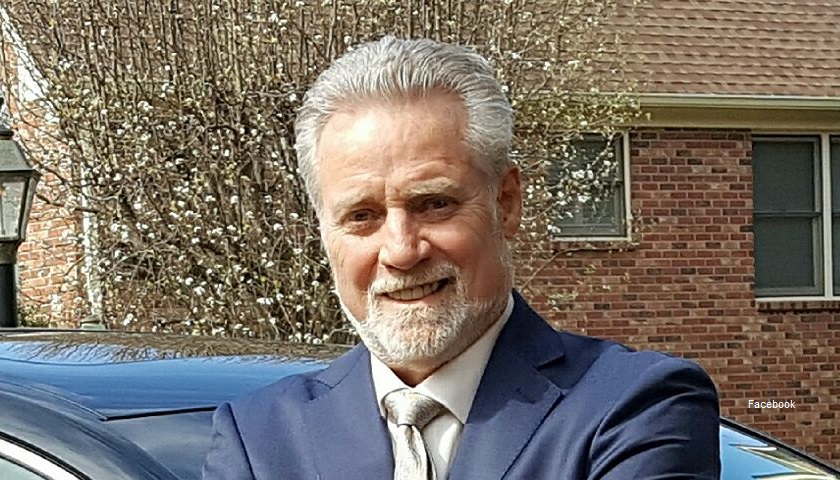

State Rep. Sam Whitson (R-Franklin), one of the 11 members of the House Transportation Committee who voted yes on increasing the gas tax and moved the amended version of Gov. Haslam’s IMPROVE Act, tells the Spring Hill Home Page he is proud of his vote in committee on Tuesday. The amended version of the IMPROVE Act for which Whitson voted is said to be the same as the amended Senate version, which reduced the gas tax increase from 7 cents per gallon to 6 cents per gallon. The full details of the amended House version Whitson voted for have not yet been released to the public. “We made sure that a we stayed a debt free and pay-as-you-go state when it comes to our public roads,” the Williamson County resident and Army veteran told the Spring Hill Home Page on Wednesday. Whitson was not asked to comment on Chairman Barry Doss’ (R-Leaoma) violation of Tennessee House of Representatives Rule 34 in the committee, a rule breaking abuse of power that enabled the vote to be held on Tuesday in committee. Whitson’s colleague, State Rep. Timothy Hill (R-Blountville), invoked Rule 34 during the hearing. Rule 34 grants members of the…

Read the full storySearch Results for: gas tax

Grover Norquist Praised Chris Christie’s Gas Tax Increase in New Jersey Before He Signed Off on Haslam’s in Tennessee

Washington insider Grover Norquist, founder of Americans for Tax Reform, praised New Jersey Gov. Chris Christie’s gas tax increase in New Jersey in 2016, a year before he claimed Gov. Haslam’s gas tax increase proposal here in Tennessee is “Taxpayer Protection Pledge compliant.” In the letter he sent to Tennessee state legislators on Monday in which he expressed support for the amended version of Gov. Haslam’s gas tax increase that passed the Senate Transportation Committee last week, Norquist also sang the praises of Christie’s earlier gas tax increase in the Garden State. “In New Jersey last year, Americans for Tax Reform supported a tax package enacted by Gov. Christie that raised the gas tax from 14.5 to 23 cents per gallon, but coupled that with a phase out of his state’s death tax, a reduction in the sales tax from 7 to 6.6%, and an increase in the earned income tax credit,” Norquist wrote. “The package, like SB 1221/HB534 was a net tax cut overall. As such, not only did ATR not oppose the deal, ATR urged lawmakers to support it,” he added. “Republican Gov. Chris Christie and the Democratic-controlled Legislature agreed to the hike because the state had run…

Read the full storyPotential GOP Gubernatorial Candidate Mae Beavers Promises to Repeal Gas Tax Increase If It Passes This Year and She is Elected in 2018

On Wednesday State Senator Mae Beavers (R-Mt. Juliet) wasted no time in claiming the conservative mantle as she considers a run for the Republican nomination for Governor in 2018. “Yesterday Senate and House committees advanced the Governor’s proposed tax increases on gasoline and diesel fuel towards passage. I remain adamantly opposed to ANY tax increase on working families in Tennessee, particularly when we have a huge and growing budget surplus that provides us plenty of resources to build and maintain roads and bridges,” Beavers tells The Tennessee Star. “As I explore the possibility of running for Governor, I can assure Tennessee taxpayers that my first priority as Governor would be to propose a budget that would include the complete repeal of this unnecessary and burdensome fuel tax if it does indeed pass,” Beavers promised. “I am the ONLY prospective candidate on either side of the aisle speaking out against this massive tax increase — which may help explain what is “fueling” so much interest in my potential candidacy across the state,” Beavers also blasted the credibility of the Fiscal Note quickly issued on March 16, three days after an amended version of Gov. Haslam’s gas tax increase proposal passed the…

Read the full storyIf Mark Green Does Not Run, Mae Beavers Will Be Only Potential or Announced GOP Candidate For Governor Who Opposes The Gas Tax Increase

“Sen. Mae Beavers, R-Mt. Juliet, said she is in the early stages of a possible run at the state’s top position after the leading conservative candidate might be headed to the nation’s capitol,” the Lebanon Democrat reported on Monday. If State Senator Mark Green (R-Clarksville) becomes the next Secretary of the Army, as many insiders expect will be the case, State Senator Mae Beavers (R-Mt. Juliet) will be the only potential or announced GOP candidate for Governor who opposes the gas tax increase. “Beavers said the idea to run for governor emerged recently after several phone calls and comments from supporters, many of which she spoke with at the recent Wilson County Republican Party Convention,” the Lebanon Democrat noted. “I said on Friday I would throw out the idea and see what happens,” Beavers told the Lebanon Democrat. “Sen. Green was the most conservative candidate. A lot of people felt the need to support a candidate who shares similar views,” she added. When the State Senate Transportation Committee passed an amended version of Gov. Haslam’s Improve Act last week that raised the gas tax by 6 cents per gallon rather than 7 cents per gallon, Beavers was the sole no…

Read the full storyBoss Doss Breaks Rules to Ram Amended Gas Tax Increase Through House Transportation Committee

In a stunning abuse of power, State Rep. Barry Doss (R-Leoma) broke a long-standing rule of the Tennessee House of Representatives to ram an amended version of Gov. Haslam’s gas tax increase through the House Transportation Committee he chairs on Tuesday. A bill containing the new and improved IMPROVE Act amendment, which restores many of the elements of Gov. Haslam’s original gas tax increase proposal, passed the House Transportation Committee in an 11 to 7 vote, but that outcome could not have taken place on Tuesday had not Chairman Doss broken Rule 34 of the Tennessee House of Representatives. Rule 34 of the Tennessee House of Representatives allows any member the privilege of “separating the question” when an amendment is added to a bill that is up for consideration. A key element of Rule 34–which is known to every member of the House–is that it is a “privilege” that can be exercised without question whenever a member invokes it in a committee hearing. It is not a “motion,” which is subject to a vote of the committee. Every chairman of every committee in the Tennessee House of Representatives, including Rep. Doss, is well aware that Rule 34 is a privilege,…

Read the full storyGrover Norquist’s Endorsement of Gov. Haslam Gas Tax Increase Backfires

Gas tax increase supporters initially believed they had scored a great political coup on Monday when Washington insider Grover Norquist, founder of Americans for Tax Reform (ATR), declared his support for the amended version of Gov. Haslam’s IMPROVE Act that passed the Senate Transportation Committee last week. That amended version reduced the proposed gas tax increase from 7 cents per gallon to 6 cents per gallon. But the fierce backlash from conservative opponents of the gas tax increase in Tennessee to the last minute attempt by supporters of the governor’s plan to bolster its chances by calling in a “celebrity ” who has never lived in the state and knows little of the intricacies of the bill or the state’s budget, spells more, rather than less, political trouble ahead for the governor and his allies. “The recent amendments made by the Senate, and supported by Gov. Haslam, have improved the bill to the extent that the bill is now a net tax decrease, and thus not a violation of the Taxpayer Protection Pledge…ATR scores the amended version of SB 1221 / HB 534 as a net tax cut and therefore Taxpayer Protection Pledge compliant,” Norquist wrote “in a memorandum to…

Read the full storyGov. Haslam Admits Up to $70 Million of Gas Taxes Can Be Spent on Mass Transit by Cities and Counties

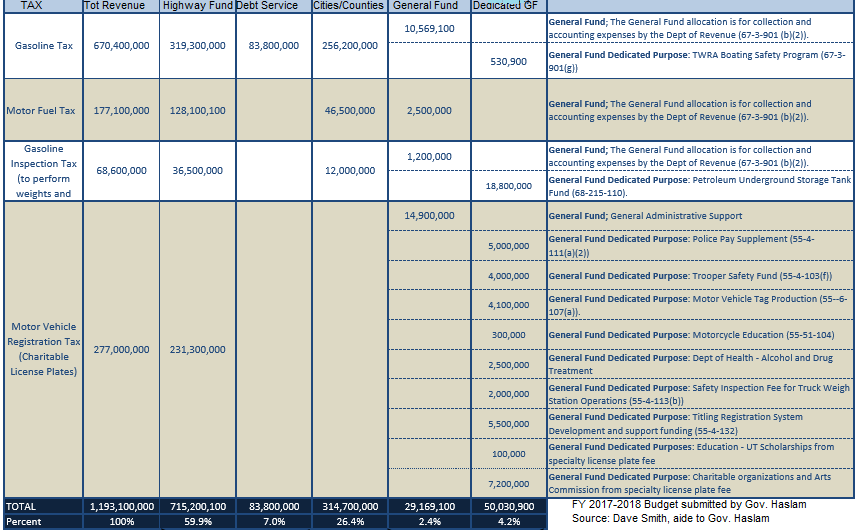

A spokesperson for Gov. Haslam has admitted that up to $70 million of highway user fees collected by the State of Tennessee, primarily from gas taxes, can be spent on mass transit in the FY 2017-2018 budget. In that budget, which he transmitted to the Tennessee General Assembly on January 30 of this year, Gov. Haslam estimates that $314.7 million of the $1.2 billion in highway user fees the State of Tennessee will collect in the upcoming fiscal year will be given to cities and counties. Those “Funds may be expended by municipalities receiving the funds for the purpose of funding mass transit systems,” Gov. Haslam’s top aide, Dave Smith, says in an email statement provided to The Tennessee Star by 99.7 FM WWTN’s Ralph Bristol, host of Nashville’s Morning News. “No more than 22.22% of the funds may be used for the purpose of funding mass transit,” Smith continues, citing Tennessee Code Annotated § 54-4-203-204. “No more than 22.22% of county funds may be expended for the purpose of funding mass transit,” Smith adds, citing Tennessee Code Annotated § 54-4-103. The total amount cities and counties may expend “for the purpose of funding mass transit” in FY 2017-FY 2018 under the budget…

Read the full storyState Senate Transportation Committee Passes Amended Gas Tax Hike

The State Senate Transportation Committee passed an amended version of Gov. Haslam’s Gas Tax hike (SB 1221) on Monday. Among the changes were a removal of the inflation indexing provision, a cut in the governor’s proposed gas tax increase from 7 cents per gallon to 6 cents per gallon, and a cut in the proposed diesel fuel tax increase from 12 cents to 10 cents per gallon. Senate revisions to Gov. Haslam’s road-funding bill: – Reduces governor’s proposed gas tax increase from 7 cents per gallon to 6 cents. Phases increases in over 3 years with 4 cents in Fiscal Year 2018, 1 cent in FY 2019 and 1 cent in FY 2020. – Reduces governor’s proposed diesel tax increase from 12 cents per gallon to 10 cents. Phases in over 3 years with 4 cents in FY 2018, 3 cents in FY 2019 and 3 cents in FY 2020 – Alternative fuel tax increase of 8 cents phased in over 3 years. – Removes inflation indexing provision – Removes 3 percent rental car surcharge – Deepens Haslam’s proposed cut to state’s sales tax by reducing the 5 percent tax to 4 percent beginning July 1 as opposed to the 4.5 percent originally…

Read the full storyHigh Noon: Steve Gill and Ralph Bristol Debate the Gas Tax on WWTN Tomorrow

Steve Gill and Ralph Bristol will debate the merits of Gov. Haslam’s proposed gas tax increase on 99.7 FM WWTN’s Dan Mandis Show tomorrow (Wednesday) at noon. Gill, the former Nashville talk radio host who led the successful opposition to Gov. Sundquist’s proposed state income tax in 2000-2002, is opposed to Haslam’s proposal to increase the gas tax by 7 cents per gallon as well as any other kind of tax increase. Bristol, the host of Nashville’s Morning News on 99.7 FM WWTN, said in testimony before the State Senate Transportation Committee on Februrary 27, “It is my humble, but considered opinion that Governor Haslam has almost presented a thoughtful, responsible plan that preserves the integrity of an admirable and enviable tax system . . . and that his plan adequately addresses a real need that has always been considered so sacred that it deserved special protection, even from economic downturns that affect the rest of the people’s purse.” “I do not support the Governor’s plan, as is, because I don’t believe it is the revenue neutral plan it advertises itself to be,” Bristol stated in his testimony But the bottom line for Bristol, he concluded in his testimony, is that “Governor Haslam’s…

Read the full storyFifty Leading Tennessee Conservatives Send Open Letter to State Legislature Opposing Gas Tax Increase

Fifty leading Tennessee conservatives have sent an open letter to the Tennessee General Assembly opposing Gov. Haslam’s proposed IMPROVE Act, which includes a 7 cents per gallon gas tax increase and a 12 cents per gallon diesel tax increase. The letter was released Tuesday morning, on the same day the House Transportation Committee is scheduled to vote on the IMPROVE Act. Conservative political strategist Steve Gill noted: “The names on this letter should raise concerns among Republican legislators. These are the exact types of conservative political activists who run in Republican primaries, recruit others to run in Republican primaries, and help those who run in Republican primaries.” Gill said that a gas tax increase, if passed, will likely be THE issue in 2018 Republican primary races. “Voters will essentially have a referendum to repeal the tax by replacing those who voted for it with those who will vote to repeal the tax increase,” Gill noted. “The mail pieces and radio adds against the tax increasers almost write themselves.” Another Republican political consultant pointed out the ideological impact of the current internal policy battles in the Republican Party at the state and national level. “The Ryan Obamacare-lite plan may expand the…

Read the full storyCarr Amendment Funds Highways Through ‘User Fees’ Without A Gas Tax Increase

The House Transportation Committee convenes on Tuesday to vote on Gov. Haslam’s IMPROVE Act. The big question is whether Committee Chairman State Rep. Barry Doss (R-Leoma) will allow a vote on an amendment proposed by State Rep. Dale Carr (R-Sevierville), a member of the committee, that would change the funding source of from a gas and diesel tax increase, as proposed by the governor, to a re-allocation of 33.5 percent of taxes collected from the sale of new or used motor vehicles for highway funding. Proponents of Gov. Haslam’s gas tax increase proposal have argued that road construction must be funded by users through “user fees.” Carr’s amendment addresses those concerns, since taxes on the sale of new or used motor vehicles are clearly paid by users of the state’s highways. Rep. Carr tells The Tennessee Star that he hand delivered the amendment to Chairman Doss on Tuesday of last week, and intends to present it for consideration when the House Transportation Committee begins deliberations on Tuesday. He notes that the amendment was “written in consultation with leadership.” “A lot of people don’t want the [gas] tax and they are having a hard time moving it through committee,” he tells The Star in an exclusive…

Read the full storyGas Tax Apologists Unable to Explain Why the 15 Percent of User Fees Diverted From Highway Fund is Not Spent on Road Construction

At least 15 percent of the $1.2 billion in highway user fees collected by the state of Tennessee in FY 2015-2016–$189 million– was diverted away from road construction (see page A-65 of The Budget: State of Tennessee, Distribution of Actual Revenue by Fund, FY 2015-2016). Under Gov. Haslam’s proposed FY 2017-2018 budget, virtually the same amount of highway user fees–$187 million–will continue to be diverted away from road construction. (see page A-67 of The Budget: State of Tennessee, Distribution of Estimated Revenue by Fund, FY 2017-2018). FY 2015-2016 is the most recent year for which actual expenditures are available. Throughout the public debate over the past two months about Gov. Haslam’s proposed IMPROVE Act, which includes a gas tax increase of 7 cents per gallon, apologists for a gas tax increase–including House Transportation Committee Chairman Barry Doss (R-Leoma), House Senate Transportation Chairman Paul Bailey (R-Sparta), and 99.7 FM WWTN radio’s Ralph Bristol, host of Nashville’s Morning News–have yet to answer one key question about the state’s budget priorities: With a $1 billion surplus in the state budget, why do you support a gas tax increase when much of the purported road construction shortfall could be addressed by simply re-allocating the $187…

Read the full storyState Rep. Susan Lynn: ‘I Am Not For The Gas Tax So There Is Nothing To Debate’

“No, I am not for the gas tax so there is nothing to debate,” State Rep. Susan Lynn (R- Mount Juliet) tells The Tennessee Star in response to challenger Jeremy Hayes’ March 8 press release calling on her to debate him over the issue. Hayes opposes Gov. Haslam’s proposed gas tax increase. In a February 28, 2017, exclusive interview with The Star, Hayes announced his run for the 57th House District in the 2018 Republican primary, citing Lynn’s support for Gov. Haslam’s gas tax increase proposal. “Thank you for giving me the opportunity to clear up this untruthful rhetoric,” Lynn responded to Hayes’ challenge in an email sent to The Star, adding: I have never voted for a tax increase and I have voted to lower our taxes many times. It is my responsibility as the representative for the 57th district to present facts, hear ideas and to create opportunities for constituents to discuss policy. While some lawmakers are shying away from holding Town Hall meetings – I have held seven since January and I will hold more on this topic and others. This individual worked for my democrat opponent – his integrity on this and other matters is entirely suspect. I’d…

Read the full storyCommentary: Governor’s Gas Tax Plan Hurts the ‘Little Guy’

The Tennessee Department of Transportation (TDOT) boasts on its website that: “Tennessee’s conservative process of funding its highway program is often referred to as a ‘pay as you go’ program. The agency only spends the funds that are available through its dedicated revenues, the highway user taxes and fees, and federal funding.” For consumers, the Governor’s proposal adds a 7-cent increase per gallon for gas and a 12-cent increase per gallon for diesel with future increases tied to the Consumer Price Index. The plan also includes a $5.00 increase to vehicle registration prices. Americans for Tax Reform and the Brookings Institute agree, that higher gas prices negatively impact economic growth and low to moderate income households: “…higher gas prices drain purchasing power from the economy. That means that these families get hit twice: once by the direct impact on their household budgets but a second time when higher prices retard the economic recovery.” Add to that, higher fuel taxes are likely to add to the cost of consumer goods when the increased cost paid by businesses is passed onto consumers. even with the tax cut in taxes paid by businesses included in the Governor’s plan. There is also a modest half…

Read the full storyHaslam Gas Tax Proponent State Rep. Barry Doss Says ‘No One’s Talking About the Tax Cuts That We’re Doing’

State Rep. Barry Doss (R-Leoma), Chairman of the House Transportation Committee and a leading proponent of Gov. Haslam’s proposal to increase the gas tax by 7 cents per gallon, told 99.7 FM WWTN’s Ralph Bristol on the Thursday edition of Nashville’s Morning News that he wanted to remind WWTN listeners how much the Tennessee General Assembly has cut taxes recently. “What is this important argument that nobody has heard yet?” Bristol asked Doss. “One thing that we’re not concentrating on,” Doss began, “no one’s talking about the tax cuts that we’re doing.” “I would like to remind all of your listeners that five years ago we lowered the inheritance and gift tax which was a $110 million tax cut, and we knew five years ago there was a drastic need for new revenue for infrastructure, yet we chose to lower taxes $110 million instead of shifting that money over to revenue,” Doss said. Doss was one of the key figures in the legislative drama at the Tennessee General Assembly on Wednesday in which proponents of Gov. Haslam’s plan forced it through the Transportation Subcommittee, which was tied 4 to 4, by making the unusual move of bringing in House Speaker…

Read the full storyState Rep. Barry Doss Dodges Key Questions on Haslam Gas Tax

After Gov. Haslam ally and gas tax advocate State Rep. Barry Doss (R-Leoma) voted “yes” in the House Transportation Subcommittee on Wednesday to send the governor’s IMPROVE Act to the full Transportation Committee which he chairs, The Tennessee Star contacted him and asked three simple, yet key questions pertinent to any further consideration of the gas tax: Can you confirm that 25% of Highway Fund user fees go to the general fund? Can you confirm that suppliers and retailers of both gas and diesel can hold the tax money anywhere from 20-51 days depending on the month before remitting to state per dept. of revenue fuel tax schedule?” Was there any particular reason these important and highly relevant issues were not raised prior to the subcommittee vote today? Rep. Doss did not respond to The Star prior to our deadline. As the House Transportation Committee which he chairs now takes the IMPROVE Act under consideration, Rep. Doss has an opportunity to bring the answers to these questions out in the open for public consideration. The answers to those questions are of great relevance to the public, since “[o]ne of the principles asserted by Governor Haslam in support of his IMPROVE…

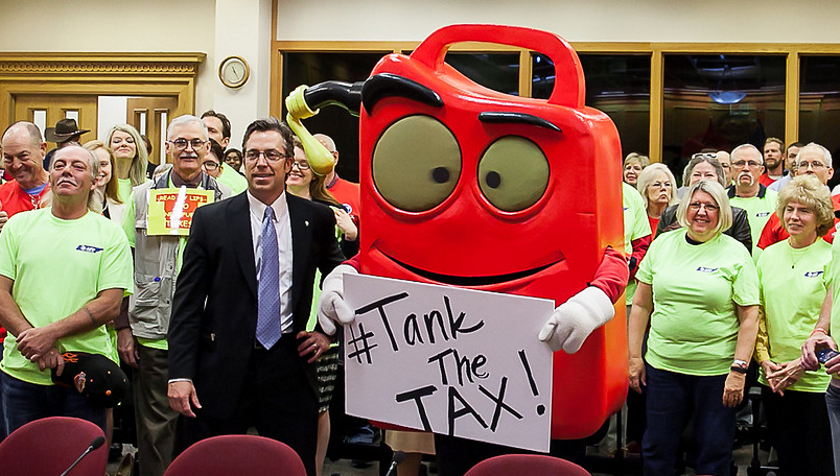

Read the full storyAFP’s Andrew Ogles: More Conservative Grassroots Pressure Needed to Stop Gas Tax

Andrew Ogles, the Tennessee director of Americans for Prosperity, was in a glum mood Wednesday afternoon after Gov. Haslam’s gas tax plan seemed to get a boost forward. Earlier in the day, Ogles and his fellow tax opponents were more buoyant as they rallied around the costumed Gas Can Man and hoped for a more positive outcome. The House Transportation Subcommittee voted in favor of Haslam’s transportation plan, albeit with an amendment that includes elements of an alternative proposal favored by opponents of the proposed tax increase. But Ogles believes that amendment will disappear once the plan is considered by the full House Transportation Committee, which Ogles says could happen sometime next week. “My suspicion is they’ll strip that off,” Ogles said. “This was merely a Trojan horse to get it out of committee.” Haslam wants to raise the tax on gas by 7 cents a gallon and for diesel, 12 cents a gallon. The current gas tax of 21.4 cents per gallon hasn’t changed since 1989. The alternative plan, known as the Hawk plan because it was put forward by Rep. David Hawk, R-Greeneville, proposes using existing sales tax revenue to pay for road improvements. The Hawk plan was…

Read the full storyStanding-Room-Only Crowds Greet the Transportation Subcommittee As They Meet to Vote on Gas Tax Increase

Standing room only crowds gathered to greet the Transportation Subcommittee as they are set to vote on the increasingly unpopular Haslam Gas Tax increase. The Tennessee Star crew arrived early. The room was full by 10:45am for the 12pm meeting… more updates on Facebook…

Read the full storyNo Response From Sen. Paul Bailey to Dept. of Revenue Confirmation Pilot Flying J Will Benefit From Gas Tax ‘Float’

State Senator Paul Bailey, Chairman of the State Senate Transportation Committee, has not responded to an inquiry from The Tennessee Star to explain the Tennessee Department of Revenue’s correction of his assertion that Pilot Flying J, the truck stop company owned and operated by Gov. Haslam’s family, will not benefit from holding on to the extra cash generated by the proposed gas tax increase for 20 to 51 days. The Tennessee Department of Revenue has corrected Sen. Paul Bailey’s statement regarding the timing of when fuel taxes must be remitted to the state. According to the Department of Revenue’s Communications Director, Kelly Cortesi, “The gasoline tax is imposed when the fuel is first imported into Tennessee. The diesel tax is imposed when the fuel is sold to the wholesaler. In either case, the taxpayer is the importer/supplier, and the return is due on the 20th day of the following month.” Sen. Bailey is the general manager and vice-president of Charles Bailey Trucking Company. The Department of Revenue was forwarded Sen. Bailey’s statement and was asked to confirm whether it was accurate in light of the fact that the Department’s website says that fuel taxes are not due to the state until…

Read the full storyNashville Talk Radio Led Opposition to Sundquist Income Tax But Is Split on Haslam Gas Tax

When former Gov. Don Sundquist proposed imposing a state income tax on residents of Tennessee in 1999, Nashville talk radio hosts Steve Gill and Phil Valentine led the horn-honking opposition that ultimately killed the unpopular proposal three years later in 2002. It is a different media landscape in 2017, as political controversy surrounds Gov. Haslam’s proposal to increase the gas tax to fund road construction. Like Sundquist, Haslam is a Republican. WLAC, 1510 am, is no longer in the local political talk business. 99.7 FM WWTN owns the local conservative talk market, with all local hosts, beginning at 5 a.m. with Ralph Bristol, 9 a.m. with Michael Del Giorno, noon with Dan Mandis, and 3 to 7 p.m. with Phil Valentine. The day’s talk agenda is set by Nashville’s Morning News host Ralph Bristol, and he testified before the State Senate Transportation Committee in favor of Gov. Haslam’s plan, provided it is truly revenue neutral, which he says it currently is not. Former Nashville talk radio host Steve Gill, in contrast, came out guns a-blazing in opposition to the gas tax increase in a commentary posted today at The Tennessee Star. “17 years ago, talk radio lead the fight to stop…

Read the full storyCommentary: Oppose Wednesday’s Vote to Raise Tennessee’s Gas Tax

There’s no denying that Tennessee’s infrastructure is in need of repair. But Gov. Bill Haslam’s proposed gas tax increases to fund the projects—which the state House of Representatives will vote on this Wednesday – isn’t the right solution. Instead, lawmakers should use money already in the state budget, which is more than enough to meet our transportation needs. The key component of Gov. Haslam’s plan is to increase the state’s tax by 7 cents a gallon on gasoline and 12 cents a gallon on diesel – respective increases of 33 percent and 65 percent over what we currently pay today. Not only that, but it will also be indexed to inflation every other year. That means each time you go to the pump, you’ll pay more to the state and have less money to spend on your personal needs—and it will get worse every two years. On top of the gas tax increase, Gov. Haslam wants to nickel-and-dime us with an increase in vehicle registration fees, too. All combined, the governor’s proposal includes nearly $300 million in higher taxes every year. And that’s not all. The proposal would also give municipalities a bite at the tax apple, allowing them to hold referendums on raising local sales taxes to…

Read the full storyJeremy Hayes to Challenge State Rep. Susan Lynn in GOP Primary Over Her Support of Gas Tax

In an exclusive interview with The Tennessee Star, Jeremy Hayes says he will challenge State Rep. Susan Lynn (R-Mt. Juliet) in the 2018 Republican primary because of her support for Gov. Haslam’s gas tax increase proposal. “I think it’s absolutely ridiculous. It’s the dumbest bill,” Hayes, the former co-chairman of the Trump campaign in Wilson County, told The Star’s Laura Baigert when asked his position on the governor’s IMPROVE Act, which raises the price of gas by 7 cents per gallon and the price of diesel fuel by 12 cents per gallon. “You do not need a math degree to understand that this thing does not make sense,” Hayes said: One, they’re telling us that they’re going to save half a cent in the grocery store, on your food tax. Well then, proposing raising the fuel tax 7 cents the first year, the diesel tax 12 cents the first year. What’s that going to do? . . . They’re going to pass that tax on to the consumer. “In addition they want to put it an index,” Hayes added, citing another feature of the governor’s gas tax proposal he opposes. Hayes also noted that the gas tax increase is unnecessary,…

Read the full storyDemocrat State Rep. Windle Files Five Obstructionist Amendments to Hawk Plan, Part of Effort to Force Gas Tax Through House

State Rep. John Mark Windle (D-Livingston), who pulled the surprise move to adjourn last week at the House Transportation Subcommittee before a fair chance was given to vote on the Hawk Plan, the alternative to the governor’s gas tax increase plan that reallocates sales tax revenue, is at it again. “Windle filed five amendments to Hawk’s legislation Monday after being rebuffed last week by Weaver. Windle, of Livingston, is introducing measures to remove sales taxes on baby formula, milk, bread and baby diapers. Yet another amendment would provide a 10-year franchise tax exemption on manufacturing plants that open or expand in economically distressed counties,” the Memphis Daily News reported. Windle’s latest exercise in legislative skullduggery came two days before the House Transportation Subcommittee is scheduled to reconsider both the Hawk Plan and Gov. Haslam’s IMPROVE Act on Wednesday. Subcommittee chairman State Rep. Terri Lynn Weaver (R-Lancaster) is a strong opponent of the governor’s proposal. “My district knows it. I’m opposed because my district is opposed to it,” Weaver told the Daily News. But Windle has aligned himself with three Republican allies of Gov. Haslam on the Transportation Subcommittee who are determined to prevent the Hawk Plan from surviving the committee:…

Read the full storyRalph Bristol Testifies Before State Senate Transportation Committee on Gas Tax Increase Proposal

At the invitation of Chairman State Sen. Paul Bailey, 99.7 FM WWTN’s Ralph Bristol, host of Nashville’s Morning News, testified before the State Senate Transportation Committee on Monday afternoon about Gov. Haslam’s proposal to pay for additional road construction funding by increasing the state’s gas and diesel tax. Bristol provided The Tennessee Star with this summary of his prepared statement, which he authorized us to release after 1:30 p.m. today, when he was scheduled to deliver his testimony. Here is the complete final draft of his prepared statement, as provided to The Star late Monday morning: Testimony to Senate Transportation Committee (final draft) By Ralph Bristol, host, Nashville’s Morning News, 99.7 WTN (approx. 7:00) I’ll try to honor Chairman Bailey’s request to share a summation of my radio audience’s response, over the past few months, to the proposals before them, including, but not limited to the governor’s, to increase transportation funding, and to offer my own insight, however limited value that might have. First, understand that I understand my audience is not representative of all of Tennessee. Nor, might I add, are the fans of of the Tennessean or the Memphis Commercial Appeal, but I digress. People who listen to…

Read the full storyDept. of Revenue Confirms Pilot Flying J Will Hold on to Extra Cash from Gas Tax Increase for 20 to 51 Days

Last week The Tennessee Star asked State Sen. Paul Bailey, chair of the Senate Transportation Committee and general manager and vice-president of Charles Bailey Trucking Company, about the possible impact Gov. Haslam’s proposed gas tax increase will have on Pilot Flying J’s business operations and whether it would be in the public interest to have a full and open discussion in a committee hearing about this issue. Pilot Flying J, the fourteenth largest privately held company in the country, owns and operates more than 500 gas and diesel truck stops around the country, approximately 40 of which are in the state of Tennessee. The Haslam family owns Pilot Flying J, and Gov. Haslam, while not involved in the operation of the business, has a significant equity interest in the company, though he has never fully disclosed the exact amount of that interest. While supportive of discussing the general issue of whether the “float” that unremitted fuel taxes benefit a fuel supplier, Sen. Bailey raised the additional question of exactly when the taxes collected are paid to the Tennessee Department of Revenue: “The payer of these taxes remit payment to the state upon delivery to their terminals; therefore, the only ‘float’ comes to…

Read the full storyHaslam Gas Tax Hike Opponents Gather at ‘Tank the Tax’ Rally Set for Wednesday

As the Haslam IMPROVE Act plan to increase fuel taxes returns to the Transportation Subcommittee on Wednesday March 1, Americans for Prosperity and other activists plan to “turn up the heat” by gathering at Legislative Plaza to express opposition to the proposed tax increases. The Transportation Subcommittee, Chaired by Rep. Terri Lynn Weaver (R-Lancaster), is scheduled to meet at noon. Andy Ogles, Tennessee Director of Americans for Prosperity, said that activists will be coming from across the state to express opposition to the proposed tax increases. “Once taxpayers realize that the huge tax increases proposed by the Governor are coming when we have a TWO BILLION DOLLAR SURPLUS their reaction to the plan becomes almost a unanimous ‘NO’ and they can’t understand why their elected officials are even entertaining the idea,” Ogles noted. “The only way the Haslam Plan passes is if their supporters successfully hide the truth about what the plan actually means to the wallets of working men and women in Tennessee. To stop it, we simply need to get the truth out and encourage taxpayers to get engaged in this fight.” Ogles also expressed concern about the glaring absence of conservative leadership in the Legislature on this issue.…

Read the full storyMore Unanswered Questions at Gov. Haslam’s Sumner County Gas Tax Town Hall

On Wednesday evening, Governor Haslam spoke about his proposed 7 cent gas tax and 12 cent diesel tax increase at Sumner County’s Station Camp High School to a group of about 300 people, around 100 of whom received a personal email invitation from County Executive Anthony Holt. The governor, joined by Department of Transportation Commissioner John Schroer on a stage with local elected officials, delivered an abbreviated and less energetic version of his state of the state address that he had delivered at his previous town hall style meetings. These events have afforded the opportunity to fact-check the claims the governor has been making since the launch of his IMPROVE Act at a press conference on January 18, and Wednesday’s Sumner County Town Hall showed that the number of unanswered questions has not diminished as his tour of the state has gone on. According to the governor, Tennessee does not use bond debt to fund roads, but his budgets for 2016-17 and 2017-18 included $88 million and $80 million in bond debt, respectively. The Tennessee Star’s Laura Baigert pressed the governor on claims that this year’s budget, like past budgets, keeps various funds separate. How, she asked, did the governor…

Read the full storyHouse Transportation Subcommittee Vote on Haslam Gas Tax Scheduled Today, No Representative from Pilot Flying J Has Yet Been Called to Testify

The first test of Gov. Haslam’s proposal to increase the gas tax to fund road construction is scheduled to take place when the House Subcommittee on Transportation votes today on whether to move the bill to the full Transportation Committee. The Subcommittee has heard testimony from various supporters and opponents of the bill, but to date has not yet heard testimony from representatives of one private corporation that will be impacted by the proposed gas tax increase: Pilot Flying J, the company owned and operated by Gov. Haslam’s family. Questions have been raised by opponents about the potential conflict of interest posed by Governor Haslam’s proposed fuel tax increase if it benefits the privately held, family owned business Pilot Flying J, a distributor and a retailer of gas and diesel fuel. Critics of any fuel tax increase, whether it is the governor’s plan or the alternative Hawk plan, have questioned whether cash flow increases on the distribution side from collecting and holding the increased tax and/or increased profits on the retail side, could aid Pilot’s recovery from its $162 million payout related to the company’s rebate fraud case. The Tennessee Star asked committee members whether a representative from the ranks…

Read the full storyState Rep. David Alexander Changes Mind on Gas Tax Increase After Dinner With the Governor

A key member of the House Subcommittee on Transportation who has previously stated his opposition to Gov. Haslam’s gas tax increase proposal has changed his mind. In an exclusive interview with The Tennessee Star, State Rep. David Alexander (R-Winchester), who many thought would vote to kill the governor’s gas tax increase proposal in the Subcommittee on Transportation when it comes to a vote this week, now says that after having dinner with Gov. Haslam in Winchster Monday night he wants to see the bill brought to the full House for a vote by all 99 members. The Star’s Laura Baigert first asked Alexander how he thought Monday evening’s gas tax town hall in Franklin County went. You can watch the full interview below: Alexander acknowledged that many of the questioners at the town hall opposed the gas tax increase, as The Star reported earlier on Tuesday. Alexander praised the governor’s answering of questions at the event. “For the last 15 or 18 months he’s been talking about the issue across the state of Tennessee so he’s got it well learned,” Alexander said. “It went on for about an hour,” Alexander said of the town hall meeting. “After it was…

Read the full storyGov. Haslam Gets Tough Questions From Informed Crowd at Franklin County Gas Tax Town Hall

Governor Haslam appeared nervous and off his game Monday night, as he was peppered with questions he could not answer at a “gas tax town hall” tour stop at the Franklin County Annex Building in Winchester. After giving 30 minutes of opening comments to the standing-room-only crowd of about 150 people, the governor opened the meeting up to questions and was challenged for the next 45 minutes with more than two dozen questions critical of his proposal to raise fuel taxes. The first questioner contrasted the 7 cents per gallon gas tax and 12 cents per gallon diesel tax increase with the half-percent reduction in the grocery sales tax contained in the governor’s plan. The questioner pointed out that the two things that have strapped everyone are groceries and fuel. The fuel tax increases will offset any grocery tax savings, the questioner stated. The governor then went through his math to assert that his proposal represents a 4 cent increase per $100 purchased in diesel fuel, but the man who posed the question found that arithmetic unsatisfying. He sat down, shaking his head. County Commissioner Dave Van Buskirk asked if the money will only go to roads. Gov. Haslam said…

Read the full storyBREAKING: Gov. Haslam Claims ‘There Have Not Been Any Other Alternatives Proposed’ To His Gas Tax Increase

“Gov. Bill Haslam did not acknowledge the multiple alternatives to his proposed gas tax increase that legislators have introduced in the statehouse during an interview with Knoxville media Friday,” WBIR TV reports. “There have not been any other alternatives proposed. No one else has laid out a plan and said ‘This is how we’re going to pay for it,’” WBIR reports Haslam stated when asked about alternative plans to fund road construction, such as The Hawk Plan, which would provide that funding by reallocating 0.25 percent of the current sales tax. “He’s very aware of other plans,” State Rep. David Hawk (R-Greeneville), author of The Hawk Plan, told WBIR: Hawk said he has discussed his plan with Haslam of taking one-quarter of one percent of sales tax revenue to create a recurring dedicated fund to address transportation needs long-term. Rep. Jason Zachary of Knoxville said his constituents are pushing him to find an alternative to a tax increase by pointing out the state is sitting on a $1 billion dollar budget surplus and another $1 billion surplus is projected for this year. He has proposed allocating a quarter of any state surplus money over $5 million each month to TDOT.…

Read the full storyReagan Economist Art Laffer to Subcommittee Hearing on Gas Tax: ‘We Don’t Need More Taxes In Tennessee’

“We don’t need more taxes in Tennessee,” well-known economist Arthur Laffer told the House Transportation Subcommittee on Wednesday at a hearing about Gov. Haslam’s proposed gas tax increase. Laffer, who gained international prominence during the Reagan Era as the author of “the Laffer Curve” –which showed government revenues increase as high taxes are cut– testified before the subcommittee at the invitation of House Transportation Subcommittee Chair State Rep. Terri Lynn Weaver (R-Lancaster). He is probably most well-known for his role on the Economic Advisory Board under President Reagan. He has a B.A. in Economics from Yale University and his Ph.D. from Stanford University. The renowned economist “made a calculation” and came to Tennessee 10 years ago, leaving the heavily taxed state of California. He hasn’t looked back. “Economics is all about incentives. People like doing things they find attractive and dislike doing things they find unattractive. Taxes change the attractiveness of activities,” Laffer told the subcommittee: If you look at taxes, all taxes are bad, but some are worse than others. What you want to do is you want to collect your tax revenues in the least damaging fashion possible and you want to spend the proceeds in the most beneficial fashion…

Read the full storyFormer Lt. Gov. Ron Ramsey: ‘I Have Never Felt the Need to Have Anything in Writing’ From Legal Counsel on Consultant Role to Pro-Gas Tax Group

Former Lt. Governor Ron Ramsey tells The Tennessee Star that his legal counsel, James Weaver, a partner with the prestigious Nashville law firm Waller Lansden Dorch & Davis, who has advised him that his appearance at a WWTN Gas Tax Town Hall to advocate in favor of Gov. Haslam’s gas tax increase, a position held by his client, the Transportation Coalition of Tennessee, is “perfectly acceptable under all Tennessee laws” has done so verbally, but not in writing. “James and I have had lots of discussions about what I can and cannot do in this first year,” Ramsey tells The Star in an emailed statement. “James is an expert in this area. As my council, I have never felt the need to have anything in writing from him. I simply wanted his advice and council,” Ramsey adds in the statement. At former Lt. Gov. Ramsey’s invitation, The Star has reached out to Mr. Weaver and anticipates providing more details on the Tennessee statutes as they relate to guidelines for consulting and lobbying as they apply to former members of the Tennessee General Assembly during their first 12 months out of office. At issue is whether Ramsey, as a paid consultant…

Read the full storyGov. Haslam to Hold ‘Town Hall’ on Gas Tax Increase Monday in Winchester

Gov. Haslam will “hold a town hall meeting on proposed gas tax increase” on Monday, February 20, at 6:00 pm in Winchester, the Franklin County seat, the Winchester Herald Chronicle reports: Gov. Bill Haslam will be in Franklin County Monday to discuss his plan for a 7 cent tax increase per gallon on gasoline and 12 cents on diesel to go toward roadway improvements. The meeting will be held at 6 p.m. at the Franklin County Annex Building [located at 855 Dinah Shore Blvd. in Winchester, 90 miles southeast of Nashville]. The purpose of the event, which is open to the public, is to provide a forum on a plan focusing exclusively on increasing much-needed funding to repair and maintain safe highways and bridges throughout Tennessee. Haslam has also proposed that sales tax be reduced on food products. Curiously, the governor’s website makes no mention of the event, which the Herald Chronicle calls “a town hall” in its headline, but which sounds more like another stop in the governor’s promotional tour for his proposed 7 cents a gallon gas tax. Typically, a town hall on a particular public policy topic is an open discussion of all possible solutions on that…

Read the full storyFormer Lt. Gov. Ron Ramsey: Appearance on WWTN Gas Tax Town Hall ‘Perfectly Acceptable Under All Tennessee Laws’

“My appearance on the WWTN Gas Tax Town Hall program, and my statements and comments during the program, were perfectly acceptable under all Tennessee laws and in complete conformance with the rules and regulations of the Tennessee Ethics Commission,” former Lt. Gov. Ron Ramsey tells The Tennessee Star in an emailed statement on Tuesday. Last week The Star broke the news that Ramsey is a paid consultant to the Tennessee Coalition on Transportation, a group that supports Gov. Haslam’s proposed gas tax. Here’s the full statement from former Lt. Gov. Ramsey: I am more than completely confident that I have followed all the rules regarding a retired elected official in Tennessee. I have consulted with legal counsel, who advised me in great detail regarding the limitations in Tennessee’s ethics laws on my activities and my right to speak my mind as protected by the free speech protections in the Tennessee and U.S. Constitutions – the same rights enjoyed by every other person in this great state and wonderful nation. I have followed the laws and rules to the letter. I have said publicly many times that repairing our outdated transportation infrastructure funding formula was about the only important piece…

Read the full storyBradley County Commissioner Proposes Resolution of Disapproval for Gov. Haslam’s Gas Tax Increase

“Bradley County Commissioner Dan Rawls is proposing a resolution that would express the Commission’s disapproval of Gov. Bill Haslam’s proposed gas tax hike,” the Cleveland Banner reports: Rawls’ resolution says the increase would be “a further tax burden on Bradley County residents that can least afford the additional tax.” “I always think it’s a better idea to cut spending than to raise taxes,” Rawls said. “The state hasn’t done that great a job. Gov. Haslam has overseen the largest increase in the size of government of any Tennessee governor.” He said although the state is portraying “a big problem with roads,” the state “thought it was a good idea” to spend $123 million on a new state library. “I don’t see how that’s good fiscal policy,” Rawls said. Not all Bradley County Commissioners think passing a resolution opposing the gas tax increase is the right action for the County Commission to undertake. “Commissioner Milan Blake said he had been talking to state legislators who are telling him ‘to wait on something like this [passing a resolution opposing the gas tax increase] right now,’ ” the Banner reported. “Vice Chairman Jeff Yarber said he agreed with opposing the increase, but…

Read the full storyState Rep. Mark Pody: ‘I Don’t Believe the 7 Cents Gas Tax is Going to Go Anywhere’

State Rep. Mark Pody (R-Lebanon) told Ralph Bristol on 99.7 FM WWTN’s Nashville Morning News on Tuesday that Gov. Haslam’s proposal to increase the gas tax by 7 cents per gallon to fund road construction is dead-on-arrival in the State House of Representatives. “I don’t believe the 7 cents gas tax is going to go anywhere,” Pody told Bristol. “To be clear, you don’t think the governor’s full proposal, as is, will make it out of the House?” Bristol asked. “If it’s going to say gas tax on cars, I don’t think it’s going to go anywhere,” Pody responded. “Is that a survey or a hunch?” Bristol pressed the question further with Pody, who has his own alternative to the governor’s proposal. “If I have to run my proposal [through the Transportation Subcommittee], I have to know where the votes are,” Pody told Bristol. “I don’t think the votes are there for the governor’s proposal,” Pody said. “Right now I don’t think the governor’s plan would have the votes to get out of the House,” Pody said. Pody praised Gov. Haslam for bringing the issue of road tax funding up for consideration by the General Assembly. “I’m glad that the…

Read the full storySimilar To Haslam, Democrats Want to Increase Gas Tax 5 Cents Per Gallon But Also Want Sales Tax Revenue for Mass Transit

Two leading Democrats in the Tennessee General Assembly support the main element of Gov. Haslam’s plan to fund road construction by increasing the state tax on gasoline. For State Rep. John Ray Clemmons (D-Nashville) and State Sen. Sara Kyle (D-Memphis), however, it’s a matter of degree. While Gov. Haslam wants to increase the tax on gas by 7 cents per gallon, these Democrats want to increase it by 5 cents per gallon. As for the diesel tax, Democrats would increase it 9 cents per gallon, 3 fewer than the 12 cents per gallon increase Gov. Haslam has proposed. The Democrat gas tax proposal has a great deal in common with Gov. Haslam’s proposal, and very little in common with the Republican alternative to Haslam’s plan. That alternative, known as the Hawk Plan, would fund road construction by reallocation 0.25 percent of the sales tax, while not raising gas taxes. Like Gov. Haslam’s proposal, the Democrats want gas taxes to increase automatically every year. While Haslam simply proposes indexing the annual increase to the rate of inflation, Clemmons and Kyle want a more complex indexing formula, based on: (1) The state’s population growth rate, multiplied by seventy-five percent (75%); and…

Read the full storyNew Survey: Majority of Tennessee Small Business Owners Oppose Haslam’s Gas Tax Increase

Fifty-five percent of “Tennessee members of the National Federation of Independent Business [NFIB], the nation’s leading small-business association,” oppose Gov. Haslam’s gas tax increase proposal to fund road construction, the NFIB said in a statement released on Monday. “NFIB’s policy positions are based on the direct input of our members,” Jim Brown, state director of NFIB, said in the statement: When asked if they support or oppose a proposed seven-cent increase in the gas tax and 12-cent increase in the diesel tax, 55 percent of NFIB members responding to the survey oppose, 40 percent support, and 5 percent are undecided. Respondents were more definitive about the proposal to “index” future gas tax increases to changes in the Consumer Price Index, Brown said. Seventy-five percent of respondents oppose, while 19 percent support and 5 percent are undecided. “Small business owners . . . are clearly opposed to indexing because they believe it would bypass future legislatures and increase revenues automatically without making the case for specific infrastructure needs,” Brown said. Brown said a few parts of the proposal registered modest or mixed support. Sixty-two percent support the proposed $100 annual fee on electric vehicles and increasing charges on vehicles using alternative…

Read the full storyState Rep. Andy Holt Supports the Hawk Plan, Opposes Haslam Gas Tax Increase

State Rep. Andy Holt “told a group of local citizens Saturday that Gov. Bill Haslam’s proposed gasoline tax increase is unnecessary and ill-timed and that there are better ways to fund road improvements,” the Post-Intelligencer reports. “Holt argued against the Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy or IMPROVE Act, introduced last month by Haslam,” according to the Post-Intelligencer. “I’m going to get a higher fuel tax and higher increase in goods and services, and a very small decrease in my groceries,” Holt, a Dresden resident, told the crowd, adding: If you extrapolate all the projects that have been approved by the legislature, and you factor in a highly increased amount of construction costs, and you put that out over a thirty-year period, and you then extrapolate what all those cost increases will be over time, then you can get to eleven billion dollars,” he said. We’re rated consistently as having the second-, third- or fourth-best road system in the United States of America . . . I think that’s a far cry from a crippling catastrophe that is looming within the next couple of weeks.” We’re in a surplus environment this year. That doesn’t mean we…

Read the full storyGov. Haslam Defends His Gas Tax Proposal on Nashville’s Morning News With Ralph Bristol

Gov. Haslam appeared on 99.7 FM WWTN’s Nashville Morning News with Ralph Bristol on Thursday to defend his controversial proposal to increase the gas tax by 7 cents per gallon (from 21 cents to 28 cents) to fund more road construction. His proposal also increases the diesel tax by 12 cents per gallon (from 18 cents to 30 cents). Haslam specifically took aim at the increasingly popular alternative to his proposal, the Hawk Plan, which would fund road construction by reallocating 0.25 percent of the 7 percent state sales tax from the general fund to road construction. “Your main opposition to the alternative to your plan, the Hawk Plan . . . is that that would shift the burden for paying for our roads and bridges from out-of-state users of the roads to Tennesseans unrelated to their road usage. Do you have any way to quantify that balance now and how much shift this would produce?” Bristol asked. “We’re in the process of doing that. I think it’s safe to say that the increase I’m proposing for fuel that half of that would come from either out of state automobile drivers or trucking companies,” Haslam told Bristol. “That’s actually not…

Read the full storyAs Gas Tax Sinks and Casada Bolts, Haslam Schedules Emergency Call to WWTN’s Ralph Bristol for Thursday Morning

Stung by Majority Leader Glen Casada’s (R-Franklin) embrace of the Hawk Plan to fund road construction through the reallocation of 0.25 percent of the current 7 percent state sales tax rather than his own gas tax increase proposal, Gov. Haslam scheduled an emergency call in to 99.7 FM WWTN’s Nashville Morning News with Ralph Bristol radio program for Thursday morning. Casada went public in a big way earlier this week. On Tuesday, he outlined his support for the Hawk Plan in an interview that was published, along with an accompanying YouTube video, early Wednesday morning at The Tennessee Star. Then later on Wednesday morning, Casada appeared on 99.7 FM WWTN’s Nashville Morning News with host Ralph Bristol. “The governor has a good idea, but I think Rep. Hawk has a great idea,” Casada told Bristol. It was polite and respectful language, but the political impact of the message signaled a revolt by conservatives against Gov. Haslam’s gas tax increase proposal, very similar to the grassroots revolt back in 1999 when Gov. Sundquist’s proposal to impose a state income tax was crushed in a populist uprising. Playing Devil’s Advocate, a role at which he excels, Bristol challenged Casada to take Gov.…

Read the full storyState Senator Mark Green Tells WWTN’s Dan Mandis ‘I’m Opposed to the Gas Tax Increase’

“I’m opposed to the gas tax increase,” State Senator Mark Green (R-Clarksville) told WWTN 99.7 FM talk show host Dan Mandis on Wednesday in an exclusive interview. “Looking towards the future, you’ve formally filed paperwork to run for governor. You went on a 34-stop listening tour across Tennessee. Tell me what you found out,” Mandis asked Green. “There’s just a stack of ideas that people have on how to make Tennessee better. It’s just awesome,” Green said. “One of the things they said they don’t want is a gas tax or a diesel tax increase. Tennesseans were pretty strong about that everywhere I went,” he added. “Now I’ve seen the polls, but I know what my anecdotal evidence is. Everywhere I went people were like ‘How dare you raise taxes in the face of a $1.8 billion surplus! You’ve overtaxed us $1.8 billion and you want more!’ And I’ve got to tend to agree with them,” the former Army doctor said. “It doesn’t make any sense that we would tax more in the face of such a large surplus,” he added. “So, I’m opposed to the gas tax increase,” the future candidate for governor declared: There were certain aspects of…

Read the full storyPoll: Republicans in Tennessee Overwhelmingly Oppose Raising Gas Tax by a 2 to 1 Margin

A new poll released on Tuesday shows that registered Republican voters in Tennessee oppose raising the gas tax by a 53 percent to 28 percent, almost a 2 to 1 margin. Gov. Haslam has proposed increasing the gas tax by 7 cents per gallon and the diesel tax by 18 cents per gallon in order to fund additional road expenditures. The poll was conducted of 600 registered Republican voters over two days, January 31 to February 1, in the immediate aftermath of Haslam’s January 30 State of the State address in which he released details of his proposed gas tax, which are included in a bill called the IMPROVE Act. Tennesseans for Conservative Action , which sponsored the poll, said in its press release announcing the results it “conducted the survey to gauge support for policies conservatives are talking about during this year’s legislative session.” TCA outlined several “key takeaways” in its release: 54% of Republicans believe we should spend the $1 billion surplus on road improvements before raising the gas tax. Of those who support the gas tax, 99% approve of Governor Haslam’s job performance. 15% of Tennessee Republicans flatly reject a 7-cent gas tax “no matter what” and…

Read the full storySubcommittee Showdown: Haslam Gas Tax Increase Versus ‘Hawk Plan’ Sales Tax Reallocation

Chris Bungard at WKRN reports that a House Transportation Subcommittee showdown looms next week between “Governor Bill Haslam’s sweeping plan that would raise the state’s gas tax by seven cents a gallon, while cutting other taxes, like those on groceries . . . [and] . . . a competing bill announced last week by House assistant majority leader David Hawk that would take a quarter of one percent of the state general sales tax and solely dedicate it to the state transportation fund.” State Rep. Barry Doss (R-Leoma), who supports Gov. Haslam’s gas tax proposal, but opposes the indexing element of it, chairs the House Transportation Committee. Hawk’s proposal, referred to by its proponents as “The Hawk Plan,” has the support of House Majority Leader Glen Casada (R-Franklin), as The Tennessee Star confirmed in an exclusive interview on Tuesday. State Rep. Terri Lynn Weaver (R-Lancaster), a strong conservative who has the respect and support of a number of grassroots groups, chairs the House Subcommittee on Transportation. Chairman Doss also serves on the subcommittee, as does State Rep. Dave Alexander (R-Winchester), State Rep. Courtney Rogers (R-Goodlettsville), State Rep. Jerry Sexton (R-Bean Station), State Rep. Sam Whitson (R-Franklin), State Rep. Barbara Cooper…

Read the full storyHouse Transportation Chair Favors Gas Tax Increase; Opposes Haslam’s Proposal to Index for Annual Inflation

State Rep. Barry Doss (R-Leoma), chairman of the House Transportation Committee, told his fellow panelists and studio audience at the WWTN Gas Tax Town Hall on Thursday that he favors Gov. Haslam’s 7 cents per gallon gas tax increase, but opposes the part of governor’s proposal that would index the tax for future annual increases tied to the consumer price index. “There are those of us up here who disagree with indexing. That’s putting a perpetual tax increase on the people,” Doss said. “If we get rid of indexing and we lower taxes above and beyond what the Governor has proposed, guys, we hope to be able to leave this session in the end of April this year saying we did not raise taxes.” Andy Ogles, executive director of Americans for Prosperity-Tennessee, which opposes both the proposed 7 cents per gallon gas tax increase and the Governor’s proposed indexing, explained the simple math of what he called a very bad idea. If the General Assembly had approved indexing in 1989, when the gas tax was increased to 20 cents per gallon, it would today be a whopping 41 cents per gallon, Ogles said. ( A 1.4 cent per gallon special…

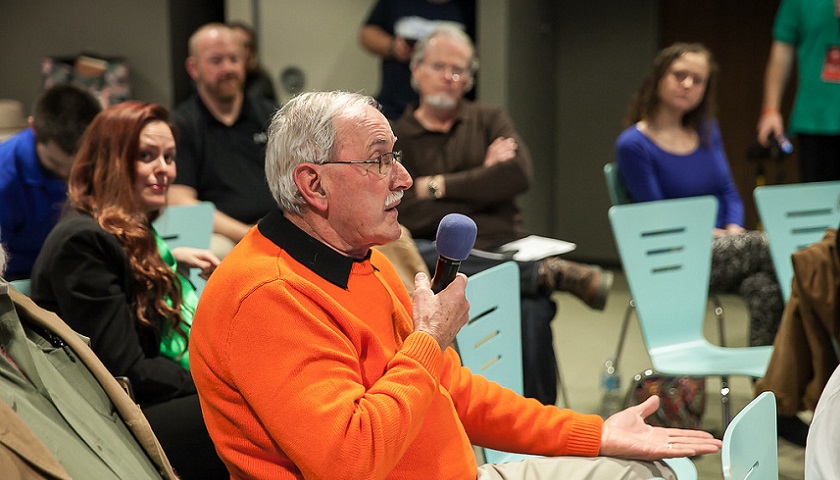

Read the full storyWWTN Town Hall Audience Virtually Unanimous in Opposition to Gas Tax Increase

The studio audience at WWTN’s Gas Tax Town Hall on Thursday was virtually unanimous in its opposition to Gov. Haslam’s proposed increase in the state tax on gasoline from the current level of 21 cents per gallon to the proposed level of 28 cents per gallon. About twenty people filled the seats in the small WWTN performance room to listen to moderator Ralph Bristol, show host Dan Mandis, and eight panelists from the General Assembly, Gov. Haslam’s office, and two public interest groups discuss the merits of the proposed gas tax increase. In the first hour of the program, several audience members opposed to the proposed gas tax increase asked questions of the panel. During a break, moderator Ralph Bristol asked if anyone in the audience favored the proposed gas tax increase and wanted to ask a question. No one raised their hand. Bristol then asked if anyone in the audience was undecided. Jessica Colon, recently retired from the Army, now working as a nurse in Middle Tennessee and living in Robertson County, raised her hand. In the second hour, Bristol called on Colon, who asked a question of the panel. After the program ended, The Tennessee Star asked Colon…

Read the full storyDetails of Gov. Haslam’s Gas Tax Proposal From His State of the State Address

Gov. Haslam dedicated about one-third of his State of the State address, delivered to the General Assembly on January 30, to his gas tax proposal. Haslam refers to his proposal using the acronym in the bill that includes the details: the IMPROVE Act (Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy). You can read the complete text of the address here: Here’s the full excerpt of the address related to gas tax proposal, with emphasis added by The Tennessee Star: With the IMPROVE Act we’re proposing to increase the gas tax 7 cents and the diesel tax 12 cents per gallon, and all new revenue goes only to address our transportation needs. The legislation will mean 962 projects in all 95 counties, both urban and rural. It will also mean 78 million dollars annually in increased revenue for counties and 39 million dollars annually in increased revenue for our cities. Scores of mayors across Tennessee – cities and counties, rural and urban – have told me that, if we don’t do something to address the fuel tax, they will have no alternative but to raise the property tax in their municipalities. I know some of you think we…

Read the full storyFormer Lt. Gov. Ramsey A Paid Consultant to Pro-Gas Tax Coalition

Former Lt. Gov. Ron Ramsey told The Tennessee Star on Thursday he is a paid consultant to the Tennessee Coalition on Transportation, an advocacy group that supports Gov. Haslam’s 7 cents per gallon gas tax increase and a 12 cents per gallon diesel tax increase. Ramsey’s revelation came during a break in the two hour broadcast of the WWTN Gas Tax Town Hall, moderated by Nashville Morning News host Ralph Bristol on the Dan Mandis Show. The event featured a studio audience, which was virtually unanimous in its opposition to the gas tax. Ramsey advocated strenuously on behalf of the gas tax increase. He was one of eight panelists at the event. Other members of the panel included Andy Ogles, executive director of the Tennessee chapter of Americans for Prosperity, which opposes the gas tax, David Smith appearing on behalf of Gov. Bill Haslam, State Sen. Jim Tracy (R-Shelbyville), State Sen. Paul Bailey (R-Sparta), State Rep. Barry Doss (R-Lawrence County), Rep. Brian Terry (R-Murfreesboro), and Rep. David Alexander (R-Winchester). “I did leave the legislature back, I made my announcement in March, and left in November, of course, at the election,” Ramsey said in his opening remarks as a member of the…

Read the full storyAmericans For Prosperity Opposes Gas Tax, Proposes Alternative

Andy Ogles, executive director of Americans for Prosperity-Tennessee (AFP), unveiled the group’s alternative plan to finance Tennessee’s highway infrastructure improvements on Thursday, vigorously rejecting Gov. Haslam’s proposed 7 cents per gallon gas tax increase. Speaking at the WWTN Gas Tax Town Hall, Ogles accepted the premise that Tennessee’s budget over the coming years should allocate $2 billion for highway improvement and new construction. But Ogles said relying upon the increase in the gas and diesel tax as the only “user fee” mechanism to fund those improvements was not a stable long-term solution, since improvements in gas mileage and the possible rise of alternative means of powering vehicles would likely continue to limit the revenues from those sources to the state. Ogles said that if you except the idea of user fees then one such user fee could be vehicle fees at the time of a vehicle purchase or registration. “I think there’s some math that is important to remember,” Ogles told the panel and studio audience. “And the biggest number or numbers that you should remember is that currently, Tennessee has $1.8 billion in surplus. Now, there’s a lot of moving parts to this and talking about math on the…

Read the full story