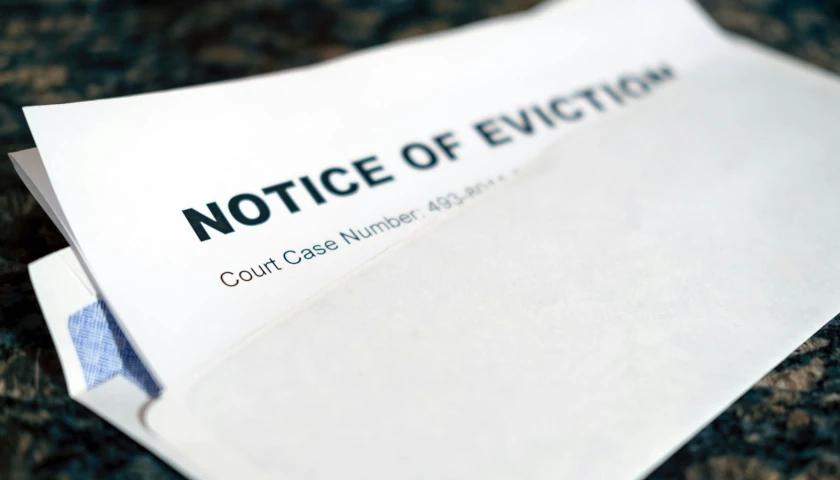

October brought Arizona’s lowest inflation rate in years with the Phoenix metro area inflation rate being 1.56% year-over-year – a decrease from 2.27% in August – according to the Common Sense Institute.

“This latest reading ends the over 2-year streak of inflation above the standard target of 2.0% annually,” reads the CSI report. “Historically, the Phoenix Metropolitan Statistical Area has experienced significant inflationary pressures, notably in June 2022, when inflation in Phoenix peaked at a record high of 13%, well above the national rate of 9.1%. This trend made Phoenix one of the fastest-inflating areas in the U.S.”

Read the full story