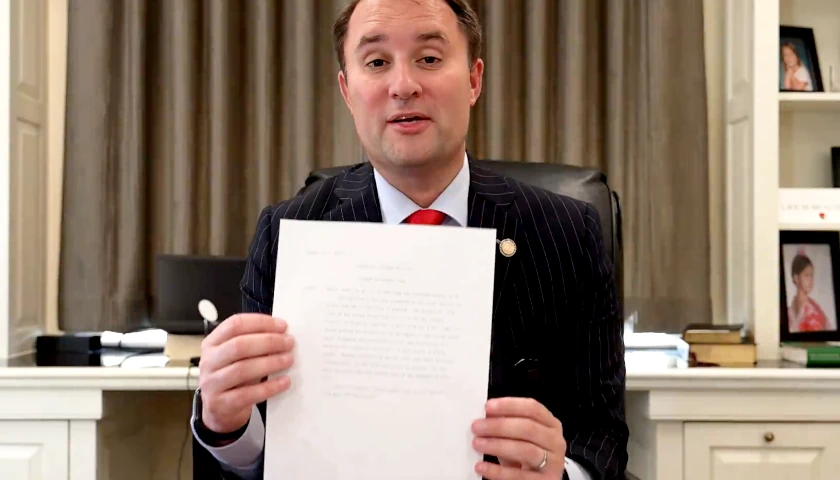

RICHMOND, Virginia – Governor Glenn Youngkin is highlighting $1 billion in tax relief in his budget amendment proposal, including lowering Virginia’s business tax rate from six to five percent and slightly lowering the income tax for payers above $17,000 from 5.75 percent to 5.5 percent.

In Thursday’s joint meeting of the General Assembly money committees, Youngkin and members of his administration told legislators that lowering tax rates will increase Virginia’s tax revenue in the long run by attracting more growth.

“This first step will mean our business tax rate will be lower than Tennessee, Georgia, and Florida. But more importantly, by setting ourselves on a committed path to an even lower rate – like Democrat-led North Carolina was able to do – we will send a clear signal to businesses that we want your jobs and we are going to drive the Commonwealth’s economic engine even faster,” Youngkin said. “Starting down this path is to reject false choices presented in the past. Yes, Virginia, we can choose competitive taxes, we can choose economic growth, and we can choose critical investment priorities all at the same time.”

In the 2023 session, the General Assembly will pass a budget amendment to update Virginia’s biennial budget passed in 2022.

Youngkin’s proposal accounts for $3.6 billion in additional funds not included in the original budget. In addition to the tax cuts, it includes $2.6 billion in spending on items, including $450 million on-site development to attract businesses, $200 million for the Resilient Virginia Revolving Loan Fund, and a combined $313 million for aid to public education. Youngkin also highlighted money for law enforcement recruitment and retention, Virginia’s behavioral health services, a program to expand clinical opportunities for entry-level nurses who need hours and to reduce pollution in the Chesapeake Bay.

During the committee meeting, some Democratic legislators expressed concern about a lack of increased funding for higher education and transportation. Other legislators worried that the heavy tax cuts would reduce Virginia’s ability to respond to a recession that Youngkin and Secretary of Finance Stephen Cummings said is coming. Virginia Department of Planning and Budget Director Michael Maul emphasized that Youngkin’s proposal includes optional spending contingent on Virginia’s revenue performing well.

After the presentations, House Appropriations Chair Barry Knight (R-Virginia Beach) told reporters that the proposals mostly came from Youngkin and his staff, “but they allowed me to have some input.”

“I think it’s a wonderful place to start. In fact, I think we’re well on our way,” he said, highlighting spending on mental health and triggers on tax cuts that will keep some cuts from taking effect if the revenue estimates aren’t met.

But Knight and Youngkin will need Senate Democrats to support the proposals.

Senate Finance and Appropriations Co-Chair George Barker (D-Fairfax) told reporters, “We did some tax cuts last year, and we also drew the line on a lot of things, and I think we’ll consider everything, but I would not expect that we will continue putting a huge amount of tax cuts year after year, particularly when many of the things they’re talking about are one-time expenditures on the expenditures side.”

“We have a long list of unmet needs in this state, things that the General Assembly has promised over many years, that we haven’t delivered on. So this is our opportunity to live up to what we’ve already promised,” Co-Chair Janet Howell (D-Fairfax) told reporters.

Text of Youngkin’s speech as prepared for delivery is available here.

– – –

Eric Burk is a reporter at The Virginia Star and The Star News Network. Email tips to [email protected].

Photos by Eric Burk.