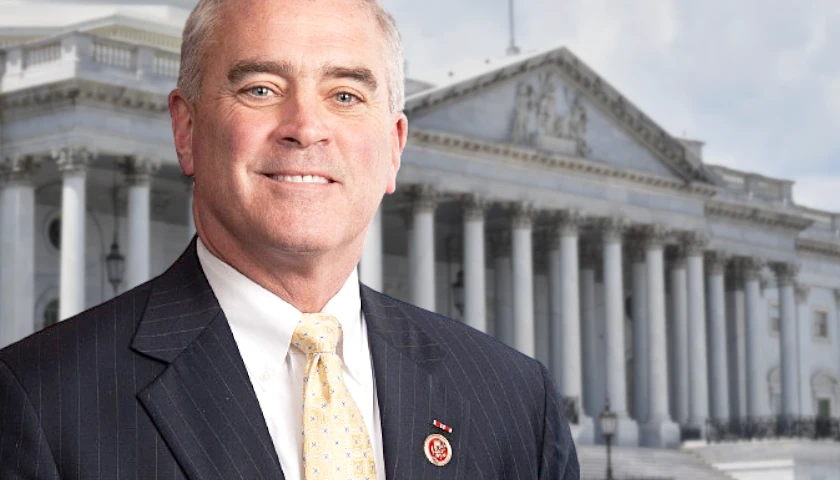

U.S. Representatives Brad Wenstrup (R-OH-2) and Danny Davis (D-IL-7) this week introduced a measure to assist homeless veterans, foster youth, and others in obtaining affordable housing as they seek college degrees.

Wenstrup and Davis hope to change the Low-Income Housing Tax Credit (LIHTC), which lightens the tax burden on developers constructing or rehabilitating low-cost rental units. Currently, LIHTC does not permit full-time students to avail themselves of LIHTC-funded housing sites. This restriction was written to prevent the tax credit from funding dormitory buildings.

The new bill’s sponsors say the rule has had the effect of keeping qualified students from accessing affordable housing. Their legislation would make an exception for students who have recently been homeless so they can reside in LIHTC-funded buildings.

“Students and veterans struggling with homelessness should be able to access affordable housing as they pursue a full-time education,” Wenstrup, himself an Army veteran, said in a statement. “This bill empowers those in need to invest in their futures and sets them on the path to achieving the American dream. I’m pleased that this bill addresses one aspect of the affordable housing crisis and am grateful to work with my colleague, Representative Danny Davis, on this bipartisan bill.”

According to Veterans Data Central, a website overseen by the nonprofit Housing Assistance Council (HAC), an estimated 730 veterans across Ohio are homeless. The organization also posits that more than 20 percent of the approximately 700,000 veterans living in the state pay excessive rates for housing. HAC avers that affordability is “the greatest housing problem among veterans.”

In urging colleagues to support the adjustment to LIHTC, Davis asserted than more than one-third of current university students and nearly half of community-college students have experienced housing insecurity at some point.

“Housing security is fundamental to physical, mental and socioeconomic well-being,” he said. “I am proud to work with Dr. Wenstrup to improve the successful Low Income Housing Tax Credit to ensure that youth and veterans struggling with homelessness do not have to choose between completing a college degree or stable housing…. This bill increases housing opportunities and stability for homeless youth and veterans so that they can complete their education and thrive.”

– – –

Bradley Vasoli is managing editor of The Ohio Star. Follow Brad on Twitter at @BVasoli. Email tips to [email protected].

Photo “Brad Wenstrup” by Brad Wenstrup. Background Photo “Homeless Veteran” by Savingourvets. CC BY-SA 4.0.