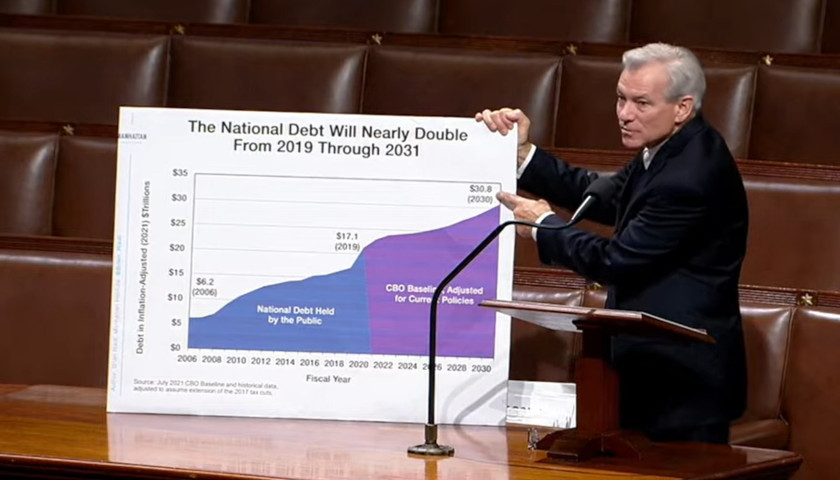

by Robert Osburn Celebrated this past July 4, America’s founding story of freedom is truly remarkable: unity, courage, integrity, and national integration (incorporating people from around the world). In most other places, the freedom story is bloody, exclusive, and, ultimately, tyrannical. Take Nicaragua, for one example: In 1979, the Sandinistas overthrew dictator Anastasio Somoza. Nearly four decades later, hundreds are dying because the very people who led the Sandinista revolution (Daniel Ortega and friends, now in power) are behaving exactly like Somoza. It’s déjà vu all over again for our Central American neighbors. In an age when democracy is clearly retreating, will America eventually succumb to autocracy while waving sayonara to democracy? It’s a question that National Review’s JonahGoldberg once very handily dismissed. He now admits that American totalitarianism is a real possibility. Utilizing a scenario-building skill that I learned during my doctoral studies, let me offer what I consider a very plausible scenario that takes America down the rathole of tyranny: Sometime between 2028 and 2034, America’s president will use executive or emergency powers to solve the nation’s Social Security trust fund crisis. As Americans celebrate that presidential act of courage, we will begin the long road to tyranny because we cannot rule ourselves. Does this remind anyone of the books of Judges and I Samuel when, because everyone did what was right…

Read the full story