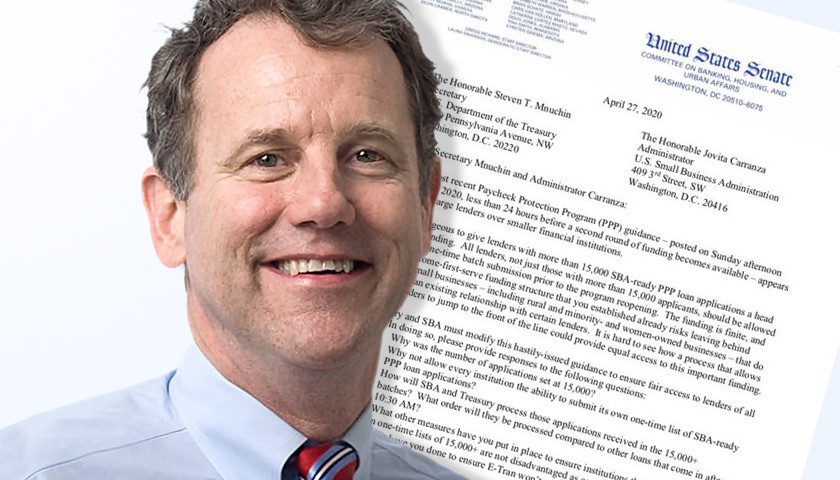

Eight people were charged for alleged roles in a $6 million fraud scheme targeting multiple pandemic relief programs, announced United States Attorney Dawn N. Ison.

Since COVID began, foreign and domestic criminals have targeted government assistance programs often using stolen identities bought from the dark web. The indictment says the defendants caused fraudulent unemployment insurance claims, fraudulent Paycheck Protection Program loan applications, and fraudulent Economic Injury Disaster Loan applications to be submitted for multiple individuals and business entities.

Read the full story