Former President Donald Trump said he would seek to use tariffs to potentially eliminate the income tax in a lengthy interview with podcaster Joe Rogan released Friday night.

Read the full storyTag: tax

Nearly $280M Behind Tax Collection Estimates, Tennessee Adjusts Revenue Predictions

Tennessee has now collected $279.9 million less than budgeted through the first five months of the fiscal year.

December’s $1.9 billion in collections were $82.5 million less than budgeted In numbers released Friday afternoon.

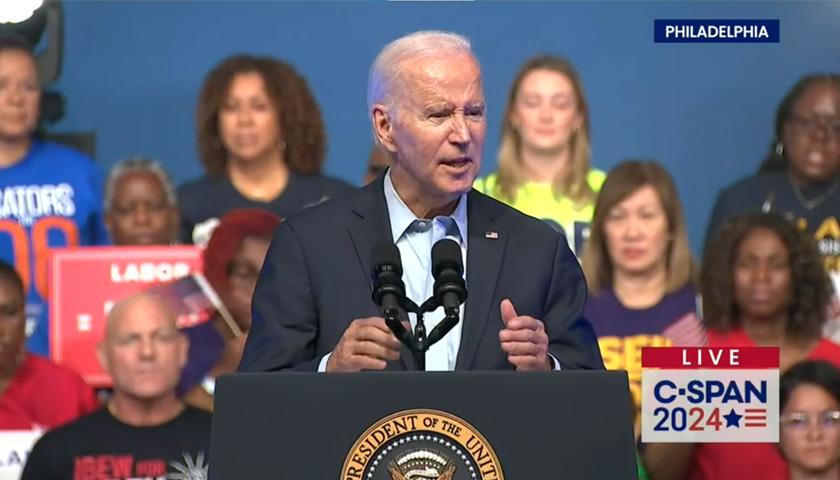

Read the full storyBiden Sets Leftist Tone for 2024 Re-Election Effort at Philadelphia Event

President Joe Biden held his first presidential re-election campaign event on Saturday at the Philadelphia Convention Center, making strong appeals to his left-wing base.

Biden appeared alongside organized-labor activists and mentioned in the first few seconds of his oration that when he thinks of working Americans, he especially values the ones who associate with causes he finds politically congenial.

Read the full storyCommentary: Tax Armageddon Day Is Coming

Benjamin Franklin famously wrote in 1789 that “our new Constitution is now established and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.” Death and taxes are fated. However, are enormous tax hikes also a fait accompli? Is it a certainty – ‘an accomplished fact’ – that the White House and Congress will repeal tax reforms that worked? Tax breaks that helped small business owners and families.

For the past several days Americans have been scrambling to make the deadline to complete their 2022 tax returns. Most taxpayers will be relieved once the ordeal is done. However, here’s an unfortunate reality: if Washington fails to act, the federal tax code is headed for major changes in just a couple of years, including massive tax hikes on families and small businesses.

Read the full storyGeorgia’s Tax Collections Wane in March

Georgia’s net tax collections for March decreased by 3 percent from a year ago, new state revenue figures show.

While collections for the month surpassed $2.6 billion, the total was more than $82.7 million less than net tax collections a year ago.

Read the full storyBill to Cut Nashville City Center Funding Calls into Question Tax Plan for New $2.2B Titans Stadium

A new proposed bill in the Tennessee not only proposes cutting some of the state tax funding to pay debt on the Music City Center, but it also calls into question plans to build a new $2.2 billion Tennessee Titans stadium.

Senate Bill 648, filed Thursday by Sen. Jack Johnson, R-Franklin, on behalf of Lt. Gov. Randy McNally, R-Oak Ridge, would change the way taxes flow to Metro Nashville to pay debt from the Music City Center, which opened in 2013. The bill does not yet have a House sponsor.

Read the full storyTennessee Has the Highest Beer Tax Rate in the U.S.

Tennessee has the highest beer tax rate in the country, according to a new report from the Tax Foundation.

Tennessee’s rate is $1.29 per gallon, one of just two states that charge more than $1 per gallon in the country. Alaska charges $1.07.

In the fiscal year just completed at the end of July, Tennessee collected more than $19 million in beer tax, which was $1.6 million more than it had budgeted. The year before, it collected $18.7 million in beer tax.

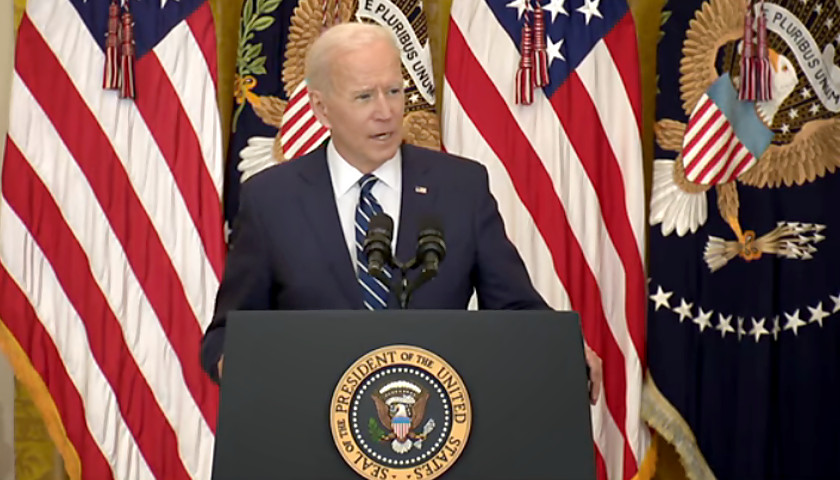

Read the full storyBiden Signs $740 Billion Climate, Tax and Health Care Bill into Law

President Joe Biden signed a $740 billion spending package into law Tuesday, the final step for the green energy, health care and tax hike bill after months of wrangling and controversy, in particular over the legislation’s hiring of 87,000 new IRS agents to audit Americans.

Democrats at the White House Tuesday touted the bill’s deficit reduction of $300 billion over the next decade. The bill includes several measures, including a $35 per month cap on insulin copays, an extension of Affordable Care Act subsidies, and authorization for Medicare to negotiate certain drug prices.

Read the full storyU.S. Senate Passes Massive Tax and Spend Bill Targeting Carbon Emissions, Prescription Drug Costs, More

The U.S. Senate on Sunday passed a $740 billion new taxing and spending bill that seeks to combat climate change and allow the government to control the price of prescription medications, among other things.

No Republicans voted for the bill, named the Inflation Reduction Act of 2022, in the divided 50-50 Senate, forcing Vice President Kamala Harris to break the tie. The measure must return to the House for a concurrence vote after senators passed several amendments Sunday. The House is expected to take the bill up again on Friday. If the House concurs, President Joe Biden has indicated he will sign it.

Read the full storyRep. John Rose Commentary: Inflation Is the Invisible Tax

Inflation is an invisible tax that Tennesseans have to pay each and every day. Everywhere you look, inflation is wreaking havoc. At the gas station: gas is up 48 percent. At the grocery store: beef is up 20 percent, chicken is up 15 percent, butter is up 14 percent, fruits and vegetables are up 7 percent, and coffee is up 12 percent. At home: electricity is up 11 percent, furniture is up 15 percent, and rent is up 5 percent. What about a vacation? You still won’t be able to escape inflation as hotels are up 29 percent and flights are up 23 percent.

Read the full storyBills Aims to ‘Triple-Tax’ Michigan Car-Sharing Industry

Renting out cars on Turo allowed Bill Huffhine of Rochester Hills to retire early.

But a bill package in the Michigan House could “triple-tax” the emerging peer-to-peer car-sharing industry, Huffhine said, and squash the thin margins that let him accelerate a one-vehicle side-hustle in 2018 into a 20-vehicle fleet.

Read the full storyMichigan Attorney General Nessel Snags $3.5 Million in Turbotax Settlement for 115,000

About 115,000 Michiganders should receive payments totaling more than $3.5 million from Intuit, the owner of TurboTax, for deceiving consumers into paying for tax services that should have been free.

As part of a multi-state agreement, Attorney General Dana Nessel said Intuit will pay $141 million in restitution nationally to millions of consumers it unfairly charged for a free service.

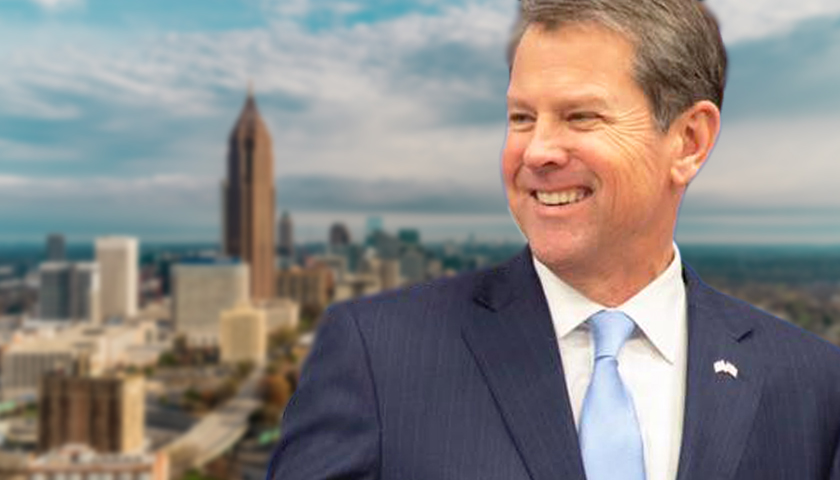

Read the full storyKemp Signs Bill to Give Georgia Taxpayers a More than $1 Billion Refund

Georgia Gov. Brian Kemp signed a measure Wednesday to give a one-time tax refund to eligible Georgia taxpayers.

Taxpayers who are single or married and filing separately will receive a $250 refund under House Bill 1302. Heads of households will receive a $375 refund, while married taxpayers who file jointly will receive a $500 refund.

The Georgia Department of Revenue will credit taxpayers with the refund once they file their 2021 taxes, which are due April 18. Taxpayers who already have filed their 2021 taxes will receive a refund based on what they indicated on their tax returns.

Read the full storyTennessee Revenues for February $212 Million More Than Budgeted

Tennessee tax revenues for February of $1.2 billion exceeded the budgeted estimate of $1.03 billion by $212 million or 20.6 percent, Commissioner of the Department Finance and Administration Butch Eley announced Friday.

February 2022 revenues were also $111.7 million more than what the state received in taxes in February 2021, reflecting a growth rate of nearly 10 percent.

Read the full storyIRS Looks to Hire 10,000 Workers in Attempt to Resolve Tax Return Backlog

The Internal Revenue Service is hiring 10,000 employees as part of an attempt to address a backlog of nearly 24 million tax returns, most of which are outstanding from the 2020 tax season.

Read the full storyBipartisan Bills Would Eliminate Michigan Sales Tax on Vehicle Rebates

The Michigan Senate will consider legislation to eliminate sales and use taxes from automotive manufacturer rebates, which could save new car buyers in the state an estimated $31 million annually.

House Bills 4939 and 4940 passed the Michigan House earlier this week. The bipartisan bills were sponsored by Reps. John Damoose, R-Harbor Springs, and Joe Tate, D-Detroit. The bills aim to take new vehicle customers off the hook for paying taxes on automotive manufacturer discounts.

Currently, Michigan car buyers incur a tax obligation for the full price of the vehicle they purchase, and no deductions are allowed for rebates offered by manufacturers. The bills under consideration would exempt rebates from state sales and use taxes.

Read the full storyManchin Objects to Dems’ Billionaire Tax, Saying They ‘Create a Lot of Jobs’

West Virginia Democratic Sen. Joe Manchin came out against his party’s plan to tax billionaires in order to finance their social-spending package just hours after it was first released.

“I don’t like it. I don’t like the connotation that we’re targeting different people,” Manchin told reporters Tuesday morning, describing billionaires as people who “contributed to society and create a lot of jobs and a lot of money and give a lot to philanthropic pursuits.”

Read the full storyBusinesses Push Back Against Biden Plan to Track All Bank Transactions over $600 Through the IRS

A major component of President Joe Biden’s plan to raise revenue to pay for his trillions of dollars in new federal spending is now under fire from trade associations across the country.

The Biden administration has made clear its plan to beef up IRS auditing by expanding the agency’s funding and power. Biden’s latest proposal would require banks to turn over to the Internal Revenue Service bank account information for all accounts holding more than $600.

In a sharp pushback against the proposal, more than 40 trade associations, some of which represent entire industries or economic sectors, signed a letter to U.S. House Speaker Nancy Pelosi, D-Calif., and Minority Leader Kevin McCarthy, R-Calif., raising the alarm about the plan.

Read the full storyJoe Biden Mistakenly Calls Michigan Gov. Gretchen Whitmer ‘Jennifer’ as She Backs Infrastructure Plan, Mileage-Tax Pilot Program

President Joe Biden mistakenly called Michigan Gov. Gretchen Whitmer (D) “Jennifer” on Wednesday, an apparent reference to a previous Michigan governor, Jennifer Granholm, who is now Biden’s energy secretary.

Of course, the two Great Lake State Democrats aren’t that easy to get confused; Granholm finished her tenure as governor eight years before Whitmer took office.

Read the full storyFarmers Cry Foul over Biden’s Death Tax Proposal

President Joe Biden has proposed amending the inheritance tax, also known as the “death tax,” but farmers around the country are raising concerns about the plan.

In the American Families Plan introduced earlier this year, Biden proposed repealing the “step-up in basis” in tax law. The stepped-up basis is a tax provision that allows an heir to report the value of an asset at the time of inheriting it, essentially not paying gains taxes on how much the assets increased in value during the lifetime of the deceased. This allows heirs to avoid gains taxes altogether if they sell the inheritance immediately.

Under Biden’s change, heirs would be forced to pay taxes on the appreciation of the assets, potentially over the entire lifetime of the recently deceased relative.

Read the full storyRepublicans Push Back Against ‘Politicization’ of IRS

President Joe Biden has pushed for beefing up IRS audits of corporations to raise revenue for his new spending proposals, but Republicans are raising the alarm about the potential consequences of the plan.

Biden unveiled his “Made in America Tax Plan” earlier this year as a strategy to help fund his trillions of dollars in proposed new federal spending that includes several tax hikes. Despite this, a bipartisan coalition in the U.S. House and Senate have agreed to a basic framework for Biden’s proposed infrastructure plan, but one element has been the theme of the negotiations among Republicans: no new taxes.

The GOP pushback against raising taxes, though, puts more pressure on the Biden administration to find ways to fund his agenda. Aside from Biden’s controversial tax hike proposals, the president also has proposed adding $80 billion in funding to the IRS so it can increase audits of corporations.

Read the full storyGov. Whitmer Vetoes PPP Tax Refund Bills Days After Business Summit

Two days after touting her administrations support of Michigan’s small businesses, Gov. Gretchen Whitmer vetoed bipartisan bills that would have exempted certain business purchases of personal protection equipment (PPE) from the 6% state sales tax.

The bills would have offered businesses exemptions and refunds for sales or use tax paid on PPE retroactive to March 10, 2020, through 2021.

Read the full storyBusiness Tax Filings Could Get Easier in Ohio

A bill passed by the Ohio House would eliminate a step businesses owners must take to file taxes with the state and local governments and free up time for those owners to create more jobs and increase business, according to the bill’s sponsor.

The legislation allows businesses to opt into a system run by the Ohio Department of Taxation to pay net profits taxes to the state, and the state notifies each municipality of the taxes. Currently, business owners can decide to be part of the state’s system but must notify municipalities themselves, instead of a one-time notification.

“The current system for filing municipal net profits tax in Ohio creates unnecessary paperwork for our hard-working business owners,” Rep. Bill Roemer, R-Richfield, said. “As if the complications of the tax code itself weren’t enough, the state also requires businesses to jump through unnecessary administration hoops to meet their tax obligations. This bill streamlines and simplifies this process, so our business owners can spend more time creating jobs and contributing to our local economies, instead of complying with burdensome filing requirements.”

Read the full storyCritics of Biden’s Proposed Oil-and-Gas Industry Taxes Fueled by Gas Shortages

Gas shortages on the East Coast have helped rally Congressional opposition to the portions of President Joe Biden’s infrastructure plan that would force oil and gas companies to pay more in taxes.

House Republicans sent a letter to House Speaker Nancy Pelosi, D-Calif., and House Majority Leader Steny Hoyer, D-Md., calling on Democrats to oppose Biden’s plan to “eliminate tax preferences for fossil fuels.”

The letter, signed by 55 Republicans, came after a cyber attack of Colonial Pipeline shut down a major pipeline on the East Coast and led to fear-driven gasoline shortages. The attack also raised questions about the nation’s energy infrastructure and vulnerability to attack.

Read the full storyOhio Extends Tax Deadline from April 15 to May 17

The Ohio Department of Taxation announced on Thursday that it would be extending the deadline to file and pay taxes in the state from April 15 to May 17.

Read the full storyGeorgia House Passes on Effort to Study State’s Tax, Revenue Structure

The Georgia House has rejected a bill that would have launched a review of the state’s revenue and tax structure.

Senate Bill 148 would have created two panels to study and make recommendations for the state’s coffers. It would have re-established the Special Council on Tax Reform and Fairness for Georgians and create the Special Joint Committee on Georgia Revenue Structure.

The House voted, 139-20, against the bill Thursday. It had 39 sponsors.

Read the full storyGov. DeWine Signs into Law Expanded Tax Exemption for Spouses of Fallen First Responders

A new law signed by Ohio Gov. Mike DeWine will increase tax exemptions for spouses of fallen first responders.

House Bill 17 was an expansion of previous legislation and increases the homestead tax exemption from $25,000 to $50,000. The legislation allows the spouse of a fallen first responder to exempt $50,000 of their home’s appraised value from property taxes or the manufactured home tax.

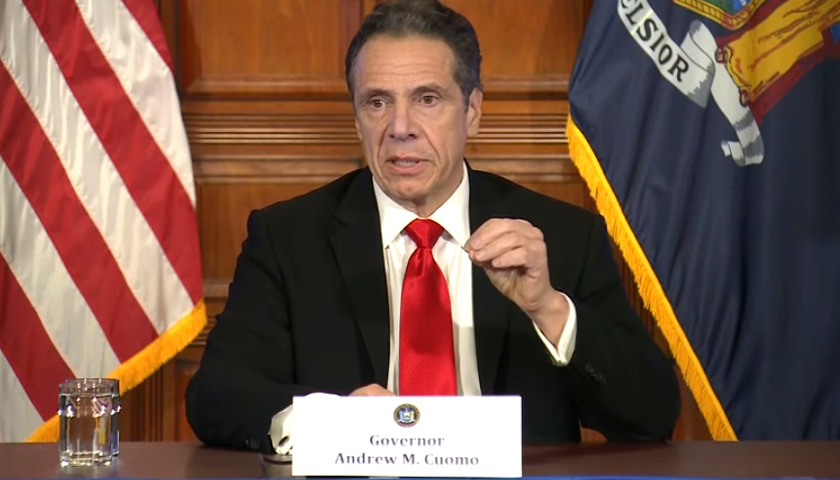

Read the full storyNew York Gov. Cuomo Tells Hero Healthcare Workers Who Traveled There to Save Coronavirus Patients Now Must Pay State Income Taxes

New York Gov. Andrew Cuomo, who once pled for an influx of healthcare workers to treat COVID-19, now says they have to pay up for the privilege of having worked there to treat the coronavirus.

Cuomo said out-of-state medical professionals who volunteered to help his state owe income taxes, Fox News said. That applies even if they stayed on the payroll in their home states. However, only workers who stayed in New York for more than 14 days are on the hook.

Read the full storyBill Package Could Generate $800 Million to Fix Michigan Roads Without Tax Increase

A new bill package introduced to the Michigan House of Representatives could help fix local roads without increasing taxes.

Read the full storyMichigan Business Leaders Push for Tax Hikes to Fund Regional Transit

More than 50 Michigan business leaders are pushing for the legislature to support a tri-county regional transit tax that would cover Oakland, Washtenaw and Wayne counties.

Read the full storyHermantown City Council Proposes Tax Hike for $28 Million Recreation Improvements

The City Council of Hermantown, a Duluth suburb, wants state lawmakers to approve a resolution to place a half-cent sales tax increase on the November ballot.

Council members this week passed a resolution 4-1 to consider increasing the city’s sales tax by 0.5 percent for 20 years.

Read the full storyFedEx CEO Challenges NYT Publisher to Public Debate After ‘Factually Incorrect’ Article

The CEO of FedEx challenged New York Times publisher A. G. Sulzberger to a public debate Sunday after the publication reported that the company didn’t pay any federal taxes in 2018.

Read the full storyChina, Tariffs, Trade, Cost and Prices: An Explainer

by Rick Manning Stock markets go up and down based upon the latest trade rumors. Predictions of price hikes make headlines, yet the inflation rate remains at the levels, 2.0 percent at last count, desired by the Federal Reserve. What is going on? And is this even really a trade war with China at all, or is it part of something much bigger? These are questions that should be asked but are often lost to click-bait headlines. So, here are a few thumbnail answers that will hopefully help you understand what is going on. Question: Are President Trump’s use of tariffs against China part of a trade war? Those who try to put tariffs on goods made in China into this context are deliberately narrowing the real challenge in the economic relations between the U.S. and China. The tariffs are designed to restructure America’s trade relations with China, but when you examine the key demands from the recent attempts to create a new economic partnership with China, they are mostly focused upon protecting patents, ending forced technology transfers to the Chinese government and stopping Chinese currency manipulation which always puts U.S. goods at a competitive disadvantage with Chinese goods. Traditional trade deals…

Read the full storyOhio Senate Breaks Even Further from Governor DeWine, Lowering Gas Tax to Six Cents

The Republican-held Ohio Senate joined Republicans in the House of Representatives in opposing Gov. Mike DeWine on his proposed gas-tax hike. House Bill 62 (HB 62), the 2020-21 Ohio transportation budget, first proposed by DeWine on Feb. 12, originally called for an 18 cent increase to the current gas tax. This was the first major bill proposal of his term. He called the measure “a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy.” In his State of the State address, as well as in other forums, he maintained that this was the absolute lowest the tax could be and would have to go into effect immediately. After being referred to the House, the Republican-held legislature broke significantly from the governor, lowering the rate to 10.7 cents and ordered it to be phased in over three years. “If they pass the House bill, we’re going to end up with the worst of all worlds,” DeWine said in response. He was insistent that the 18 cent number was the only acceptable rate. While DeWine seemed hopeful he could convince the legislature to return to his 18 cent number, the Ohio Senate seems to be making it clear that 18…

Read the full storyGeorgia Legislators Pursue ‘Netflix Tax’ to Cash in on Digital Streaming

by Brittany Hunter When the private sector needs to generate more revenue, entrepreneurs innovate and create in order to draw in consumers and raise profits. When the government needs to generate additional revenue, they are left with only one option: Extort through fees and taxation. And after it has taxed everything feasibly within its grasp, it has to get creative. California lawmakers have sunk so low, there is now a tax on fruit purchased from vending machines. It should be noted that regular fruit purchased at a store is not subject to this tax, only those purchased from a vending machine. Following this line of absurdity, Indiana has an instituted a candy tax on marshmallows. Maine has a fruit tax specifically on blueberries. Unfortunately, Georgia may be the next state to fall victim to absurd government attempts to generate revenue by taxing digital streaming services like Netflix and Hulu. Tax All the Things At the end of last year, California tried to pull a fast one on its residents when local policymakers attempted to levy a 4 percent tax on text messaging. Just weeks prior, Chicago became a target for criticism after PlayStation’s decision to begin enforcing the city’s new 9…

Read the full storyFederal Judge Ends Obamacare!

A federal court has ruled that all of the Affordable Care Act, or Obamacare, is unconstitutional based on the individual mandate that requires people to have insurance and how that affects a new tax law. The ruling came just before Saturday, which is the deadline to enroll for Obamacare for the year. Judge Reed O’Connor of the U.S. District Court Northern District of Texas found the ACA unconstitutional in a ruling in Texas v. United States, which he issued Friday night, The Washington Post said. Congress in August set the individual mandate penalty to $0 in new tax legislation, The Washington Times said. The $0 penalty could affect a 2012 Supreme Court decision finding Obamacare constitutional because Congress has the power to tax, according to CBS News. But if there is no penalty, the tax does not exist, the plaintiffs said. California’s Attorney General, Xavier Becerra, has fought against the plaintiffs in Texas v. United States. He said in a statement, “Today’s ruling is an assault on 133 million Americans with preexisting conditions, on the 20 million Americans who rely on the ACA for healthcare, and on America’s faithful progress toward affordable healthcare for all Americans. The ACA has already…

Read the full storyChicago’s New PlayStation Tax Shows How Greedy Politicians Can Be

by Brittany Hunter “If it moves, tax it.” That’s government’s eternal motto, as Ronald Reagan quipped. To this, the city government of Chicago has added, “If it amuses, tax it.” A few weeks ago, PlayStation 4 users in Chicago were shocked when they turned on their consoles and saw a message from Sony. The message informed users that as of November 14, 2018, they would be required to pay a 9 percent “amusement tax” for PlayStation subscriptions such as PlayStation Now, PlayStation Plus, PlayStation Music, and others. The tax is specifically related to streaming services, so the PlayStation games themselves will not be subject to the 9 percent tax. But in today’s subscription-heavy economy, many users purchase these consoles as a medium to stream videos and music rather than using them solely to play games. Not to mention, the tax will still include subscription services that allow Playstation users to connect and play with other users around the globe. So if you own a PlayStation in Chicago, it is unlikely that you will be able to fully avoid this tax. PlayStation users, however, are not the only victims of this absurd tax. Chicago’s Amusement Tax Chicago is one of the…

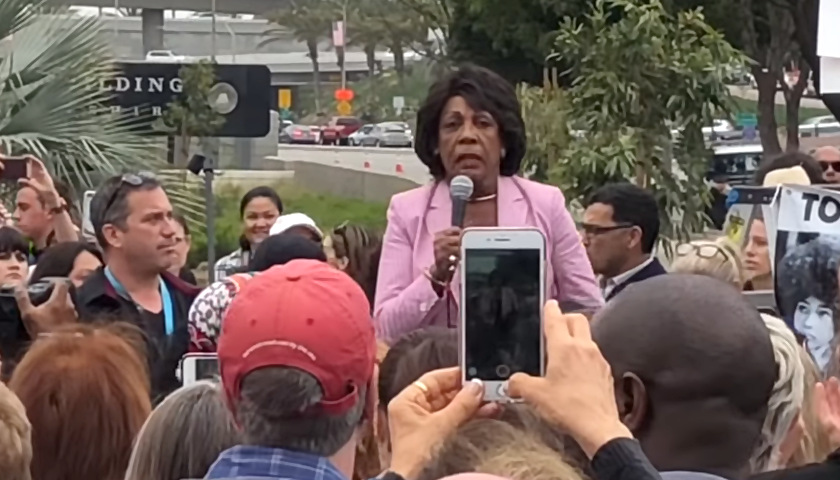

Read the full storyWaters’ Spotty Ethical Record and Extreme Policy Positions Leave Many Questioning Her Fitness to Serve as Banking Chair

by Richard McCarty Congresswoman Maxine Waters (D-CA-43) represents all that is wrong with Washington, D.C., yet she is next in line to chair the House Financial Services Committee should Democrats seize control of the House. It should be noted that the Financial Services Committee has broad authority with jurisdiction over the banking, housing, insurance, and securities industries and oversight over the Federal Reserve, the Treasury Department, and the Department of Housing and Urban Development. Waters, an 80-year-old California Democrat, was first elected to Congress in 1990. Although she currently represents a working class district, she chooses to live outside of her district in a $4.8 million mansion (which means that the value of her home is more than eight times the median value of homes in her district). Prior to Congress, she spent 14 years in the California State Assembly. She has been a member of the Democratic National Committee for nearly 40 years. Recently, Waters has seen a surge in her popularity among Democrats due to her hatred and contempt for President Trump; but before reinventing herself as a Resistance leader, she was widely viewed as corrupt. In fact, she has repeatedly been labelled one of the most…

Read the full storyTennessee Voters Back Trump Tariff and Tax Policies

Although the federal tax cuts promoted by President Donald Trump and passed by the Republican Congress, without a single Democrat vote in support of the plan, are not yet fully in place Tennessee voters support the plan according to a new Tennessee Star poll conducted in early September. The tax cut plan produced immediate bonuses for many workers, but most voters won’t see the actual benefits until they file their 2018 tax returns in 2019. Nevertheless, the issue is becoming a talking point in the 2018 election cycle in Tennessee and other states. The Tennessee Star poll asked likely November general election voters whether the new tax laws had produced any impact. Forty-one percent said the new tax laws had been “for the better” for them; 16.1% said “for the worse”, 34% “not much impact so far”, and 8.9% were not sure or didn’t know. Most economic experts have credited the tax law changes, along with Trump Administration regulatory reform, with spurring the financial gains generated in the past year that have produced record lows of unemployment among blacks and hispanics, record levels of employment and wage gains, and an apparent boom in manufacturing reinvestment. Numerous “gloom and doom” predictions…

Read the full storyTennessee Lawmakers Introduce a Bill to End Mandatory Emissions Tests

Tennessee State Senators Bo Watson (R-Hixson) and Todd Gardenhire (R-Chattanooga) joined State Representative Mike Carter (R-Ooltewah) to file Senate Bill 2656, which would end mandatory emissions tests for vehicles registered in those counties that still have the requirement. The bill’s summary, as it appears in the legislative database reads: Motor Vehicles – As introduced, bans counties in attainment status from entering into or renewing contracts regarding vehicle inspection and maintenance programs to maintain compliance with national ambient air quality standards. – Amends TCA Title 55 and Title 68. Annually, over 1.5 million vehicles across the half-dozen counties of Hamilton, Davidson, Rutherford, Sumner, Williamson and Wilson would see relief. “Vehicle owners in these counties should not be penalized as the standards have been met,” Senator Watson said in a joint statement about the measure. “Emission testing is not only time-consuming, but has costs attached, which are especially hard on low-income families. This legislation would relieve this burdensome regulation for citizens in these six counties.” The lawmakers explain that the 1990 Federal Clean Air Act required the State of Tennessee to develop more restrictive regulations to control air pollution from mobile sources in counties which were not meeting the Federal Standards for air quality. In August, the Tennessee Department…

Read the full storyEarly Voting Begins in Williamson County on Referendum to Increase Sales Tax

Early voting for the Williamson County referendum to raise the sales tax began Wednesday and will run through Thursday, February 1. On the ballot is a proposal that would increase the county’s contribution to the state sales tax by a hefty 22 percent resulting is a new tax rate of 2.75 percent: Shall Resolution No. 11-17-15, passed by the Williamson County Commission on November 13, 2017 published in the Tennessean, Williamson A.M., newspapers of general circulations, and as authorized by and be levied and collected pursuant to the Retailer’s Sales Tax Act and the 1963 Local Option Revenue Act under Title 67, chapter 6, Tennessee Code Annotated, which will increase the local option sales and use tax rate from 2.25% to 2.75% become operative? County officials and some business leaders support the measure and say the “modest” hike will generate about $60 million over three years. The money is slated to retire outstanding debt from new school construction. The Tennessee Star obtained two separate mailers, one sent by the National Association of Realtors Issues Committee. The other was by group calling itself “Citizens for School Funding” with the web address: voteforschools.tn A quick lookup shows Matt Largen listed as the group’s…

Read the full storyTrump to Unveil Tax Cuts Wednesday

US President Donald Trump will roll out a plan to reform America’s tax code Wednesday, a high stakes bid to salvage his agenda and bolster his faltering presidency. Amid a string of legislative setbacks, Trump teased a “big announcement tomorrow,” when the White House and Republicans will unveil tax reform plans. “I’ve asked lawmakers in both…

Read the full storyCommentary: NO, It ISN’T a Tax Cut for Regular Tennesseeans

Proponents of Governor Bill Haslam’s fuel tax increase claim it is actually a tax CUT thanks to reductions in a couple of large corporate taxes, like the Franchise & Excise tax. Cutting taxes on businesses to create more job growth while we have a $2 billion surplus is a great idea…but you don’t have to increase taxes elsewhere to justify it. As Nike ads used to proclaim: “Just DO It!!” The claim that a large tax increase on drivers in Tennessee with a slight reduction of taxes on food is a “net cut” because it is combined with unrelated cuts that benefit a few of the Governor’s cronies is the kind of misrepresentation that“fuels” a legitimate distrust of government. The tax INCREASES on fuel far surpass the CUTS in the sales tax on food. It’s not even close. Muddying the water with corporate tax cuts that benefit a few doesn’t change that truth. As the Haslam IMPROVE Act currently stands, it is a $345 million tax increase. Approximately $188 million will come from the increase in the gasoline tax; another $100 million will be generated by the increased diesel tax; and finally, about $57 million will be collected in the…

Read the full storyNashville Taxpayers Voice Skepticism of Proposed $14 Million Tax Incentive Deal for Opryland Waterpark Development

Once again, powerful business interests have approached the Metro Nashville Development and Housing Agency for a tax break, and once again, the Metro Nashville Development and Housing Agency appear to be all-too-happy to grant their request. Nashville taxpayers, however, are not so eager. In a statement released by the Beacon Center of Tennessee: According to a new rapid online poll released by the Beacon Center of Tennessee and Nashville-based polling firm icitizen, a full 92% of Tennesseans are opposed to the Metro Council’s proposal to use $14 million in taxpayer money to fund a waterpark at the Opryland Hotel that only hotel guests are allowed to use. Only about 5% of respondents approve of this deal. The incentives for the waterpark are viewed extremely unfavorably by Democrats, Republicans, and Independents alike. “With this tax break, [the new Opryland development, Sound Waves] are competing with other, existing water parks, with government help. And on top of that, it is not open to regular Nashville residents,” said Mark Cunningham, Beacon’s marketing and communications director, in an interview with The Tennessee Star this morning. The Beacon Center is a 501 c(3) dedicated to “empowering Tennesseans to reclaim control of their lives.” “So let’s think about this,”…

Read the full story