportation. But it seems that not all state fuel tax monies reach TDOT before being diverted to the general fund. Issues raised after Wednesday’s Sumner County gas tax town hall call into question the transparency…

Read the full storyMore Unanswered Questions at Gov. Haslam’s Sumner County Gas Tax Town Hall

On Wednesday evening, Governor Haslam spoke about his proposed 7 cent gas tax and 12 cent diesel tax increase at Sumner County’s Station Camp High School to a group of about 300 people, around 100 of whom received a personal email invitation from County Executive Anthony Holt. The governor, joined by Department of Transportation Commissioner John Schroer on a stage with local elected officials, delivered an abbreviated and less energetic version of his state of the state address that he had delivered at his previous town hall style meetings. These events have afforded the opportunity to fact-check the claims the governor has been making since the launch of his IMPROVE Act at a press conference on January 18, and Wednesday’s Sumner County Town Hall showed that the number of unanswered questions has not diminished as his tour of the state has gone on. According to the governor, Tennessee does not use bond debt to fund roads, but his budgets for 2016-17 and 2017-18 included $88 million and $80 million in bond debt, respectively. The Tennessee Star’s Laura Baigert pressed the governor on claims that this year’s budget, like past budgets, keeps various funds separate. How, she asked, did the governor…

Read the full storyPure Foods Goes Bankrupt After Benefiting From $1.2 Million in Tennessee State Economic Development Funds

Less than two weeks before Governor Haslam introduced his IMPROVE Act centered on a gas tax increase for road funding, Pure Foods, Inc., a recipient of $1.2 million in state economic development funds, filed for bankruptcy. The $1. 2 million from the state’s FastTrack Economic Development (ED) Fund did not go directly to Pure Foods. Instead, it was allocated for use by KEDB for construction of a speculative building that Pure Foods leased for 10 years. According to the Kingsport Tennessee Times News, in March 2015, the Canadian based gluten-free snack food company, Pure Foods, Inc., was set to establish its U.S. headquarters at the Gateway Commerce Park in Kingsport, Sullivan County. The deal included an investment of $22 million, an 80,000-plus square foot facility, and the creation of 273 new jobs generating an annual a payroll of $8 million. The Kingsport Economic Development Board (KEDB) and the Kingsport Chamber of Commerce also supported the project by providing financial assistance and various incentives, including the purchase of 33 acres of land in the Gateway Commerce Park for $6.5 million borrowed from First Tennessee Bank. According to the Transparent Tennessee website’s FastTrack Project Database, ED grants provide additional support for…

Read the full storyBREAKING: Gov. Haslam Claims ‘There Have Not Been Any Other Alternatives Proposed’ To His Gas Tax Increase

“Gov. Bill Haslam did not acknowledge the multiple alternatives to his proposed gas tax increase that legislators have introduced in the statehouse during an interview with Knoxville media Friday,” WBIR TV reports. “There have not been any other alternatives proposed. No one else has laid out a plan and said ‘This is how we’re going to pay for it,’” WBIR reports Haslam stated when asked about alternative plans to fund road construction, such as The Hawk Plan, which would provide that funding by reallocating 0.25 percent of the current sales tax. “He’s very aware of other plans,” State Rep. David Hawk (R-Greeneville), author of The Hawk Plan, told WBIR: Hawk said he has discussed his plan with Haslam of taking one-quarter of one percent of sales tax revenue to create a recurring dedicated fund to address transportation needs long-term. Rep. Jason Zachary of Knoxville said his constituents are pushing him to find an alternative to a tax increase by pointing out the state is sitting on a $1 billion dollar budget surplus and another $1 billion surplus is projected for this year. He has proposed allocating a quarter of any state surplus money over $5 million each month to TDOT.…

Read the full storyReagan Economist Art Laffer to Subcommittee Hearing on Gas Tax: ‘We Don’t Need More Taxes In Tennessee’

“We don’t need more taxes in Tennessee,” well-known economist Arthur Laffer told the House Transportation Subcommittee on Wednesday at a hearing about Gov. Haslam’s proposed gas tax increase. Laffer, who gained international prominence during the Reagan Era as the author of “the Laffer Curve” –which showed government revenues increase as high taxes are cut– testified before the subcommittee at the invitation of House Transportation Subcommittee Chair State Rep. Terri Lynn Weaver (R-Lancaster). He is probably most well-known for his role on the Economic Advisory Board under President Reagan. He has a B.A. in Economics from Yale University and his Ph.D. from Stanford University. The renowned economist “made a calculation” and came to Tennessee 10 years ago, leaving the heavily taxed state of California. He hasn’t looked back. “Economics is all about incentives. People like doing things they find attractive and dislike doing things they find unattractive. Taxes change the attractiveness of activities,” Laffer told the subcommittee: If you look at taxes, all taxes are bad, but some are worse than others. What you want to do is you want to collect your tax revenues in the least damaging fashion possible and you want to spend the proceeds in the most beneficial fashion…

Read the full storyGov. Haslam to Hold ‘Town Hall’ on Gas Tax Increase Monday in Winchester

Gov. Haslam will “hold a town hall meeting on proposed gas tax increase” on Monday, February 20, at 6:00 pm in Winchester, the Franklin County seat, the Winchester Herald Chronicle reports: Gov. Bill Haslam will be in Franklin County Monday to discuss his plan for a 7 cent tax increase per gallon on gasoline and 12 cents on diesel to go toward roadway improvements. The meeting will be held at 6 p.m. at the Franklin County Annex Building [located at 855 Dinah Shore Blvd. in Winchester, 90 miles southeast of Nashville]. The purpose of the event, which is open to the public, is to provide a forum on a plan focusing exclusively on increasing much-needed funding to repair and maintain safe highways and bridges throughout Tennessee. Haslam has also proposed that sales tax be reduced on food products. Curiously, the governor’s website makes no mention of the event, which the Herald Chronicle calls “a town hall” in its headline, but which sounds more like another stop in the governor’s promotional tour for his proposed 7 cents a gallon gas tax. Typically, a town hall on a particular public policy topic is an open discussion of all possible solutions on that…

Read the full storyBradley County Commissioner Proposes Resolution of Disapproval for Gov. Haslam’s Gas Tax Increase

“Bradley County Commissioner Dan Rawls is proposing a resolution that would express the Commission’s disapproval of Gov. Bill Haslam’s proposed gas tax hike,” the Cleveland Banner reports: Rawls’ resolution says the increase would be “a further tax burden on Bradley County residents that can least afford the additional tax.” “I always think it’s a better idea to cut spending than to raise taxes,” Rawls said. “The state hasn’t done that great a job. Gov. Haslam has overseen the largest increase in the size of government of any Tennessee governor.” He said although the state is portraying “a big problem with roads,” the state “thought it was a good idea” to spend $123 million on a new state library. “I don’t see how that’s good fiscal policy,” Rawls said. Not all Bradley County Commissioners think passing a resolution opposing the gas tax increase is the right action for the County Commission to undertake. “Commissioner Milan Blake said he had been talking to state legislators who are telling him ‘to wait on something like this [passing a resolution opposing the gas tax increase] right now,’ ” the Banner reported. “Vice Chairman Jeff Yarber said he agreed with opposing the increase, but…

Read the full story