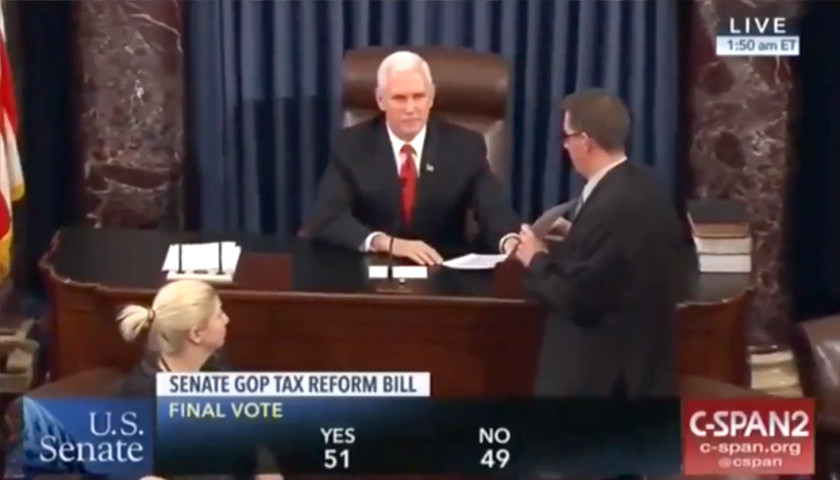

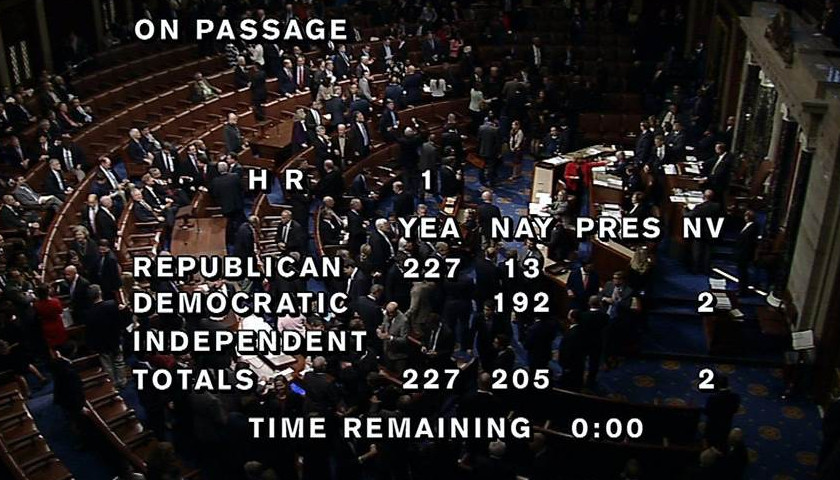

by Kalena Bruce As we enter the summer, Republicans and Democrats continue to debate the merits of the tax cuts. Lost in this partisan bickering is the genuine and long-overdue relief the tax cuts offer small businesses. Sadly, the media reporting on small business tax cuts has been heavily politicized, complicating rather than clarifying the issue. Even The New York Times couldn’t get it straight in an article earlier this year, leading to an embarrassing correction. As a certified professional accountant, I’ve already started dealing with the new tax code for small business clients who file returns on a quarterly basis. Here’s what they need to know. The new tax structure lowers tax rates and expands the income thresholds for anyone who pays individual income tax, including small businesses that are structured as pass-throughs. These include sole proprietorships, partnerships, LLCs, and S-Corps. The liberal Left continue to push their radical agenda against American values. The good news is there is a solution. Find out more >> Under the new tax structure, rates fall to 10, 12, 22, 24, 32, 35, and 37 percent from 10, 15, 25, 28, 33, 35, and 40 percent. Income thresholds under these new rates are also expanded. For instance,…

Read the full story