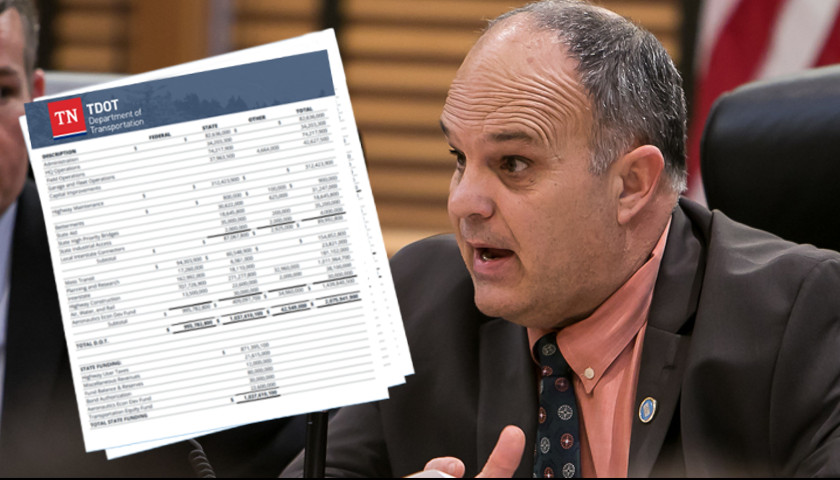

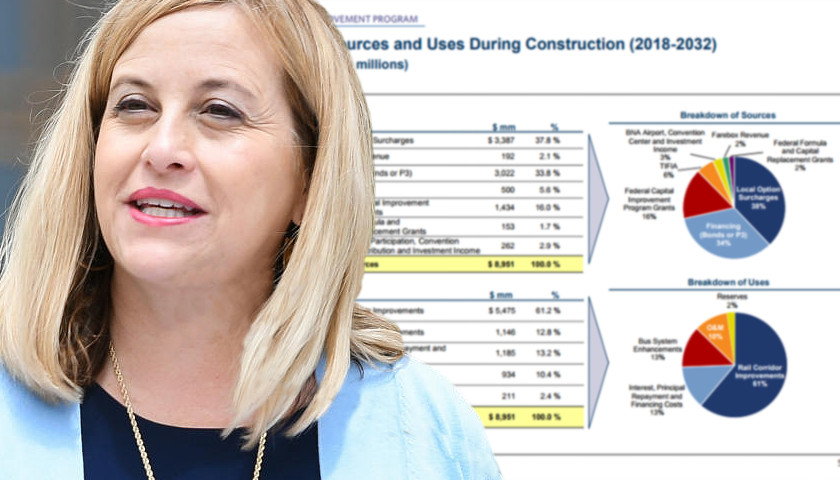

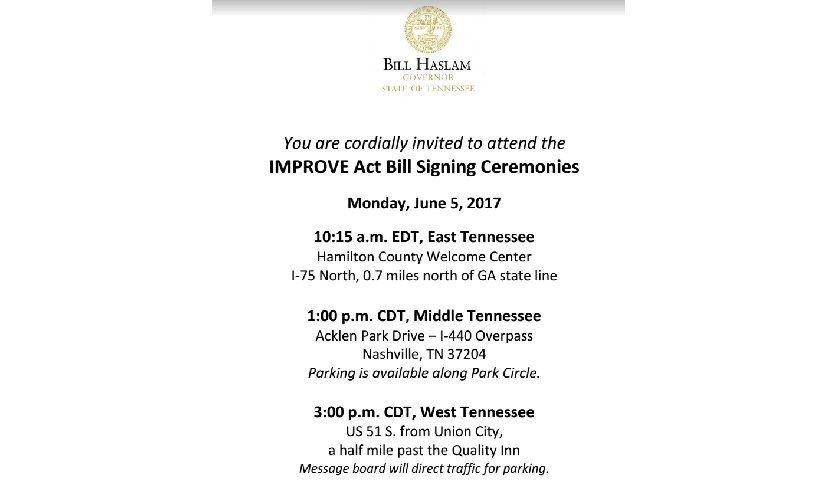

The foundation of the case by Governor Haslam and other proponents of the IMPROVE Act gas tax increase was that it is a “user fee,” paid by those who use the roads. In contrast, for the purpose of funding public transit system projects, the IMPROVE Act authorizes 16 local governments, through public referendum, to levy a surcharge on six existing taxes that aren’t remotely linked to a mass transportation user fee, otherwise known as passenger fares. The IMPROVE Act, passed by the legislature as HB 534, specifies a local government, for purposes of the surcharge, as any county in this state including a county with a metropolitan or consolidated form of government with a population in excess of 112,000, which is currently Blount, Davidson, Hamilton, Knox, Montgomery, Rutherford, Shelby, Sullivan, Sumner, Washington, Williamson and Wilson, and any city in this state with a population in excess of 165,000, which is currently Chattanooga, Knoxville, Memphis and Nashville. The six taxes eligible for surcharge are the local option sales tax, business tax, motor vehicle tax, local rental car tax, tourist accommodation/hotel occupancy tax, and residential development tax. Looking at other transit systems around the country, it’s obvious that these additional revenues will…

Read the full story