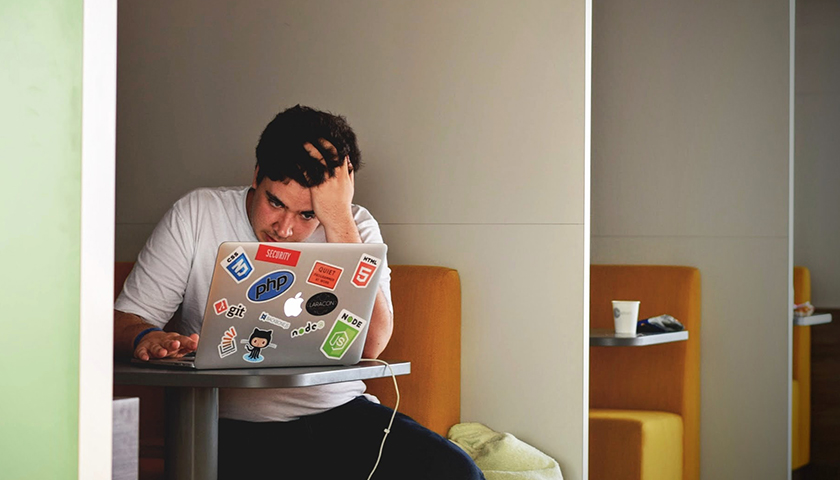

As borrowing costs for student loans are already at unseen levels, rates are expected to rise even higher in the coming months to a high not seen in 16 years.

According to ABC News, the current interest rate on a federal undergraduate student loan, which is 5.5%, is expected to rise to 6.5% in July. This would mark the highest level since 2008. The borrowing rate for student loans is determined as a result of adding a fixed amount of 2.05% to the yield on the 10-year Treasury bond, which is set every May at an annual auction. On Wednesday, the 2024 auction saw 10-year Treasury bonds sold at a yield of 4.48%.

Read the full story