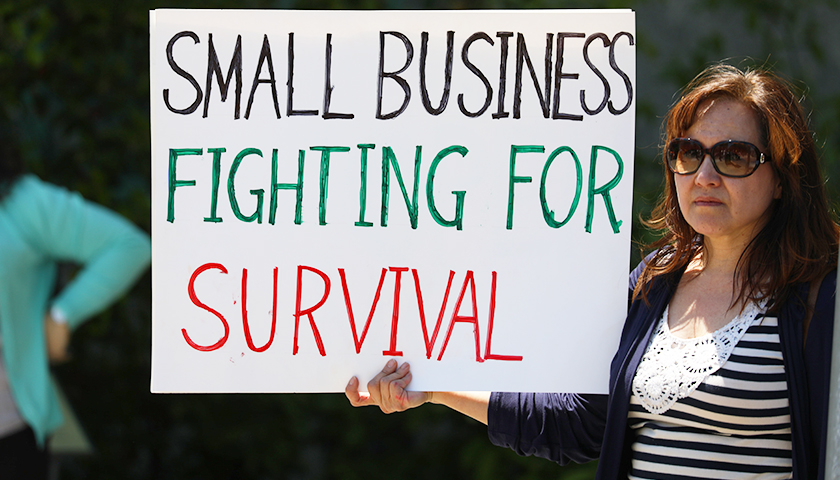

One-third of small-business owners say increased crime is cutting into their earnings, and 7 in 10 grade President Joe Biden’s performance negatively in terms of helping small businesses, a new poll finds.

Pollsters John McLaughlin and Scott Rasmussen conducted the survey, along with the Job Creators Network Foundation in March, among 400 small-business owners. When asked about their sentiments regarding the state of the economy, 46% of small-business owners said the economy is getting worse, while just 27% said it’s getting better.

Read the full story