House Majority Leader Glen Casada (R-Franklin), issued a press release Monday defending his vote to increase the gas tax through Governor Haslam’s IMPROVE Act, after initially announcing on February 8 his support for the alternative Hawk Plan. The press release was forwarded via email, addressed to “Friends,” stating “I wanted to forward a statement I released to the press regarding my vote on the IMPROVE Act.” If the comments on Rep. Casada’s Facebook page responding to posts on the gas tax, the overwhelming majority of which are against the gas tax, is representative of other feedback he’s been getting, it likely prompted Casada’s need to explain his vote. The cover email continued, Though I still believe there was a better way to fund road construction for Tennessee that did not raise taxes, I did vote for the amendment that was the IMPROVE Act. My support for the alternative plan that would have shifted funds to the Department of Transportation without raising the gasoline tax died twice in committee and again on the House floor. Thus, my only option was to do nothing on road funding, or vote for the IMPROVE Act – the next best vehicle available to attain our goal of…

Read the full storyTag: Hawk Plan

House Republican Conservatives Put Up a Valiant Fight Against Gov. Haslam’s Gas Tax Increase, Setting Stage for 2018 Election

When the Tennessee House of Representatives passed Governor Haslam’s gas tax increase bill by a 60 to 37 margin on Wednesday, a bare majority of Republicans–37 for and 35 against—voted yes in favor of the unpopular tax increase. The 35 conservative Republicans who stood for the foundational principle of limited government were not sufficient to withstand the huge financial and political pressures mounted by the special interests who wanted the bill to pass. Those forces arrayed against the conservative opposition were significant, beginning with Governor Haslam’s taxpayer funded statewide tour that promoted a 962 road project list in all 95 counties, the support of lobbying groups numbering in the thirties, tax reductions for a select group of businesses, and a reported $250 million taxpayer funded deal for the Democrats. These conservatives lost the battle in 2017, but the war for the Tennessee General Assembly election in 2018 has just begun. The arguments made by these 35 stalwarts on the floor of the House on Wednesday will resonate throughout the state over the next year and a half. The process through the House subcommittees and committees was not without controversy including the make up of the Transportation Committee, procedural issues, breaking…

Read the full storyGas Tax Increase Passes House Finance Committee on a Voice Vote

Rep. Charles Sargent (R-Franklin), chairman of the House Finance, Ways, and Means Committee, presided over a voice vote on Tuesday that advanced the controversial IMPROVE Act “Tax Cut Act of 2017” to the Calendar and Rules Committee, where it awaits scheduling for a vote on the floor of the full House. Rep. Barry Doss (R-Leoma), as sponsor of the bill, once again presented the features of the IMPROVE Act “Tax Cut Act of 2017.” Doss unexpectedly made a point of saying that the renaming of the bill last week to include The Tax Cut Act of 2017 was something that was not important to him, but it was to its sponsor, Rep. Gerald McCormick (R-Chattanooga). Chairman Sargent allowed a leisurely-paced question and answer period from Committee members to Rep. Doss, which came primarily from Democrat members of the Committee. Rep. Mike Carter (R-Ooltewah) pointed out that while he wished it wasn’t included in the IMPROVE Act “Tax Cut Act of 2017”, he wouldn’t vote for a bill that didn’t include the change from the franchise and excise tax to the single sales factor due to the loss of Polaris from his district to the state of Alabama. Rep. David Hawk (R- Greeneville)…

Read the full storySenate Transportation Committee Approves 15 Percent Increase in TDOT Budget That Includes $278 Million From IMPROVE Act Funding

The State Senate Transportation Committee voted on Monday to approve the Tennessee Department of Transportation’s (TDOT) 2017-18 budget of $2.2 billion, an increase of 15 percent over the 2016-17 budget of $1.9 billion. Five members of the committee voted in favor of the increased funding, while three passed on the vote. Senators Richard Briggs (R-Knoxville), Becky Massey (R-Knoxville), Jim Tracy (R-Shelbyville), Jeff Yarbro (D-Nashville) and Chairman Paul Bailey voted for the budget, while Senators Mae Beavers (R-Mt. Juliet), Janice Bowling (R-Tullahoma) and Frank Nicely (R-Strawberry Plains) passed. Senator John Stevens (R-Huntingdon) did not respond for the roll call vote. The additional $300 million one year increase in the budget incorporates $278 million in additional funding that comes from the 7 cents per gallon tax increase (and 12 cents per diesel gallon tax increase) included in Gov. Haslam’s controversial IMPROVE Act proposal. The move sets up a conflict between the current version of Gov. Haslam’s plan, which passed through the House Transportation Subcommittee last week in an unusual legislative maneuver which required the governor’s allies to bring in House Speaker Pro-Tem Curtis Johnson (R-Clarksville) to break a 4-4 tie in committee. The bill that passed through the House Transportation Subcommittee temporarily…

Read the full storyState Rep. Susan Lynn Confirms User Fees are ‘Diverted From the Highway Fund’ in Email Sent to Entire Tennessee General Assembly

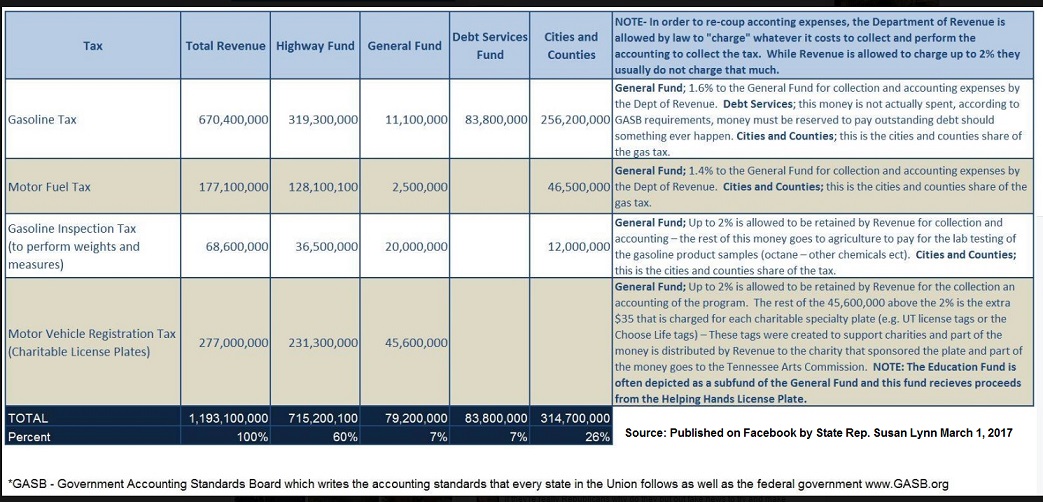

“I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes,” State Rep. Susan Lynn (R-Mt. Juliet) told a constituent in an email, confirming The Tennessee Star’s report that Highway Fund user fees are being allocated to the General Fund, Education and Debt Service. The constituent had forwarded a link to The Star’s report on Wednesday that “The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service.” In the email reply to her constituent, Rep. Lynn copied every member of the Tennessee General Assembly in both the House and Senate, ensuring that they have knowledge of the “diversion” of user fees from the Highway Fund. You can read the first part of Lynn’s reply to her constituent here: I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes. Each amount makes perfect sense. Please see my slide below with…

Read the full story25 Percent of Highway Fund ‘User Fees’ Are Allocated to General Fund, Education, and Debt

One of the principles asserted by Governor Haslam in support of his IMPROVE Act and its proposed increase of 7 cents per gallon in the gas tax is that “users” of roads should pay for road construction. The gas tax is proper, he argues, because people who purchase gas to fuel their cars are the users of roads, and the gas tax is the best mechanism to charge them for that usage. For at least a decade, however, revenue sources originally designed to fund highway construction have been intermingled, and that “user” fee principle has not strictly been applied to the funding of road construction. The IMPROVE Act does not fully address the co-mingling of funds. The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service. Though the majority of these “user fee” revenues have been allocated to the Highway Fund, between 25 percent and 29 percent of those fees -ranging from $177 million to $196 million annually– have been diverted away from the…

Read the full storyCommentary by Steve Gill: It’s Not About the Roads!

As Governor Bill Haslam continues to tout the need for a massive tax increase in order to fund road and bridge construction and maintenance in Tennessee it is increasingly clear that the well-funded and heavily lobbied campaign for higher taxes actually has nothing to do with roads. It is actually about spending billions in surplus and increased recurring revenue on everything EXCEPT roads! A good magician is a master of misdirection. While you are captivated by what they are doing with their right hand the real trick is happening in the left hand. Governor Haslam is using the same sort of misdirect move to hide the truth about his tax increase scheme. While Tennessee currently has a surplus of a billion dollars AND an extra billion dollars in recurring revenue the Governor is fighting against any an all efforts to spend ANY of that money on roads. He prefers to impose higher taxes on Tennessee drivers with a seven cent increase in the gasoline tax and a twelve cent increase in the diesel tax (plus additional fees and taxes) that will generate about $300 million a year more for state and local road projects. State Representative David Hawk has proposed…

Read the full storyShenanigans at the State Capital

Dear Tennessee Star, Shenanigans at the State Capitol never cease. The proposed Gas Tax is a tax that will definitely affect every single Tennessee citizen in more ways than one. The Transportation House Sub Committee suddenly adjourned their meeting last week and the next meeting is at HIGH NOON, March 1 in LP Room 16. I wonder if more time was needed in order to twist more arms in order to vote a certain way. If you like paying more taxes, pay this article no mind. But, if you realize that many politicians can’t spend enough Tennessee citizens’ money…read on and contact the House Transportation Sub Committee members below and then pass this information on to others and ask them to do the same. Haslam’s Gas Tax Proposal The governor proposes a 7 cent increase in gas tax and 12 cent increase in diesel tax Also, there is a pesky automatic index to future gas tax increases…which means this proposed gas tax will automatically increase. That means, this gas tax will keep on taking bigger bites out of your wallet as time moves on, and you, the taxpayer will have no say in the matter. Haslam says that it will be “revenue neutral.” Not buying that one. The math doesn’t add up. Keep in mind of that pesky automatic increase that…

Read the full storyEXCLUSIVE Grassroots Pundit Interview With Sponsor of Hawk Plan to Fund Roads by Reallocating Sales Tax

In an exclusive interview with The Tennessee Star’s Grassroots Pundit, Laura and Kevin Baigert, on Capitol Hill Wednesday, State Rep. David Hawk (R-Greeneville) explained the details of his increasingly popular Hawk Plan to fund additional road construction by reallocating 0.25 percent of the state’s 7 percent sales tax. “We’ve had substantial over collections over the last two and a half years and looking at a third year in a row where we’re over collecting franchise and excise tax, over collecting sales tax collections. Saying that, there’s more money coming in than we had budgeted. Substantially more,” Hawk noted. Several estimates place the current annual surplus at about $950 million. Hawk explained that the 0.25 percent he wants to allocate comes from the 1 percent of the current 7 percent sales tax that is not specifically dedicated to particular state programs. “I found that the last time the legislature increased the sales tax in Tennessee it went from 6 percent to 7 percent in 2002,” Hawk told the Baigerts. ‘Those dollars [collected with that extra 1 percent added to the sales tax that year] were largely unaffiliated,” Hawk explained. “The 6 percent below had strings attached to them,” he continued. “There…

Read the full story