Knoxville Mayor Indya Kincannon proposed her 2022-23 budget on Friday at the State of the City Address, according to a press release by the city.

Read the full storyTag: proposal

Governor Lee Proposes 30-Day Suspension of State and Local Grocery Sales Tax

On Thursday, Tennessee Governor Bill Lee announced in a press release his proposal for a 30-day suspension of state and local grocery sales tax to provide “direct financial relief to Tennesseans amid surging inflation nationwide.”

Read the full storyState Senate Republicans Pitch $65 Million Law Enforcement Recruiting Package for Minnesota

Minnesota Senate Republicans pitched a 2022 “top priority” $65 million law enforcement recruiting package Wednesday.

The proposals – dubbed the “Creating Opportunities in Public Safety” (C.O.P.S) program – would incentivize law enforcement recruitment statewide to address a police officer shortage, Senate Majority Leader Jeremy Miller, R-Winona, said in a news conference.

“Across the state, we’ve been hearing from law enforcement agencies that are struggling with staff,” Miller said. “Law Enforcement officers are leaving the force in far higher numbers than they are applying to join the force and it’s hitting a critical stage for their ability to provide for safe communities,” “This isn’t an accident. These losses are a direct result of the ‘Defund the Police’ and anti-police rhetoric, that has demonized police officers and left them personally demoralized and their agencies diminished in size and standing.”

Read the full storyMinnesota Gov. Walz Wants to Give $700M Back to Taxpayers

Gov. Tim Walz says he plans to send 2.7 million Minnesotans “Walz Checks” up to $350 as part of his 2022 Local Jobs and Projects Plan.

“To continue growing Minnesota’s economy, we must invest in the people who made it strong in the first place,” Walz said in a statement. “By investing in workforce development, cutting taxes for the middle class and working families, lowering costs, and expanding access to resources like technical education and high-speed broadband, we will improve economic prosperity across the state and grow the workforce we need to compete.”

The proposal aims to deliver $700 million in direct payments to Minnesotans funded by Minnesota’s tax surplus.

Read the full storyUniversity of Tennessee System Proposes New Initiative to Offer Veterans In-State Tuition Rate

On Veterans Day this week, the University of Tennessee announced a new proposed initiative that would allow military-affiliated students–veterans, active-duty military personnel, reservists, Tennessee National Guard members, and Army and Air Force ROTC cadets to attend a UT institution of their choosing at the in-state tuition rate, according to a press release.

Read the full storyCommentary: The Proposed Methane Fee Is an All-Downside Proposal

The Methane Emissions Reduction Act of 2021 has been proposed as a “pay-for” – a source of revenue – in the reconciliation infrastructure package. It would impose a “fee” on methane emissions from natural gas and petroleum production systems and related processes, but not on such emissions from agricultural and other operations. Accordingly, it is worse than a mere money grab: it’s a blatant exercise in punitive politics directed at the fossil-fuel energy sector, a tax on conventional energy.

Not so, says Representative Diana DeGette (D-CO), as summarized by the Washington Examiner:

“This is not a tax. It’s a fee on natural gas waste,” adding oil and gas operators have the technologies to combat methane leaks at low cost. “The smart players want to prevent waste because they can capitalize it to make money. Customers won’t be paying a fee on gas delivered. The only fee will be paid [by an operator] on what doesn’t make it to the consumer.”

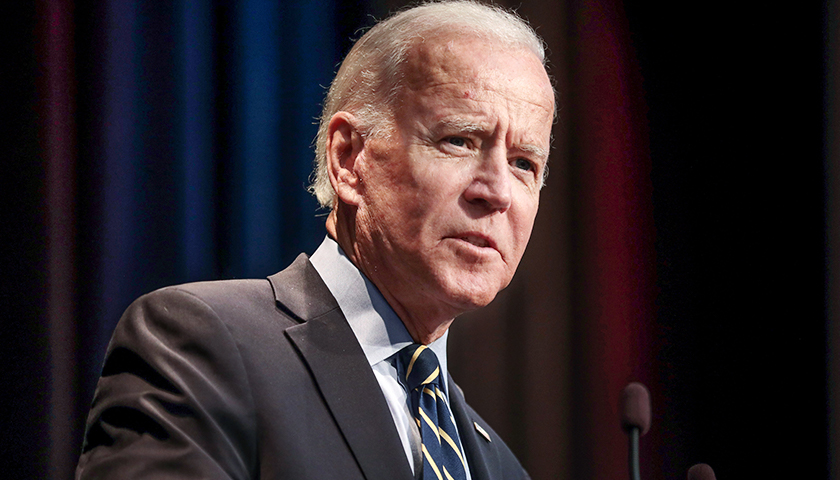

Read the full storyBiden Tax Proposal Would Cost Arizona Thousands of Jobs: Report

President Joe Biden’s proposal to increase the United States’ Global Intangible Low-Tax Income (GILTI) tax will lead to job losses at 266 public companies in Arizona, according to research from Arizona State University.

The proposal doubles the GILTI rate to 21% from 10.5%. Ninety-four percent of U.S manufacturers believe the increase will harm their business, according to a National Association of Manufacturers (NAM)survey on Sept. 9.

The study by the Seidman Institute at ASU’s W. P. Carey School of Business and Ernst & Young’s Quantitative Economic and Statistics Team (QUEST) said the tax “is specifically targeted at the income earned by foreign affiliates of those companies from intangible assets including intellectual property such as patents, trademarks, and copyrights.”

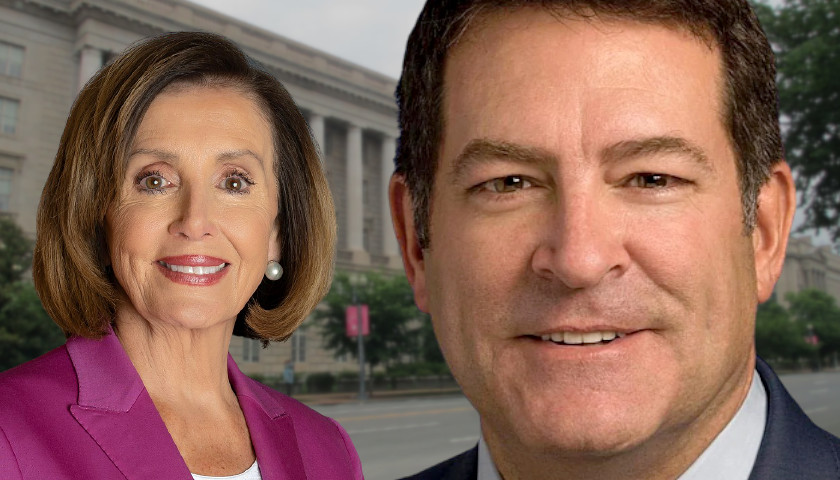

Read the full storyTennessee Representative Mark Green Sends Letter with over 100 Republicans to Speaker Nancy Pelosi Regarding IRS Data Collection Proposal

In an official press release Tuesday, Tennessee Representative Mark Green (R-TN-07) announced that he and 100 Republican colleagues sent a letter to Speaker Nancy Pelosi, Ways and Means Committee Chairman Richard Neal, Treasury Secretary Janet Yellen, and IRS Commissioner Charles Rettig, expressing their frustration over a recent IRS data collection proposal to increase tax information reporting requirements on financial institutions.

The proposed measure would require financial institutions to report transactions to the Internal Revenue Service on any bank account with a balance of more than $600. The Treasury Department says the proposal for extra data is being sought to target high earners who underreport their tax liabilities.

Read the full storySchool-Choice Advocates Applaud Ohio Senate’s Budget Plan

School-choice advocates are calling the recently passed Ohio Senate budget proposal as a step in the direction toward more options for parents.

The Senate’s version of the budget includes differences negotiators still must work out with the House’s budget, but it includes a provision that allows parents to create an education savings account for afterschool care. Negotiations begin this week.

“While the new Afterschool Child Enrichment Education Savings Account program is limited, its inclusion in the budget is an important step in helping parents afford desperately-needed resources giving them the flexibility necessary to improve their children’s educational outcomes,” said Rea Hederman, executive director of the Economic Research Center at The Buckeye Institute, a Columbus-based think tank.

Read the full storyOhio Governor Mike DeWine Announces Plan for 30 New Drug Courts to Combat Opioid Epidemic

Ohio Governor Mike DeWine unveiled the latest aspect of his plan Tuesday to fight opioid addiction by creating more specialty courts statewide. The plan is the latest announced component of his upcoming budget proposal for the 2020-2021 fiscal year. If approved, it would allocate $2.5 million in 2020 for the creation of “15 specialty dockets” as well as an additional $5 million in 2020 to “support the newly created specialty dockets and fund an additional 15.” Governor DeWine said of the courts: Specialty dockets give judges the flexibility necessary when they encounter someone in the court system who is may benefit more from treatment for substance use disorder rather than serving jail time,…These specialty courts are a proven way to hold those with substance use disorder accountable and ensure participation in mental health and addiction treatment. According to the Ohio Office of Criminal Justice Services, Specialty Courts, often referred to as “Drug Courts,” “specialize in the adjudication and treatment of offenders who use drugs.” Judges across the state found that they were seeing the same individuals again and again for drug-related offenses. These courts were designed to more effectively address the issues relating to these individuals. The only offenders eligible for these courts are those who have been…

Read the full story