Dear Tennessee Star, In George Orwell’s dystopian masterpiece 1984, the unfortunate character Winston is battling desperately to grasp objective truth. Meanwhile the power mongers ruling the Ministry of Truth tell him, “War is peace. Freedom is slavery. Ignorance is strength.” Orwell thought he was writing satire; too bad he couldn’t witness our Tennessee General Assembly, where a tax increase is hawked as a tax cut. Gone is the IMPROVE Act; now we have the “Tax Cut Act of 2017.” Same steaming cowpie, just an added dash of Haslamian perfume. We must assume our politicians dreamed this up supposing that average Tennesseans are complete imbeciles who salivate at the mere mention of tax cuts. Well, tax cut for whom, you may ask? Good question. Short answer – it ain’t us. Longer answer – the bulk of the tax cuts are specifically in the Franchise and Excise tax, targeted to save some of Tennessee’s largest corporations about $113 million. Most conservatives might be fine with reasonable corporate tax reductions as the state runs a $2 billion surplus, but not in the same bill that seeks to slam average Tennesseans with a huge increase in fuel taxes. The Governor and his political…

Read the full storyTag: Gas tax

Gas Tax Increase Passes House Finance Committee on a Voice Vote

Rep. Charles Sargent (R-Franklin), chairman of the House Finance, Ways, and Means Committee, presided over a voice vote on Tuesday that advanced the controversial IMPROVE Act “Tax Cut Act of 2017” to the Calendar and Rules Committee, where it awaits scheduling for a vote on the floor of the full House. Rep. Barry Doss (R-Leoma), as sponsor of the bill, once again presented the features of the IMPROVE Act “Tax Cut Act of 2017.” Doss unexpectedly made a point of saying that the renaming of the bill last week to include The Tax Cut Act of 2017 was something that was not important to him, but it was to its sponsor, Rep. Gerald McCormick (R-Chattanooga). Chairman Sargent allowed a leisurely-paced question and answer period from Committee members to Rep. Doss, which came primarily from Democrat members of the Committee. Rep. Mike Carter (R-Ooltewah) pointed out that while he wished it wasn’t included in the IMPROVE Act “Tax Cut Act of 2017”, he wouldn’t vote for a bill that didn’t include the change from the franchise and excise tax to the single sales factor due to the loss of Polaris from his district to the state of Alabama. Rep. David Hawk (R- Greeneville)…

Read the full storySteve Gill Commentary: Crony Capitalism Drives the Haslam Gas Tax Plan

The Haslam Administration is doling out over $113 million in tax CUTS to some of Tennessee’s largest corporations to justify over $350 million in tax INCREASES on working Tennesseans. According to the Times Free Press, just 24 large manufacturing companies will each receive tax breaks of over a million dollars a year under the Haslam plan. Those two dozen companies will reduce their tax burden by over $57 million and receive OVER HALF of the proposed $113 million in Franchise and Excise tax reduction. Tennessee law doesn’t allow the state to release the specific identities of the 24 companies that will benefit most from the Franchise and Excise tax cut. However, according to the Times Free Press certain companies that fit the profile of those who are most likely among the 24 sharing in the $57 million tax break include Nissan, Volkswagen, and General Motors. “This whole tax scheme appears to be built upon a foundation of special treatment for the Governor’s friends while sticking it to ordinary working Tennesseans,” according to State Rep. Judd Matheny. “Before the plan moves one step forward there needs to be full and complete disclosure of who exactly stands to benefit, and how…

Read the full storyDespite Ethics Cloud, ‘Proud’ Barry Doss Presented ‘New and IMPROVED’ Gas Tax Bill for ‘Rebranding’ as ‘Tax Cut Act of 2017’

Rep. Barry Doss (R-Leoma) told the House Finance, Ways and Means Committee on Wednesday he was “proud to bring the bill before you,” as he presented Governor Haslam’s IMPROVE Act, the gas tax increase proposal he co-sponsors, for consideration. Rep. Doss continues to sponsor and present the bill, despite the call for an ethics investigation by the Tennessee Republican Assembly over potential Tennessee Department of Transportation contracts for his company. Doss statement of pride in the gas tax increase proposal came both in his opening statement and again later in response to Rep. David Hawk (R-Greeneville). Hawk said he would continue to work to “present a plan our colleagues can vote for, as opposed to presenting a plan that our colleagues may have to hold their nose and vote for.” Doss took exception to Hawk’s comments, and said again that he was proud to sponsor the gas tax increase bill and that he is “not holding my nose today.” He conceded, however, that it’s “going to take some education of our constituents,” something he said he has “been doing for a solid year.” Although he has served two previous terms in the House of Representatives, Rep. Doss has not been a member…

Read the full storySpeaker Harwell Says She Will Have a Road Funding Plan That Does Not Raise The Gas Tax

Speaker Beth Harwell (R-Nashville) says that she and many other members of the Tennessee House of Representatives will introduce an alternative plan that will not increase gas taxes when the IMPROVE Act “Tax Cut Act of 2017” comes before the House Finance Ways and Means Committee on Monday for consideration. “When you buy a car in the state of Tennessee, whether used or new, you pay a sales tax on that. We want to take that sales tax and put it to our roads program. That brings in a tremendous amount of money and we think that’s an appropriate, new, dedicated source of funding for our roads, which then we would not have to raise the gas tax,” Harwell said in an interview with Ralph Bristol, host of 99.7 FM WWTN’s Nashville’s Morning News on Monday. Full details of the plan are being finalized, with input from other House members, Speaker Harwell said. But the plan will use existing revenues from the sales tax of new and used vehicle sales already collected by the state and dedicate those revenues to funding road projects, she added. Allocating the state portion of the vehicle sales tax revenues toward roads would result in…

Read the full storyAmericans For Prosperity To Hold ‘A Gas Tax Day Of Action’ In Speaker Harwell’s District

Americans For Prosperity-Tennessee (AFP) announced ‘A Day of Action’ in the fight against the gas tax hike in the home district of Speaker Beth Harwell (R-Nashville), in order to encourage her to oppose the unpopular measure. Volunteers will be door-knocking all day Saturday, April 8 from 9 a.m. to 5 p.m. in the Belle Meade, Forest Hills and Oak Hill areas of Nashville. Full details are available on AFP’s Facebook page. The gas tax increase is the more common term applied to Governor Haslam’s IMPROVE Act – recently renamed the “Tax Cut Act of 2017” – which, in its current form, includes a 6 cent per gallon gas tax increase and a 10 ten cent per gallon diesel tax increase. The tax hikes are slated to be phased in over a three-year period to fund the Tennessee Department of Transportation’s (TDOT) list of 962 projects that currently carry a $10.5 billion price tag. Speaker Harwell has played a key role this session in the advancement of the gas tax through the Tennessee House of Representaives. At the outset of the current 110th Tennessee General Assembly, she assigned the members and picked the chairmen of the House Committees and Subcommittees including the critical…

Read the full storySpeaker Harwell Says She ‘Cannot Recall a Bill from the Finance Subcommittee’

Tennessee State House Speaker Beth Harwell’s office contacted The Tennessee Star Tuesday morning in response to our story Monday about State Representative Jerry Sexton’s press conference. In that press conference, Rep. Sexton (R-Bean Station) called on Speaker Harwell to send back the Gax Tax bill to the House Transportation Subcommittee. “I saw the recent Tennessee Star article entitled “State Rep. Sexton Tells Speaker Harwell: ‘Hit The Restart Button’ On Gas Tax, Send It Back to Subcommittee ‘To Be Debated Fairly and Openly’” and wanted to clarify something,” Deputy Chief of Staff for Communications and Policy Kara Owen wrote. Ms. Owen continued: The Speaker of the House cannot recall a bill from the House Finance Subcommittee to the House Transportation Subcommittee, per our House rules. This takes a motion on the House floor by a member, and 66 votes (two thirds) for the motion to prevail.

Read the full storyState Rep. Jerry Sexton Calls Out Hypocrisy of Gas Tax Supporters Who Oppose Use of Sales Taxes for Road Construction

Fireworks erupted on the floor of the Tennessee House of Representativesewhen the typically rapid-fire tick-tock of the day’s agenda was interrupted as Rep. Jerry Sexton (R-Bean Station) questioned Rep. Ryan Williams (R-Cookeville) on the “special privilege” of professional sports teams re-directing sale tax revenues back to a Nashville municipal organization whose purpose is to promote sporting events and sports teams. Rep. Sexton drew a strong parallel between the redirection of those funds – which Williams supports – and the redirection a small portion of sales tax revenues for the benefit of road construction, improvements and repairs – which Williams opposes. Williams supports of Gov. Haslam’s plan to raise taxes on gas and diesel to fund road construction instead. Sexton pointedly called out the hypocrisy of supporters of Haslam’s gas tax increase plan, who claim road construction can only be funded by “user fees” of those who use roads, while sports team stadiums can be funded by those who do not use or attend events at those stadiums. Sexton made his remarks during a debate “over an unrelated bill on the House floor on Thursday that would redirect sales taxes collected at a proposed Major League Soccer stadium in Nashville to be…

Read the full storyConcerned Veterans of America: ‘Veterans Being Used in Tennessee Tax Hike Ploy’

Concerned Veterans of America (CVA) blasted Tennessee’s Republican political establishment on Monday for using veterans in a “Tennessee [gas] tax hike ploy.” “The politicians pushing for this gas tax increase know that it’s unpopular, so they’ve resorted to using veterans as pawns to push their big government agenda. Pretending that this massive tax hike is good for the military community is an unconscionable move that disrespects those who fought and sacrificed for this country,” Mark Lucas, executive director of CVA said in a statement. “The truth is that this gas tax will hurt families and veterans alike who rely on affordable transportation in the state. Veterans deserve property tax relief, but not as part of a glaringly obvious ploy to increase taxes across the board. We urge the Tennessee legislature to look for ways to cut wasteful government spending instead of approving this disingenuous and costly tax hike,” Lucas said. The amended version of Gov. Haslam’s IMPROVE Act gas tax increase that passed the Senate Transporation Committee last week “includes a small tax relief for veterans which would exempt them from paying property taxes under certain circumstances, but would not protect them from the impact of the massive gas tax…

Read the full storyState Rep. Sam Whitson is Proud of His Vote to Increase the Gas Tax in House Transportation Committee

State Rep. Sam Whitson (R-Franklin), one of the 11 members of the House Transportation Committee who voted yes on increasing the gas tax and moved the amended version of Gov. Haslam’s IMPROVE Act, tells the Spring Hill Home Page he is proud of his vote in committee on Tuesday. The amended version of the IMPROVE Act for which Whitson voted is said to be the same as the amended Senate version, which reduced the gas tax increase from 7 cents per gallon to 6 cents per gallon. The full details of the amended House version Whitson voted for have not yet been released to the public. “We made sure that a we stayed a debt free and pay-as-you-go state when it comes to our public roads,” the Williamson County resident and Army veteran told the Spring Hill Home Page on Wednesday. Whitson was not asked to comment on Chairman Barry Doss’ (R-Leaoma) violation of Tennessee House of Representatives Rule 34 in the committee, a rule breaking abuse of power that enabled the vote to be held on Tuesday in committee. Whitson’s colleague, State Rep. Timothy Hill (R-Blountville), invoked Rule 34 during the hearing. Rule 34 grants members of the…

Read the full storyBoss Doss Breaks Rules to Ram Amended Gas Tax Increase Through House Transportation Committee

In a stunning abuse of power, State Rep. Barry Doss (R-Leoma) broke a long-standing rule of the Tennessee House of Representatives to ram an amended version of Gov. Haslam’s gas tax increase through the House Transportation Committee he chairs on Tuesday. A bill containing the new and improved IMPROVE Act amendment, which restores many of the elements of Gov. Haslam’s original gas tax increase proposal, passed the House Transportation Committee in an 11 to 7 vote, but that outcome could not have taken place on Tuesday had not Chairman Doss broken Rule 34 of the Tennessee House of Representatives. Rule 34 of the Tennessee House of Representatives allows any member the privilege of “separating the question” when an amendment is added to a bill that is up for consideration. A key element of Rule 34–which is known to every member of the House–is that it is a “privilege” that can be exercised without question whenever a member invokes it in a committee hearing. It is not a “motion,” which is subject to a vote of the committee. Every chairman of every committee in the Tennessee House of Representatives, including Rep. Doss, is well aware that Rule 34 is a privilege,…

Read the full storyUnder Governor Haslam, Tennessee Department of Transportation ‘Overhead’ Costs Have Grown 63 Percent, While ‘Highway Infrastructure’ Spending Has Shrunk By 33 Percent

The Tennessee Department of Transportation (TDOT) total costs for “Administration” plus “Headquarters Operation,” what would be considered “overhead” in the business world, have grown by 63 percent, from $78.9 to $117 million, in the seven years between Gov. Haslam’s first budget in FY 2011-12 and his proposed budget for FY 2017-18. While TDOTs overhead has skyrocketed, spending on one of the main Programs for road improvements, “Highway Infrastructure,” has gone down by more than 30 percent in that same time period. Table 1 provides the details of TDOT’s “Recommended Budget By Program and Funding Source” obtained from multiple years of budget documents and includes the links to the source documents and the page references. The table demonstrates that since fiscal year 2010-11, the last year of Governor Bredesen’s administration, there are multiple Programs, including Administration, Headquarters Operation, State Industrial Access, Planning and Research, Interstate System and Highway Infrastructure and TDOT as a whole, for which the funding was reduced by Gov. Haslam’s in his first year and have never recovered. Table 1 Department of Transportation Recommended Budget by Program Source Source Source Source Source Sheet 46 of 656 Sheet 46 of 550 Sheet 46 of 558 Sheet 47 of 558…

Read the full storyHouse Transportation Committee Delays Vote on The IMPROVE Act Another Week

State Rep. Courtney Rogers (R-Goodlettsville), Vice-Chair of the House Transportation Committee, acted as Chair when the committee convened on Tuesday in the absence of Chairman Barry Doss (R-Leoma), who was not present at the hearing. Acting Chair Rogers reported to the committee members present that Chairman Doss had asked that HB 534, the “caption bill” for the IMPROVE Act, be “rolled” for one week. The request, which constitutes the second delay in as many weeks of a vote on the bill, seemed an unexpected turn of events to the full-to-capacity meeting room that included media, camera crews, and several Tennessee Department of Transportation representatives. As The Tennessee Star reported last week, the committee voted 9 to 8 when it met one week earlier on March 7 to “roll” the bill forward to this Tuesday’s meeting in order to allow the committee members to review the numerous amendments proposed to the bill. A point of order raised at the March 7 meeting by State Rep. Timothy Hill (R-Blountville)–whether it was in order for Chairman Doss, as sponsor of the bill, to preside over the hearing–was raised indirectly at Tuesday’s meeting. Hill’s earlier point of order was resolved at the March…

Read the full storyHouse Transportation Committee Fails To Advance IMPROVE Act, Despite Multiple Tactics By Chairman Doss

The House Transportation Committee failed to advance Gov. Haslam’s IMPROVE Act (HB 0534) on Tuesday, despite multiple tactics employed by Chairman State Rep. Barry Doss (R-Leoma), a vigorous proponent of the governor’s gas tax increase proposal, to accomplish that outcome. The committee voted instead to roll the vote over for another session in one week. Voting in favor of a one-week delay were Representatives David Alexander (R-Winchester), Dale Carr (R-Sevierville), Timothy Hill (R-Blountville), Bo Mitchell (D-Nashville), Courtney Rogers (R-Goodlettsville), Bill Sanderson (R-Kenton), Jerry Sexton (R-Bean Station), Terri Lynn Weaver (R-Lancaster) and Jason Zachary (R-Knoxville). Voting against the delay were Chairman Doss, and Representatives Barbara Cooper (D-Memphis), Bill Dunn (R-Knoxville), Kelly Keisling (R-Byrdstown), Eddie Smith (R-Knoxville), Ron Travis (R-Dayton), Sam Whitson (R-Franklin), John Mark Windle (D-Livingston). Chairman Doss initially declared that the motion to delay the vote for one week had failed, even though the roll call vote was 9 to 8 in favor the delay. When several members vocally objected, Chairman Doss declared the motion passed and the meeting was quickly adjourned. The day began in subterfuge, when Chairman Doss held a bill review session one hour prior to the scheduled full committee meeting. That bill review session was…

Read the full storySenate Transportation Committee Approves 15 Percent Increase in TDOT Budget That Includes $278 Million From IMPROVE Act Funding

The State Senate Transportation Committee voted on Monday to approve the Tennessee Department of Transportation’s (TDOT) 2017-18 budget of $2.2 billion, an increase of 15 percent over the 2016-17 budget of $1.9 billion. Five members of the committee voted in favor of the increased funding, while three passed on the vote. Senators Richard Briggs (R-Knoxville), Becky Massey (R-Knoxville), Jim Tracy (R-Shelbyville), Jeff Yarbro (D-Nashville) and Chairman Paul Bailey voted for the budget, while Senators Mae Beavers (R-Mt. Juliet), Janice Bowling (R-Tullahoma) and Frank Nicely (R-Strawberry Plains) passed. Senator John Stevens (R-Huntingdon) did not respond for the roll call vote. The additional $300 million one year increase in the budget incorporates $278 million in additional funding that comes from the 7 cents per gallon tax increase (and 12 cents per diesel gallon tax increase) included in Gov. Haslam’s controversial IMPROVE Act proposal. The move sets up a conflict between the current version of Gov. Haslam’s plan, which passed through the House Transportation Subcommittee last week in an unusual legislative maneuver which required the governor’s allies to bring in House Speaker Pro-Tem Curtis Johnson (R-Clarksville) to break a 4-4 tie in committee. The bill that passed through the House Transportation Subcommittee temporarily…

Read the full storyHaslam Gas Tax Proponent State Rep. Barry Doss Says ‘No One’s Talking About the Tax Cuts That We’re Doing’

State Rep. Barry Doss (R-Leoma), Chairman of the House Transportation Committee and a leading proponent of Gov. Haslam’s proposal to increase the gas tax by 7 cents per gallon, told 99.7 FM WWTN’s Ralph Bristol on the Thursday edition of Nashville’s Morning News that he wanted to remind WWTN listeners how much the Tennessee General Assembly has cut taxes recently. “What is this important argument that nobody has heard yet?” Bristol asked Doss. “One thing that we’re not concentrating on,” Doss began, “no one’s talking about the tax cuts that we’re doing.” “I would like to remind all of your listeners that five years ago we lowered the inheritance and gift tax which was a $110 million tax cut, and we knew five years ago there was a drastic need for new revenue for infrastructure, yet we chose to lower taxes $110 million instead of shifting that money over to revenue,” Doss said. Doss was one of the key figures in the legislative drama at the Tennessee General Assembly on Wednesday in which proponents of Gov. Haslam’s plan forced it through the Transportation Subcommittee, which was tied 4 to 4, by making the unusual move of bringing in House Speaker…

Read the full storyState Rep. Susan Lynn Confirms User Fees are ‘Diverted From the Highway Fund’ in Email Sent to Entire Tennessee General Assembly

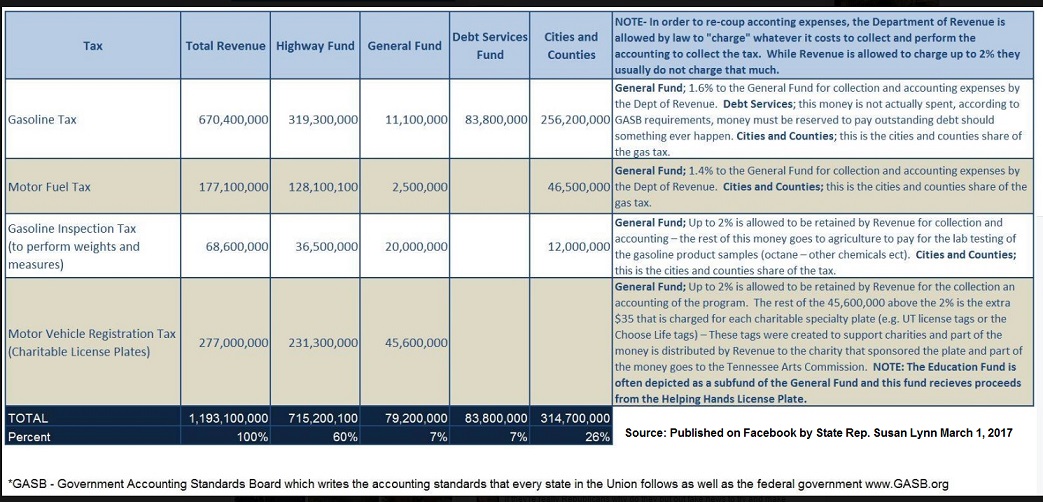

“I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes,” State Rep. Susan Lynn (R-Mt. Juliet) told a constituent in an email, confirming The Tennessee Star’s report that Highway Fund user fees are being allocated to the General Fund, Education and Debt Service. The constituent had forwarded a link to The Star’s report on Wednesday that “The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service.” In the email reply to her constituent, Rep. Lynn copied every member of the Tennessee General Assembly in both the House and Senate, ensuring that they have knowledge of the “diversion” of user fees from the Highway Fund. You can read the first part of Lynn’s reply to her constituent here: I actually have a slide in my town hall presentation that shows why money is diverted from the Highway Fund and where it goes. Each amount makes perfect sense. Please see my slide below with…

Read the full storyAFP’s Andrew Ogles: More Conservative Grassroots Pressure Needed to Stop Gas Tax

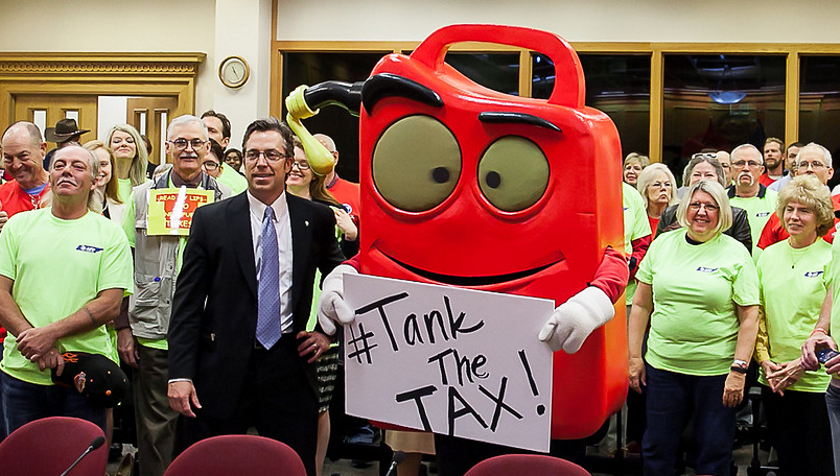

Andrew Ogles, the Tennessee director of Americans for Prosperity, was in a glum mood Wednesday afternoon after Gov. Haslam’s gas tax plan seemed to get a boost forward. Earlier in the day, Ogles and his fellow tax opponents were more buoyant as they rallied around the costumed Gas Can Man and hoped for a more positive outcome. The House Transportation Subcommittee voted in favor of Haslam’s transportation plan, albeit with an amendment that includes elements of an alternative proposal favored by opponents of the proposed tax increase. But Ogles believes that amendment will disappear once the plan is considered by the full House Transportation Committee, which Ogles says could happen sometime next week. “My suspicion is they’ll strip that off,” Ogles said. “This was merely a Trojan horse to get it out of committee.” Haslam wants to raise the tax on gas by 7 cents a gallon and for diesel, 12 cents a gallon. The current gas tax of 21.4 cents per gallon hasn’t changed since 1989. The alternative plan, known as the Hawk plan because it was put forward by Rep. David Hawk, R-Greeneville, proposes using existing sales tax revenue to pay for road improvements. The Hawk plan was…

Read the full story25 Percent of Highway Fund ‘User Fees’ Are Allocated to General Fund, Education, and Debt

One of the principles asserted by Governor Haslam in support of his IMPROVE Act and its proposed increase of 7 cents per gallon in the gas tax is that “users” of roads should pay for road construction. The gas tax is proper, he argues, because people who purchase gas to fuel their cars are the users of roads, and the gas tax is the best mechanism to charge them for that usage. For at least a decade, however, revenue sources originally designed to fund highway construction have been intermingled, and that “user” fee principle has not strictly been applied to the funding of road construction. The IMPROVE Act does not fully address the co-mingling of funds. The Highway Fund receives road construction “user fee” revenues from gasoline tax, motor fuel tax, gasoline inspection tax, motor vehicle registration tax and the motor vehicle title fees. At least 25 percent of those road construction “user fees” go to the General Fund, Education and Debt Service. Though the majority of these “user fee” revenues have been allocated to the Highway Fund, between 25 percent and 29 percent of those fees -ranging from $177 million to $196 million annually– have been diverted away from the…

Read the full storyCommentary: Oppose Wednesday’s Vote to Raise Tennessee’s Gas Tax

There’s no denying that Tennessee’s infrastructure is in need of repair. But Gov. Bill Haslam’s proposed gas tax increases to fund the projects—which the state House of Representatives will vote on this Wednesday – isn’t the right solution. Instead, lawmakers should use money already in the state budget, which is more than enough to meet our transportation needs. The key component of Gov. Haslam’s plan is to increase the state’s tax by 7 cents a gallon on gasoline and 12 cents a gallon on diesel – respective increases of 33 percent and 65 percent over what we currently pay today. Not only that, but it will also be indexed to inflation every other year. That means each time you go to the pump, you’ll pay more to the state and have less money to spend on your personal needs—and it will get worse every two years. On top of the gas tax increase, Gov. Haslam wants to nickel-and-dime us with an increase in vehicle registration fees, too. All combined, the governor’s proposal includes nearly $300 million in higher taxes every year. And that’s not all. The proposal would also give municipalities a bite at the tax apple, allowing them to hold referendums on raising local sales taxes to…

Read the full storyJeremy Hayes to Challenge State Rep. Susan Lynn in GOP Primary Over Her Support of Gas Tax

In an exclusive interview with The Tennessee Star, Jeremy Hayes says he will challenge State Rep. Susan Lynn (R-Mt. Juliet) in the 2018 Republican primary because of her support for Gov. Haslam’s gas tax increase proposal. “I think it’s absolutely ridiculous. It’s the dumbest bill,” Hayes, the former co-chairman of the Trump campaign in Wilson County, told The Star’s Laura Baigert when asked his position on the governor’s IMPROVE Act, which raises the price of gas by 7 cents per gallon and the price of diesel fuel by 12 cents per gallon. “You do not need a math degree to understand that this thing does not make sense,” Hayes said: One, they’re telling us that they’re going to save half a cent in the grocery store, on your food tax. Well then, proposing raising the fuel tax 7 cents the first year, the diesel tax 12 cents the first year. What’s that going to do? . . . They’re going to pass that tax on to the consumer. “In addition they want to put it an index,” Hayes added, citing another feature of the governor’s gas tax proposal he opposes. Hayes also noted that the gas tax increase is unnecessary,…

Read the full storyDemocrat State Rep. Windle Files Five Obstructionist Amendments to Hawk Plan, Part of Effort to Force Gas Tax Through House

State Rep. John Mark Windle (D-Livingston), who pulled the surprise move to adjourn last week at the House Transportation Subcommittee before a fair chance was given to vote on the Hawk Plan, the alternative to the governor’s gas tax increase plan that reallocates sales tax revenue, is at it again. “Windle filed five amendments to Hawk’s legislation Monday after being rebuffed last week by Weaver. Windle, of Livingston, is introducing measures to remove sales taxes on baby formula, milk, bread and baby diapers. Yet another amendment would provide a 10-year franchise tax exemption on manufacturing plants that open or expand in economically distressed counties,” the Memphis Daily News reported. Windle’s latest exercise in legislative skullduggery came two days before the House Transportation Subcommittee is scheduled to reconsider both the Hawk Plan and Gov. Haslam’s IMPROVE Act on Wednesday. Subcommittee chairman State Rep. Terri Lynn Weaver (R-Lancaster) is a strong opponent of the governor’s proposal. “My district knows it. I’m opposed because my district is opposed to it,” Weaver told the Daily News. But Windle has aligned himself with three Republican allies of Gov. Haslam on the Transportation Subcommittee who are determined to prevent the Hawk Plan from surviving the committee:…

Read the full storyHaslam Gas Tax Hike Opponents Gather at ‘Tank the Tax’ Rally Set for Wednesday

As the Haslam IMPROVE Act plan to increase fuel taxes returns to the Transportation Subcommittee on Wednesday March 1, Americans for Prosperity and other activists plan to “turn up the heat” by gathering at Legislative Plaza to express opposition to the proposed tax increases. The Transportation Subcommittee, Chaired by Rep. Terri Lynn Weaver (R-Lancaster), is scheduled to meet at noon. Andy Ogles, Tennessee Director of Americans for Prosperity, said that activists will be coming from across the state to express opposition to the proposed tax increases. “Once taxpayers realize that the huge tax increases proposed by the Governor are coming when we have a TWO BILLION DOLLAR SURPLUS their reaction to the plan becomes almost a unanimous ‘NO’ and they can’t understand why their elected officials are even entertaining the idea,” Ogles noted. “The only way the Haslam Plan passes is if their supporters successfully hide the truth about what the plan actually means to the wallets of working men and women in Tennessee. To stop it, we simply need to get the truth out and encourage taxpayers to get engaged in this fight.” Ogles also expressed concern about the glaring absence of conservative leadership in the Legislature on this issue.…

Read the full storyMore Unanswered Questions at Gov. Haslam’s Sumner County Gas Tax Town Hall

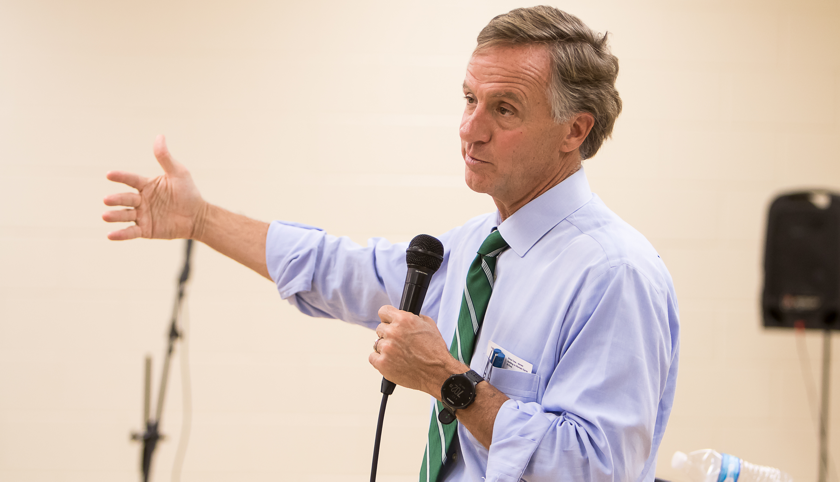

On Wednesday evening, Governor Haslam spoke about his proposed 7 cent gas tax and 12 cent diesel tax increase at Sumner County’s Station Camp High School to a group of about 300 people, around 100 of whom received a personal email invitation from County Executive Anthony Holt. The governor, joined by Department of Transportation Commissioner John Schroer on a stage with local elected officials, delivered an abbreviated and less energetic version of his state of the state address that he had delivered at his previous town hall style meetings. These events have afforded the opportunity to fact-check the claims the governor has been making since the launch of his IMPROVE Act at a press conference on January 18, and Wednesday’s Sumner County Town Hall showed that the number of unanswered questions has not diminished as his tour of the state has gone on. According to the governor, Tennessee does not use bond debt to fund roads, but his budgets for 2016-17 and 2017-18 included $88 million and $80 million in bond debt, respectively. The Tennessee Star’s Laura Baigert pressed the governor on claims that this year’s budget, like past budgets, keeps various funds separate. How, she asked, did the governor…

Read the full storyPure Foods Goes Bankrupt After Benefiting From $1.2 Million in Tennessee State Economic Development Funds

Less than two weeks before Governor Haslam introduced his IMPROVE Act centered on a gas tax increase for road funding, Pure Foods, Inc., a recipient of $1.2 million in state economic development funds, filed for bankruptcy. The $1. 2 million from the state’s FastTrack Economic Development (ED) Fund did not go directly to Pure Foods. Instead, it was allocated for use by KEDB for construction of a speculative building that Pure Foods leased for 10 years. According to the Kingsport Tennessee Times News, in March 2015, the Canadian based gluten-free snack food company, Pure Foods, Inc., was set to establish its U.S. headquarters at the Gateway Commerce Park in Kingsport, Sullivan County. The deal included an investment of $22 million, an 80,000-plus square foot facility, and the creation of 273 new jobs generating an annual a payroll of $8 million. The Kingsport Economic Development Board (KEDB) and the Kingsport Chamber of Commerce also supported the project by providing financial assistance and various incentives, including the purchase of 33 acres of land in the Gateway Commerce Park for $6.5 million borrowed from First Tennessee Bank. According to the Transparent Tennessee website’s FastTrack Project Database, ED grants provide additional support for…

Read the full storyState Rep. Mark Pody: ‘I Don’t Believe the 7 Cents Gas Tax is Going to Go Anywhere’

State Rep. Mark Pody (R-Lebanon) told Ralph Bristol on 99.7 FM WWTN’s Nashville Morning News on Tuesday that Gov. Haslam’s proposal to increase the gas tax by 7 cents per gallon to fund road construction is dead-on-arrival in the State House of Representatives. “I don’t believe the 7 cents gas tax is going to go anywhere,” Pody told Bristol. “To be clear, you don’t think the governor’s full proposal, as is, will make it out of the House?” Bristol asked. “If it’s going to say gas tax on cars, I don’t think it’s going to go anywhere,” Pody responded. “Is that a survey or a hunch?” Bristol pressed the question further with Pody, who has his own alternative to the governor’s proposal. “If I have to run my proposal [through the Transportation Subcommittee], I have to know where the votes are,” Pody told Bristol. “I don’t think the votes are there for the governor’s proposal,” Pody said. “Right now I don’t think the governor’s plan would have the votes to get out of the House,” Pody said. Pody praised Gov. Haslam for bringing the issue of road tax funding up for consideration by the General Assembly. “I’m glad that the…

Read the full storyGov. Haslam Defends His Gas Tax Proposal on Nashville’s Morning News With Ralph Bristol

Gov. Haslam appeared on 99.7 FM WWTN’s Nashville Morning News with Ralph Bristol on Thursday to defend his controversial proposal to increase the gas tax by 7 cents per gallon (from 21 cents to 28 cents) to fund more road construction. His proposal also increases the diesel tax by 12 cents per gallon (from 18 cents to 30 cents). Haslam specifically took aim at the increasingly popular alternative to his proposal, the Hawk Plan, which would fund road construction by reallocating 0.25 percent of the 7 percent state sales tax from the general fund to road construction. “Your main opposition to the alternative to your plan, the Hawk Plan . . . is that that would shift the burden for paying for our roads and bridges from out-of-state users of the roads to Tennesseans unrelated to their road usage. Do you have any way to quantify that balance now and how much shift this would produce?” Bristol asked. “We’re in the process of doing that. I think it’s safe to say that the increase I’m proposing for fuel that half of that would come from either out of state automobile drivers or trucking companies,” Haslam told Bristol. “That’s actually not…

Read the full storyPoll: Republicans in Tennessee Overwhelmingly Oppose Raising Gas Tax by a 2 to 1 Margin

A new poll released on Tuesday shows that registered Republican voters in Tennessee oppose raising the gas tax by a 53 percent to 28 percent, almost a 2 to 1 margin. Gov. Haslam has proposed increasing the gas tax by 7 cents per gallon and the diesel tax by 18 cents per gallon in order to fund additional road expenditures. The poll was conducted of 600 registered Republican voters over two days, January 31 to February 1, in the immediate aftermath of Haslam’s January 30 State of the State address in which he released details of his proposed gas tax, which are included in a bill called the IMPROVE Act. Tennesseans for Conservative Action , which sponsored the poll, said in its press release announcing the results it “conducted the survey to gauge support for policies conservatives are talking about during this year’s legislative session.” TCA outlined several “key takeaways” in its release: 54% of Republicans believe we should spend the $1 billion surplus on road improvements before raising the gas tax. Of those who support the gas tax, 99% approve of Governor Haslam’s job performance. 15% of Tennessee Republicans flatly reject a 7-cent gas tax “no matter what” and…

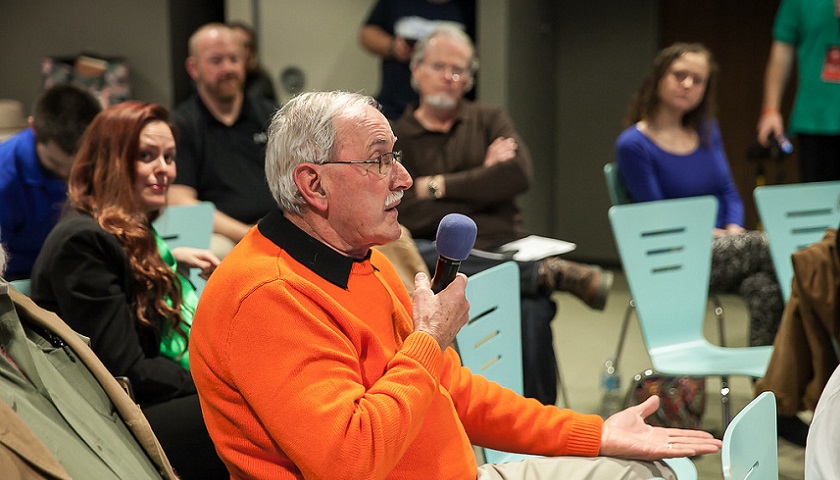

Read the full storyWWTN Town Hall Audience Virtually Unanimous in Opposition to Gas Tax Increase

The studio audience at WWTN’s Gas Tax Town Hall on Thursday was virtually unanimous in its opposition to Gov. Haslam’s proposed increase in the state tax on gasoline from the current level of 21 cents per gallon to the proposed level of 28 cents per gallon. About twenty people filled the seats in the small WWTN performance room to listen to moderator Ralph Bristol, show host Dan Mandis, and eight panelists from the General Assembly, Gov. Haslam’s office, and two public interest groups discuss the merits of the proposed gas tax increase. In the first hour of the program, several audience members opposed to the proposed gas tax increase asked questions of the panel. During a break, moderator Ralph Bristol asked if anyone in the audience favored the proposed gas tax increase and wanted to ask a question. No one raised their hand. Bristol then asked if anyone in the audience was undecided. Jessica Colon, recently retired from the Army, now working as a nurse in Middle Tennessee and living in Robertson County, raised her hand. In the second hour, Bristol called on Colon, who asked a question of the panel. After the program ended, The Tennessee Star asked Colon…

Read the full storyFormer Lt. Gov. Ramsey A Paid Consultant to Pro-Gas Tax Coalition

Former Lt. Gov. Ron Ramsey told The Tennessee Star on Thursday he is a paid consultant to the Tennessee Coalition on Transportation, an advocacy group that supports Gov. Haslam’s 7 cents per gallon gas tax increase and a 12 cents per gallon diesel tax increase. Ramsey’s revelation came during a break in the two hour broadcast of the WWTN Gas Tax Town Hall, moderated by Nashville Morning News host Ralph Bristol on the Dan Mandis Show. The event featured a studio audience, which was virtually unanimous in its opposition to the gas tax. Ramsey advocated strenuously on behalf of the gas tax increase. He was one of eight panelists at the event. Other members of the panel included Andy Ogles, executive director of the Tennessee chapter of Americans for Prosperity, which opposes the gas tax, David Smith appearing on behalf of Gov. Bill Haslam, State Sen. Jim Tracy (R-Shelbyville), State Sen. Paul Bailey (R-Sparta), State Rep. Barry Doss (R-Lawrence County), Rep. Brian Terry (R-Murfreesboro), and Rep. David Alexander (R-Winchester). “I did leave the legislature back, I made my announcement in March, and left in November, of course, at the election,” Ramsey said in his opening remarks as a member of the…

Read the full storyGrassroots Pundit: The Governor’s Over-Engineered Plan for a Gas Tax Increase

After two consecutive losses on the Insure Tennessee front, Governor Haslam designed a better plan for his gas tax increase, packaging it as his IMPROVE (Improving Manufacturing Public Roads and Opportunities for a Vibrant Economy) Act. But, the good planning goes well beyond a name and includes a little help from his friends. COMPTROLLER’S OFFICES OF RESEARCH AND EDUCATION ACCOUNTABILITY REPORT The 76-page report, “Tennessee Transportation Funding: Challenges and Options,” was issued in January 2015. As the title implies, the report reviews the current situation and various ways to address transportation funding needs. One thing it doesn’t do is make any recommendations on how to proceed. With even cursory reading, it will be obvious that not all revenue that should go to roads actually does. nMOTION The Nashville Metropolitan Transit Authority (MTA) and the Regional Transportation Authority of Middle Tennessee (RTA) set out to develop the nMotion report of a transit implementation plan. The report development process started with “public engagement” from April 2015 through October 2016. Since the pre-determined goal was to develop a comprehensive ten-county mass transit plan, the presentations made by MTA/RTA and TDoT and the surveys obtained from the public were designed to create that end…

Read the full storyRalph Bristol’s Exclusive Interview With Gov. Haslam About His Gas Tax Proposal

One day after he announced his proposal to increase the tax on gas by 7 cents, from 21 cents per gallon to 28 cents per gallon, Gov. Bill Haslam gave an exclusive in-studio interview to Ralph Bristol, host of Nashville’s Morning News on 99.7 FM, WWTN, on January 18. Haslam made the case for his gas tax proposal, which he elaborated on in his “State of the State address” at the Capitol on January 30, which the General Assembly is now considering. “Can you legitimately bring that [Hall Income Tax cut] forward to balance now against the gas and other tax increases to make it an even balance?” Bristol asked to begin the interview. “Sure. Let’s start here,” Haslam answered. “Our administration and the legislature has already cut $270 million in taxes. The most any administration or legislature had ever done before was $60 million. We’re proposing another $270 million cut in this budget,” the governor continued, adding: Your point is we already cut the Hall Tax last year. But we didn’t. We passed a bill to do that. It still has to come out of the budget. It’s like you and your spouse saying were going to make a…

Read the full storyCommentary: Gas Tax Increase Creates Problems for School Budgets

Public education must remain a high priority in Tennessee. That should be reflected in Governor Haslam’s State of the State. We have made a strong commitment in the terms of taxpayer dollars. We have simply played catch-up the last few years, especially in regards to funding our public schools. The Tennessee Constitution set forth the purpose of public education: “The state of Tennessee recognizes the inherent value of education and encourages its support. The General Assembly shall provide for the maintenance, support, and eligibility standards of a system of free public schools.” It is worth the reminder to reflect on that purpose as we enter legislative session at the Tennessee General Assembly. Living and working in Nashville, and operating a motor vehicle, it is clear that “Music City” is also “pothole city.” We have no problem with increasing the budget to spend more on improving our roads, from which we all derive the benefit. Under Governor Haslam’s proposal, we would pay an additional 7 cents per gallon on gasoline and 12 cents per gallon on diesel in Tennessee. In addition, the plan would reduce the state’s grocery sales tax rate to 4.5 percent, down a half-percentage point. Our concern is the…

Read the full storyTennessee Has Paid for Highways With a Gas Tax Since 1924

Tennessee has paid for highway construction and maintenance with a gas tax since 1924, when a 2 cent per gallon tax Gov. Austin Peay proposed and the General Assembly passed the previous year went into effect. At the time, Tennessee’s roads were so poor the Volunteer State was often referred to as a “detour state,” according to the Tennessee Department of Transportation website: Tennessee’s funding resource for transportation is called “dedicated funding,” because the funding resource is directly related to the service or product provided. That philosophy began in 1923 when Governor Austin Peay recommended to the state legislature the burden of highway improvements be transferred from property owners to motorists to fund faster work on state highways. During the 1920’s, Tennessee had become known in the southeast as a “detour state” because it hadn’t kept up with road improvements like sister states. The first gas tax of two cents was passed and enacted in 1924 specifically for highway purposes. Peay, who was the only Tennessee governor to die in office, put the revenue generated by the gas tax to good use, as the Tennessee Encyclopedia of History and Culture notes: By the time of his death in 1927, Tennessee’s…

Read the full storyGrassroots Pundit: What Does Governor Haslam’s Revenue Neutral Gas Tax Increase Mean to Tennessee Families?

Governor Haslam introduced his “revenue neutral” IMPROVE Act (Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy) late last month. The proposed bill focuses primarily on increasing the fuel (gas and diesel) tax to fund transportation initiatives and offsetting the increases with other tax cuts. Under the governor’s proposal, the state tax on gasoline will increase from 21 cents per gallon to 28 cents per gallon. The state tax on diesel fuel will increase from 18 cents to 30 cents per gallon. Ominously, the tax will be indexed to increase each year based on inflation. The plan proposes tax cuts of $270 million annually, while increasing revenues through taxes and fees by $278 million this year. The taxing procedure that allows government to receive the same amount of money despite changes in tax law is the definition of “revenue neutral.” This was a strategic move by the Governor to combat the obvious and predictable opposition to any tax increase given the state’s budget surplus in excess of $1 billion. But how neutral is the IMPROVE Act for Tennesseans? At least one group is trying to explain what the gas tax increase would cost the average driver. The Transportation Coalition…

Read the full storyGrassroots Pundit: Sumner County’s Role in the Governor’s Gas Tax Increase Story

The story of the Governor’s proposed gas tax increase introduced on Wednesday was being written for nearly two years in Sumner County. The most recent chapter was added with the attendance of County Executive Holt and Jimmy Johnston of Forward Sumner, the county’s hired provider of economic and community development services, at the Governor’s press conference Wednesday. In preparation for the budget year that runs July 1 to June 30, the Sumner County Budget Committee holds several workshop-like sessions in April and May to review all of the required and requested budget line items. This was the case in 2015, the first budget to be set after the 24% property tax increase. As an outcome of a Highway Commission meeting, an additional $100,000 was proposed for the Highway Department. The proposal came out of the Highway Commission to address the poorly received stoppage of brush pick up, especially in light of the considerable property tax increase. Initially, the $100,000 was added to the proposed 2015-16 budget. But, then at the Budget Committee meeting of June 8, 2015, after County Executive Holt made the argument that funding to the Highway Department would have to be maintained in the future, it was…

Read the full story