The annual budget deficit has already hit $1.9 trillion and counting for the fiscal year that will end in September, according to the U.S. Treasury’s April statement, and it will reach as high as $3.6 trillion this year, says the White House Office of Management and Budget (OMB). Comparatively, in 2020, the deficit totaled about $3.1 trillion for the entire year.

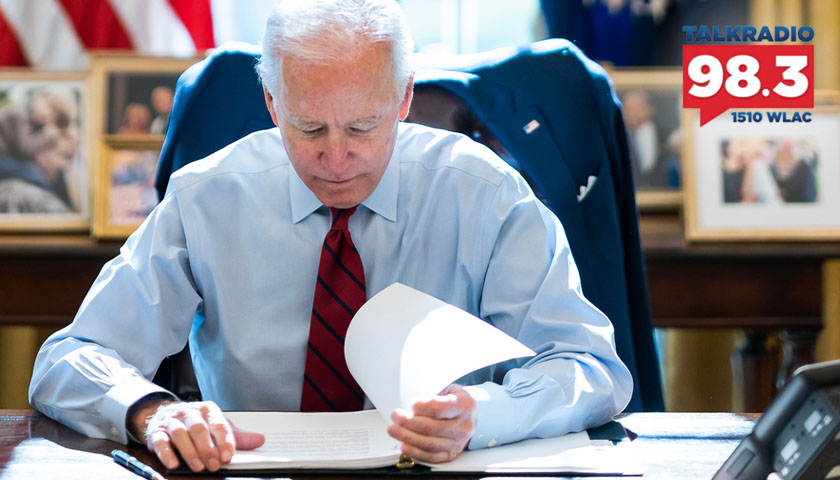

This comes amid the massive government spending in response to the Covid pandemic, including the $2.2 trillion CARES Act in March 2020, the $900 billion phase four legislation in Dec. 2020 and then President Joe Biden’s additional $1.9 trillion Covid stimulus bill in March 2020. Another $2.1 trillion infrastructure plan is in the works. And now, Biden is offering his $6 trillion budget, which will blow another $1.8 trillion hole in the deficit in 2022.

As a result, 33 percent of marketable national debt, or about $7.27 trillion of the $22 trillion of publicly held debt, will be coming due within the next year, according to the latest data by the U.S. Treasury. For perspective, that’s more debt than existed as recently as 2003.

Read the full story