by Molly Prince A Ukrainian gas company gave a seat on its board to the son of former Vice President Joe Biden in an attempt to secure relationships with Democrats while it was under multiple investigations, according to a recent New York Times report. Biden largely took credit for pressuring Ukraine into removing its top prosecutor, who was leading those probes. Ukraine recently relaunched an investigation into the company, the Times reported Wednesday, and President Donald Trump’s personal attorney, Rudy Giuliani, has repeatedly called for the U.S. Department of Justice to scrutinize the Bidens. Hunter Biden was appointed to the four-member board of Burisma Holdings, Ukraine’s largest privately owned gas company, in April 2014. The seat came while the elder Biden was serving in former President Barack Obama’s administration and was slated to head relations with Ukraine for the administration. Burisma is a natural gas exploration and production company owned by Mykola Zlochevsky, a cabinet member of former Ukrainian President Viktor Yanukovich. Yanukovich was removed from his position in February 2014. He currently lives in exile in Russia and is wanted by Ukraine for high treason. Zlochevsky later fled the country in late-2014 as Ukrainian prosecutors launched investigations into his time in public…

Read the full storySearch Results for: gas tax

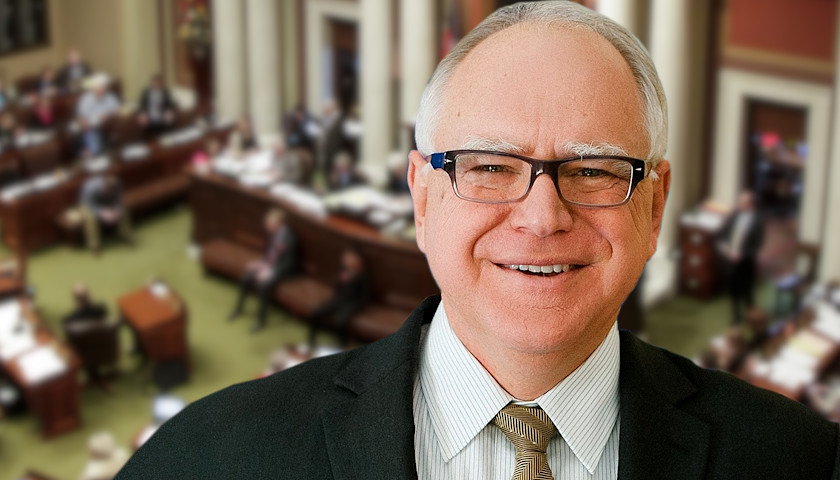

Conference Committees Meet to Hash Out Tax, Spending Increases in Minnesota Budgets

by Bethany Blankley With 17 days to go before the end of session, legislative conference committees began meeting Friday to hash out differing proposals for three of the most contentious omnibus bills yet to be voted on by the full Legislature. The Omnibus tax bill, Omnibus Health and Human Services (HHS), and Omnibus jobs and economic development, energy and climate, and telecommunications policy and finance bills are all expected to be revised through the weekend. Omnibus bills include numerous items that might not be passed on their own and only require a single legislative vote. The House Omnibus HHS bill alone is 1,043 pages long. Both Democratic Gov. Tim Walz’s budget proposal and the Democratic House spending plan raise taxes at a time when the state’s tax revenue is at a record high with an expected billion-dollar surplus. The House plan includes new payroll taxes, new licensing fees and government mandates, in addition to other measures, which the Department of Revenue states would hurt low-income Minnesotans the most. The department’s report estimates that individuals earning less than $14,528 annually would pay an extra $2.37 for every $100 of income, more than double what the highest income earners would pay. On…

Read the full storyConference Committees Meet to Hash Out Tax, Spending Increases in Minnesota Budgets

by Bethany Blankley With 17 days to go before the end of session, legislative conference committees began meeting Friday to hash out differing proposals for three of the most contentious omnibus bills yet to be voted on by the full Legislature. The Omnibus tax bill, Omnibus Health and Human Services (HHS), and Omnibus jobs and economic development, energy and climate, and telecommunications policy and finance bills are all expected to be revised through the weekend. Omnibus bills include numerous items that might not be passed on their own and only require a single legislative vote. The House Omnibus HHS bill alone is 1,043 pages long. Both Democratic Gov. Tim Walz’s budget proposal and the Democratic House spending plan raise taxes at a time when the state’s tax revenue is at a record high with an expected billion-dollar surplus. The House plan includes new payroll taxes, new licensing fees and government mandates, in addition to other measures, which the Department of Revenue states would hurt low-income Minnesotans the most. The department’s report estimates that individuals earning less than $14,528 annually would pay an extra $2.37 for every $100 of income, more than double what the highest income earners would pay. On…

Read the full storyTennessee Tax Revenues Exceed Estimates for March

Department of Finance and Administration Commissioner Stuart McWhorter announced this week that Tennessee tax revenues exceeded budgeted estimates in March. Overall March revenues totaled $1.1 billion, which is $52.8 million more than the state received in March of 2018 and $28.6 million more than the budgeted estimate for the month. “Sales tax revenues continue to demonstrate the strength of the Tennessee consumer by outpacing last year’s receipts and the state’s budgeted estimate for the month,” McWhorter said in a press release. “Franchise and excise taxes also showed growth compared to March 2018 but were less than the state’s estimate. All other tax revenues combined exceeded the month’s budgeted estimates. The state’s year-to-date tax revenue growth indicates a promising finish to the 2018-2019 fiscal year. However, a fourth of the state’s volatile corporate tax revenue collections typically occur within the next month. Therefore, we will continue to monitor our monthly tax receipts closely.” On an accrual basis, March is the eighth month in the 2018-2019 fiscal year, the press release went on to say. General fund revenues were $29 million more than the budgeted estimate while the four other funds that share in state tax revenues were $0.4 million less…

Read the full storyExpert: Lamar Alexander ‘Betrays Taxpayers’ Fighting for More Electric Vehicle Tax Credits

U.S. Republican Sen. Lamar Alexander of Tennessee defends fighting for more tax credits for electric vehicles, even as an expert with a Virginia-based think tank says this act “betrays taxpayers.” As The Tennessee Star reported this month, Alexander is co-sponsoring a bill that would extend tax credits for electric car manufacturers. This, despite Republican U.S. President Donald Trump wanting to do away with them. In an emailed statement to The Star Wednesday, Alexander was unwavering in his commitment. “Ten years ago, there were no mass produced electric cars on U.S. highways and, today, there are about one million automakers planning to make millions more,” Alexander said. “The all-electric Nissan Leaf that I bought in 2011 had a hard time getting me from the Capitol to Dulles airport and back. Its real range was about 70 miles. Today’s Nissan Leaf can travel 226 miles on one charge. Investing in American research and technology for better electric vehicles is one way to help our country and the world deal with climate change. I’m glad to cosponsor this important legislation, which will encourage even more production of electric vehicles, create good jobs and boost the economy.” In a new column, Veronique de…

Read the full storyBuckeye Institute Annual Report Identifies $2.5 Billion in Savings for Ohio Taxpayers

The Buckeye Institute released its annual Piglet Booklet Wednesday, which identifies wasteful government spending across state agencies that could save Ohio taxpayers $2.5 billion. “In this year’s Piglet Booklet, The Buckeye Institute identified at least $2.5 billion that policymakers can save Ohioans. And with the increase in the gas tax, it is critical to cut spending and taxes to relieve the growing burden on Ohio families,” said Greg Lawson, research fellow at The Buckeye Institute and author of the report. “Making these cuts will save Ohio taxpayers money, make government more efficient and effective, and keep the state on solid financial ground to better weather the next economic storm,” Lawson continued. The Piglet Booklet identifies four key areas where government spending and oversight can be reduced, including corporate welfare programs, government philanthropy and advocacy, burdensome occupational licensing regimes, and earmarks in spending bills. “Governments should not engage in crony capitalism by supporting one private company over another—it is ethically inappropriate and economically harmful,” the report says of the corporate welfare category. It identifies eight different “corporate welfare programs that should be eliminated,” such as the $3.1 million that is used to conduct “marketing on behalf of the state’s wine grape…

Read the full storyBuckeye Institute Blasts Tax Hike, Warns Legislators: ‘Don’t Increase the Tax Burden on Ohioans!’

A joint committee of the Ohio House of Representatives and Senate was convened Wednesday in the hopes of reconciling the major divides in their respective transportation budgets. As they work towards a solution, one state think tank is reminding them not to forget the consequences Ohio citizens will face as a result of their decisions. House Bill 62 (HB 62), the 2020-21 Ohio Transportation Budget, the first major bill proposed of newly-elected Ohio Republican Governor Mike DeWine’s tenure, called for an 18 cent gas tax increase. It would go into effect immediately and carry no tax offsets. The Ohio House of Representatives revised the proposal to 10.7 cents and ordered it to be phased in over three years. Most recently, the Ohio Senate dropped the tax rate even lower to six cents. None of the proposals carry a complete tax offset. In this joint session, the legislators hope to reconcile differences, yet DeWine has maintained from day one that his 18 cent proposal is “a minimalist, conservative approach, with this being the absolute bare minimum we need to protect our families and our economy.” The Buckeye Institute, an independent think tank whose focus is “to advance free-market public policy” has acknowledged that a gas tax increase is…

Read the full storyTennessee Tax Revenues Exceed February Budget Estimates

Tennessee Department of Finance and Administration Commissioner Stuart McWhorter has announced that Tennessee tax revenues exceeded budgeted estimates in February, according to a state press release. Overall February revenues were $953.8 million, which is $68.9 million more than the state received in February 2018 and $39.9 million more than the budgeted estimate. The growth rate for February was 7.79 percent, the press release said. “The state experienced sound growth in its two largest contributors to the state’s tax base, state sales and use tax revenues and franchise and excise tax revenues, compared to last February,” the press release quoted McWhorter as saying. “All other revenues combined also exceeded the state’s budgeted estimate. On a year-to-date basis, state revenue collections are well positioned to finish the fiscal year ahead of our budgeted estimates. Typically, more than one half of our corporate revenues for the year are accounted for in the months of April through June; however, due to the volatile nature of these taxes we will remain cautiously optimistic and continue to manage conservatively.” On an accrual basis, February is the seventh month in the 2018-2019 fiscal year. General fund revenues exceeded the budgeted estimates in the amount of $40.4 million…

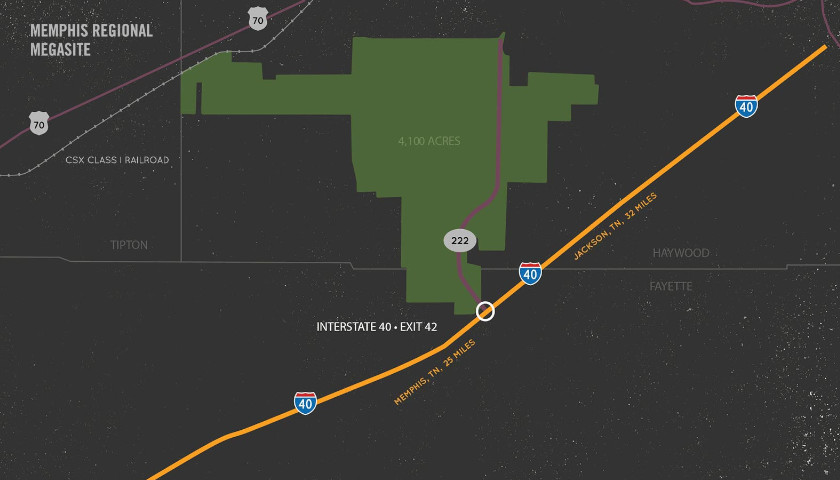

Read the full storyMemphis Regional Megasite Reportedly Three Years Away

The Memphis Regional Megasite, which has already cost Tennessee taxpayers more than $140 million is reportedly three years away from completion, according to The Jackson Sun. Justin Owen, president of The Beacon Center of Tennessee, a Nashville-based free market think tank, previously called the megasite “an empty field of broken promises.” This, Owen said, despite “big talk by state officials” to bring thousands of jobs to a downtrodden area. The Jackson Sun quoted Tennessee Economic and Community Development Commissioner Bob Rolfe as saying the eminent domain process will take several more months. The wastewater pipeline process, meanwhile, will take 18 to 24 months, the paper quoted Rolfe as saying. “The largest hurdles facing the Megasite right now are the approval of permits from the Army Corps of Engineers and Tennessee Department of Environment and Conservation, and using the eminent domain process in order to lay the wastewater pipeline,” according to The Jackson Sun. According to the paper, the ECD has hired the consulting firm Gresham Smith “to determine what company would be best for managing the utilities on site.” Gresham Smith has received roughly $500,000, the paper said. Quoting TNECD Deputy Commissioner of Business Community and Rural Development Allen Borden, The Jackson Sun said the site will…

Read the full storyTennessee State Tax Revenues Exceed Estimates

Tennessee Department of Finance and Administration Commissioner Stuart McWhorter announced this month that overall January state tax revenues exceeded budgeted estimates. Revenues for January totaled $1.4 billion, which is $28.8 million more than budgeted and 2.81 percent greater than revenues received in January 2018, according to a press release on the state government’s website. “January sales tax revenues, reflecting consumer spending that occurred during December, remain strong and represent 22 consecutive months of positive growth. The second quarter growth rate from sales activity was 6.05 percent compared to last year, representing the highest growth rate in three years,” McWhorter said. “Corporate tax revenues also posted positive growth gains against the month’s estimate, while all other revenues finished near estimate. “It should be noted that there was a large drop in Hall income tax revenues when compared to this same time last year due to the implementation of the federal Tax Cuts and Jobs Act (TCJA) of 2017. And, while year-to-date revenues look promising, we must continue to monitor revenues and closely manage our expenditures so that Tennessee continues to be prepared for any future economic slowdown.” On an accrual basis, January is the sixth month in the 2018-2019 fiscal year,…

Read the full storyGOP Pushes Innovation, Natural Gas As Counter-Offers to Green New Deal

by Michael Bastasch Louisiana Republican Sen. Bill Cassidy says he has an answer to Democrats’ Green New Deal resolution that will grow the economy and cut greenhouse gas emissions — natural gas. Cassidy put forward a white paper Thursday making the case that private sector-led investments in natural gas extraction have allowed the U.S. to lead the world in reducing carbon dioxide emissions. Cassidy wants to see that trend continue. “This is a pro-jobs approach to lowering greenhouse gas emissions,” Cassidy said in a statement. “Instead of pie-in-the-sky, feel-good pipe dreams, let’s do what data and science say actually works.” Democratic New York Rep. Alexandria Ocasio-Cortez’s and Democratic Massachusetts Sen. Ed Markey’s recently introduced Green New Deal resolutions call for “meeting 100 percent of the power demand” with renewables and zero-emissions energy sources within 10 years. The World War II-style mobilization the bill calls for also includes retrofitting every building in the U.S. to be more energy efficient and also cutting emissions as much as possible from every sector of the economy. The Green New Deal also demands a slew of welfare programs, from universal health care to job guarantees, and outlines social justice goals. Republicans panned the plan…

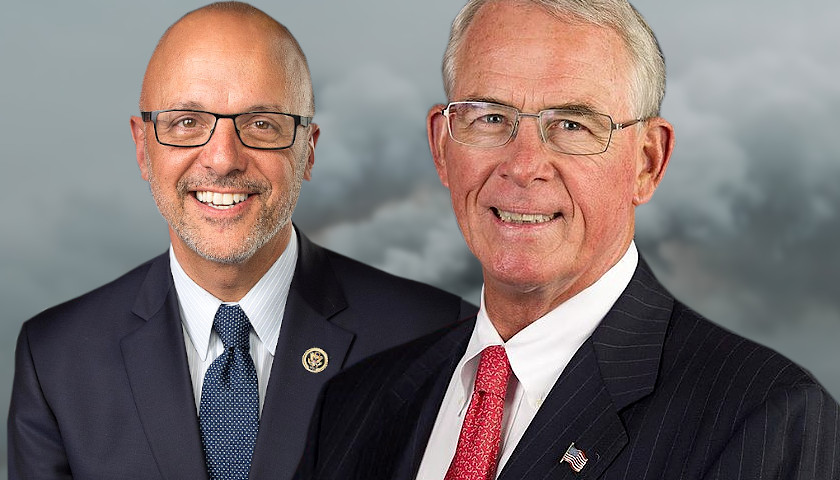

Read the full storyLawmakers Claim Their Carbon Tax Proposal is ‘Revenue-Neutral’ When It’s Actually a $1 Trillion Tax Hike

by Tim Pearce The bipartisan House Climate Solutions Caucus claims it is pushing a “revenue-neutral” carbon tax, but legislation proposed Thursday would hike taxes by at least $1 trillion over the next decade, according to Paul Blair, director of strategic initiatives for the right-leaning policy institute Americans for Tax Reform. Reps. Ted Deutch, a Democrat, and Francis Rooney, a Republican, reintroduced a bill Thursday that would place a $15-per-ton tax on carbon emissions in 2019. The tax would rise by $10-a-year increments until it hits nearly $100 per ton. “To let the free market price out coal we should consider value pricing carbon,” Rooney said in a statement. “A revenue-neutral carbon fee is an efficient, market-driven incentive to move toward natural gas and away from coal, and to support emerging alternate sources of energy.” Though Rooney claims the tax is “revenue-neutral,” the plain text of the bill does not include any reciprocal tax cuts to balance out the burden of the added tax on emissions, Blair told The Daily Caller News Foundation. The Climate Solutions Caucus, co-led by Deutch and Rooney, claims the bill is “revenue-neutral” through carbon dividends. The IRS will pay out the funds raised by the…

Read the full storyCongress Puts a Carbon Tax Back on the Table after It Failed in 2018

by Tim Pearce A pair of U.S. congressmen from Florida are making a renewed bipartisan push for carbon tax legislation that failed to gain traction in 2018, The Washington Examiner reported. Reps. Ted Deutch, a Democrat, and Francis Rooney, a Republican, are planning to reintroduce a bill Thursday that would place a $15-per-ton tax on carbon emissions in 2019. The tax would rise by $10-a-year increments until it hits nearly $100 per ton. “I am supportive of a carbon fee as a non-regulatory, revenue-neutral and market-driven incentive to move toward natural gas and away from coal, and to support emerging alternate sources of energy,” Rooney told The Washington Examiner. “This bill provides a method of ensuring that any fees are rebated back to the public.” The pair of legislators, who co-chair the bipartisan Climate Solutions Caucus, partnered with other lawmakers to introduce an earlier version of the same bill in November 2018. That bill did not come up for a vote and died after the new session of Congress began. The proposal is revenue neutral, or does not create another source of tax revenue for the federal government to tap into and divert for other causes. The money collected…

Read the full storyCity of Memphis Employees Allegedly Steal Gas

Employees who work for the City of Memphis are using taxpayer money to fill up their personal vehicles with gasoline, according to that city’s CBS affiliate WREG. No word yet on whether Tennessee’s fuel tax increase drove those city employees to do this. City officials, the station went on to say, have launched an internal investigation. “According to that investigation, the city doesn’t do a good enough job of tracking who’s getting gas and where it’s going. That’s largely because some fuel stations don’t have an effective way of doing it,” WREG reported. “Two city employees have been fired for filling up their personal cars with city gas, purchased with taxpayer dollars. Security at city-owned pumps varies. Some are padlocked, requiring a special key. Others are automated, unlocked using electronic key fobs.” The audit, the station went on to say, says those pumps track gas usage easily. The others, however, typically require manual logs that don’t always exist. “The issue increases the potential for fraud. The city’s General Services Division says it’ll fix the problem by putting devices to unlock pumps directly into city vehicles,” WREG reported. “They’re designed to track who’s driving, how much gas they’re getting and when…

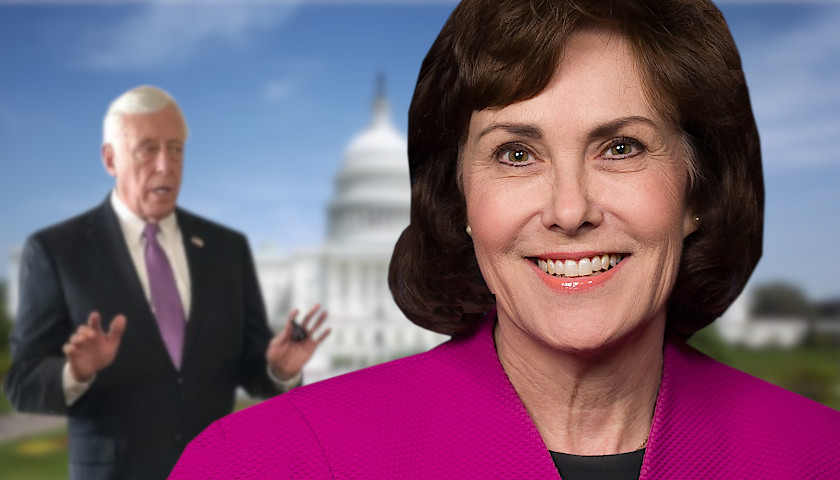

Read the full storyDemocrats Pushing to Match Your Tax Dollars to Small Campaign Contributions at an Astonishing Rate

by Evie Fordham House Democrats are expected to unveil legislation Friday that uses taxpayer money to match small-dollar campaign donations at the astonishing rate of 6-to-1, a policy that would likely benefit Democrats much more than Republicans. “When you do something that looks like a political stunt, it makes you look worse, not better, in the eyes of the public,” Zach Wamp, a Republican former congressman and co-chair of nonpartisan organization Issue One, told The Wall Street Journal. Republicans are especially wary of the small-dollar donation matching policy, which would turn a $20 donation into more than $100 for a candidate. Democrats consistently rake in more small-dollar donations than Republicans, according to a WSJ review of Federal Election Commission reports. For example, freshman Nevada Sen. Jacky Rosen, a Democrat, unseated incumbent Dean Heller after outraising him by amassing small-dollar donations, reported the Las Vegas Review-Journal. Roughly 32 percent of her funds came from small individual contributions, while only 9 percent of Heller’s came from small-time donors, according to the Center for Responsive Politics (CRP). And Democrat Beto O’Rourke, who unsuccessfully challenged Republican Texas Sen. Ted Cruz in 2018, was the fourth most-popular congressional candidate for small dollar donations, according…

Read the full storyFrench President Macron Waves The White Flag On Carbon Taxes

by Michael Bastasch French President Emmanuel Macron decided to scrap the planned carbon tax on fuels after weeks of protests rocked Paris and other major cities across the country. An Élysée Palace official told The Associated Press Wednesday that “the president decided to get rid of the tax.” Macron’s decision comes one day after the government announced plans to delay implementing the carbon taxes for six months. The fuel taxes were meant to go into effect in January as part of France’s plan to fight global warming. Prime Minister Edouard Philippe told French lawmakers the carbon tax “is now abandoned.” Phillippe said the government is “ready for dialogue” on what the next steps will be. [ RELATED: France May Be Ahead Of The Curve When It Comes To Global Warming Policy Backlash ] Thousands of protesters called “yellow vests” took to the streets to protest the carbon taxes, which would have added 33 cents to a gallon of diesel and 17 cents for a gallon of gasoline. Taxes already make up about 60 percent of the price of fuel in France. The average cost to fill a tank in France runs about $7 per gallon. The protests, the worst to hit Paris in 50 years, were also…

Read the full storyGreenpeace Fighting to Stop Drivers From Learning About Carbon Tax Costs

by Jason Hopkins Greenpeace is suing to stop the placement of stickers on gas stations that notify drivers of higher fuel prices due to the implementation of a carbon tax. Ontario Premier Doug Ford — who has embarked on a pro-energy agenda in his province since entering office — will execute a number of measures to fight back against Canada’s nationwide carbon tax. Besides challenging the carbon tax initiative in court, the conservative politician is looking to include lie item breakdowns on gas receipts and heating bills, informing customers of how much the carbon fee is costing them. The Ontario government is also looking to include stickers at gas pumps across the province, informing customers of the fee. “Today, I want to confirm that in Ontario the carbon tax’s days are numbered,” Ford told the media back in June. “In fact, upon the swearing in of my new cabinet, at the top of our agenda the very first item will be to pass an order to cancel the Liberal cap-and-trade carbon tax.” However, Ford’s sticker program is already running into opposition. Greenpeace — an international environmentalistorganization — announced it’s intention to mount a challenge. The group is arguing that the stickers are deceptive because…

Read the full storyNew Study Calls Into Question Claims Made by Carbon Tax Supporters

by Jason Hopkins A study released Wednesday casts doubt on many of the assurances made by carbon tax supporters, revealing such a fee on emissions would not bring substantial benefits to the environment or the economy. Calls for implementing a carbon tax — a fee imposed on large emitters of carbon — have been growing in the U.S. Lawmakers from both parties have introduced their own versions of carbon pricing legislation in Congress, while some of the largest oil and gas companies in the world have signed on to initiatives promoting the implementation of a carbon tax in the U.S. Carbon tax proposals are also gaining steam at the state level as well. The battle over whether to pass a carbon fee in Washington state is on track to become the most expensive campaign initiative in the state’s history, with both sides already dropping around $45 million to sway voters. Supporters of carbon pricing argue it’s a market-oriented approach to reducing greenhouse emissions — and more efficient than simply piling the generation industry with more environmental regulations. Americans for Carbon Dividends, a self-proclaimed conservative organization that is lobbying for a carbon tax in Congress, argues such a plan would…

Read the full storyNew Study Calls Into Question Claims Made by Carbon Tax Supporters

by Jason Hopkins A study released Wednesday casts doubt on many of the assurances made by carbon tax supporters, revealing such a fee on emissions would not bring substantial benefits to the environment or the economy. Calls for implementing a carbon tax — a fee imposed on large emitters of carbon — have been growing in the U.S. Lawmakers from both parties have introduced their own versions of carbon pricing legislation in Congress, while some of the largest oil and gas companies in the world have signed on to initiatives promoting the implementation of a carbon tax in the U.S. Carbon tax proposals are also gaining steam at the state level as well. The battle over whether to pass a carbon fee in Washington state is on track to become the most expensive campaign initiative in the state’s history, with both sides already dropping around $45 million to sway voters. Supporters of carbon pricing argue it’s a market-oriented approach to reducing greenhouse emissions — and more efficient than simply piling the generation industry with more environmental regulations. Americans for Carbon Dividends, a self-proclaimed conservative organization that is lobbying for a carbon tax in Congress, argues such a plan would…

Read the full storySteve Gill, Ben Cunningham, and Mae Beavers Blast ‘Fibber Phil’ Bredesen and The Tennessean for Rewriting History on 2000 Horn Honkers Uprising That Stopped State Income Tax

On Friday morning’s Tennessee Star Report with Steve Gill and Michael Patrick Leahy – broadcast on Nashville’s Talk Radio 98.3 and 1510 WLAC weekdays from 5:00 am to 8:00 am – Steve Gill talked with veteran grassroots activist Ben Cunningham and former State Sen. Mae Beavers regarding The Tennessean’s revisionist history and continuous cover up for ‘Fibber Phil’ Bredesen’s lies – in particular their dishonest misrepresentation in a story published Thursday on how the state income tax proposed by then-Gov. Don Sundquist was stopped. Tennesseans who were living in Nashville at the time know the proposed income tax was stopped by a populist uprising led by state legislators Marsha Blackburn, Mae Beavers, and Diane Black, and talk radio hosts Steve Gill and Phil Valentine. Bredesen is the Democrat nominee for the U.S. Senate seat currently held by retiring Sen. Bob Corker (R-TN). He faces Rep. Marsha Blackburn (R-TN-07), the Republican nominee, in the November 6 general election. Gill, Cunningham, and Beavers also reflected upon the historic fight to keep a state income tax out of Tennessee. Gill: Am I overstating it, Ben, to say that Phil [Valentine] and Marsha and Diane and Mae and your efforts and the efforts and…

Read the full storyCalifornia’s Gas Prices Inch Toward $4 Per Gallon At A Bad Time For Democrats

by Chris White Gas prices in Southern California are hovering around $4 per gallon as Golden State Democrats attempt to defend an unpopular gas tax outgoing Democratic Gov. Jerry Brown signed in 2017. The average pump price for regular gas in the Los Angeles area is hovering around $3.736 a gallon Thursday, up nearly 19 percent from a year earlier, according to the American Automobile Association. It’s an unwelcome development for Democrats who are fighting for their political lives. The average price in California stood at $3.683 a gallon, up 18 percent from $3.11 in 2017, the AAA said. A portion of the increase stems from the unpopular 12-cent increase in California’s fuel excise tax that went into effect in November. The state tax now sits at 41.7 cents per gallon and is one of the highest in the country. Nearly 58 percent of voters oppose the tax increase, including 39 percent who say they strongly reject the legislation, according to a survey the University of California, Berkeley’s Institute of Governmental Studies conducted shortly after the measure was passed in April 2017. Only 35 percent of voters surveyed at the time favored the law, which also hikes vehicle registration fees to fix roads. Opposition against…

Read the full storyPhil Bredesen Picked Winners and Losers on Taxpayer-Funded Electric Cars

Eight years ago, then-Tennessee Democratic Gov. Phil Bredesen said that during the coming decade we’d see a surge of electric vehicles on the state’s roads and highways. So certain of it, he handed out $2.5 million in government money to encourage people to buy EVs. But we’re not talking about all EVs. Nope, we’re only talking about the Nissan Leaf, manufactured in Smyrna. People who bought the Chevy Volt or any other brand of EV did not qualify. At the time, a Franklin-based businessman who sold electric cars complained he got shortchanged as well. That businessman, Josh Womack, said Bredesen, in this instance, picked winners and losers. Now that the decade is nearly out, evidence indicates Bredesen, now the state’s U.S. Senate Democratic candidate, was no visionary. In 2018 the Daily Caller reported EVs aren’t popular and only people with six-figure incomes generally have them. No one at Bredesen’s campaign returned The Tennessee Star’s request for comment Monday. As the Tennessee Watchdog reported in the fall of 2010, just as he was leaving the governor’s office, Bredesen announced a rebate to the first 1,000 Tennessee residents who bought the Leaf. Specifically, that was a $2,500 rebate to the first 1,000…

Read the full storyKarl Dean Promises More Taxpayer Money for Memphis

If Tennessee Democratic gubernatorial candidate Karl Dean gets elected governor then he’ll invest more state taxpayer dollars in Memphis and the west Tennessee region. Dean made this promise while touring Memphis this week. This, even though leaders in that corner of the state don’t get much when they invest local taxpayer money in projects meant to attract new business. According to the Memphis Daily News, Dean wants the Tennessee Department of Economic and Community Development to set up an office in Memphis. There he said he will use state resources to focus on boosting women-and minority-owned businesses. “Dean is ‘very specific’ about building economic opportunities for women and ethnic groups, which he could do through executive order or legislative initiatives,” according to the paper. Dean, the paper went on, wants to do that by improving procurement programs to make it easier for women and minorities to compete for contracts. He also wants to recruit businesses to the Memphis Regional Megasite in Haywood County. In an opinion column last year, Beacon Center of Tennessee President Justin Owen said state officials have spent more than $140 million in taxpayer money to buy and develop the site to attract a large manufacturer to…

Read the full storyReport: Taxpayers Pay for Democrat Rep. Steve Cohen’s Hush-Hush Trip to South America

You, the taxpayer, just reportedly spent an unknown sum of money to send U.S. Rep. Steve Cohen, D-Memphis, and eight other congressmen on a super-secret mission to Guyana, in South America, this week. Officials involved have cut off all information to members of the press, including The Tennessee Star. Six publications based out of Latin America, however, reported the trip this week. Going by a Google search, no U.S.-based media outlets have mentioned it. The Congressional delegation reportedly consists of seven Republicans and two Democrats, including Cohen. The other Democrat is Rep. Scott Peters of California. The seven Republicans are Reps. Bob Goodlatte of Virginia, John Rutherford of Florida, Mark Sanford of South Carolina, John Curtis of Utah, Todd Rokita of Indiana, Richard Hudson of North Carolina, and Darrell Issa of California. The last time Sanford traveled to South America without anyone knowing about it, of course, was to break his marriage vows. No one in Sanford’s office returned The Star’s repeated requests for comment Monday. Neither did anyone in Cohen’s office. Only staff members from two of the nine congressmen would comment. Katie Thompson, Curtis’ spokeswoman, did not dispute the accuracy of the reports coming out of Latin America.…

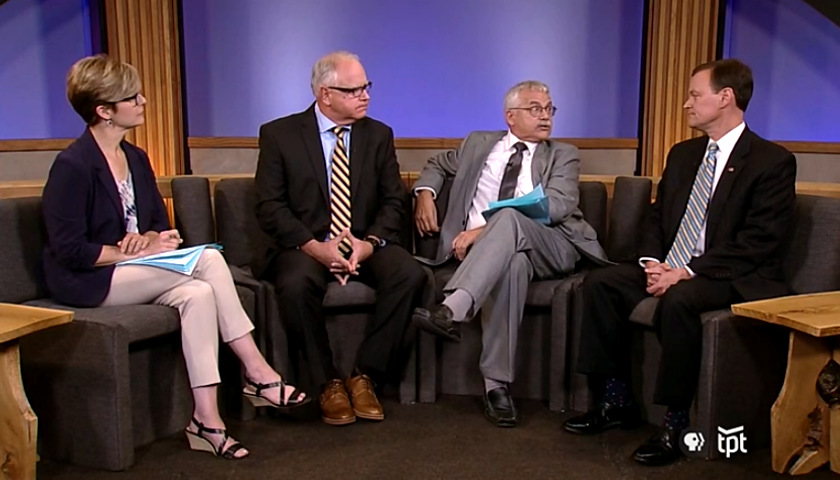

Read the full storyJohnson and Walz Spar Over Taxes, Refugee Resettlement In First Minnesota Gubernatorial Debates

It’s been just one week since Rep. Tim Walz and Hennepin County Commissioner Jeff Johnson won their respective primaries, but the two are already hitting the debate circuit in their race for Minnesota’s governor seat. On Friday, the two went head-to-head in front of a live audience in Nisswa, Minn., showing right off the bat that the fundamental differences between the two candidacies will come down to taxes and diversity-related issues. Johnson, on the one hand, promised not to raise a single tax, prompting his opponent Walz to criticize him for closing “the door on any potential negotiation.” He put himself “in a box that does not allow you ideologically to have that discussion,” Walz suggested. While both agreed that costs of healthcare in the state are too high, their visions of a solution were far different. Walz expressed support for a single-payer healthcare system, while Johnson favored a free-market solution. “I don’t believe that as governor I should be able to tell someone that if you think limited coverage is best for you, I know better. Let’s give people more options and choice,” Johnson commented, though Walz retorted by revealing that he believes “healthcare is a basic human right.”…

Read the full storyTop Commentary: Solar Power Is Harming Taxpayers & Consumers

Thanks to politicians, environmentalists, and the solar industry, taxpayers and consumers are being fleeced. The federal government heavily subsidizes the solar industry, and a number of state governments have policies encouraging solar and green energy production.

Read the full storyDemocrats Target Republican Mae Beavers with Facebook Attack Claiming She ‘Opposes Tax Cuts’

A Democrat Party PAC is hitting conservative Republican candidate for Wilson County Mayor Mae Beavers with a Facebook ad that claims she “opposes tax cuts.” The Tennesseans for Common Sense PAC, with leadership that includes longtime liberal Democrat activist Carol Andrews, is also running radio ads, purchased at least one billboard and has done one county wide mailing so far. The PAC, in the supposedly non-partisan County Mayor’s race, clearly intends to help re-elect Democrat Randall Hutto. Andrews herself is a candidate for the Democratic Party State Executive Committee in the August 2 Democrat Primary. The Democrat PAC is targeting Beavers for her vote in opposition to the Improve Act, which Hutto favored. The Improve Act raised fuel taxes and registration fees about $350 million a year at a time when Tennessee enjoyed a $2 billion surplus. A narrow majority of Republicans in the House supported the tax increase, 37-35, but proponents relied on Democrat votes to get enough to pass it. Beavers was one of only about 6 Republicans in the Senate to vote against the tax increase. Advocates of the plan have argued that the Improve Act cut taxes on the sales tax on food; but even when…

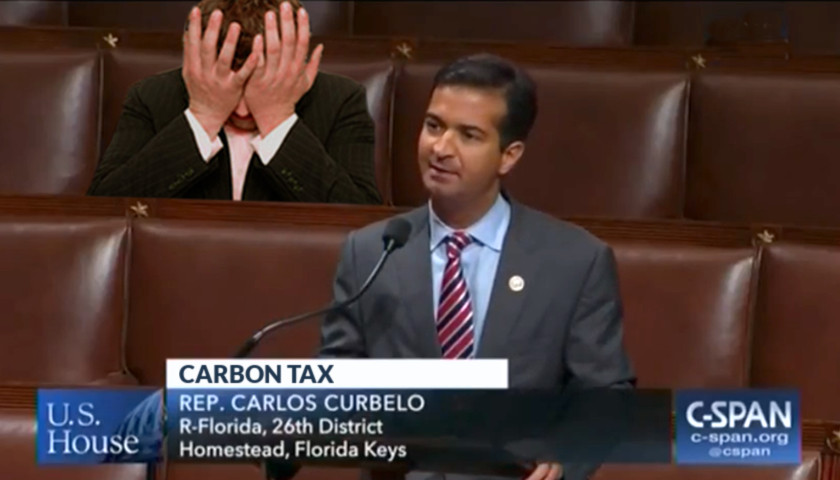

Read the full storyCommentary: The RINO Carbon Tax Proposal Reminds Us the Power to Tax is the Power to Destroy

by Jeffery Rendall With all the crazy stuff coming out of Washington these days it shouldn’t be surprising to hear a liberal congressman introduced a tax to address “climate change” that he claims is an investment in the future. But when it’s a Republican doing the proposing the matter’s worth a double-take. Such is the case for a lone RINO lawmaker representing a district full of Democrat voters. His latest attempt to save his own political skin makes a statement – and it’s not a positive one for conservatives. Josh Siegel reported in the Washington Examiner, “Rep. Carlos Curbelo, R-Fla., on Monday became the first Republican to introduce national carbon pricing legislation in nearly a decade, and challenged his party to confront climate change to save future generations from ‘crushing environmental debt.’ “’While there are still some deniers out there, most Americans today understand that climate change caused by human activity is a reality that must be addressed,’ Curbelo said at an event at the National Press Club. “’I remind my colleagues who often decry our nation’s growing debt that saddling young Americans with a crushing environmental debt, meaning an unhealthy planet, is at least as immoral as leaving behind an unsustainable fiscal…

Read the full storyThe Department of the Interior Will Pay 1,900 Local Governments $553 Million in ‘Lost Tax Revenue’ in 2018

by Daniel Di Martino Over 1,900 local governments received $553 million from the Department of Interior this year to compensate them for lost tax revenue for federal lands that cannot be developed in their territory. These payments are the consequence of more than 640 million acres of land, which amounts to 28 percent of the U.S. territory owned by the federal government. The Federal Government Is Hoarding Huge Potential Prosperity The costs of federal ownership are not only payments to local governments but also environmental damage due to mismanagement and deferred maintenance, as well as the lost economic activity that cannot occur in 28 percent of the country. Of all federal land, 27.4 million acres are National Parks, while approximately 600 million acres are managed by the Bureau of Land Management, the National Forest Service, the Fish and Wildlife Service, and the National Park Service. These government agencies allow grazing and other economic activities on federal lands in exchange for fees. However, since fees are not enough for the expenses of these agencies, the federal government spends several billion dollars per year to cover the difference. Additionally, the federal government owns more than three trillion barrels of oil and 450 trillion cubic meters of natural…

Read the full storyMetro Nashville Public Schools Director Makes $285,000 Per Year, Has Outside Consulting Business, Taxpayer Provided Car, and Much More

Metro Nashville Public Schools Director Shawn Joseph has a pretty sweet arrangement with his employer, according to his four-year contract, which began in 2016. He makes $285,000 a year. That salary, all courtesy of taxpayers, will never decrease — but it could increase. Joseph’s contract clearly states he must devote all his full working time to the school district and can have no other gainful employment — except for later in the contract when it says otherwise. Joseph, as the contract goes on, owns an LLC named Joseph and Associates. “The board agrees that the director is entitled to engage in outside professional activities, including writing, consulting, and lecturing, with or without honorarium, as long as such activities do not interfere with the performance of his duties as the director,” according to the contract. The school district did not return a request for comment Wednesday. Among the other luxuries in Joseph’s contract: • The school system pays for the medical, vision, and dental benefits for Joseph and his family — using the program of their choice. • Joseph gets a smartphone, a tablet, a laptop, an answering machine, a printer, and a computer installed at his house. Taxpayers are billed…

Read the full storyCommentary: The ‘Internet Tax’ Fight Isn’t Really About Internet Taxation

By Dan Mitchell One of the key principles of a free society is that governmental power should be limited by national borders. Here’s an easy-to-understand example. Gambling is basically illegal (other than government-run lottery scams, of course) in my home state of Virginia. So they can arrest me (or maybe even shoot me) if I gamble in the Old Dominion. I think that’s bad policy, but it would be far worse if Virginia politicians also asserted extraterritorial powers and said they could arrest me because I put a dollar in a slot machine during my last trip to Las Vegas. And if Virginia politicians tried to impose such an absurd policy, I certainly would hope and expect that Nevada authorities wouldn’t provide any assistance. This same principle applies (or should apply) to taxation policy, both globally and nationally. On a global level, I’m a big supporter of so-called tax havens. I’m glad when places with pro-growth tax policy attract jobs and capital from high-tax nations. This process of tax competition rewards good policy and punishes bad policy. Moreover, I don’t think those low-tax jurisdictions should be under any obligation to enforce the bad tax laws of uncompetitive countries. There’s a very similar debate inside America. Some…

Read the full storyTennessee ECD Commissioner: Memphis Regional Megasite Will Need A Total of $220 Million To Be ‘Shovel Ready’

At the invitation of Senator Mark Green (R-Clarksville), Tennessee Economic and Community Development (ECD) Commissioner Rob Rolfe presented at this year’s first meeting of the Senate Commerce and Labor Committee on the topic of the Memphis Regional Megasite and told the committee that it will take $220 million to get the site “shovel ready.” Commissioner Rolfe reported, without any specifics, that thus far appropriations for the Memphis Regional Megasite, which he said is used interchangeably with “MRM” and “megasite,” have been $143,650,000, of which $87,253,000 has been spent to date. Additional funding required to get the megasite shovel ready is estimated at $80 million, the majority of which will be allocated for wastewater. Senator Green invited the Department of Economic and Community Development to testify before the committee, because, “After meeting with many elected officials in West Tennessee, I’ve heard repeated concerns about the progress of the megasite. I’m pleased ECD will be making a presentation before our committee to address those concerns,” according to a press release by the senator, who also serves as the committee’s vice chairman. Green was one of the attendees of the 8th Annual Southwest Tennessee Development District Legislative Luncheon held in early January, where…

Read the full story‘NoTax4Tracks’ Says Mayor Barry’s $9 Billion Transit Plan Will Make Nashville Sales Tax Highest in Country and Won’t Fix Congestion

NoTax4Tracks, a new PAC founded to oppose Mayor Megan “Moonbeam” Barry’s $9 billion transit plan, came out blazing Tuesday, issuing a statement that the proposal will raise Music City’s sales tax to the highest levels in the nation. Furthermore, the group cites urban planning and traffic study experts that say the costly proposal will not solve Nashville’s traffic challenges. Last week, the Metro Council voted to place Mayor Barry’s tax increase plan before the voters of Nashville/Davidson County in a referendum to be held on May 1, just three and a half months from now. Voters in Nashville/Davidson County can expect to see a vigorous battle play out in the news media, on social media sites, on the phone, and in person, as supporters and opponents of the $9 billion transit plan spend what could well be millions of dollars to compete for their votes in May. The battle was clearly joined within minutes of the release of the NoTax4Tracks statement. “Transit for Nashville, which is campaigning for Barry’s proposal, slammed the new PAC’s motives,” The Tennessean reported: “The anti-transit group that has come out in opposition wants to do nothing to help Nashville’s growing traffic problems,” Transit for Nashville spokeswoman Kelly…

Read the full storyRepublican and Democrat Gubernatorial Candidates Weigh In On The Need For An Additional $72 Million For Memphis Regional Megasite Infrastructure

At the eighth annual South West Tennessee Development District (SWTDD) Legislative Luncheon held January 3, one of the topics discussed by the gubernatorial candidates in attendance is the need for an additional $72 million to address infrastructure at the Memphis Regional Megasite. The Memphis Regional Megasite is a 4,100-acre state-owned manufacturing site located between Jackson and Memphis off I-40. The site was acquired by the state in 2009 according to the Tennessee Economic and Community Development (TNECD) website, has had investments of more than $106 million, although other reports indicate tax payer investments of as much as $144 million. TNECD Commissioner, Bob Rolfe, named to the position on February 16, 2017, following the departure of former TNECD Commissioner turned gubernatorial candidate Randy Boyd, recently said another $72 million would be needed to complete infrastructure projects that would make the site “shovel ready.” Five gubernatorial candidates were represented at the SWTDD luncheon: Republicans Mae Beavers, Diane Black and Bill Lee as well as Democrat Craig Fitzhugh and Karl Dean’s campaign manager, Courtney Wheeler. Republican candidates Randy Boyd, Beth Harwell and Kay White did not attend. Four of the five candidates agreed that the $72 million additional investment needs to be made.…

Read the full storyFailed Former Governor Don Sundquist – Who Tried To Force State Income Tax on Tennesseans–‘Is Helping Randy Boyd’ In His Gubernatorial Race

Don Sundquist, the establishment Republican who failed in his efforts to force a state income tax on Tennesseans when he served as the state’s governor between 1995 and 2003, has a new political purpose–he wants to help his “friend and neighbor” Randy Boyd become the next governor of the state. The Tennessee Star obtained a copy of the Sundquist family Christmas Letter for 2017 in which the former governor and his wife issued a call for help and support in the gubernatorial campaign of Knoxville-area businessman, Randy Boyd. At the end of the second paragraph of the five-paragraph missive, the Sundquists boast about the many high-level political events they have been a part of through the year. After a quick recap of what was undoubtedly a beautiful week spent in a villa in Tuscany, Italy, the couple talk about their time in Washington, D.C. for the 50th anniversary of the Fund for American Studies that the letter says former Governor Sundquist “has been a part of since its inception.” A notable high point of the event was a featured speech by the newest member of the Supreme Court, Justice Neil Gorsuch. Next, the letter sets up for a pivot and an ‘ask,’ with:…

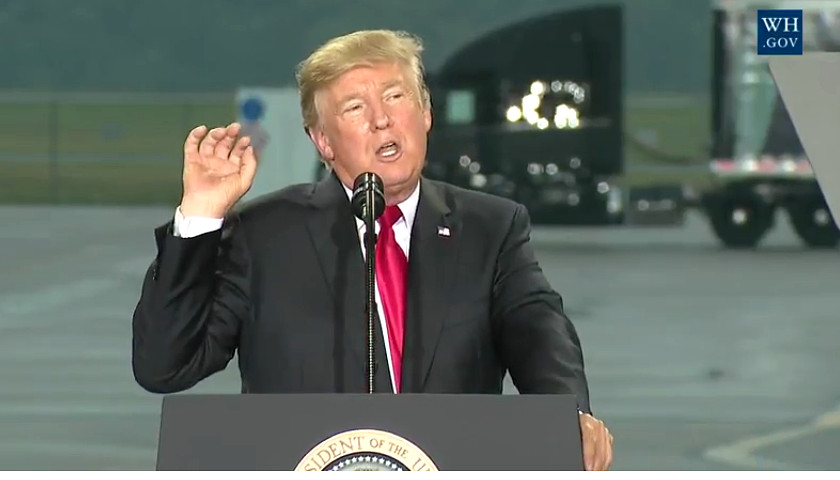

Read the full storyPresident Trump Wows Pennsylvania Truckers With Tax Pitch

President Trump delivered a stem-winder of a campaign-style speech to an enthusiastic, capacity crowd of American Trucking Association members at Harrisburg, Pennsylvania Wednesday. In the forty-minute appearance, President Trump discussed the policy framework of his pro-growth tax overhaul proposal, and the urgency to pass it. President Trump began by acknowledging the victims of the many natural disasters and tragedies that have befallen our fellow Americans over that last several weeks. “Before we begin,” he said, “I want to take a moment to address some of the recent tragedies that have struck our incredible nation. In the darkest moments, the light of our people has shown through like seldom before — their goodness, their courage, and their love. No destructive force on Earth is more powerful than the strength and resilience of the American people.” “We are praying for all of the families affected by the horrific mass shooting that took place in Las Vegas. We grieve with you, and we will never leave your side,” President Trump said, to thunderous applause. Watch the speech: TRANSCRIPT via the White House: THE PRESIDENT: Thank you very much, ladies and gentlemen. It’s great to be back in Pennsylvania with the proud men and…

Read the full storyMark Green Wins Award From Tax Reform Group

State Senator Mark Green (R-Clarksville) has won an award from a tax reform group. “Tennessee Senator Mark Green, MD was honored for his ongoing work devoted to taxpayers via legislative and regulatory reforms by the Tax Foundation, an independent tax policy organization. The award presentation was made at the monthly meeting of the Center Right Coalition of TN meeting by Patrick Gleason of the Americans for Tax Reform (ATR),” Mark Green for Tennessee said in a statement released earlier this week: “My commitment to Tennesseans has not and will not change. A government should always look for ways to allow its citizens to keep more money in their family budget and not the State’s,” noted Green, physician and business owner. “The Hall Income Tax was bad policy that penalized both investors and those who saved.” Annually the Tax Foundation, a nonprofit, independent tax policy organization recognizes state leaders – legislators, governors and other officials – for the effective legislative and regulatory reforms that improve a state’s tax policy. The honoree, according to the group, must be noted as 1) outstanding, 2) achieved during the 2016 legislative calendar and 3) reform taxes to make simpler, more neutral, more transparent, more…

Read the full storyRep. Jerry Sexton Calls The Tax Cuts of The IMPROVE Act A Farce

TAZEWELL, Tennessee — At an Americans For Prosperity Town Hall Monday, Rep. Jerry Sexton (R-Bean Station) told the 30-plus people who turned out to thank him for his no vote on the IMPROVE Act that the tax cuts were a “farce,” if you do the math right. Sexton proved the point when only one person raised their hand as a payer of the F&E tax, no one raised their hand as a payer of the Hall Income Tax, and that the grocery tax savings of $2.88 were based on a family size of 4 when the actual average family size in Tennessee is 2.3. When asked, “What would it take for you to be for this bill,” Sexton said he responded that he wanted to vote for roads and infrastructure, but he wouldn’t vote to raise taxes in order to do it. The results of a poll Sexton commissioned in the three counties he covers revealed that 80 percent of respondents wanted roads improved, but 70 percent said no to a gas tax increase. Sexton signed on as a co-sponsor of the Hawk amendment, which used the sales tax from new and used vehicles, which Sexton said couldn’t get closer…

Read the full storySumner County Executive Anthony Holt Wants Industrial Park to Obtain More Property Tax Revenue

by Chris Butler To hear some people in Sumner County tell it, County Executive Anthony Holt is “hell-bent” on building an industrial park north of Gallatin along Dobbins Pike. The park’s would-be neighbors don’t want it. But Holt, in his third term as county commissioner, says he’s dismissed the idea of using county money to pay for the park, mostly because he couldn’t persuade other commissioners to play along. “I’m confident the commissioners in general are doing what they need to do. But it’s Holt I’m concerned about,” said Brad Wear, one of the many people who live adjacent to the proposed park and whose property values could suffer if it’s built. He and several of his neighbors told Tennessee Watchdog the proposed industrial park may push them to leave their homes. As reported, local developers seem to have taken an interest in the park, enticed by state taxpayer money to help get it built. As reported, those developers hold positions of influence in county government, thanks to Holt. “This is a story about local officials, starting with the county executive, who have tremendous power. Holt gets to appoint all the committees, and they are either approved, or not, by…

Read the full storySpecial Fuel Tax CUT for FedEx Preceded Haslam Push for Fuel Tax INCREASE on Regular Tennesseans

The Haslam administration and their pro-tax allies in the Tennessee General Assembly have increasingly relied upon a “user fee” argument to disguise the actual impact of their proposed gasoline and diesel fuel tax increase plan. The bill, now under consideration in the current session of the Tennesssee General Assembly under its “new and improved” name, the IMPROVE Act “Tax Act Cut of 2017,” proposes to fund an additional annual infusion of $350 million for road and bridge construction through what is now a 6 cents per gallon gas tax increase and a 10 cents per gallon diesel tax increase. Former Reagan official and respected economist Art Laffer specifically dismissed the “user fee” claim in testimony before the House Transportation Subcommittee last month. “The talk about the gas tax being a user fee is not correct,” Laffer testified. “It’s a tax pure and simple.” Nevertheless, in 2015 the Haslam administration promoted and passed a huge “user fee” jet fuel tax break to Memphis-based FedEx, whose Chairman Fred Smith sits on the Board of the Governor’s family business Pilot/Flying J, shortly before embarking on the effort to impose a huge fuel tax increase on Tennessee drivers. The special tax break on aviation…

Read the full storyCommentary: NO, It ISN’T a Tax Cut for Regular Tennesseeans

Proponents of Governor Bill Haslam’s fuel tax increase claim it is actually a tax CUT thanks to reductions in a couple of large corporate taxes, like the Franchise & Excise tax. Cutting taxes on businesses to create more job growth while we have a $2 billion surplus is a great idea…but you don’t have to increase taxes elsewhere to justify it. As Nike ads used to proclaim: “Just DO It!!” The claim that a large tax increase on drivers in Tennessee with a slight reduction of taxes on food is a “net cut” because it is combined with unrelated cuts that benefit a few of the Governor’s cronies is the kind of misrepresentation that“fuels” a legitimate distrust of government. The tax INCREASES on fuel far surpass the CUTS in the sales tax on food. It’s not even close. Muddying the water with corporate tax cuts that benefit a few doesn’t change that truth. As the Haslam IMPROVE Act currently stands, it is a $345 million tax increase. Approximately $188 million will come from the increase in the gasoline tax; another $100 million will be generated by the increased diesel tax; and finally, about $57 million will be collected in the…

Read the full storyConcerned Veterans of America: ‘Veterans Being Used in Tennessee Tax Hike Ploy’

Concerned Veterans of America (CVA) blasted Tennessee’s Republican political establishment on Monday for using veterans in a “Tennessee [gas] tax hike ploy.” “The politicians pushing for this gas tax increase know that it’s unpopular, so they’ve resorted to using veterans as pawns to push their big government agenda. Pretending that this massive tax hike is good for the military community is an unconscionable move that disrespects those who fought and sacrificed for this country,” Mark Lucas, executive director of CVA said in a statement. “The truth is that this gas tax will hurt families and veterans alike who rely on affordable transportation in the state. Veterans deserve property tax relief, but not as part of a glaringly obvious ploy to increase taxes across the board. We urge the Tennessee legislature to look for ways to cut wasteful government spending instead of approving this disingenuous and costly tax hike,” Lucas said. The amended version of Gov. Haslam’s IMPROVE Act gas tax increase that passed the Senate Transporation Committee last week “includes a small tax relief for veterans which would exempt them from paying property taxes under certain circumstances, but would not protect them from the impact of the massive gas tax…

Read the full storyThirty Tennessee General Assembly Members Signed The ‘Taxpayer Protection Pledge,’ But Some Are Breaking It With The IMPROVE Act

“Politicians often run for office saying they won’t raise taxes, but then quickly turn their backs on the taxpayer. The idea of the Pledge is simple enough: Make them put their no-new-taxes rhetoric in writing,” says Americans for Tax Reform. The “Taxpayer Protection Pledge” commits an elected official or candidate for public office “to oppose [and vote against/veto] any efforts to increase taxes.” According to the Americans for Tax Reform searchable data base, the Pledge has been signed by 30 active Tennessee State Representatives and State Senators, who are listed below. State Representatives State Senators District First Last District First Last 24 Kevin Brooks 17 Mae Beavers 19 Harry Brooks 16 Janice Bowling 71 David Byrd 22 Mark Green 63 Glen Casada 26 Dolores Gresham 16 Bill Dunn 27 Ed Jackson 11 Jeremy Faison 23 Jack Johnson 56 Beth Harwell 13 Bill Ketron 7 Matthew Hill 5 Randy McNally 22 Dan Howell 1 Steve Southerland 68 Curtis Johnson 24 John Stevens 89 Roger Kane 14 Jim Tracy 38 Kelly Keisling 57 Susan Lynn 72 Steve McDaniel 36 Dennis Powers 45 Courtney Rogers 61 Charles Sargent 49 Mike Sparks 40 Terri Lynn Weaver The IMPROVE Act includes five tax increases: a…

Read the full storyGov. Haslam Has a History of Supporting Tax Increases

Gov. Bill Haslam has a history of supporting tax increases. His current proposal to increase the gas tax by 7 cents per gallon and diesel fuel by 12 cents per gallon in 2017 is no aberration, it is part of a consistent pattern. In 2004, newly elected Knoxville Mayor Bill Haslam raised the city’s property taxes approximately 13%, but claimed the property tax rate was the lowest in several years. Former Lt. Governor Ron Ramsey challenged the claim saying that a reappraisal which lowered the overall rate, did not lower the overall percentage increase. Years earlier, Haslam was being schooled by his father on the need to raise taxes in Tennessee. Jim Haslam II, was a board member of Citizens for Fair Taxes, a group planning a public education blitz about Tennessee’s “state budget crisis” as a prelude to supporting Don Sundquists’ proposal for a state income tax. Fast forward to 2010 when Haslam, during his first gubernatorial campaign materials stated affirmatively that, “…taxes are job killers. The last thing we should do is raise taxes on a population that is already struggling and a small business community that has been forced to cut back,” and, that: “Tennessee already has the highest…

Read the full storyState Rep Andy Holt Skewers pro-Gax Tax Hike Republicans in Blistering Facebook Rant

Wednesday afternoon, State Representative Andy Holt let loose with a blistering rant against the House Transportation Committee’s arcane maneuvers to pass Gov Bill Haslam’s IMPROVE Act, going so far as to include a photo of a bag of thirty pieces of silver. Via Facebook: Well everyone, The Governor’s gas tax just passed out of the House Transportation Sub-Committee. That’s what you expected from the “fiscally conservative” super-majority controlled republican House of Representatives here in Tennessee, right? So. Gross. If allowed to pass, your taxes are about to go up by HUNDREDS of MILLIONS of dollars in Tennessee — literally!! You all need to know something. You need to know the truth. You deserve the truth. The “media” will likely tell you that the tax was “stripped out of the bill”. That’s not true, and they know it isn’t… This episode of political theater was a well orchestrated display. The bill will soon be returned to its original form so they can add back all the taxes, and possibly more… Worst part of all? The “media” has been told by countless people what’s going on behind the scenes. They’ve literally been shown proof of corruption, lies, and quid pro quo, but…

Read the full storyLetter to the Editor: Today’s Shenanigans at House Transportation Subcommittee Deflate Tennessee Taxpayers

Dear Tennessee Star, Conference room 16 was packed with an overflow standing room only crowd of “Ax the Tax” folks, and they listened respectfully to every word. The Gas Can Man was there bigger than life and getting all kinds of photo ops. Yet, in the end, the Tennessee taxpayer crowd left feeling defeated and deflated like those Tom Brady footballs. I read Rep. Andy Holt’s remarks about the hearing on Facebook. He describes the shenanigans at the Sub House Transportation Committee. Rep. Holt also gives you insight to our own “FAKE MEDIA” which is alive and well in Tennessee….except for one….the conservative Tennessee Star. Go to their web site and check out the latest fact gathering information on this Republican fiasco. To Chairman Terri Lynn Weaver’s credit, she defended and upheld what the taxpayers wanted which was the common sense Hawk Plan. When she voiced that opinion the crowd clapped loudly. But, the votes were not to be. Those who opposed the Haslam Improve Act were: Lt. Col. Courtney Rogers, Chairman Terri Lynn Weaver, Rep. Jerry Sexton, and Rep. John Mark Windle. Those voting in favor of the Haslam Improve Act (the Gas Tax Increase) were: Rep. David…

Read the full storyGovernor’s ‘Transparent Tennessee’ Does Not Apply to Fuel Tax

Three years ago when the “Transparent Tennessee” website was launched, Governor Haslam said: “A state government that is accountable to Tennessee taxpayers is an important part of being customer-focused, efficient and effective. The advanced function of this website will allow citizens more access to information about how state dollars are spent.” Last year Haslam disclosed that the 2016 budget would repay the transportation fund $261 million dollars that was transferred to the general operating fund during the Sundquist and Bredesen administrations to close budget shortfalls. “We have a covenant with our citizens that the gas tax charged by the state at the pump is dedicated to transportation-related purposes and not something totally unrelated,” State Sen. Jim Tracy (R-Shelbyville) said several months before the 2016 legislative session began, urging that this repayment be made. This is called “dedicated funding” and according to TDOT, “[n]o money from the state’s general fund, which relies on the sales tax, is used in any of the programs of the Tennessee Department of Transportation. But it seems that not all state fuel tax monies reach TDOT before being diverted to the general fund. Issues raised after Wednesday’s Sumner County gas tax town hall call into question the transparency…

Read the full storyTennessee Watchdog: Eleven Tennessee Utilities Squander Taxpayer Money on Broadband

This article is reprinted with permission from the Tennessee Watchdog. By Chris Butler February 13, 2017 More than 200 municipal broadband networks in the U.S. have placed taxpayer money in jeopardy, and 11 of those networks are in Tennessee, a new report from the Taxpayers Protection Alliance says. The Washington, D.C.-based nonprofit unveiled a graphic this week pinpointing the locations of those networks. “Government-owned (i.e. taxpayer-funded) network projects have needlessly reduced resources available to help more pressing needs such as improving education, infrastructure and public safety,” according to a TPA press release. “These networks also unfairly compete against private businesses. Worst of all, these projects have proven to put taxpayer dollars at risk, leaving hardworking constituents to foot the bill, often at a steep cost.” Among the networks listed in Tennessee: • Memphis Networx, which, the TPA said, Memphis Light, Gas and Water created in 1999 and “was a financial drain on taxpayers.” “In 2007, with the Internet experiment on the verge of bankruptcy, Memphis Networx was sold off for $11.5 million,” the TPA said. That, the TPA added, was a loss of $20.5 million on the city’s $32 million total investment in the project. • E Plus Broadband, created…

Read the full storyEXCLUSIVE Grassroots Pundit Interview With Sponsor of Hawk Plan to Fund Roads by Reallocating Sales Tax

In an exclusive interview with The Tennessee Star’s Grassroots Pundit, Laura and Kevin Baigert, on Capitol Hill Wednesday, State Rep. David Hawk (R-Greeneville) explained the details of his increasingly popular Hawk Plan to fund additional road construction by reallocating 0.25 percent of the state’s 7 percent sales tax. “We’ve had substantial over collections over the last two and a half years and looking at a third year in a row where we’re over collecting franchise and excise tax, over collecting sales tax collections. Saying that, there’s more money coming in than we had budgeted. Substantially more,” Hawk noted. Several estimates place the current annual surplus at about $950 million. Hawk explained that the 0.25 percent he wants to allocate comes from the 1 percent of the current 7 percent sales tax that is not specifically dedicated to particular state programs. “I found that the last time the legislature increased the sales tax in Tennessee it went from 6 percent to 7 percent in 2002,” Hawk told the Baigerts. ‘Those dollars [collected with that extra 1 percent added to the sales tax that year] were largely unaffiliated,” Hawk explained. “The 6 percent below had strings attached to them,” he continued. “There…

Read the full storyEXCLUSIVE: House Majority Leader Casada Supports Hawk Plan to Fund Roads With Existing Sales Tax

In an exclusive interview with The Tennessee Star on Capitol Hill Tuesday, House Majority Leader State Rep. Glen Casada (R-Franklin) explained why he supports State Rep. David Hawk‘s (R-Greeneville) plan to fund road construction by reallocating one quarter of one percent (0.25) out of the 7 percent currently paid in sales tax on retail purchases that goes to the state’s general fund. (Tennessee residents pay an additional 2.25 per cent to 2.75 percent in sales tax on retail purchases to fund local governments.) Gov. Haslam has proposed a plan to pay for additional road construction by increasing the gas tax by 7 cents, from 21 cents per gallon to 28 cents per gallon, and the diesel tax by 12 cents, from 18 cents to 30 cents per gallon. The Star’s Laura Baigert interviewed State. Rep. Casada in his Capitol Hill offices. “First let me say, that the governor, I applaud him because he has identified there’s a need in the state, and that need is to build more roads,” Casada told Baigert. “The reason that has arisen, the reason the gas tax by itself is not sufficient is because of inflation, because of increased automobile gas mileage. We’re not collecting…

Read the full story