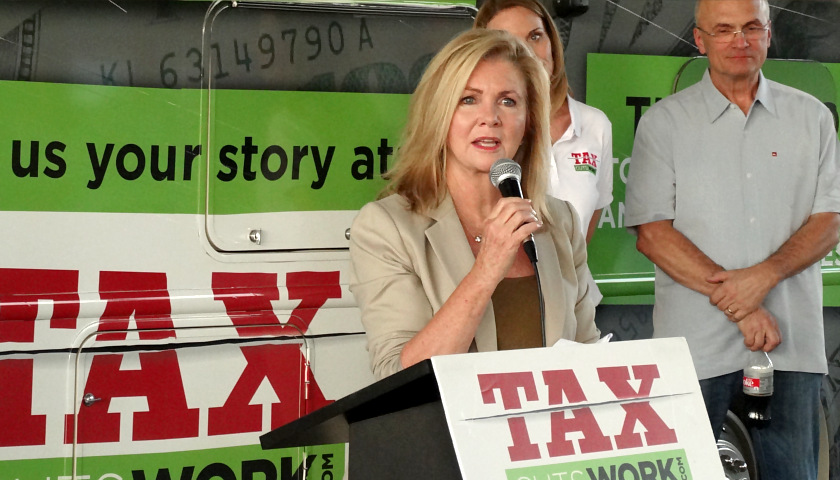

The Marsha Blackburn campaign for the U.S. Senate on Saturday released its final two television ads which will air in media markets across the state. In an ad titled, “Closing,” U.S. Rep. Blackburn (R-TN-07) says, “As a World War II veteran’s daughter, I know America is always one generation from slipping away. I’m Marsha Blackburn. I’ll fight to build the wall, reclaim the Supreme Court, protect Trump’s tax cuts, and repeal Obamacare. Phil Bredesen, he won’t do any of that. I’m Marsha Blackburn and I approve this message because we won’t right America if we don’t fix what’s wrong.” “I’m Marsha Blackburn, and I approve this message because we won’t right America if we don’t fix what’s wrong.” “Closing” is available to watch here. A second new ad is “We Need Marsha.” In the video, President Donald Trump says, “We need Marsha Blackburn to win. We need Marsha in the Senate to continue the amazing progress and work that we’ve done over the last year and a half. This November this is the state where America’s comeback will continue full speed ahead. We need Marsha. We will make America great again.” “We Need Marsha” is available to watch here. Speaking about…

Read the full storyTag: tax cuts

In FY2018, the Deficit Increased – But Not Because of Tax Cuts

by Robert Romano The numbers for the end of Fiscal Year 2018 are in and they aren’t pretty for fiscal hawks, as the budget deficit increased by an eye-popping $113 billion to $779 billion. But it had nothing to do with tax cuts. Tax receipts rose by $14 billion. All of it was because spending increased, and more than half of it was because gross interest owed on the national debt spiked by $65 billion to $521.5 billion. That bit is unsurprising, as 10-year treasuries interest rates have jumped from 2.2 percent in Sept. 2017 to 3.1 percent today. No wonder President Donald Trump thinks the Federal Reserve is crazy for hiking interest rates. With $21 trillion in debt, for every percentage point interest rates increase, that’s another $210 billion U.S. taxpayers will owe on the debt long-term. The other half of the deficit increase was a jump in spending that was already baked into the cake, largely in areas like Social Security, Medicare and defense spending. What’s amazing is that Social Security and Medicare spending have not been growing faster, considering how rapidly the population 65 years old and older has been expanding, but inflation was much lower…

Read the full storyIn Honor of Trump’s Visit to Johnson City, Group Names Plethora of Examples of Tennessee Business Growth Thanks to President’s Tax Cuts

In honor of President Trump visiting Johnson City Monday night, Americans for Tax Reform (ATR) released a list of “Tennessee Examples of Tax Reform Good News.” Trump’s appearance was a Make America Great Again (MAGA) midterm rally to share “great news” about the economy and support U.S. Representative Marsha Blackburn (R-TN) in her Senate race. The Tax Cuts and Jobs Act that was passed by the Republican Congress and signed by President Donald Trump means 90 percent of wage earners have higher take-home pay, ATR said. The group praised Blackburn’s “yes” vote on the tax cuts. Garren Shipley, Republican National Committee spokesman, said, “President Trump couldn’t have made the stakes more clear. A vote for Phil Bredesen is a vote for the failed polices espoused by Hillary Clinton – a candidate Bredesen enthusiastically supported in 2016. A vote for Marsha Blackburn is a vote to continue to success our country has seen over the last 20 months. Marsha knows that the tax cuts passed by Republicans and the drastic reduction in burdensome regulations has jumpstarted our economy. Tennesseans cannot afford the Bredesen/Clinton policies and that’s why Marsha Blackburn will be elected to the U.S. Senate.” Watch the live video feed…

Read the full storyTrump’s Tax Cuts Were ‘Oversold,’ Says Bredesen, Who Raised Taxes and Fees by Nearly $1 Billion as Governor

Former Governor Phil Bredesen said Wednesday that President Donald Trump’s tax cuts were “oversold” and have had little impact on falling unemployment rates. Bredesen’s comments appeared in a story in The Tennessean based on an interview with the newspaper’s editorial board. Bredesen is running for the U.S. Senate seat being vacated by retiring Senator Bob Corker (R-TN). His opponent is U.S. Representative Marsha Blackburn (R-TN-07). Bredesen said the tax cut is a “perfect example of what’s wrong in Washington,” arguing it missed an opportunity to overhaul the tax code, which he said is full of loopholes. The former governor said much of the tax cut funds have gone into stock buybacks. Bredesen said he was “100 percent for tax reform.” While the debate began as reform, Congress last December failed. “Instead it was, well, let’s just do the tax cut because that’s easy and everybody’s happy.” The Tennessee Republican Party has called out Bredesen for what it says are “phony” claims to have balanced the state budget when he served as governor 2003-2011, as the Tennessee Star reported this week. The state constitution requires the budget to be balanced, they said. The GOP pointed out how Bredesen fails to say that…

Read the full storySmall Business Owners: Trump’s Tax Cuts Miraculous for Tennessee

FRANKLIN, Tennessee — The national economy is on fire right now, thanks to Republican President Donald Trump’s tax cuts. Yet this story isn’t getting the media coverage it deserves. Tennessee’s small business owners, meanwhile, are thriving. They’re expanding their businesses. They’re hiring more employees. As if it wasn’t already obvious, that’s because they suddenly have more cash at their disposal. These were among the key messages conveyed at an event at The Factory at Franklin Wednesday. The Atlanta-based Job Creators Network, a small business advocacy group, organized it. U.S. Rep. Marsha Blackburn (R-TN-07), one of the speakers and the Republican nominee for the U.S. Senate seat being vacated by Sen. Bob Corker (R-TN), told The Tennessee Star the tax cuts have made Tennessee’s median income rate grow faster than any state in the American Southeast. Tennessee’s median income rate, meanwhile, is one of the five fastest growing nationwide. “The state is at 2.7 percent unemployment, and that is why you are seeing the aggressive wage growth,” said Blackburn, currently running to replace Bob Corker in the U.S. Senate. “Business owners can pay their employees more and not have people leave, so there is no constant retraining for them to have…

Read the full storyTrump Tax Cuts At Risk: Democrats Conspire to Repeal While Record Low Unemployment Surges

Tennessee Star Political Editor Steve Gill discussed on Monday’s edition of The Gill Report – broadcast on Knoxville’s 92.3 FM WETR – how Democrats are conspiring to repeal the Trump tax cuts while record low unemployment among Hispanic and African-Americans surge and the federal government rakes in a record amount of individual tax revenue for 2018. “You know we’ve been hearing from the left ever since the Trump tax cuts were passed by the Republican House and Senate with no help at all from the Democrats,” Gill began. “Democrats – including Democrats like Phil Bredesen who is running for the US Senate – declaring that they were mere crumbs; that they would only help the wealthy and that most Americans wouldn’t see the benefits.” He added: Now keep in mind that the tax cuts for most Americans haven’t gone into effect yet. They haven’t even gone into effect, because they will go fully into effect next year. The tax cuts have been cut for the income earned this year but the benefits the tax payers will see is when they file their tax returns next April 15th. And yet your already seeing companies give bigger bonuses your seeing pay raises you’re…

Read the full storyHardly ‘Crumbs’: Cookie Maker Hires Five Workers, Raises Pay, Expands Production Under Tax Cuts

by Rachel del Guidice The overhaul of the tax code by congressional Republicans didn’t produce just crumbs for the business of a popular cookie maker based in Florida. The Tax Cuts and Jobs Act has meant hiring, raises, investment in new equipment, and expanded operations, he says. “It has had a direct impact on us,” Joseph Semprevivo, founder, CEO, and president of Joseph’s Lite Cookies, told The Daily Signal in a phone interview. (pictured, above) “We have added five more positions, we’ve expanded our factory, exclusively for … the sugar-free pancake syrup [and] we are launching into another business, a honey business,” Semprevivo said. [ The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more ] He said the new syrup, branded Joseph’s Sugarfree Pancake Syrup, also is gluten free and approved by weight-loss businesses and groups such as Weight Watchers. “Since the tax cut, though, we were able to invest more money into promoting the [syrup] brand, expanding the brand, and so we decided to increase productivity and move it closer to our corporate offices in … Sebastian, Florida,” Semprevivo said. Republicans’ tax reform package, which passed the…

Read the full storyCiting Tax Cuts, McDonald’s Serves Up Tuition Benefits for Employees

by Rachel del Guidice Fast-food icon McDonald’s will supersize its 3-year-old education benefits program for hundreds of thousands of employees. McDonald’s Corp. will allocate $150 million over five years to its global Archways to Opportunity education program, tripling its reach, the restaurant giant announced Thursday. “This investment will provide almost 400,000 U.S. restaurant employees with accessibility to the program as the company will also lower eligibility requirements from nine months to 90 days of employment and drop weekly shift minimums from 20 hours to 15 hours.” McDonald’s is one of 472 companies, and counting, that have announced benefits such as pay raises, bonuses, utility rate cuts, or 401(k) hikes since Congress passed the tax cuts supported by President Donald Trump, according to Americans for Tax Reform. The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more >> Among other changes, the Republican tax overhaul, which went into effect Jan. 1, reduced the federal corporate tax rate from 35 percent to 21 percent. The Archways to Opportunity program gives eligible McDonald’s employees in the U.S. a path to obtain a high school diploma, acquire assistance for college tuition, learn English as a second language, and access education…

Read the full storyDemocrats Bash Corporate Tax Cuts Even as Their Blue States Slash Their Rates

Democrats trained their heaviest fire in attacking the measure’s corporate tax cuts, as a massive giveaway to the rich. But even as prominent Democrats like Senate Minority Leader Chuck Schumer (D-N.Y.), and Sens. Sheldon Whitehouse (D-R.I.) and Richard Durbin (D-Ill.) trashed the idea, their extremely blue home states have been cutting corporate tax rates.

Read the full storyNFL Wants More Crony Capitalism: Fights Tax Cut Bill with No Stadium Bond Breaks

The NFL has come out against House Republicans’ tax cut bill, putting the league out on a political limb even as it deals with the fallout from national anthem protests. Other big pro sports leagues are staying out of the fight, but a spokesman for the National Football League said teams don’t want to lose a…

Read the full story