After two consecutive losses on the Insure Tennessee front, Governor Haslam designed a better plan for his gas tax increase, packaging it as his IMPROVE (Improving Manufacturing Public Roads and Opportunities for a Vibrant Economy) Act. But, the good planning goes well beyond a name and includes a little help from his friends. COMPTROLLER’S OFFICES OF RESEARCH AND EDUCATION ACCOUNTABILITY REPORT The 76-page report, “Tennessee Transportation Funding: Challenges and Options,” was issued in January 2015. As the title implies, the report reviews the current situation and various ways to address transportation funding needs. One thing it doesn’t do is make any recommendations on how to proceed. With even cursory reading, it will be obvious that not all revenue that should go to roads actually does. nMOTION The Nashville Metropolitan Transit Authority (MTA) and the Regional Transportation Authority of Middle Tennessee (RTA) set out to develop the nMotion report of a transit implementation plan. The report development process started with “public engagement” from April 2015 through October 2016. Since the pre-determined goal was to develop a comprehensive ten-county mass transit plan, the presentations made by MTA/RTA and TDoT and the surveys obtained from the public were designed to create that end…

Read the full storySearch Results for: gas tax

Ralph Bristol’s Exclusive Interview With Gov. Haslam About His Gas Tax Proposal

One day after he announced his proposal to increase the tax on gas by 7 cents, from 21 cents per gallon to 28 cents per gallon, Gov. Bill Haslam gave an exclusive in-studio interview to Ralph Bristol, host of Nashville’s Morning News on 99.7 FM, WWTN, on January 18. Haslam made the case for his gas tax proposal, which he elaborated on in his “State of the State address” at the Capitol on January 30, which the General Assembly is now considering. “Can you legitimately bring that [Hall Income Tax cut] forward to balance now against the gas and other tax increases to make it an even balance?” Bristol asked to begin the interview. “Sure. Let’s start here,” Haslam answered. “Our administration and the legislature has already cut $270 million in taxes. The most any administration or legislature had ever done before was $60 million. We’re proposing another $270 million cut in this budget,” the governor continued, adding: Your point is we already cut the Hall Tax last year. But we didn’t. We passed a bill to do that. It still has to come out of the budget. It’s like you and your spouse saying were going to make a…

Read the full storyCommentary: Gas Tax Increase Creates Problems for School Budgets

Public education must remain a high priority in Tennessee. That should be reflected in Governor Haslam’s State of the State. We have made a strong commitment in the terms of taxpayer dollars. We have simply played catch-up the last few years, especially in regards to funding our public schools. The Tennessee Constitution set forth the purpose of public education: “The state of Tennessee recognizes the inherent value of education and encourages its support. The General Assembly shall provide for the maintenance, support, and eligibility standards of a system of free public schools.” It is worth the reminder to reflect on that purpose as we enter legislative session at the Tennessee General Assembly. Living and working in Nashville, and operating a motor vehicle, it is clear that “Music City” is also “pothole city.” We have no problem with increasing the budget to spend more on improving our roads, from which we all derive the benefit. Under Governor Haslam’s proposal, we would pay an additional 7 cents per gallon on gasoline and 12 cents per gallon on diesel in Tennessee. In addition, the plan would reduce the state’s grocery sales tax rate to 4.5 percent, down a half-percentage point. Our concern is the…

Read the full storyHow Will Gov. Haslam’s Gas Tax Proposal Impact His Family’s Pilot Flying J Company?

Gov. Haslam’s proposal to increase the gas tax by 7 cents per gallon and the diesel tax by 12 cents per gallon will have an impact on the family-owned Pilot Flying J company, which “operates over 650 travel centers in 43 states and Canada,” 31 of which are located in Tennessee, and is the 14th largest privately held company in the United States with $22 billion in annual revenues according to Forbes. “Located along interstates, the travel centers cater to both professional drivers and motorists selling gas, diesel, convenience store goods and fast food. Headquartered in Knoxville, Tennessee, the company was formed in 2010 when Pilot Travel Centers merged with Flying J to create a new company.In October 2015, the Haslam family announced that it had bought out the minority stake of private-equity firm CVC partners,” Forbes reports. Exactly what that impact will be has been the subject of scrutiny and debate. On the one hand, higher fuel prices are likely to have a dampening effect on the demand for gas and diesel fuel at Pilot’s retail facilities in Tennessee. That impact is not likely to be that great, since, as a percentage of the total retail price of these fuels, the tax…

Read the full storyTennessee Has Paid for Highways With a Gas Tax Since 1924

Tennessee has paid for highway construction and maintenance with a gas tax since 1924, when a 2 cent per gallon tax Gov. Austin Peay proposed and the General Assembly passed the previous year went into effect. At the time, Tennessee’s roads were so poor the Volunteer State was often referred to as a “detour state,” according to the Tennessee Department of Transportation website: Tennessee’s funding resource for transportation is called “dedicated funding,” because the funding resource is directly related to the service or product provided. That philosophy began in 1923 when Governor Austin Peay recommended to the state legislature the burden of highway improvements be transferred from property owners to motorists to fund faster work on state highways. During the 1920’s, Tennessee had become known in the southeast as a “detour state” because it hadn’t kept up with road improvements like sister states. The first gas tax of two cents was passed and enacted in 1924 specifically for highway purposes. Peay, who was the only Tennessee governor to die in office, put the revenue generated by the gas tax to good use, as the Tennessee Encyclopedia of History and Culture notes: By the time of his death in 1927, Tennessee’s…

Read the full storyGrassroots Pundit: What Does Governor Haslam’s Revenue Neutral Gas Tax Increase Mean to Tennessee Families?

Governor Haslam introduced his “revenue neutral” IMPROVE Act (Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy) late last month. The proposed bill focuses primarily on increasing the fuel (gas and diesel) tax to fund transportation initiatives and offsetting the increases with other tax cuts. Under the governor’s proposal, the state tax on gasoline will increase from 21 cents per gallon to 28 cents per gallon. The state tax on diesel fuel will increase from 18 cents to 30 cents per gallon. Ominously, the tax will be indexed to increase each year based on inflation. The plan proposes tax cuts of $270 million annually, while increasing revenues through taxes and fees by $278 million this year. The taxing procedure that allows government to receive the same amount of money despite changes in tax law is the definition of “revenue neutral.” This was a strategic move by the Governor to combat the obvious and predictable opposition to any tax increase given the state’s budget surplus in excess of $1 billion. But how neutral is the IMPROVE Act for Tennesseans? At least one group is trying to explain what the gas tax increase would cost the average driver. The Transportation Coalition…

Read the full storyGrassroots Pundit: Sumner County’s Role in the Governor’s Gas Tax Increase Story

The story of the Governor’s proposed gas tax increase introduced on Wednesday was being written for nearly two years in Sumner County. The most recent chapter was added with the attendance of County Executive Holt and Jimmy Johnston of Forward Sumner, the county’s hired provider of economic and community development services, at the Governor’s press conference Wednesday. In preparation for the budget year that runs July 1 to June 30, the Sumner County Budget Committee holds several workshop-like sessions in April and May to review all of the required and requested budget line items. This was the case in 2015, the first budget to be set after the 24% property tax increase. As an outcome of a Highway Commission meeting, an additional $100,000 was proposed for the Highway Department. The proposal came out of the Highway Commission to address the poorly received stoppage of brush pick up, especially in light of the considerable property tax increase. Initially, the $100,000 was added to the proposed 2015-16 budget. But, then at the Budget Committee meeting of June 8, 2015, after County Executive Holt made the argument that funding to the Highway Department would have to be maintained in the future, it was…

Read the full storyGassy Cows and Pigs Face a Carbon Tax in Denmark, a World First

The Associated Press Denmark will tax livestock farmers for the greenhouse gases emitted by their cows, sheep and pigs from 2030, the first country to do so as it targets a major source of methane emissions, one of the most potent gases contributing to global warming. The aim is to reduce Danish greenhouse gas emissions by 70% from 1990 levels by 2030, said Taxation Minister Jeppe Bruus. As of 2030, Danish livestock farmers will be taxed 300 kroner ($43) per ton of carbon dioxide equivalent in 2030. The tax will increase to 750 kroner ($108) by 2035. However, because of an income tax deduction of 60%, the actual cost per ton will start at 120 kroner ($17.3) and increase to 300 kroner by 2035. READ THE FULL STORY

Read the full storyCommentary: Hidden Fuel Taxes Are Increasing Your Gas Bill

A Chevron gas station in Los Angeles was spotted charging over $8.00/gal for gasoline on Tuesday, a stark reminder of just how much fuel prices have risen across the country. Customers were unsurprisingly frustrated by the price, but felt there was little they could do to avoid it.

Read the full storyMichigan Senators Take Steps Toward Gas-Tax Vacation

As residents of the Great Lakes State and out-of-state tourists prepare to inaugurate the 2022 outdoor vacation season, they’re being stymied by gasoline prices rising steadily toward the $5 per gallon range.

The Michigan Senate has passed a slate of bills designed to alleviate drivers’ pain at the pump. If signed into law by Gov. Gretchen Whitmer, the bills would save Michigan drivers between 40 cents to 50 cents a gallon by temporarily eliminating the state’s 6% sales tax and 27-cent-per-gallon excise tax.

Read the full storyConnecticut Gas Prices Rising Despite Tax Pause

Both Democrats and Republicans in Hartford worked for and celebrated the Connecticut gasoline-tax suspension that Gov. Ned Lamont (D) signed in late March, but new data indicate its effect could be lessening.

The center-right Yankee Institute (YI) published an analysis on Saturday showing that the difference between gasoline costs in Connecticut and those in Massachusetts, which did not enact a similar gas-tax holiday, are narrowing.

Read the full storyWith Gas Prices at Historic Highs, Biden Calls for Raising Taxes on Oil Drillers

President Joe Biden’s budget proposes to scrap more than $45 billion in fossil fuel subsidies, his administration’s latest attack on the beleaguered industry.

The White House budget will remove more than a dozen fossil fuel industry tax credits, increasing the federal government’s revenue by an estimated $45.2 billion between 2023-2032, according to the proposal published Monday. The administration explained that the proposal was written to prevent further fossil fuel investment.

Read the full storyMichigan Lawmaker: Slashing Gas Sales Tax ‘a Requirement, Not an Option’

Suspension of Michigan’s 6% sales tax on gasoline through March 1, 2023 has been proposed by Senate Minority Leader Jim Ananich.

The bill is in response to record gas prices caused by inflation and international conflict that brought trade restrictions. Gas prices, less than $3 a gallon just over a year ago, have soared past $4 per gallon.

Read the full storyGov. Lamont Signs Connecticut Gas-Tax Holiday Legislation

Gov. Ned Lamont (D) this week signed legislation suspending Connecticut’s 25-cent-per gallon gasoline tax.

The gas-tax holiday passed both houses of the state legislature unanimously and will last through the end of June. Also to ease Nutmeggers’ economic woes in light of skyrocketing inflation, the state is also providing free bus service to residents throughout April.

Read the full storyGovernor Youngkin Says New Report Shows That Regional Greenhouse Gas Initiative Is Carbon Tax Passed on to Consumers

Governor Glenn Youngkin is trying to withdraw Virginia from participation in the Regional Greenhouse Gas Initiative (RGGI,) and the Virginia Department of Environmental Quality (DEQ) published a Youngkin-ordered report on the program, which requires utilities to bid on carbon dioxide allowances.

“Costs are soaring for Virginia families and as governor, I pledged to address over taxation and Virginia’s high cost of living. That’s why I signed Executive Order Nine to direct DEQ to examine the impact of RGGI and start the process of ending Virginia’s participation. This report reveals that RGGI is in reality a carbon tax passed on to families, individuals and businesses throughout the Commonwealth – it’s a bad deal for Virginians,” Youngkin said in a press release Tuesday.

Read the full storyCritics of Biden’s Proposed Oil-and-Gas Industry Taxes Fueled by Gas Shortages

Gas shortages on the East Coast have helped rally Congressional opposition to the portions of President Joe Biden’s infrastructure plan that would force oil and gas companies to pay more in taxes.

House Republicans sent a letter to House Speaker Nancy Pelosi, D-Calif., and House Majority Leader Steny Hoyer, D-Md., calling on Democrats to oppose Biden’s plan to “eliminate tax preferences for fossil fuels.”

The letter, signed by 55 Republicans, came after a cyber attack of Colonial Pipeline shut down a major pipeline on the East Coast and led to fear-driven gasoline shortages. The attack also raised questions about the nation’s energy infrastructure and vulnerability to attack.

Read the full storyWalz’s Revised Budget Proposal Still Includes 20-Cent Gas-Tax Increase

Gov. Tim Walz (D-MN) was forced to reexamine his budget proposal “line by line” after the state’s budget forecast came up $492 million short of November’s estimated $1.5 billion surplus. But his recently released revised budget recommendations still include a 20-cent gas-tax hike. “The governor recommends the state commit to a major transportation investment plan to fund the estimated $6 billion gap that exists between funding needs and available revenues over the next 10 years. The governor proposes filling the $6 billion gap in road and bridge funding by initiating a 20 cent gas tax increase, including fuel in distributor storage at the start time of each increase,” the budget recommendations state. Walz is also calling for increasing the registration tax from 1.25 percent to 1.5 percent and increasing the motor vehicle sales tax from 6.5 percent to 6.875 percent. “This is not a choice between whether we want the gas tax or not. It’s a choice between living in a state with the best transportation system in the country or one with crumbling roads and bridges,” Walz said in February when unveiling his initial budget proposal. Overall, Walz’s budget proposal would raise spending by more than $3 billion, increasing…

Read the full storyTennessee Star Poll: As Gas Prices Rise So Does Opposition to Tennessee Fuel Tax Increase

Gasoline prices across Tennessee continue to nudge towards $3 a gallon. As those prices rise Tennessee voter opposition to the fuel tax increase included in the IMPROVE Act is increasing as well. Despite the state having two billion dollars in surplus and recurring revenues, Governor Bill Haslam and Republican legislative leadership jammed through a $330 million a year fuel tax increase last year, which is phased in over three years. The latest phased increase went into effect on July 1. A new Tennessee Star statewide poll of 1,040 likely Republican Primary voters conducted by Triton Polling from June 25-28, 2018 indicates that voters are not supportive of the fuel tax increase. The poll asked: “Last year, the Tennessee General Assembly passed a bill, signed into law by Gov. Haslam, to increase the gas tax by 6 cents per gallon and the diesel tax by 10 cents per gallon, to fund road construction. Do you support this gas tax increase?” 35.4 percent of likely GOP primary voters support the tax increase while 51.3 percent oppose the increase. 13.3 percent were not sure of had no opinion. A year ago, the Tennessee Star Poll conducted at that time indicated that 48.1 percent of…

Read the full storyGas Can Man Braves Rain to Reprimand Tax-Raising State Rep. Rick Tillis

NASHVILLE, Tennessee–There was a rare Gas Can Man sighting in downtown Nashville Tuesday afternoon. Gas Can Man stood out on the public sidewalks, sometimes in the rain, to scold State Rep. Rick Tillis (R-Lewisburg) for voting to raise the state’s gas tax last year. Gas Can Man held a sign mocking the legislator as “Gas Tax Tillis.” Tillis, as previously reported, promised not to vote to raise the gas tax during the 2017 legislative session, yet he did it anyway. The time and the place for Gas Can Man’s public protest — outside Nashville’s downtown Sheraton Hotel — was no random choice. While Gas Can Man stood outside and braved the elements, Tillis enjoyed his time inside, at the ritzy hotel bar, surrounded by lobbyists, who were reportedly there to hold a fundraiser for him. Tillis had time to feast on appetizers and make small talk with lobbyists. He had zero time, according to one of those lobbyists, to talk to The Tennessee Star about the gas tax or his thoughts about Gas Can Man. The lobbyist told us this was a private event and that Tillis was off limits — even though other hotel patrons seemed able to come…

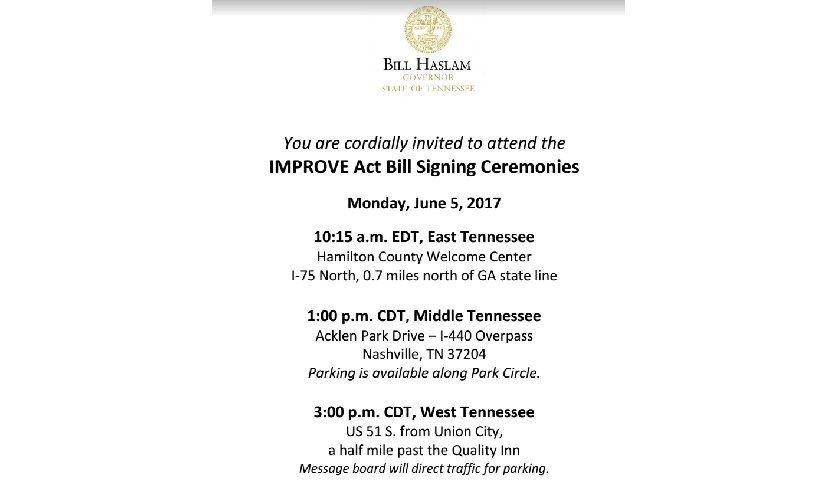

Read the full storyGov. Haslam Holds Ceremonial Signings Today for Gas-Tax Increasing IMPROVE Act In Each of Tennessee’s Three Grand Divisions

Governor Haslam will hold ceremonial signings of the controversial and gas-tax increasing IMPROVE Act Monday in each of Tennessee’s three grand divisions, as reported last week by The Tennessee Star. According to the invitation on Governor Bill Haslam’s letterhead, the IMPROVE Act signing ceremonies will be held as follows: 10:15 a.m. EDT, East Tennessee Hamilton County Welcome Center I-75 North, 0.7 miles north of GA state line 1:00 p.m. CDT, Middle Tennessee Acklen Park Drive – I-44 Overpass Nashville, TN 37204 3:00 p.m. CDT, West Tennessee US 51 S. from Union City A half mile past the Quality Inn The signings are spaced so closely together in time, Gov. Haslam is almost certainly flying from site to site at taxpayers’s expense to celebrate this tax increase. The IMPROVE Act, initially named for “Improving Manufacturing, Public Roads and Opportunities for a Vibrant Economy,” was renamed to the Tax Cut Act of 2017, by its House sponsor of HB 534 Rep. Barry “Boss” Doss (R-Leoma), will raise the gas tax by 6 cents per gallon and the diesel tax by 10 cents per gallon phased in over three years. Effective July 1, the gas tax will increase from 20 cents to 24…

Read the full storyGas Can Man Leads Opposition to Haslam Tax Increase

Gas Can Man cheered gas tax opponents at Wednesday’s legislative hearing. Making his grand entrance before the hearing, Gas Can Man strode in the room carrying a sign reading, “Haslam’s a Pain In My Gas.” Clearly the rock star of the event, he was photographed and videorecorded by admiring fans. Some even wore t-shirts bearing his likeness. He was surrounded by shouts of “Tank the Tax!” The packed hearing room was filled mostly with people there on behalf of the conservative group Americans For Prosperity, which opposes the tax. Having arrived early, they were able to grab a seat. People who couldn’t find a seat were sent to an overflow area outside the room where they could watch the proceedings on a TV screen. Among those who came from across the state was Chelsea Houk, who lives in Knoxville with her husband Zachary. The 26-year-old grew up in a family in which politics was rarely discussed to keep the peace. But now she finds that approach a misguided quest that doesn’t do anything to keep change at bay. “It provides a false sense of security,” she said. A farmhand who works with show horses, Houk these days finds…

Read the full storySen. Bob Casey Confirms Democrats May Kill Trump Tax Cuts, Prompts Dave McCormick to Vow No Hike for ‘Middle Income Pennsylvanians’

U.S. Senator Bob Casey (D-PA) confirmed last Thursday that Democrats are still making decisions about tax cuts, including whether they will reverse the 2017 tax cuts championed by former President Donald Trump and other Republicans, including U.S. Senate nominee Dave McCormick.

Casey made the remarks to Roll Call after the publication noted that allowing the reduced tax rates established in the Tax Cuts and Jobs Act of 2017 to expire would violate President Joe Biden’s pledge not to increase taxes on those earning less than $400,000 per year.

Read the full storyDozens of Energy Orgs Ask Congress to Kill Bill They Say Would ‘Inevitably’ Lead to Carbon Taxes

Dozens of energy policy and advocacy groups signed a Monday letter to Congress to express their opposition to a bill they say could be the first step toward carbon taxes or tariffs.

The letter urges House lawmakers to vote against the PROVE IT Act, a bill that has not yet been introduced in the lower chamber but is expected to be soon. The PROVE IT Act — which has already been introduced in the Senate — would have the Department of Energy (DOE) study the carbon intensity of goods, including aluminum, steel, plastic and crude oil, produced in the U.S. and the carbon intensity of products from other countries, according to E&E News.

Read the full storyPennsylvania House Passes Bill Offering Tax Credits to Businesses Covering Employee Child Care

The Pennsylvania House of Representatives approved legislation that would provide tax credits to businesses that cover childcare costs for employees, with employers able to offset up to 30 percent of the costs.

HB 1958, also known as Incentivizing Employer Contributions to Employee Childcare, passed the Pennsylvania House last Wednesday with 155 votes in favor and 47 against.

Read the full storyRelease from Gasoline Reserve Raises Doubts Biden will Replenish the Strategic Petroleum Reserve

The Biden Administration announced Tuesday that it would release 42 million gallons of gasoline from the Northeast Gasoline Supply Reserve. The release, the Department of Energy explained, is “strategically timed and structured to maximize its impact on gas prices.” This will, according to the DOE, help lower prices at the pump during the summer months when prices tend to go up along with demand.

The Northeast Gasoline Supply Reserve was created in 2012 following Superstorm Sandy, which damaged two refineries and shut down 40 terminals in New York Harbor. Some New York gas stations went as long as 30 days without a supply of gasoline as a result of the supply disruption. The Obama administration established the gas reserve to prevent such a shock from happening again.

Read the full storyCalifornia Considers Rules That Could Push Gas Prices up an Additional $1.11/Gallon by 2026

California gas prices could rise by at least $1.11 per gallon by 2026 if the California Air Resources Board adopts amendments to its low carbon fuel standard program, CARB says. The LCFS amendments proposed at the end of 2023 would phase-out credits for turning manure into renewable natural gas, ending that business, and add jet fuel to LCFS purview, increasing flying costs for every flight that starts or ends in California even if the fuel was purchased elsewhere. Because so much of America’s imports come in through California, the LCFS amendments would raise the costs of goods for every American.

LCFS uses a system of credits and deficits to reward or punish producers that make fuel better or worse than the rising “clean” standard.” Current LCFS guidelines call for a 20% reduction in carbon intensity by 2030 compared to 2010, while the proposed amendments call for a 90% reduction by 2045, including significant step-downs starting in 2025 that would result in major fuel cost increases starting that year.

Read the full storyThe 2024 Sunset of the Trump Tax Cuts Becoming Election Year Issue as Inflation, Cost of Living Climbs

The sweeping Trump-era tax cuts in the Tax Cuts and Jobs Act of 2017 are set to expire next year, setting up the tax debate as a potentially key political issue this election year.

While illegal immigration and inflation top Americans’ list of concerns, both parties are increasingly talking about the Trump-era tax cuts, which President Joe Biden has said he will allow to expire next year.

Read the full storyElevated Gas Prices Poised to Rise More This Summer

Gas prices have been elevated in recent months heading into summer, when prices are expected to rise even more.

According to AAA, the average national price for a gallon of regular unleaded gasoline is $3.65 per gallon, up from $3.59 a month ago. The prices have fluctuated in recent days and are lower than the all-time high of $5.02 in the summer of 2022. However, prices overall have risen significantly this year and are on pace to rise more in the summer months.

Read the full storyMedia Trumpet Study Finding Gas Stoves Impact Health While Ignoring Studies with Different Results

Stanford researchers recently claimed to have found a link between childhood respiratory illnesses and the use of gas stoves.

The study, which was reported last week across multiple national news outlets, posed an interesting contrast to a study in February funded by the World Health Organization and published in The Lancet that found no such link and appeared to received no mention in any such outlet.

Read the full storyKnox County Mayor Glenn Jacobs Most Proud of Not Raising Taxes During His Tenure, Says ‘We Have to Make Sure Our People Are Being Taken Care Of’

Knox County Mayor Glenn Jacobs said the accomplishment he’s most proud of since assuming office in 2018 is his and his team’s work to avoid raising taxes for county residents.

Jacobs said that while it is becoming “more difficult” to construct a budget amid economic challenges resulting from decisions made at the federal level, his administration is “doing everything that we can to be creative and think outside the box” to avoid raising taxes.

Read the full storyAirlines Launch Effort Backing Green Jet Fuel Tax Credit that Could Raise Food Prices for Americans

A coalition of major airlines has formed a group supporting a tax credit pushed by President Joe Biden that experts say could jack up food prices.

More than 40 companies, including Boeing, American Airlines, JetBlue and United as well as ethanol trade groups, are pushing the federal government to “expand” existing tax credits for “sustainable aviation fuel” (SAF) and to pass legislation to increase the fuel’s availability, Axios reported. Corn-based ethanol is a common component in SAF and experts previously told the Daily Caller News Foundation that increasing the demand for corn by incentivizing its use in jet fuel could indirectly raise food costs for Americans.

Read the full storyGeorgia Tax Collections Decrease 4 Percent amid Calls for Income Tax Cut Acceleration

Tax collections in Georgia decreased by about 4 percent in February. The change was driven by sharp decreases in the state’s income tax revenues following Republican-led tax cuts, though Georgia simultaneously saw increased revenue from sales taxes and taxes on corporations.

A press release from the office of Governor Brian Kemp notes the state’s tax revenues fell 4.3 percent in February while the year’s tax collections are down 3.1 percent to date.

Read the full storyTaxpayers May Get Stuck with Cost of Removing an Offshore Wind Farm After Biden Admin Waives Fees

The Biden administration reportedly waived fees for an offshore wind project that are in place to ensure that the infrastructure is removed and the site reclaimed at the end of the project’s life.

President Joe Biden, as part of his climate agenda, is pushing an aggressive buildout of offshore wind projects along the East Coast. With the offshore wind industry struggling financially, the waiving of these fees raises concerns about what would happen if these companies go bankrupt and leave behind wind farms they can’t afford to remove.

Read the full storyArizona’s Tax Rebate Will Be Taxed Federally, Impacting Families

Those who received a tax rebate from the Arizona government in 2023 will have to pay federal taxes on the money.

Qualifying Arizona families received a tax rebate starting on Oct. 30, 2023, with $250 for each dependent under 17 and $100 each for dependent adults, but the total went no higher than $750 for any family, The Center Square reported at the time.

Read the full storyCommentary: Lawfare Against Trump Is Running Out of Gas

We should dispense with the tired narrative that four conscientious state and federal prosecutors — independently and without contact with the Biden White House or the radical Democrats in Congress — all came to the same disinterested conclusions that Donald Trump should be indicted for various crimes and put on trial during the campaign season of 2024.

The prosecutors began accelerating their indictments only once Trump started to lead incumbent Joe Biden by sizable margins in head-to-head polls. Moreover, had Trump not run for the presidency, or had he been of the same party as most of the four prosecutors, he would have never been indicted by any of them.

Read the full storyMilwaukee Sales Tax Increase Has Mayor, Washington County Executive at Odds

Milwaukee’s new 2% sales tax has spawned a war of words between the city’s mayor and the county executive in Washington County.

It began New Year’s Day when Washington County Executive Josh Schoemann posted a message on social media welcoming people to shop in his county.

Read the full storyNFIB: Minnesota’s 9.8 Percent Corporate Income Tax Is Highest in Nation

In 2024, Minnesota has the highest corporate tax rate in the United States at 9.8%.

The National Federation of Independent Business called on state lawmakers to create a tax system that reduces the burden on small business owners.

Read the full storyNumber of EVs Eligible for Tax Credits Plummet as U.S. Seeks to Shrink Reliance on China’s Supply Chain

The number of electric vehicles (EV) that qualify for tax credits fell from 43 to 19 on Monday following new rules about the number of components in the vehicle that can be made by China and other foreign entities, according to Reuters.

On Dec. 1, 2023, the Treasury Department released guidance for which EVs are eligible for its $7,500 tax credit, requiring vehicles to have at least 60% of battery components and 50% of total critical minerals used not be from a foreign entity of concern like China starting in 2024. Vehicles that are impacted by the changes include the Volkswagen ID.4, Tesla Model 3 Rear Wheel Drive, BMW X5 xDrive 50e, Audi Q5 PHEV 55, Cadillac Lyriq and Ford E-Transit, losing eligibility for the credit, according to Reuters.

Read the full storyPennsylvania Appeals Carbon ‘Tax’ Decision

The Shapiro administration will appeal a Pennsylvania court’s decision to strike down a proposed carbon “tax” as unconstitutional in a bid to “protect” the authority of future governors.

The news comes just one day after Gov. Josh Shapiro teased the appeal during a press club luncheon in Harrisburg. He said it was important to “listen” to all sides involved, most of whom agree that “cap and trade” is a good idea to reduce harmful emissions.

Read the full story‘Too Favored to Fail:’ Taxpayers Bailout Biden’s Green Friends

While America struggles to buy groceries, President Joe Biden has a green slush fund worth billions of dollars, and he’s not afraid to use it.

Recent revelations uncovered that the CEO and lobbyists of Rivian, an electric vehicle manufacturer, held a quiet meeting at the White House with Biden’s Climate Czar, John Podesta. That’s right, the same John Podesta who served as chairman of Hillary Clinton’s ill-fated 2016 presidential campaign before being pulled from the ranks of profitable green consulting to oversee distribution of $369 billion from the Inflation Reduction Act (IRA). Biden selected a political operative with green company ties to dole out the goodies from one of the largest slush funds in history. Now green CEOs who are hemorrhaging cash are beating a path to his White House office, presumedly with hat in hand.

Read the full storyCommonwealth Court Strikes Down Carbon ‘Tax’

Commonwealth Court struck down Pennsylvania’s entry into an emissions regulatory program Wednesday, agreeing with critics that it’s an unconstitutional tax.

The decision delivers a blow to supporters of the Regional Greenhouse Gas Initiative – a multi-state program that charges power generators for the pollution they produce – who had hoped Pennsylvania might join the rest of the Mid-Atlantic and Northeast in the agreement.

Read the full storyHaley Lays Out Economic ‘Freedom Plan,’ Packed with Promises of Tax Cuts, Entitlement Reform and Regulatory Relief

Declaring that it’s time for Washington to start working for Americans and not the other way around, GOP presidential candidate Nikki Haley laid out her economic “Freedom Plan in a speech Friday in New Hampshire.

The former South Carolina governor and United Nations ambassador is proposing a litany of middle-class tax cuts, regulatory relief and “third rail” entitlement reforms in a proposal she asserts will check communist China aggression through American prosperity.

Read the full storyFeds to Drop Shipping Container Border Wall Lawsuit After $2.1 Million Payment from Arizona Taxpayers

A lawsuit launched by the Department of Justice against Arizona over a makeshift border wall made of shipping containers is set to be dismissed following a final payment of $2.1 million from the state to the U.S. Forest Service, even after Governor Katie Hobbs (D) dismantled the barrier and put the containers up for sale.

The shipping container wall was constructed under former Governor Doug Ducey (R), whose administration argued the hastily constructed barrier was necessary until the Biden administration resumed construction on the southern border wall started by former President Donald Trump. A lawsuit was launched by the federal government just weeks before Hobbs took office.

Read the full storyVirginia Gas Prices up 15 Cents in the Last Week, 30 Cents in a Month

Virginia’s price for a gallon of unleaded gasoline has risen nearly 30 cents in a month, half of that in just the last week.

The American Automobile Association’s daily tracking put the state average at $3.59 on Monday, up from $3.42 a week ago and $3.30 a month ago.

Read the full storyBiden Admin Proposes New Rule to Jack Up Prices for Oil and Gas Leases

The Biden administration unveiled a new oil and gas leasing rule proposal Thursday that would jack up prices at nearly every stage of the public land leasing process.

The Bureau of Land Management (BLM), a subagency of the Department of the Interior (DOI), issued the rule proposal Thursday in an effort to adopt a “more transparent, inclusive and just approach” to federal oil and gas leasing on public lands and “[provide] a fair return to taxpayers,” Principal Deputy Assistant Secretary for Land and Minerals Management Laura Daniel-Davis said, according to a Thursday DOI press release. The rule nominally aims to boost land conservation efforts, but it would do so by massively increasing minimum bid thresholds and required per-acre fees for energy interests and developers to pay.

Read the full storyArizona House Speaker, Senate President File Brief to Stop Hobbs’ Taxpayer Funded Child Gender Surgeries

Arizona House Speaker Ben Toma (R-Peoria) and Arizona Senate President Warren Petersen (R-Mesa) filed an amicus brief on Monday, asking a federal court to align Governor Katie Hobbs’ executive order, which forces government agencies to pay for the gender reassignment surgeries of employees, with a state law banning minors from receiving such treatments.

The amicus brief was filed in Toomey v. State of Arizona, a lawsuit launched in 2019 on behalf of Russell Toomey, an associate professor at the University of Arizona who is transgender, by the American Civil Liberties Union (ACLU). It alleged that Arizona violated federal civil rights statutes and the U.S. Constitution because it “unlawfully discriminates against transgender people” by refusing to pay for “gender-affirming surgery”.

Read the full story$114 Million Knoxville Baseball Stadium, to Open in 2025, Relies on Tax Capture Funding

Starting in 2025, the Tennessee Smokies Minor League Baseball Team will have a new $114 million home in East Knoxville.

After a $65 million publicly backed bond sale in late May, the team held a ceremonial groundbreaking at the site last week to discuss the 7,000-seat stadium, touting numbers from Convention, Sports and Leisure International, which claim the stadium will have a positive economic impact for Knoxville residents.

Read the full storyPennsylvania Utility Commission: 2023 Natural Gas Impact Fees Top $278 Million

Pennsylvania’s Public Utility Commission announced this week that the commonwealth and its localities will collect nearly $279 million from natural gas extraction impact fees this year.

The revenues, applying to drilling activity throughout 2022, bring the total fees collected for gas extraction from the Marcellus Shale sedimentary rock formation to $2.5 billion since 2012, the year lawmakers imposed the tax on fossil-fuel producers. This year’s allocations will be the largest yearly amount the government amassed through the levy, representing a 19 percent increase over the prior year’s take.

Read the full storyState House Passes Legislation Modernizing the Ohio Revised Code to Save Taxpayer Dollars

The Ohio House of Representatives passed a Republican-backed legislation that attempts to save taxpayers millions of dollars statewide by modernizing the Ohio Revised Code.

The Ohio House passed the legislation with overwhelming bipartisan support by a vote of 94-1, advancing it to the senate for its consideration.

Read the full storyPennsylvania Localities Benefitting Substantially from Gas Extraction Fee

While Democrats insist Pennsylvania misses out on revenue from natural gas extraction, a Pittsburgh nonprofit’s analysis published on Thursday observes drilling impact fees yielded $2.25 billion through 2021.

Since the boom in hydraulic fracturing (or fracking), the horizontal drilling technique gas companies use to access the vast reserves of fossil fuel from the Marcellus Shale sedimentary rock formation, many politicians have eyed an extraction tax. Instead of such a tax, former Governor Tom Corbett (R) and a Republican-led legislature levied an impact fee in 2012, with revenues going to localities largely to mitigate fracking-related environmental disruption. In the new policy brief from the Allegheny Institute (AI), the think tank’s executive director Frank Gamrat detailed those revenue gains.

Read the full story