The Metro Nashville Council passed Mayor Freddie O’Connell’s multi billion-dollar transit plan on its first reading during Tuesday’s meeting.

Read the full storyTag: IMPROVE Act

Nashville Mayor Freddie O’Connell Declares His Transportation Referendum ‘Very Progressive’

Nashville Mayor Freddie O’Connell described his “Choose How You Move” transportation referendum as “very progressive” in a Wednesday interview, highlighting the endeavor as one of the most progressive acts of his administration.

O’Connell was asked by The Guardian, which describes itself as “the world’s leading liberal voice,” to what level he views himself “as a progressive leader in a state that is not politically progressive” following the 2022 redistricting process that split Nashville between multiple congressional districts.

Read the full storyNashville’s Legally Dubious $3.1 Billion Transportation Plan Sparks Debate over Future Tax Burden

Ben Cunningham, founder of the Nashville Tea Party, said not only does Nashville Mayor Freddie O’Connell’s $3.1 billion transit referendum, which is expected to be presented to Davidson County voters on the November ballot, appear illegal under the 2017 IMPROVE Act, but its implementation would inevitably raise property taxes for residents.

O’Connell unveiled his transit plan, “Choose How You Move: An All-Access Pass to Sidewalks, Signals, Service, and Safety,” last month.

Read the full storyLegal Battle Brews over Nashville Mayor’s $3.1 Billion Transportation Plan

Ben Cunningham, founder of the Nashville Tea Party, continues to scrutinize the legality of the Nashville mayor’s $3.1 billion transit referendum expected to be presented in front of Davidson County voters on the November ballot.

Mayor Freddie O’Connell unveiled his $3.1 billion transit plan, “Choose How You Move: An All-Access Pass to Sidewalks, Signals, Service, and Safety,” last month. The plan would be funded through a half-cent increase in the city’s sales tax to construct miles of new sidewalks, bus stops, transit centers, parking facilities, and upgraded traffic signals.

Read the full storyMetro Legal Responds to Claim Transportation Referendum Not Legally Authorized

Metro Government has responded to a criticism that Nashville Mayor Freddie O’Connell’s proposed transportation plan is not legal under state law.

Nashville Tea Party founder Ben Cunningham recently called O’Connell’s referendum illegal because it would increase taxes to fund projects he argues are not covered by the IMPROVE Act, like sidewalks and traffic signals.

Read the full storyAmericans for Prosperity – Tennessee Urges Nashville Mayor to Cut City Budget, Protect Residents from Property Tax Hikes Amid $3.1 Billion Transit Plan

Americans for Prosperity – Tennessee (AFP-TN) released a statement Thursday in response to Nashville Mayor Freddie O’Connell’s proposed $3.1 billion transit referendum that will be presented to Davidson County voters on the November ballot.

AFP-TN State Director Tori Venable, noting how Nashville voters rejected then-Mayor Megan Barry’s $9 billion transit plan six years ago, acknowledged the dramatic cost difference in O’Connell’s plan while also pointing out the half-cent increase in the city’s sales tax that will be used to fund the plan.

Read the full storyBen Cunningham Calls Nashville Mayor’s $3.1 Billion Transit Referendum ‘Absurd’

Ben Cunningham, founder of the Nashville Tea Party, said not only does Nashville Mayor Freddie O’Connell’s transit referendum appear to be illegal under the IMPROVE Act, but the transit plan’s overall vision of commuters suddenly switching over to public transport is “absurd.”

O’Connell unveiled his $3.1 billion transit plan, called “Choose How You Move: An All-Access Pass to Sidewalks, Signals, Service, and Safety,” last week, which would be funded through a half-cent increase in the city’s sales tax.

Read the full storyBen Cunningham: Nashville Mayor’s Transit Plan Appears to be Illegal

Ben Cunningham, founder of the Nashville Tea Party, said Nashville Mayor Freddie O’Connell’s transit plan, which is expected to be on the November ballot, is likely illegal under the IMPROVE Act, which passed the Tennessee General Assembly in 2017.

The 2017 IMPROVE Act, signed by former Governor Bill Haslam, permits local governments to seek a dedicated funding source via surcharge to support mass transportation projects through local referendum.

Read the full storyForbes Study: Nashvillians Face America’s ‘Toughest Commute’

According to a study by Forbes Home, those who work in Nashville face the toughest work commute in all of America.

The study analyzed 25 major U.S. cities, including New York and Los Angeles, and using eight separate metrics, determined that Nashville’s workers spend the most time trying to get to work.

Read the full storyTennessee Revenues for January $212.9 Million over Budget

State tax revenues for the month of January exceeded budgeted estimates by $212.9 million, according to the monthly revenue announcement released Wednesday by Department of Finance and Administration Commissioner Jim Bryson.

The state’s surplus in year-to-date tax collections is $1.17 billion through six months.

Read the full storyTennessee’s December Revenues $217 Million More than Budgeted

Tennessee revenues for December were $217.2 million more than budgeted and represented growth of nearly five percent over December 2021, according to Friday’s announcement by the state’s Commissioner of Finance and Administration Jim Bryson.

December is the fifth month, on an accrual basis, of the 2022-2023 fiscal year, and the year-to-date revenues are $959.9 billion in excess of what was budgeted and $655 million over the same time last fiscal year.

Read the full storyGovernor Lee Announces $26 Billion Transportation Proposal

Tennessee Governor Bill Lee recently announced a $26 billion proposal to address transportation needs across the state. Lee’s infrastructure proposal, “Build With Us,” comes as the state’s growth is outpacing roadway capacity investments.

Read the full storyState Revenues in February Exceeded the Budget by $191 Million, Puts Fiscal Year Surplus at $1.3 Billion

Commissioner of the Tennessee Department of Finance and Administration Butch Eley announced Friday that tax revenues to the state for the month of February exceeded the budgeted estimates by $190.9 million, which puts the fiscal year surplus at $1.3 billion.

February revenues of $1.13 billion represent an 11.06 percent growth rate or $112.7 million more than February of last year.

Read the full storyEXCLUSIVE: Tennessee House Speaker Cameron Sexton on Upcoming Legislative Session and Hot Topics

As the 111th Tennessee General Assembly is set to enter its second session, newly elected Speaker of the House Cameron Sexton gave an exclusive interview to The Tennessee Star to discuss legislative priorities and current issues.

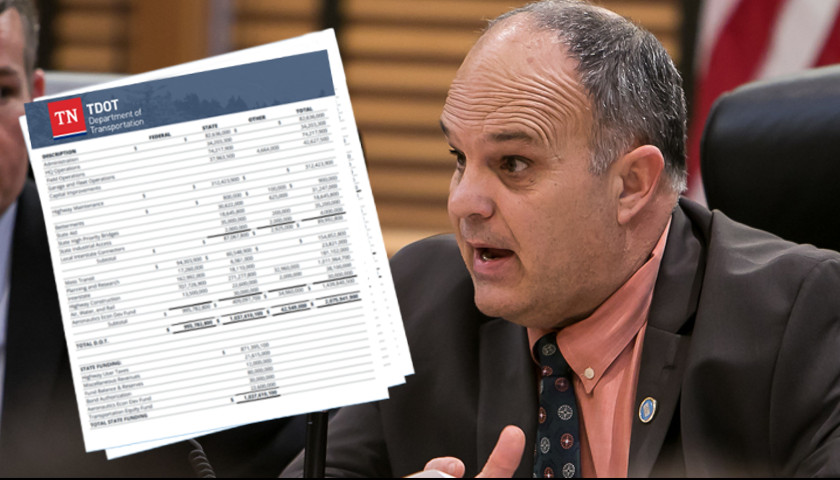

Read the full storyTDOT Reports Timing for Completion of 962 Road Projects Included in the Fuel-Tax-Increasing IMPROVE Act Going from 10 to 20-Plus Years

Tennessee Department of Transportation (TDOT) officials reported last week that the timing for the completion of the 962 projects totaling $10.5 billion included in the fuel tax increasing IMPROVE Act will now take 20 plus years instead of the 10 years originally estimated.

Read the full storyWith One Month Remaining in the Fiscal Year, Tennessee’s Budget Surplus Is Now Up To $649 Million

Department of Finance and Administration Commissioner Stuart McWhorter announced Wednesday that Tennessee’s June revenues were $92.5 million more than the state budgeted for the month, resulting in a total budget surplus of $649.2 million with just one month remaining in the 2018-2019 fiscal year. The state’s revenue collections of $1.6 billion for the month of June, which is the eleventh month of the year on an accrual basis, were $115.3 million more than collected in June of 2018. McWhorter acknowledged that total revenues in June “were notably higher than expected,” which confirms the strength of the Tennessee economy, he said. Revenues have exceeded the budgeted estimates all 11 months of the current fiscal year, with surpluses ranging from a low of $3.2 million in October 2018 to the high of $258.9 million in April 2019. April’s excess revenues alone account for nearly 40 percent of the year-to-date budget surplus. June’s surplus puts revenues to the state 4.8 percent ahead of the budget and 5.6 percent ahead of this time last fiscal year. The Franchise and Excise Tax plus the Sales and Use Tax make up about 80 percent of the State’s total revenues as well as the budget surplus…

Read the full storyOhio Lawmakers Considering A Gas Tax Increase Hear Testimony About Tennessee’s Gas Tax Increase Signed into Law in 2017

COLUMBUS, Ohio – As Ohio lawmakers consider the call by newly-inaugurated Governor Mike DeWine for an increase in motor fuel taxes of 18 cents per gallon on both gas and diesel, both the state House and Senate have heard testimony on the matter. One of the witnesses providing testimony used Tennessee’s 2017 passage of Governor Bill Haslam’s gas and diesel tax increasing IMPROVE Act – Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy – as an example of a gas tax increase successfully implemented over the past several years. American Association of State Highway and Transportation Officials (AASHTO) is a non-profit, non-partisan association representing highway and transportation departments in all 50 states plus the District of Columbia and Puerto Rico, according to its website. “Its primary goal is to foster the development, operation, and maintenance of an integrated national transportation system,” representing all transportation modes including air, highways, public transportation, active transportation, rail and water. Jim Tymon, Executive Director of AASHTO since January 2019, submitted a written copy and presented verbal testimony at the Ohio State House Finance Committee earlier this week, and to the Ohio State Senate Transportation, Commerce and Workforce Committee the following day. Tymon’s nine-page…

Read the full storyStokes Nielson’s Tweet On New Podcast Questioning Possible Senate Hopeful Bill Haslam’s Gas Tax Goes Viral

Stokes Nielson’s tweet about his podcast, “The Spirit of Humanity,” which raises questions about former Governor and possible U.S. Senate hopeful Bill Haslam relative to gas tax increases, goes viral with over a half million impressions within hours of its pre-release. As reported by The Tennessee Star, Stokes launched a new issue advocacy initiative called Stokes For Tennessee Freedom to provide a two-way dialogue on issues that could impact Tennessee citizens. Stokes’ first podcast of the new initiative, “The Spirit of Humanity,” was launched through Stokes & Friends on the Westwood One Podcast Network and featured international sensation Korean-born BTS, the “biggest new force in pop” according to Spotify, Dua Lipa, South Korean boy-band Day6, Chinese-Canadian actor, single and songwriter Kris Wu, and country superstar Tim McGraw. In a press release about the podcast, Stokes said that, per his normal practice, he tweeted out the podcast episode to his followers in a pre-release on Tuesday, February 26. Within hours, the tweet had gone viral with nearly 600,000 impressions, which “propelled the episode immediately into the Top 100 of Apple Music Podcasts,” reported Stokes. According to the award-winning songwriter and producer, Stokes, when he inadvertently encountered a fiery street protest in…

Read the full storyDemocrat Gubernatorial Candidate Karl Dean Calls for Higher Gas Taxes

Democratic Party candidates in California are starting to distance themselves from a 12 cent a gallon gas tax increase imposed on drivers in their state and which is subject to a repeal effort this Fall. At least 4 Democrat candidates are turning against their own party on the issue of increased gas taxes. But in Tennessee, Democrat gubernatorial candidate Karl Dean is not only embracing last year’s IMPROVE Act fuel tax increase that raised gas and diesel taxes over $300 million a year, he wants to allow local governments to raise the fuel taxes even higher. Dean, a former two-term mayor of Nashville, says the state needs to expand on the IMPROVE Act, the 2017 law that increased gas taxes 6 cents a gallon and diesel taxes 10 cents per gallon. The tax increase was passed while Tennessee enjoyed about a $2 billion dollar SURPLUS. The phased in gas tax increase went up another one cent per gallon on July first. The final cent in the six cent increase goes into effect July 1, 2018. “Unlike my opponent,” Dean said in endorsing local option fuel tax increases, “I believe passing the IMPROVE Act was the right move for Tennessee. But…

Read the full storyTennessee House District 75: Bruce Griffey Challenge to Rep Tim Wirgau Has Become a House Race to Watch

While much of the focus during the Republican primary season has been on the 18 House seats vacated by Republican legislators who are retiring or seeking other offices a handful of challenges to incumbents are attracting increasing attention. One of those races is in West Tennessee’s 75th District (covering Henry, Stewart and Benton counties) where incumbent Tim Wirgau is facing serious competition from Bruce Griffey. Wirgau has been in the Legislature since 2011 and chairs the House Local Government Committee. Bruce Griffey is an attorney and Chairman of the Henry County Republican Party who lives in Paris, TN. Griffey has taken Wirgau to task for Wirgau’s vote in support of providing taxpayer funded in-state tuition for illegal aliens (2016 HB 675). Illegal immigration has topped the list of Republican voter concerns in Tennessee and opposition to providing in-state tuition to illegals has been extraordinarily high according to polls of likely Republican primary voters. A Tennessee Star poll conducted in December 2017 that focused on GOP Primary voters underlined how support for using taxpayer funds to subsidize tuition for illegal aliens may be harmful to Republican candidates facing primary opposition. Those polled were asked: In 2018, the Tennessee state legislature is expected…

Read the full storyGas Tax Increases Another 1 Cent Per Gallon Today Thanks to Gov. Haslam, Democrats, and ‘Moderate’ Republicans

The state gas tax increased another 1 cent per gallon today, thanks to the IMPROVE Act passed by Democrats and “moderate” Republicans in the Tennessee General Assembly and signed into law by Gov. Bill Haslam in May 2017. The controversial law raised state gas taxes by 6 cents per gallon and diesel taxes by 10 cents per gallon. The gas tax increases were phased in over three years. The first 4 cents per gallon increase went into effect on July 1, 2017. An additional 1 cent per gallon gas tax increase goes into effect today, and the final 1 cent per gallon gas tax increase goes into effect July 1, 2018. The law was deemed necessary to fund road construction by Haslam and his allies despite the fact the state of Tennessee had a $2 billion surplus at the time it was passed and signed into law. One under reported element of the law at the time was a provision that allowed the twelve largest counties in the state to hold local referendums to increase local taxes to fund transportation projects. It was this provision upon which former Nashville Mayor Megan Barry relied when she introduced her $9 billion transit…

Read the full storyDemocrat PAC Uses Fear Mongering and Deception to Malign Conservative Legislators, Praises Governor Haslam On Gas Tax Increase

LEBANON, Tennessee – A newly launched Political Action Committee (PAC) commissioned a billboard with a scandalous message attacking two conservative middle Tennessee lawmakers, former State Senator Mae Beavers (R-Mt. Juliet) and current State Senator Mark Pody (R-Lebanon), for their votes against Governor Haslam’s gas tax increasing IMPROVE Act. The IMPROVE Act – Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy – also dubbed “2017 Tax Cut Act,” passed the Tennessee General Assembly in April 2017. On the eve of the next installment of the IMPROVE Act’s additional $0.01 per gallon gas tax and $0.03 per gallon diesel tax increases set to go in effect on July 1, 2018, and nearing the highpoint of election season, the billboard appeared on the northbound side of Highway 109 in Wilson County. Beavers is running in a hotly contested race for Wilson County Mayor against eight-year incumbent Randall Hutto. Meanwhile Pody is seeking re-election to the District 17 State Senate seat encompassing Wilson County which was vacated by Beavers when she decided to run for Governor. Pody, a sitting State Representative at the time, narrowly won the seat against Democrat opponent Mary Alice Carfi in a special election held in late 2017…

Read the full storyRegional Group That Backed Failed Nashville Transit Plan Names State Rep. Susan Lynn ‘Legislator of the Year’

A Middle Tennessee mayors association that pushed for Nashville’s failed $9 billion transit plan has handed out an award to State Rep. Susan Lynn (R-Mt. Juliet) as state legislator of the year. Voters in Nashville/Davidson County resoundingly rejected the transit plan by a 64 percent to 36 percent margin in a May 1 referendum. The Tennessee House Republicans issued a statement on the award Monday. Greater Nashville Regional Council honored as its legislator of the year during its May executive board meeting. This award is given annually to one member from both the House and Senate for their work towards the legislative priorities of area mayors. “As an organization, we are grateful to Rep. Lynn for her tireless efforts and continued leadership on behalf of Middle Tennesseans,” said City of Franklin Mayor Ken Moore, president of the Regional Council. Moore endorsed “Let’s Move Nashville” as “the first major step in constructing a regional transit system,” the Brentwood Homepage website said in March. The endorsement came after years of collaboration among regional leaders who serve on the Regional Council and its Transportation Policy Board (TPB). The TPB convenes mayors from across seven counties with transportation officials and is responsible coordinating regional plans and programs.…

Read the full storyChallenger Shane Disputes State Rep. Susan Lynn’s Defense of Her Vote for the Gas Tax Raising IMPROVE ACT

Conservative businessman Aaron Shane, a Republican candidate for State Representative in the 57th District has called for current State Rep. Susan Lynn (R-Mt. Juliet) to explain her support of the gas/diesel/registration tax increase (Improve Act) that raised fuel taxes and car registration fees by $350 million per year. “Prior to her casting her vote raise taxes on Tennessee families, Lynn promised she would not support the tax increase, and even boasted that the funding for the expansion of Highway 109 was already approved and didn’t need the IMPROVE Act for funding,” Shane pointed out. “Yet, just a few weeks ago at an event in Mt. Juliet she said that her vote for the tax increase provided the funding for Highway 109 — despite the fact that state Department of Transportation records show it was on the project list in January, 2017 and it was reported in our local papers.” With surplus and recurring funds of over $2 BILLION dollars in our state’s coffers, Lynn raised taxes by $350 million on our families after promising not to do it, Shane said. “Now she is trying to fool people into believing that her tax increase was really a tax cut! The next…

Read the full storyGas Can Man ‘Fuels’ Renewed Anger Over Gas Tax Increase in Murfreesboro

Gas Can Man made a pit stop in Murfreesboro early Friday morning at DJ Mart on Lascassas Pike to pump out $25 in free gas to 100 lucky – and very happy – drivers. SuperTalk 99.7 WTN morning host Brian Wilson announced the location of the Energize America giveaway at 7:05 am and within 10 minutes dozens of cars were lined up around the gas station waiting for the fuel to flow at 7:30 am. Within less than an hour the giveaway ended after the one hundredth car had been “pumped up.” One driver, who got out of his car for a selfie with Gas Can Man, said his low fuel light came on while he was waiting in line. Several drivers pointed out that fuel prices are moving back towards $3 per gallon and that legislators who added to the “pain at the pump” should pay a price. “I don’t know how my representative voted, but I will find out if they voted for the tax increase,” one man exclaimed. “And I’ll tell him they voted last year but I get to vote this year!” The $25 in free gas provided to drivers who were quick to arrive represented the…

Read the full storyPlanning Continues for Rebuilding Interstate 440 in Nashville

Planning is underway for a major overhaul of Interstate 440 in Davidson County, a project that is expected to take three years. The Tennessee Department of Transportation began requesting bids in January for what is called “Design-Build,” sort of a streamlined turn-key project. Contractors bid for the project, which involves the design and construction of large projects. For roadways, that can include design, right-of-way acquisition, regulatory permit approvals, utility relocation, and construction. “This is not going to be a typical low-bid project,” said Kathryn Schulte, TDOT community relations officer for Region 3 (part of Middle Tennessee). “Proposals/plans are currently being developed by the competing design-build teams.” The winning contract will be announced in the summer of 2018, according to TDOT’s timeline. The timeline does not say when work would begin. The plan calls for “removing substandard pavement and widening portions of the 7.6-mile corridor to provide three travel lanes in each direction” between Interstate 40 and Interstate 24. The project is intended to address congestion and improve safety.” The design calls for replacement of deteriorated concrete pavement with asphalt and removal of the grassy elevated median. Other components include ramp widening, construction of new noise walls and replacement of light…

Read the full storyTDOT: Uncertainty Over Federal Funding Puts 962 Projects Promised with IMPROVE Act Gas Tax Increase In Jeopardy

During this session’s first meeting of the House Transportation Committee, chaired by Rep. Barry Doss (R-Leoma), the Tennessee Department of Transportation (TDOT) presented their budget for fiscal year 2019, revealing that the uncertainty surrounding the 47 percent of the department’s budget that comes from federal funding puts the 962 projects listed in the IMPROVE Act in jeopardy. TDOT Commissioner John Schroer was joined by Chief Engineer Paul Degges and Chief Financial Officer Joe Galbato. Degges and Galbato both gave overviews of their respective departmental areas, and were followed by Commissioner Schroer, who spoke on the uncertainty surrounding federal funding to TDOT. This is a result of the spending authorization that expires this week as well as the continued use of short-term spending authorizations. Additionally, the federal FAST Act – Fixing America’s Surface Transportation Act, authorized in 2015 expires in 2020, which Schroer said “Gave us money they didn’t have.” Since they didn’t have all of the money to cover the “pay fors,” it may result in a rescission of that money in 2020, which totals $170 million for Tennessee. TDOT CFO Galbato said that with the passage of the IMPROVE Act, the state is down from about 55 percent federal…

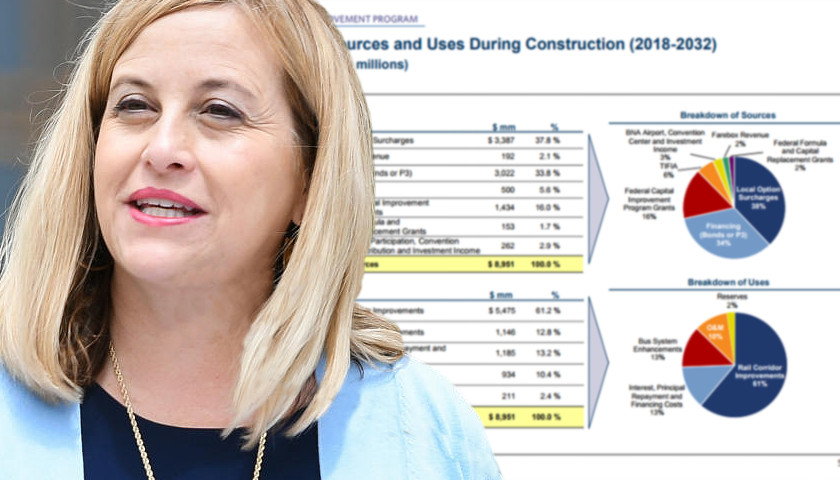

Read the full storyMetro’s Official Document Reveals That The Real Price Tag For Mayor Megan Barry’s Mass Transit Plan Is $9 Billion, Not $5.4 Billion

Nashville Mayor Megan Barry’s transit plan has been presented as having a cost of $5.4 billion during the 15 year construction plan through 2032. But that figure represents just the rail corridor improvements portion of the plan. But, in reality, he total cost is a whopping $8.95 Billion. The figures for costs and revenues were provided in greater detail within the Let’s Move Nashville Metro’s Transportation Solution Transit Improvement Program document dated December 13, 2017. In addition to the $5.4 Billion for the rail corridor improvements, which quickly increased from the original $5.1 Billion to address an extension to the Charlotte Avenue route, is $1.146 Billion for Bus System Enhancements, $1.185 for Interest, Principal and Financing Costs, $934 Million for Operation and Maintenance and $211 Million for Reserves for a grand total of $8.951 Billion. The corresponding $8.951 Billion in revenues are said to come from Local Option Surcharges of $3.387 Billion, Financing of $3.022 Billion, Federal Capital Improvement Program Grants of $1.434 Billion, TIFIA (Transportation Infrastructure Finance and Innovation Act) of $500 Million, Contributions from BNA Airport, the Convention Center and Investment Income of $262 Million, Federal Formula and Capital Replacement Grants of $153 Million and Farebox Recovery, otherwise…

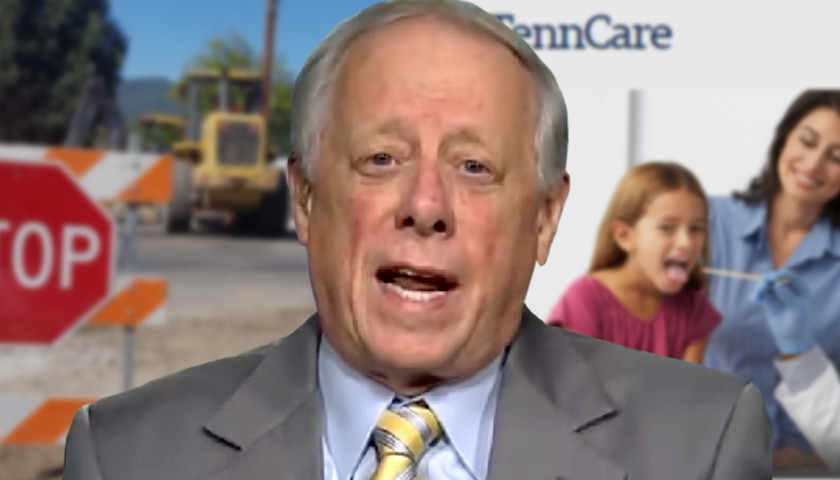

Read the full storyAs Governor, Democrat Phil Bredesen Diverted Road Money to Balance the Budget and Pay for TennCare

Last week, Tennessee’s former Governor Phil Bredesen announced that he would run for the U.S. Senate seat currently held by retiring Sen. Bob Corker (R-TN) in the 2018 election. Even though Bredesen is a Democrat and Corker is a Republican, both disfavor President Trump, both have no aversion to raising taxes, and both are okay with diverting transportation money for non-roadway projects. By the time Bredesen left the governor’s office in 2009 after eight years in the job, several tax increases had been put on cigarettes and certain managed care companies. Other revenues were raised in the form of fee increases. Corker proposed raising the federal fuel tax in 2014. Congress hasn’t raised the federal gas tax since 1993, and in 1998, over $8 billion was diverted from the Highway Trust Fund (HTF) to the general fund. This was before Corker’s time, but he still pushed his gas tax increase without tackling the diversion of HTF money for non-highway projects: A Government Accountability Office report found that 32% of the HTF didn’t go toward highway or bridge construction and upkeep from fiscal 2004-08. That rose to 38% in 2009, according to an analysis by Ron Utt, senior research fellow at the…

Read the full storyRoving Patriots PAC Announces Commitment of $7,800 State Maximum In Support of Doss Challenger Clay Doggett

PULASKI, Tennessee – At Clay Doggett’s campaign kick-off event against incumbent District 70 State Representative Barry Doss (R-Leoma) in Pulaski on Monday evening, Roving Patriots PAC Executive Director Kevin Baigert pledged financial support of the state maximum of $7,800 to the grassroots conservative challenger. Roving Patriots PAC was founded with the purpose of its first project, Partnership for a Constitutional Tennessee, being to identify, vet and support conservative candidates in order to achieve a true conservative majority in the Tennessee House of Representatives. After Doggett made the formal announcement of his intention to run, to the group of about 100 attending the event Baigert explained that he was there representing grassroots activists and contributors from across the state who want to “drain the swamp” in Nashville Tennessee, not just Washington, D.C. Baigert made specific mention of the passage of the tax- and fee-increasing IMPROVE Act, while the state had a $2 billion budgetary surplus as a bellwether issue. While Doggett never mentioned Doss, Baigert cited the representative’s key role in passing the IMPROVE Act followed by his company’s work on state roads and his attendance at Nashville Mayor Megan Barry’s introduction of a $5.2 billion transit plan. As a first…

Read the full storyGrassroots Conservative Clay Doggett Announces Challenge to Boss Doss in Tennessee House District 70 GOP Primary

PULASKI, Tennessee – Grassroots conservative candidate Clay Doggett announced his run Monday for Tennessee House District 70, a seat currently held by the chief promoter of the gas-tax increasing IMPROVE Act, Barry “Boss” Doss. Doggett said of his decision to run that, like so many others before him, he was resolved “to stand up and protect the freedoms and liberties we now enjoy.” While Barry Doss’s role as champion of the IMPROVE Act, breaking rules and renaming it the Tax Cut Act of 2017, calls for an ethics investigation, and, subsequent to the passage of the Act, his provocative road work and front-row support of Nashville Mayor Megan Barry’s $5.2 billion transit plan would have been an easy target for Doggett, he instead stayed remarkably focused on his own positions and qualifications. A Giles County native, Doggett made his announcement at the Staar Theater in the county seat of downtown Pulaski after an eloquent and touching introduction by his six-year-old son, Coell. While there were about 100 people in attendance at the historic venue, one could nearly hear a pin drop as the audience listened intently to Doggett’s message. After going to Giles County public schools and graduating from the…

Read the full storyFundraising Support For Tim Burchett Comes With Elements of Controversy

Recent campaign fund raising events and reports reveal that support for Tim Burchett, candidate for the 2nd U.S. Congressional District being vacated by Congressman John “Jimmy” Duncan, is coming from sources involved in various levels of controversy. Burchett, term-limited as Knox County Mayor, announced on August 5, 2017, his intention to run for Congress after months of speculation about which office he would run for, largely induced by his own leading comments. Since the announcement, several fund raising events have been held for Burchett and the first FEC filing of the Burchett For Congress campaign was submitted October 15, 2017. For the period July 1 to September 30, 2017, Burchett For Congress has cash on hand of $113,676 after receiving contributions of $140,801 and having expenditures of $27,125 for the period. Contributions came from 212 individuals and two PACs, Red State PAC at $500 and former Lt. Governor Ron Ramsey’s PAC, RAAMPAC at $1,000. Ramsey, who introduced Burchett at a fundraiser held on September 28, 2017, the two having served together in the both the Tennessee House and Senate, repeatedly made references to “my friend, Tim.” Under Ramsey’s leadership, Republicans gained majorities in the House and Senate with Ramsey ending…

Read the full storyBoss Doss Runs Away From The Tennessee Star At Megan Barry Transit Launch Event

NASHVILLE, Tennessee – After sitting in the front row throughout Metro Nashville Mayor Megan Barry’s Transit Launch Event Tuesday for the “Let’s Move Nashville Metro’s Transportation Solution,” State Rep. Barry “Boss” Doss (R-Leoma) ran away from The Tennessee Star, avoiding follow-up questions on his sponsorship of the IMPROVE Act, a major portion of which was dedicated to enabling public transit systems like the $5.2 billion “Solution” Barry unveiled. Going off his prepared script to ensure Doss was given special recognition for his role in the passage of the IMPROVE Act, Democratic State Senator from Nashville, Jeff Yarbro, one of the event’s speakers explained, “This legislature’s biggest priority this year was addressing the growing traffic problems in middle Tennessee and across this whole state.” Then, gesturing to acknowledge Doss sitting in the front row, “In order to do that, we really relied on a bipartisan coalition that included people like Barry Doss,” said Yarbro as seen at 11:16 in this video. The IMPROVE Act enabled “local governments” designated as counties, including those with a metropolitan or consolidated form of government, with a population of more than 112,000 or cities with a population of more than 165,000 to implement tax surcharges to fund…

Read the full storySumner County Property Assessor John Isbell Will Run Against County Executive Anthony Holt

John Isbell, the four times elected and internationally recognized Property Assessor of Sumner County, announced Monday that he is running for County Executive against incumbent Anthony Holt in the 2018 election cycle to “bring transparency to the office and stop the crony capitalism that plagues the administration.” First elected as Sumner County Property Assessor in 2004, Isbell has served in numerous positions in both the state and the 7,000-member global association of assessing officers and is pursuing his Ph.D. in public policy. In his campaign platform, Isbell is focused on integrity, transparency and accountability in leadership. “The citizens of Sumner County deserve an honest government and they know I defeated Anthony Holt’s plan to unconstitutionally railroad a tax increase on the property owners in Sumner County,” states Isbell’s press release, which continues, I believe in transparency and plan to bring to light Holt’s policy initiatives while in office. My reputation for honesty is the reason why I have received more votes than Anthony Holt in the past three elections. The unconstitutional tax increase Isbell refers to relates to a 2014 contention by Holt and Sumner County Schools Director Del Phillips that Isbell needed to raise property values following the housing…

Read the full storyGov. Haslam’s Gas Tax Increase Sponsor ‘Boss’ Doss Offers No Explanation Why His Company’s Equipment Is Being Used on Road Construction Project

ARDMORE, Tennessee – Doss Brothers Inc., the construction company owned by State Rep. Barry “Boss” Doss (R-Leoma), the House sponsor of Governor Bill Haslam’s gas-tax increasing IMPROVE Act, is currently performing work at a road construction site on SR 7 in Ardmore, Tennessee, as well as several Giles County locations which lie within the House District 70, which he currently represents. According to TDOT records (page 10 of 17) and Bid Express, the “Secure Internet Bidding” website that handles departments of transportation for 38 states including Tennessee, the bid was “generated” on March 6, 2017, and “let” (awarded) on March 31, 2017. The successful bidding contractor was Rogers Group, Inc., with a “Total Bid” of $2,290,682.00 and a “completion time on or before December 15, 2017,” for “The grading, drainage and paving on U.S. 31 (S.R. 7) from Union Hill Road to Morrow Road in Ardmore,” Giles County Doss Brothers, Inc. heavy equipment, clearly marked as such, has been unmistakably observed within the past week at a road construction site on SR 7 in Ardmore, Tennessee, as seen in the image on the right. The Tennessee Star asked Rep. Doss to comment as to whether Doss Brothers, Inc. equipment has been used on a road construction project…

Read the full storyRTA CEO: ‘Daily Recurring Congested’ Areas To Get Much Worse in Metro Nashville, One Million People And $8 Billion Later

GALLATIN, Tennessee – During the nMotion Plan Update meeting for Sumner County held last month, Metropolitan Transit Authority (MTA) and Regional Transit Authority (RTA) CEO Steve Bland spoke to a short slide presentation that included, among others, one titled “Projected Traffic Congestion.” The slide includes two maps, shown here, using red to highlight the “daily recurring congested” areas within middle Tennessee. The map on the left, portraying the current situation for daily recurring congested areas, is described as being “based on roadway volumes and travel speeds” and reflects what middle Tennesseans are painfully aware as locations for commuter traffic delays. Comparatively, the map on the right dated 2040 is captioned, “Based on the MPO’s (Metropolitan Planning Organization’s) traffic model which incorporates growth and development forecasts,” after an additional one million people are expected to migrate to the Nashville area over the next twenty-plus years. Shockingly, the projected congested areas in 2040 is after a whopping $8 billion is spent on transit and other improvements, according to Steve Bland. Indeed, the slide is subtitled, “These forecasts include all current and proposed projects in the 2040 Regional Plan.” Bland, who dubbed the information “the slide of doom,” did not elaborate on…

Read the full storyThe Gas Tax Increase Goes Into Effect Today: How It Happened Despite Record State Revenues

The gas tax increase of 4 cents per gallon, which will eventually increase to 6 cents per gallon, as well as a diesel tax increase that will eventually reach 10 cents per gallon, both go into effect today, July 1, throughout Tennessee. The culprit for this tax increase is Governor Haslam’s IMPROVE Act – Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy – later renamed the Tax Cut Act of 2017. As Tennesseans are forced to pay this higher tax, it’s time to review how it happened in a state with record revenues and a billion dollar surplus. It started no later than 2015, when Governor Bill Haslam and Department of Transportation (TDOT) Commissioner John Schroer went on a taxpayer-funded six-week 15-city tour, meeting with elected officials, business leaders and chamber of commerce executives as well as “infrastructure officials and community members” creating a “need” and building support for a gas tax increase. At the time, there was a $6.1 billion backlog of road and bridge projects. Davidson and Middle Tennessee counties that ring it, were provided Resolutions to be passed by their respective legislative bodies, most often a County Commission, that urged Governor Haslam and the Tennessee…

Read the full storyThe Tennessee Star Announces Blockbuster Month with Over a Half-Million Visits

FRANKLIN, TENNESSEE (Wednesday, June 21) — In another stunning announcement, The Tennessee Star released updated web traffic reports in a tweet Wednesday that shows the online news, information, and opinion website surpassed 500,000 visits in the last thirty days. WOW! Thank you, Tennessee!!30days (5/20-6/20): 526,841 visits 290,288 visitorsAll time (2/06-6/20): 1,536,671 visits 712,233 visitors pic.twitter.com/HBxgV2CKnf — Tennessee Star (@TheTNStar) June 22, 2017 “In three months and two weeks we went from zero at our launch to over one million visits. Now, in just the last thirty days – a quarter of that time – we have been visited more than five hundred and twenty-five thousand times,” said managing editor Christina Botteri. “If there was a Moore’s Law for journalism and readership, we’d be doubling it right now!” Botteri said, referencing Intel founder Gordan Moore’s observation that computer processing speed doubles every 18 months. The explosion in traffic can be traced directly to The Star’s coverage of the top three areas of most concern for Middle Tennesseans, as reported in the Tennessee Star-Triton Poll released ten days ago, together with a fundamental understanding of the algorithms that drive social media traffic. “The poll results reflect what we observe personally, which is that there…

Read the full storyState Senate Candidate Mark Pody Calls The IMPROVE Act ‘Washington Politics’

MOUNT JULIET, Tennessee — At his first public speaking engagement since announcing, in an exclusive interview with The Tennessee Star, his candidacy for the State Senate seat Mae Beavers (R-Mt. Juliet) will be leaving to run for the Republican nomination for governor in 2018, Rep. Mark Pody (R-Lebanon) called the IMPROVE Act “Washington politics” for the way numerous issues were combined in one bill without an “up or down” vote on each individually. At the Americans For Prosperity Town Hall held in Mt. Juliet on Monday evening with Field Director Shawn Hatmaker and attended by more than 30 people to honor and appreciate Rep. Pody and Sen. Beavers for their vote against the gas tax increasing IMPROVE Act, Rep. Pody’s comments on the recently concluded legislative session focused largely on the IMPROVE Act. Using four different colored packs of sweeteners and sugar, Rep. Pody gave a visual demonstration of the IMPROVE Act when he ripped the packets open and poured them out together, alluding to the separate and unrelated issues in the bill (HB534), saying “They all came out white,” and they then had to “Vote on that, whether there was some good or some bad. That’s what DC does.” “As…

Read the full storyGubernatorial Candidate Mae Beavers on the Gas Tax Increasing IMPROVE Act: ‘The Joke Is On The People Who Put the Plan Together’

MOUNT JULIET, Tennessee — Gubernatorial candidate Sen. Mae Beavers at an Americans For Prosperity Town Hall meeting Monday evening honoring her and Rep. Mark Pody for voting against the gas tax, said “I think the joke is on the people who put the plan together.” Sen. Beavers was referring to the IMPROVE Act, 4 cent gas and 6 cent diesel tax increases set to go into effect July 1 and then an additional 1 cent and 2 cents, respectively, on July 1, 2018, just before the state primaries are held on August 2, 2018. Given the results of the recent Tennessee Star poll where 48.1 percent of likely Republican primary voters responded that they were more likely to support a gubernatorial candidate who promises to repeal, Sen. Beavers may be right about the impact to State House and Senate incumbents who voted for the gas tax. Sen. Beavers is the only one of three declared gubernatorial candidates who is making the repeal of the gas tax a major topic of her campaign platform. “Most of you know, I was around for the state income tax fight, and this was completely different,” said Beavers of the IMPROVE Act. “It seems like…

Read the full storyMae Beavers Tells Haslam State Will Pay For Roads After Gas Tax Repeal With $2 Billion Surplus and Ending Diversion of Road Funds to Other Uses

Gov. Bill Haslam threw a soft ball over the middle of the plate to State Senator Mae Beavers (R- Mt. Juliet) about her campaign pledge to repeal the gas tax, and the recently announced GOP Gubernatorial candidate knocked it out of the park. Appearing in Nashville at one of the three ceremonial signings for the IMPROVE ACT passed by the Tennessee General Assembly this session that he signed in May, Haslam asked what he thought of Beavers’ campaign pledge to repeal the 6 cents per gallon gas tax increase and 10 cents per gallon diesel tax increase included in the new law. “If you want to repeal that, then how are you going to pay for road improvements? And are you going to take the tax cuts that we’ve made off the table, too?” Haslam asked. “That’s an easy question to answer,” Beavers told The Tennessee Star Monday afternoon. “If the Governor and legislative leadership had allowed for a full and fair discussion of road funding alternatives rather than cutting back room deals and strong arming the gas tax increase down taxpayers throats then Governor Haslam might be aware of the other alternatives available,” Beavers noted. “We can repeal…

Read the full storyGov. Haslam Holds Ceremonial Signings Today for Gas-Tax Increasing IMPROVE Act In Each of Tennessee’s Three Grand Divisions

Governor Haslam will hold ceremonial signings of the controversial and gas-tax increasing IMPROVE Act Monday in each of Tennessee’s three grand divisions, as reported last week by The Tennessee Star. According to the invitation on Governor Bill Haslam’s letterhead, the IMPROVE Act signing ceremonies will be held as follows: 10:15 a.m. EDT, East Tennessee Hamilton County Welcome Center I-75 North, 0.7 miles north of GA state line 1:00 p.m. CDT, Middle Tennessee Acklen Park Drive – I-44 Overpass Nashville, TN 37204 3:00 p.m. CDT, West Tennessee US 51 S. from Union City A half mile past the Quality Inn The signings are spaced so closely together in time, Gov. Haslam is almost certainly flying from site to site at taxpayers’s expense to celebrate this tax increase. The IMPROVE Act, initially named for “Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy,” was renamed to the Tax Cut Act of 2017, by its House sponsor of HB 534 Rep. Barry “Boss” Doss (R-Leoma), will raise the gas tax by 6 cents per gallon and the diesel tax by 10 cents per gallon phased in over three years. Effective July 1, the gas tax will increase from 20 cents to 24…

Read the full storyGov. Haslam Attends Ceremonial Signings, Ignores Severe Weather Damage in Memphis

As Governor Bill Haslam sets out next Monday on cross-state IMPROVE Act Bill Signing Ceremonies, he has not yet seen the damage himself from the severe weather that hit Memphis and surrounding Shelby County last Saturday night. And, he has no plans to travel there this week, according to a report from Fox 13 Memphis. Meanwhile, Governor Haslam has announced IMPROVE Act Bill Signing Ceremonies to be held Monday, June 5 in each of Tennessee’s three grand divisions. As of Thursday morning, the fifth day after the storm, Memphis Light Gas and Water Division (MLGW) power outage map indicates that over 32,000 customers are still impacted by power outages, down from a peak of 188,000. While power has been restored to the majority of customers, full restoration could take more than a week for the remaining customers as progress slows dealing with smaller outages. The storm has been described by MLGW as the “third worst storm in the area’s history.” An email dated May 31 from the Tennessee County Services Association (TCSA) Executive Director, David Connor, attached an invitation on Governor Haslam’s letterhead that included the details of the ceremonies: 10:15 a.m. in Hamilton County, 1 p.m. in Nashville/Davidson…

Read the full storyGovernor Haslam’s IMPROVE Act Allows Local Non-User-Fee Funding of Mass Transit

The foundation of the case by Governor Haslam and other proponents of the IMPROVE Act gas tax increase was that it is a “user fee,” paid by those who use the roads. In contrast, for the purpose of funding public transit system projects, the IMPROVE Act authorizes 16 local governments, through public referendum, to levy a surcharge on six existing taxes that aren’t remotely linked to a mass transportation user fee, otherwise known as passenger fares. The IMPROVE Act, passed by the legislature as HB 534, specifies a local government, for purposes of the surcharge, as any county in this state including a county with a metropolitan or consolidated form of government with a population in excess of 112,000, which is currently Blount, Davidson, Hamilton, Knox, Montgomery, Rutherford, Shelby, Sullivan, Sumner, Washington, Williamson and Wilson, and any city in this state with a population in excess of 165,000, which is currently Chattanooga, Knoxville, Memphis and Nashville. The six taxes eligible for surcharge are the local option sales tax, business tax, motor vehicle tax, local rental car tax, tourist accommodation/hotel occupancy tax, and residential development tax. Looking at other transit systems around the country, it’s obvious that these additional revenues will…

Read the full storySC Gov. McMaster Vetoes Gas Tax, In Stark Contrast to TN Gov. Haslam, Who Championed It

South Carolina Governor Henry McMaster posted a video “Gas Tax Veto” to his Facebook page, saying “Today I vetoed the General Assembly’s gas tax bill, and I would like to tell you why.” He continued, “Unfortunately, raising taxes was the only solution seriously considered by the legislature.” Quite a contrast to recent events in Tennessee, where Governor Haslam was the one who would only accept a gas tax increase to fund roads through his IMPROVE Act. The Governor persisted in his “my way or the highway” solution to road funding, despite other alternatives being offered by some members of the House of Representatives, and nearly half of his own party at 35 of 37 Republican Representatives, voting against it. Tennessee suffers from much the same problem as South Carolina, as stated by Governor McMaster, “Right now over one-fourth of your gas tax dollars are not used for road repairs. They’re siphoned off for government agency overhead and programs that have nothing to do with roads.” As previously reported by The Tennessee Star, some of the current road “user fees” are diverted from the Highway Fund, and the Tennessee Department of Transportation (TDOT) “overhead” has grown 63 percent under Governor…

Read the full storyEffort to Correct Some of The Gas Tax ‘User Fee’ Diversion From The Highway Fund Amended Away

A bill introduced to remove a portion of the diversion of fuel tax “user fees” from the Highway Fund to the General Fund was amended so drastically that the bill was rewritten so that it rewrote the bill, and instead increased the amount distributed to the Wildlife Resources Fund. As reported by The Tennessee Star, and confirmed by Rep. Susan Lynn (R-Mt. Juliet), Tennessee Code Annotated requires that portions of the “user fee” fuel taxes be allocated to the General Fund to cover the costs incurred by the state Department of Revenue for the collection of those taxes. HB 910 / SB 230 by Rep. Tim Wirgau (R-Buchanan) and Sen. Mark Green (R-Clarksville), respectively, would have “eliminated the administrative allocation of the gasoline tax, motor fuel tax, and gasoline inspection tax to the General Fund.” It would have no impact on the total collections from the various fuel taxes, but would simply allocate them to the Highway Fund rather than the General Fund. The fiscal memo for the original bill reported increases to the Highway Fund of $12 million and to local governments of $2.6 million. The bill was then completely re-written by the amendment so that the diversions to the General Fund…

Read the full storyEducation Bill Passed By House, But Rolled to 2018 In Senate

While House Minority Leader Craig Fitzhugh (D-Ripley) relentlessly pursued his education funding bill, HB 841, through passage in the House, the Senate sponsor, Jeff Yarbro (D-Nashville) wasn’t as successful with SB 831, and requested of the Senate Finance Ways & Means Committee that the bill be rolled to 2018. The bill, originating in the House and rumored to be in exchange for Democratic votes in favor of the IMPROVE Act, used excess state revenues over-collected in fiscal years 2015-16 and 2016-17 in the amount of $250 million to be used for K-12 block grants that would be distributed by the Department of Education. After passing through the House Finance, Ways & Means Subcommittee and Committee, Fitzhugh started by introducing Amendment 1 on the House floor May 9, which rewrote the bill to enact the Education Investment Act. The Act creates the K-12 block grant program via a revocable trust to be administered by the state treasurer, with a board of trustees that would also include the comptroller of the treasurer, the secretary of state, the commissioner of education and the commissioner of finance and administration. Amendment 1 passed by voice vote. Rep. Sabi “Doc” Kumar (R-Springfield) sponsor of Amendment 2,…

Read the full storyMulti-Million Dollar Education Bill Still in Play, Critics Claim in Return for Democrat Support of IMPROVE Act

While last week’s two-day House floor showdown over Governor Haslam’s 2017-18 budget never did take up an amendment for a $55 million education appropriation, HB 841, known as the K-12 Block Grant Act, was approved in a new form in the House Finance, Ways & Means Subcommittee and Committee on Monday. That approval advances the bill to the Calendar & Rules Committee meeting, which was later scheduled to Tuesday. In full Committee, House Minority Leader Craig Fitzhugh (D-Ripley) before moving for adoption spoke very briefly on his new and only amendment to the bill, which, he stated, “takes out the funding for the bill in the way it was originally funded.” The bill in its original form called for a one-time transfer of $250 million from a variety of revenue sources within the General Fund to the Education Fund, as The Tennessee Star reported previously. Fitzhugh referred to the arrangement as an Education Investment Endowment Act for which a Fund (EIEF) would be created, and said “It’s much on the same premise as the Tennessee Promise,” where the reserves from the lottery have been set up as an endowment for the Tennessee Promise. Fitzhugh continued, We are attempting to do the same thing…

Read the full storyDemocrats Unlikely to Get The $250 Million Education Bill For Their Yes Vote On The IMPROVE Act

House Minority Leader Craig Fitzhugh (D-Ripley) said Wednesday in both the Finance, Ways & Means Subcommittee and full Committee that he didn’t have the votes for the $250 million K-12 Block Grant Act, which was reportedly part of the deal Governor Haslam made to get needed support from the Democrats to pass his IMPROVE Act. On the morning of the House floor vote which eventually approved the IMPROVE Act, there were rumors that the Governor would appropriate $250 million for an education plan and that the Democrats, despite their expected opposition to the gas tax increase, were going to vote for it. The deal appeared successful when 23 of 25 Democrats voted in favor of the IMPROVE Act. The rumors of the quid pro quo deal were confirmed when the video of Leader Fitzhugh explaining the plan during an April 4 Education Administration & Planning Subcommittee meeting came to light. The plan, called the K-12 Block Grant Act, would take $250 million from various sources, as Fitzhugh explained, and put it in an endowment type fund from which the interest would be drawn and allocated to school systems throughout the state for non-recurring expenses. During the Finance, Ways & Means…

Read the full storyFollow The Money: Campaign Receipts May Shed Light on Why Some Republicans Voted For The Gas Tax

“Follow the money” is a catchphrase made popular in the 1976 movie, “All The President’s Men,” based on the actual events of the Watergate Break-in and suggests a money trail or corruption scheme within the political arena. While campaign receipts are no guarantee of how an elected official will vote on a particular issue, when a politician’s vote comes as a surprise to their constituents and political pundits, the behind-the-scenes world of money and power may shed light on the matter. The situation of campaign financing in the state of Tennessee is a complex web of individual and Political Action Committee (PAC) contributions and receipts to and from each other. The Tennessee Bureau of Ethics and Campaign Finance defines a PAC as a “multi-candidate politician campaign committee that participates in any state or local election. ‘Multi-candidate committee’ is defined as a committee that makes expenditures to support or oppose two or more candidates for public office or two or more measures in a referenda election. T.C.A. 2-10-102(9).” The State of Tennessee’s Online Campaign Finance webpage includes a searchable database for contributions and expenditures to candidates and PACs and from candidates, PACs, private individuals or businesses/organizations. The complexity, special interests…

Read the full story